- United Kingdom

- /

- Trade Distributors

- /

- AIM:HSS

UK Penny Stocks To Watch In October 2025

Reviewed by Simply Wall St

The United Kingdom's market has recently experienced some turbulence, with the FTSE 100 index closing lower amid weak trade data from China, highlighting global economic interdependencies. In such a climate, identifying stocks with strong financial underpinnings becomes crucial for investors seeking stability and potential growth. Although the term "penny stocks" might seem dated, it still refers to smaller or emerging companies that can offer significant value when built on solid financial foundations.

Top 10 Penny Stocks In The United Kingdom

| Name | Share Price | Market Cap | Rewards & Risks |

| Foresight Group Holdings (LSE:FSG) | £4.735 | £530.11M | ✅ 4 ⚠️ 0 View Analysis > |

| Warpaint London (AIM:W7L) | £2.20 | £177.73M | ✅ 4 ⚠️ 2 View Analysis > |

| Ingenta (AIM:ING) | £0.755 | £11.4M | ✅ 2 ⚠️ 2 View Analysis > |

| Integrated Diagnostics Holdings (LSE:IDHC) | $0.495 | $287.76M | ✅ 4 ⚠️ 2 View Analysis > |

| RWS Holdings (AIM:RWS) | £0.925 | £342.04M | ✅ 5 ⚠️ 2 View Analysis > |

| LSL Property Services (LSE:LSL) | £2.50 | £256.79M | ✅ 4 ⚠️ 1 View Analysis > |

| Alumasc Group (AIM:ALU) | £3.425 | £123.16M | ✅ 4 ⚠️ 1 View Analysis > |

| Begbies Traynor Group (AIM:BEG) | £1.16 | £184.68M | ✅ 4 ⚠️ 3 View Analysis > |

| Croma Security Solutions Group (AIM:CSSG) | £0.70 | £9.64M | ✅ 3 ⚠️ 4 View Analysis > |

| Braemar (LSE:BMS) | £2.41 | £73.43M | ✅ 3 ⚠️ 3 View Analysis > |

Click here to see the full list of 287 stocks from our UK Penny Stocks screener.

Below we spotlight a couple of our favorites from our exclusive screener.

HSS Hire Group (AIM:HSS)

Simply Wall St Financial Health Rating: ★★★★★☆

Overview: HSS Hire Group plc, with a market cap of £70.50 million, operates in the United Kingdom and the Republic of Ireland offering tool and equipment hire along with related services.

Operations: HSS Hire Group generates its revenue from tool and equipment hire services in the United Kingdom and the Republic of Ireland.

