- United Kingdom

- /

- Consumer Services

- /

- LSE:MEGP

James Latham And 2 Other Premier Dividend Stocks

Reviewed by Simply Wall St

As global markets navigate through a mix of challenges and moderate gains, with the FTSE 100 showing resilience amidst broader economic uncertainties, investors may find solace in dividend stocks. These stocks can offer potential stability and regular income, qualities that are particularly appealing in the current fluctuating market environment.

Top 10 Dividend Stocks In The United Kingdom

| Name | Dividend Yield | Dividend Rating |

| Record (LSE:REC) | 8.12% | ★★★★★★ |

| Keller Group (LSE:KLR) | 3.74% | ★★★★★☆ |

| Dunelm Group (LSE:DNLM) | 7.53% | ★★★★★☆ |

| Plus500 (LSE:PLUS) | 6.09% | ★★★★★☆ |

| Big Yellow Group (LSE:BYG) | 3.86% | ★★★★★☆ |

| Grafton Group (LSE:GFTU) | 3.82% | ★★★★★☆ |

| Rio Tinto Group (LSE:RIO) | 6.37% | ★★★★★☆ |

| NWF Group (AIM:NWF) | 4.00% | ★★★★★☆ |

| James Latham (AIM:LTHM) | 3.01% | ★★★★★☆ |

| Hargreaves Services (AIM:HSP) | 6.84% | ★★★★★☆ |

Click here to see the full list of 59 stocks from our Top Dividend Stocks screener.

Let's uncover some gems from our specialized screener.

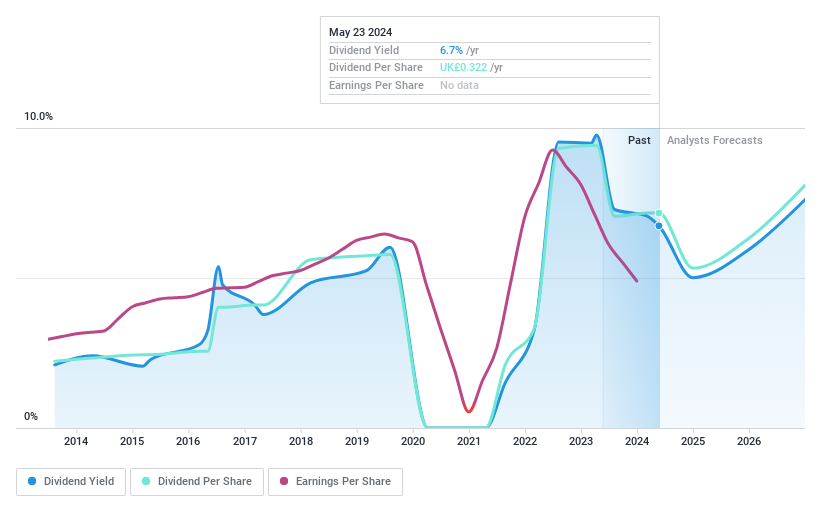

James Latham (AIM:LTHM)

Simply Wall St Dividend Rating: ★★★★★☆

Overview: James Latham plc operates in the import and distribution of timber, panels, and decorative surfaces across the UK, Ireland, other parts of Europe, and internationally, with a market capitalization of approximately £242.31 million.

Operations: James Latham plc generates £386.46 million from its timber importing and distribution activities.

Dividend Yield: 3%

James Latham has maintained stable dividends over the past decade, with a current yield of 3.01%, which is modest compared to the UK market's top dividend payers. The dividend sustainability is strong, evidenced by a low payout ratio of 19.6% from earnings and 20.8% from cash flows, indicating good coverage. However, earnings are expected to decline by an average of 26.2% annually over the next three years, posing potential challenges for future dividend growth and stability.

- Take a closer look at James Latham's potential here in our dividend report.

- Insights from our recent valuation report point to the potential overvaluation of James Latham shares in the market.

