- United Kingdom

- /

- Luxury

- /

- AIM:SOS

UK Penny Stocks To Watch In March 2025

Reviewed by Simply Wall St

The UK market has been experiencing a downturn, with the FTSE 100 and FTSE 250 indices both closing lower due to weak trade data from China, highlighting ongoing challenges in global economic recovery. Despite these broader market pressures, certain investment opportunities remain attractive, particularly within the realm of penny stocks. Although often considered a term from past trading eras, penny stocks—typically smaller or newer companies—can offer significant growth potential when backed by solid financials.

Top 10 Penny Stocks In The United Kingdom

| Name | Share Price | Market Cap | Financial Health Rating |

| Warpaint London (AIM:W7L) | £3.65 | £294.87M | ★★★★★★ |

| Next 15 Group (AIM:NFG) | £2.92 | £290.41M | ★★★★☆☆ |

| Begbies Traynor Group (AIM:BEG) | £0.916 | £145.98M | ★★★★★★ |

| Foresight Group Holdings (LSE:FSG) | £3.86 | £439.05M | ★★★★★★ |

| Polar Capital Holdings (AIM:POLR) | £4.385 | £422.7M | ★★★★★★ |

| Ultimate Products (LSE:ULTP) | £0.83 | £66.46M | ★★★★★★ |

| Van Elle Holdings (AIM:VANL) | £0.38 | £41.12M | ★★★★★★ |

| Alumasc Group (AIM:ALU) | £3.25 | £116.88M | ★★★★★★ |

| Luceco (LSE:LUCE) | £1.394 | £215M | ★★★★★☆ |

| Helios Underwriting (AIM:HUW) | £2.13 | £151.96M | ★★★★★☆ |

Click here to see the full list of 442 stocks from our UK Penny Stocks screener.

Here we highlight a subset of our preferred stocks from the screener.

Flowtech Fluidpower (AIM:FLO)

Simply Wall St Financial Health Rating: ★★★★☆☆

Overview: Flowtech Fluidpower plc, with a market cap of £38.23 million, distributes engineering components and assemblies within the fluid power industry across the United Kingdom, Europe, and internationally.

Operations: The company's revenue is primarily generated from Great Britain (£81.16 million), followed by Ireland (£21.65 million) and Benelux (£10.73 million).

Market Cap: £38.23M

Flowtech Fluidpower, with a market cap of £38.23 million, is navigating challenges typical of penny stocks. Despite being unprofitable and experiencing increased losses over the past five years, its short-term assets (£60.2M) comfortably cover both short-term (£20.7M) and long-term liabilities (£25.1M). The company's debt is well covered by operating cash flow (37.2%), though interest coverage remains low at 2.1x EBIT. While analysts forecast significant earnings growth of 118% annually, the dividend yield of 3.62% isn't supported by earnings, indicating financial strain amidst potential upside in stock price projections (78%).

- Jump into the full analysis health report here for a deeper understanding of Flowtech Fluidpower.

- Evaluate Flowtech Fluidpower's prospects by accessing our earnings growth report.

Sosandar (AIM:SOS)

Simply Wall St Financial Health Rating: ★★★★★★

Overview: Sosandar Plc is a company that manufactures and distributes clothing products through internet and mail order in the United Kingdom and internationally, with a market cap of £14.89 million.

Operations: The company's revenue is generated from retail sales, amounting to £40.30 million.