Market Cap: £70.5M

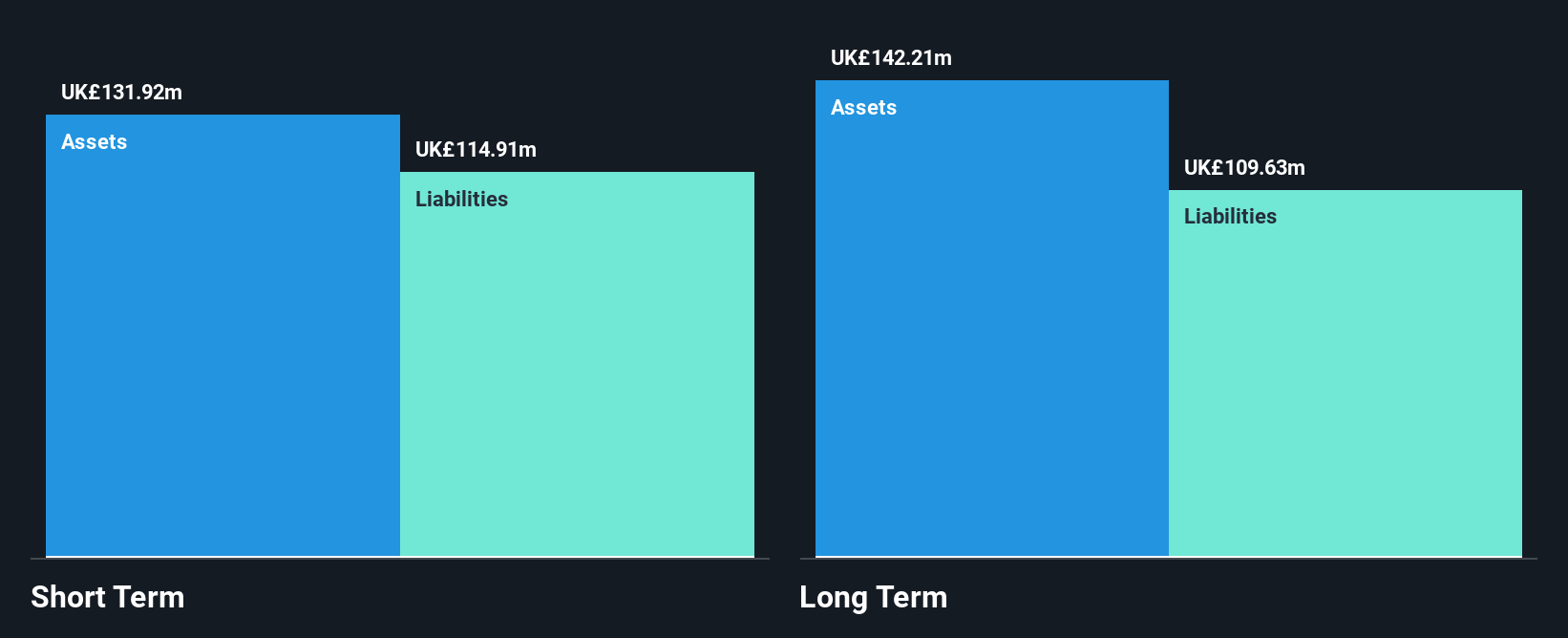

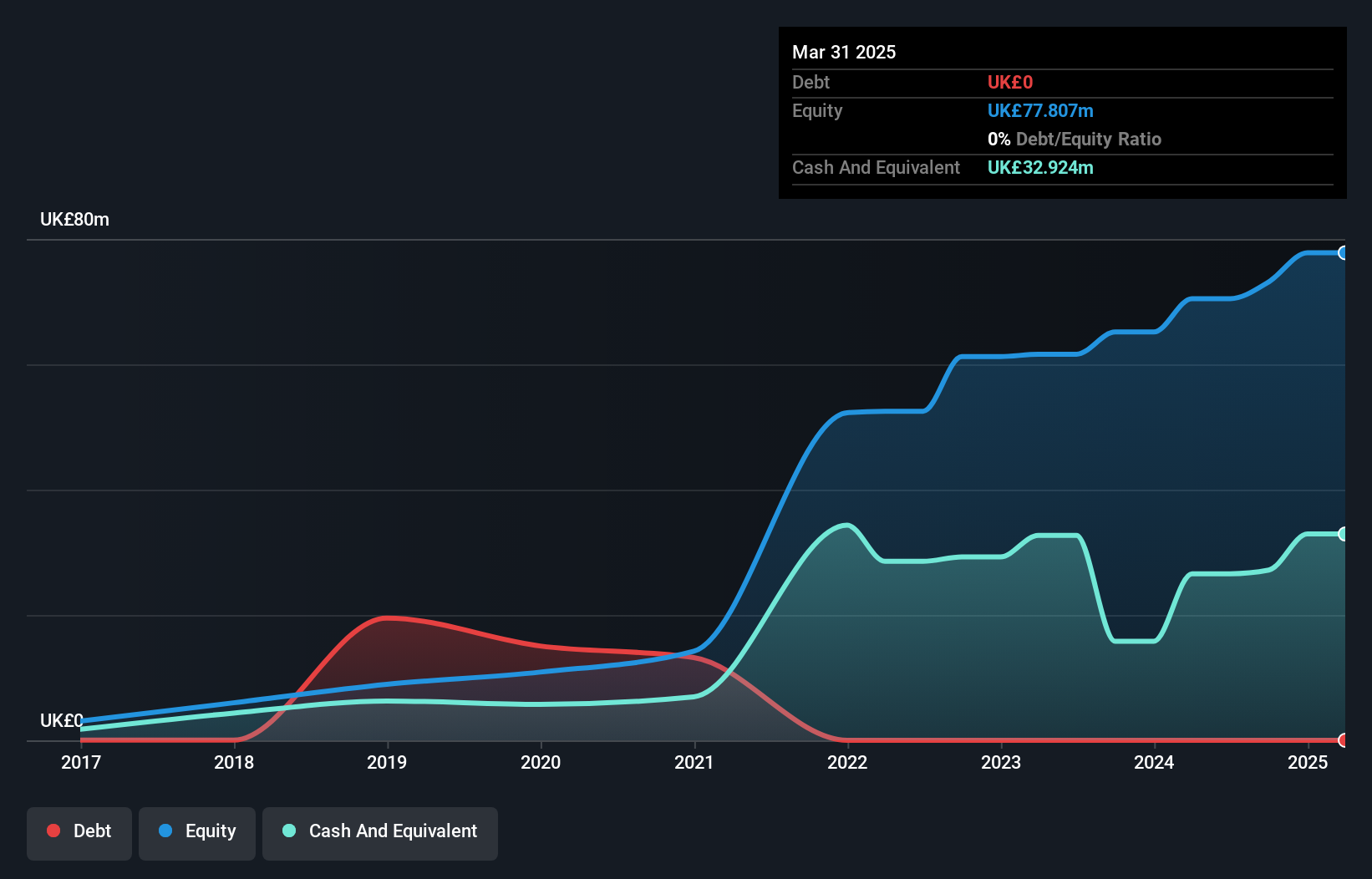

HSS Hire Group, with a market cap of £70.50 million, faces challenges typical of penny stocks. Despite generating £378.99 million in sales for the fifteen months ending March 2025, it reported a net loss of £129.71 million and remains unprofitable with declining earnings over the past five years. The company's high debt levels are concerning, though its debt-to-equity ratio has improved from 287.6% to 139% over five years. While HSS's short-term assets cover both its short- and long-term liabilities, its volatile share price and negative return on equity highlight ongoing financial instability despite having sufficient cash runway for more than three years.