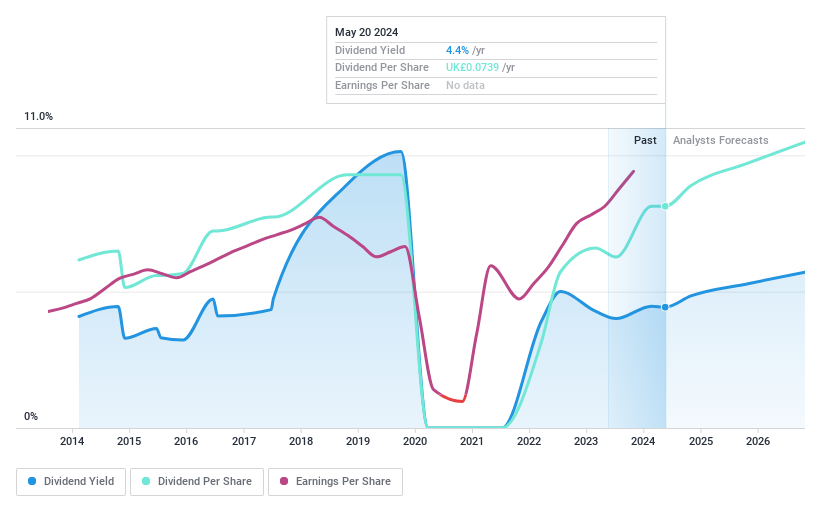

ME Group International (LSE:MEGP)

Simply Wall St Dividend Rating: ★★★★☆☆

Overview: ME Group International plc specializes in operating, selling, and servicing a range of instant-service equipment across the United Kingdom, with a market capitalization of approximately £627.27 million.

Operations: ME Group International plc generates £297.66 million in revenue from its personal services segment.

Dividend Yield: 4.4%

ME Group International has demonstrated a pattern of increasing dividends over the last decade, though its dividend reliability has been questioned due to volatility in payments. Currently, the dividend yield stands at 4.44%, which is below the top quartile of UK dividend stocks. Despite this, dividends are well-supported by earnings and cash flows with payout ratios at 55.2% and 82.6% respectively. Recent approvals for increased dividends highlight a positive outlook, yet analysts project modest earnings growth ahead.

- Click here to discover the nuances of ME Group International with our detailed analytical dividend report.

- Our valuation report here indicates ME Group International may be undervalued.