Market Cap: £14.89M

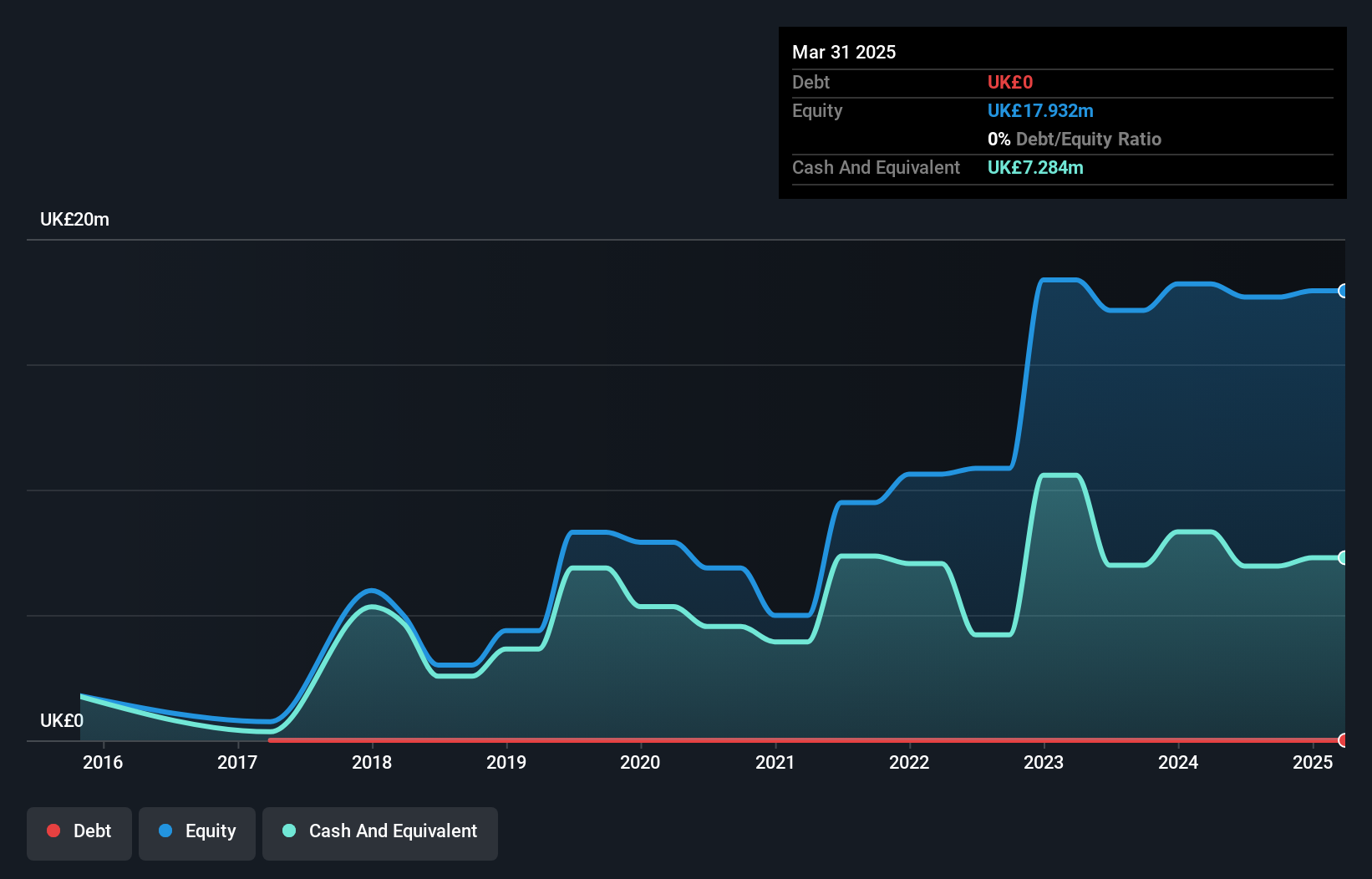

Sosandar Plc, with a market cap of £14.89 million, exemplifies the volatility and potential of penny stocks. Despite achieving profitability over the past five years, recent earnings growth has been negative at -41.3%. The company operates debt-free, alleviating concerns over interest payments and showcasing strong asset coverage with short-term assets (£23.0M) exceeding liabilities (£8.0M). Recent expansion into prime retail locations in Bath and Harrogate could bolster revenue growth, forecasted at 14.53% annually. However, its low return on equity (1.5%) and volatile share price highlight ongoing challenges within this investment category.

- Navigate through the intricacies of Sosandar with our comprehensive balance sheet health report here.

- Examine Sosandar's earnings growth report to understand how analysts expect it to perform.

Castings (LSE:CGS)

Simply Wall St Financial Health Rating: ★★★★★★

Overview: Castings P.L.C. is involved in iron casting and machining operations across various regions including the United Kingdom, Europe, and the Americas, with a market cap of £116.90 million.

Operations: The company generates revenue from its Foundry Operations, which contribute £225.67 million, and its Machining Operations, which add £35.57 million.