- Navigate through the intricacies of HSS Hire Group with our comprehensive balance sheet health report here.

- Understand HSS Hire Group's track record by examining our performance history report.

LBG Media (AIM:LBG)

Simply Wall St Financial Health Rating: ★★★★★★

Overview: LBG Media plc is an online media publisher operating in the United Kingdom, Ireland, Australia, the United States, and internationally with a market cap of £212.43 million.

Operations: The company generates its revenue from the online media publishing industry, amounting to £91.70 million.

Market Cap: £212.43M

LBG Media, with a market cap of £212.43 million, exhibits characteristics attractive to penny stock investors. The company is debt-free and has seen significant earnings growth of 281.2% over the past year, outpacing the entertainment industry average. Its net profit margins have improved to 16%, and its short-term assets (£57.2M) comfortably cover both short- (£20.6M) and long-term liabilities (£2.2M). Despite having a low return on equity at 18.9%, LBG's price-to-earnings ratio of 14.4x suggests it may be undervalued compared to the broader UK market (16.8x).

- Click to explore a detailed breakdown of our findings in LBG Media's financial health report.

- Learn about LBG Media's future growth trajectory here.

Quartix Technologies (AIM:QTX)

Simply Wall St Financial Health Rating: ★★★★★★

Overview: Quartix Technologies plc designs, develops, markets, and delivers vehicle telematics services across the United Kingdom, France, the United States, and other European territories with a market cap of £150.62 million.

Operations: The company's revenue is generated from its vehicle telematics services, with £19.46 million from the United Kingdom, £8.53 million from France, £3.18 million from the United States of America, and £2.77 million from other European territories.

Market Cap: £150.62M

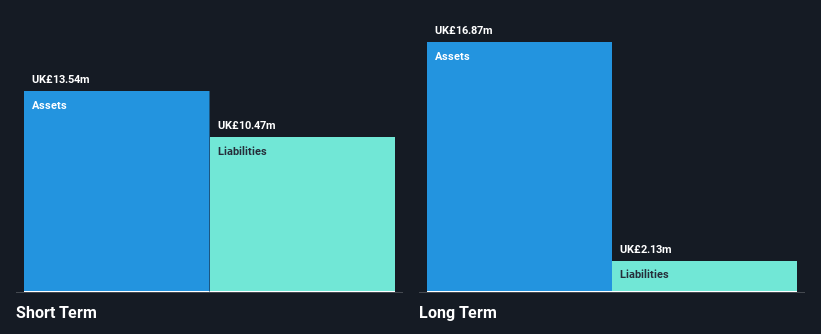

Quartix Technologies, with a market cap of £150.62 million, presents several appealing features for penny stock investors. The company is debt-free and has become profitable recently, reporting net income of £2.67 million for the half year ended June 2025. Its short-term assets (£15.4M) exceed both short- (£9.6M) and long-term liabilities (£1.4M), indicating solid financial health without dilution concerns over the past year. While its board and management team are relatively inexperienced, Quartix's high return on equity (25%) and stable earnings quality suggest potential value relative to peers in the telematics sector.

- Take a closer look at Quartix Technologies' potential here in our financial health report.

- Examine Quartix Technologies' earnings growth report to understand how analysts expect it to perform.

Turning Ideas Into Actions

- Click here to access our complete index of 287 UK Penny Stocks.

- Ready For A Different Approach? Trump has pledged to "unleash" American oil and gas and these 22 US stocks have developments that are poised to benefit.

This article by Simply Wall St is general in nature. We provide commentary based on historical data and analyst forecasts only using an unbiased methodology and our articles are not intended to be financial advice. It does not constitute a recommendation to buy or sell any stock, and does not take account of your objectives, or your financial situation. We aim to bring you long-term focused analysis driven by fundamental data. Note that our analysis may not factor in the latest price-sensitive company announcements or qualitative material. Simply Wall St has no position in any stocks mentioned.

Valuation is complex, but we're here to simplify it.

Discover if HSS Hire Group might be undervalued or overvalued with our detailed analysis, featuring fair value estimates, potential risks, dividends, insider trades, and its financial condition.

Access Free AnalysisHave feedback on this article? Concerned about the content? Get in touch with us directly. Alternatively, email editorial-team@simplywallst.com

About AIM:HSS

HSS Hire Group

Provides tool and equipment hire, and related services in the United Kingdom and the Republic of Ireland.

Excellent balance sheet and good value.

Similar Companies

Market Insights

Community Narratives