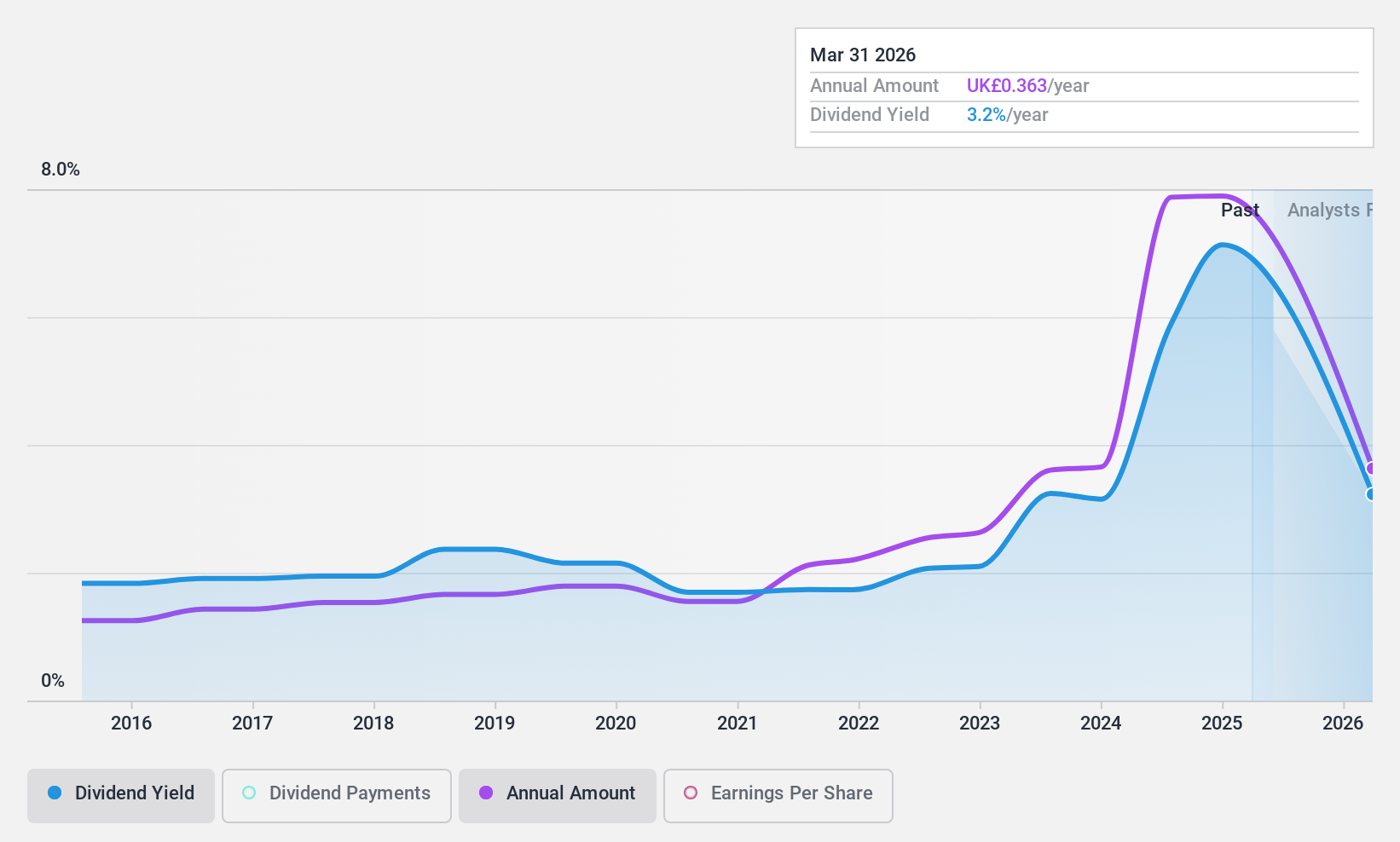

PageGroup (LSE:PAGE)

Simply Wall St Dividend Rating: ★★★★★☆

Overview: PageGroup plc operates as a recruitment consultancy offering services across the UK, Europe, the Middle East, Africa, Asia Pacific, and the Americas, with a market capitalization of approximately £1.36 billion.

Operations: PageGroup plc generates £2.01 billion from its recruitment services across various global regions.

Dividend Yield: 7.5%

PageGroup offers a dividend yield of £7.46%, ranking in the top 25% of UK dividend stocks. However, its dividend history shows volatility with significant annual drops over the past decade. The dividends are reasonably covered by earnings and cash flows, with payout ratios at 67.1% and 83.2%, respectively, suggesting sustainability from a financial perspective. Despite trading below estimated fair value, concerns about its unstable dividend track record and reduced profit margins year-over-year might caution investors looking for consistent returns.

- Dive into the specifics of PageGroup here with our thorough dividend report.

- Upon reviewing our latest valuation report, PageGroup's share price might be too pessimistic.

Key Takeaways

- Delve into our full catalog of 59 Top Dividend Stocks here.

- Hold shares in these firms? Setup your portfolio in Simply Wall St to seamlessly track your investments and receive personalized updates on your portfolio's performance.

- Simply Wall St is a revolutionary app designed for long-term stock investors, it's free and covers every market in the world.

Interested In Other Possibilities?

- Explore high-performing small cap companies that haven't yet garnered significant analyst attention.

- Fuel your portfolio with companies showing strong growth potential, backed by optimistic outlooks both from analysts and management.

- Find companies with promising cash flow potential yet trading below their fair value.

This article by Simply Wall St is general in nature. We provide commentary based on historical data and analyst forecasts only using an unbiased methodology and our articles are not intended to be financial advice. It does not constitute a recommendation to buy or sell any stock, and does not take account of your objectives, or your financial situation. We aim to bring you long-term focused analysis driven by fundamental data. Note that our analysis may not factor in the latest price-sensitive company announcements or qualitative material. Simply Wall St has no position in any stocks mentioned.

New: Manage All Your Stock Portfolios in One Place

We've created the ultimate portfolio companion for stock investors, and it's free.

• Connect an unlimited number of Portfolios and see your total in one currency

• Be alerted to new Warning Signs or Risks via email or mobile

• Track the Fair Value of your stocks

Have feedback on this article? Concerned about the content? Get in touch with us directly. Alternatively, email editorial-team@simplywallst.com

About LSE:MEGP

ME Group International

Operates, sells, and services a range of instant-service equipment in the United Kingdom.

Outstanding track record with flawless balance sheet and pays a dividend.