Market Cap: £116.9M

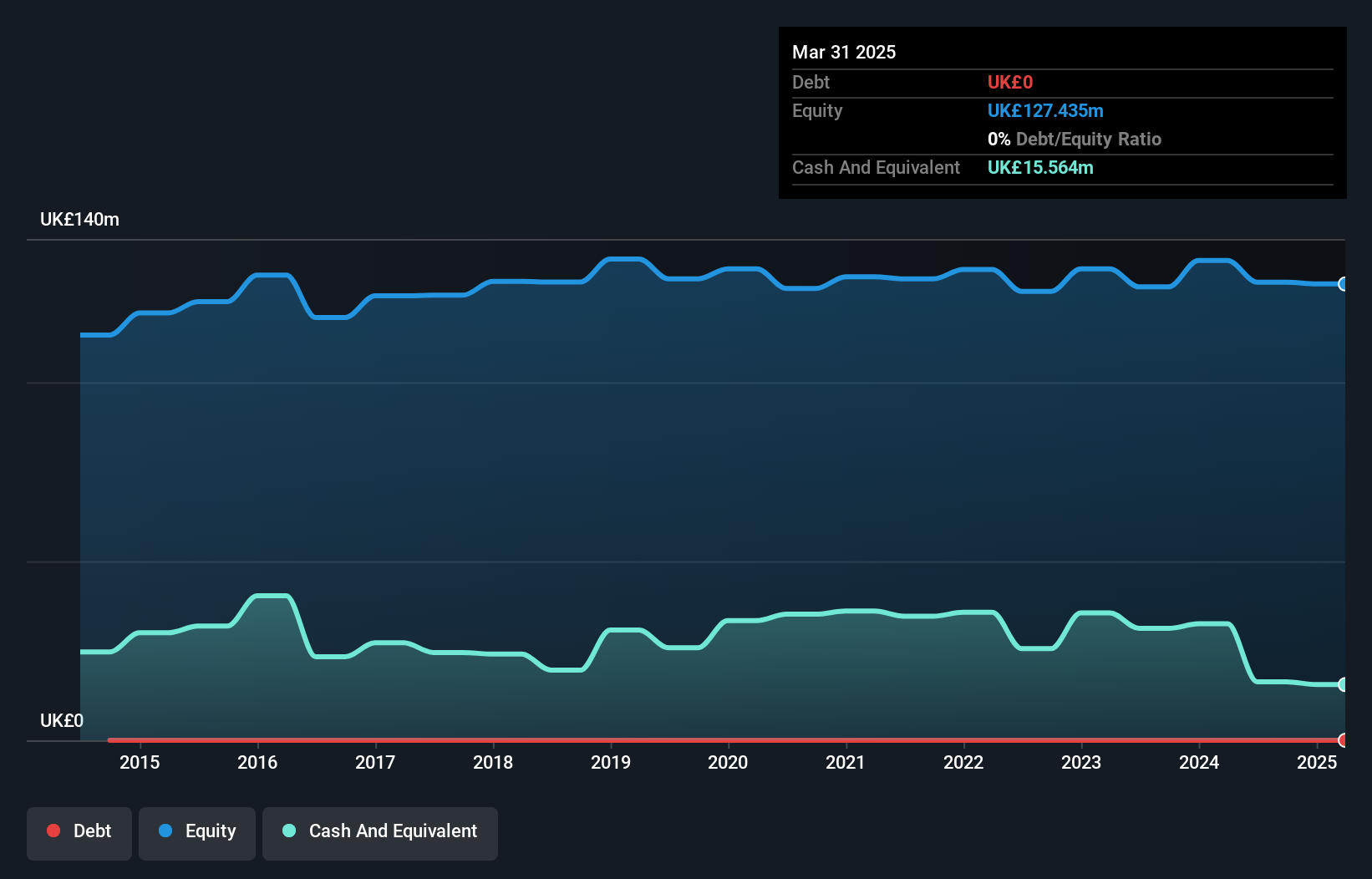

Castings P.L.C. offers a mix of stability and challenges within the penny stock landscape. With a market cap of £116.90 million, it operates debt-free, easing financial risk concerns. Its foundry and machining operations generate substantial revenues (£225.67M and £35.57M respectively), yet recent negative earnings growth (-21.6%) raises caution for potential investors, as does its low return on equity (9.5%). The company's short-term assets (£98.3M) comfortably cover liabilities, indicating solid financial health despite declining earnings forecasts over the next three years (-0.4% annually). Castings' dividend yield (6.84%) is not well supported by free cash flows, suggesting sustainability issues.

- Click here to discover the nuances of Castings with our detailed analytical financial health report.

- Review our growth performance report to gain insights into Castings' future.

Next Steps

- Navigate through the entire inventory of 442 UK Penny Stocks here.

- Already own these companies? Link your portfolio to Simply Wall St and get alerts on any new warning signs to your stocks.

- Enhance your investing ability with the Simply Wall St app and enjoy free access to essential market intelligence spanning every continent.

Contemplating Other Strategies?

- Explore high-performing small cap companies that haven't yet garnered significant analyst attention.

- Jump on the AI train with fast growing tech companies forging a new era of innovation.

- Find companies with promising cash flow potential yet trading below their fair value.

This article by Simply Wall St is general in nature. We provide commentary based on historical data and analyst forecasts only using an unbiased methodology and our articles are not intended to be financial advice. It does not constitute a recommendation to buy or sell any stock, and does not take account of your objectives, or your financial situation. We aim to bring you long-term focused analysis driven by fundamental data. Note that our analysis may not factor in the latest price-sensitive company announcements or qualitative material. Simply Wall St has no position in any stocks mentioned.

New: Manage All Your Stock Portfolios in One Place

We've created the ultimate portfolio companion for stock investors, and it's free.

• Connect an unlimited number of Portfolios and see your total in one currency

• Be alerted to new Warning Signs or Risks via email or mobile

• Track the Fair Value of your stocks

Have feedback on this article? Concerned about the content? Get in touch with us directly. Alternatively, email editorial-team@simplywallst.com

About AIM:SOS

Sosandar

Engages in the manufacture and distribution of clothing products in the United Kingdom and internationally.

Adequate balance sheet and slightly overvalued.

Market Insights

Community Narratives