- United Kingdom

- /

- Oil and Gas

- /

- AIM:NWF

Top 3 UK Dividend Stocks To Consider

Reviewed by Simply Wall St

The United Kingdom's FTSE 100 index has recently faced downward pressure, largely influenced by weak trade data from China, which has impacted companies with close ties to the Chinese economy. Amidst these challenging market conditions, investors often turn their attention to dividend stocks as they can provide a steady income stream and offer potential resilience against market volatility.

Top 10 Dividend Stocks In The United Kingdom

| Name | Dividend Yield | Dividend Rating |

| WPP (LSE:WPP) | 6.51% | ★★★★★★ |

| Man Group (LSE:EMG) | 7.43% | ★★★★★☆ |

| 4imprint Group (LSE:FOUR) | 5.15% | ★★★★★☆ |

| Keller Group (LSE:KLR) | 3.29% | ★★★★★☆ |

| Treatt (LSE:TET) | 3.10% | ★★★★★☆ |

| DCC (LSE:DCC) | 3.94% | ★★★★★☆ |

| OSB Group (LSE:OSB) | 7.20% | ★★★★★☆ |

| Big Yellow Group (LSE:BYG) | 4.52% | ★★★★★☆ |

| Grafton Group (LSE:GFTU) | 3.83% | ★★★★★☆ |

| James Latham (AIM:LTHM) | 7.08% | ★★★★★☆ |

Click here to see the full list of 59 stocks from our Top UK Dividend Stocks screener.

Let's take a closer look at a couple of our picks from the screened companies.

Epwin Group (AIM:EPWN)

Simply Wall St Dividend Rating: ★★★★☆☆

Overview: Epwin Group Plc manufactures building products for various markets including repair, maintenance, improvement, social housing, and new builds in the UK, Europe, and internationally with a market cap of £127.65 million.

Operations: Epwin Group Plc generates revenue from two main segments: Extrusion and Moulding (£232.20 million) and Fabrication and Distribution (£131.30 million).

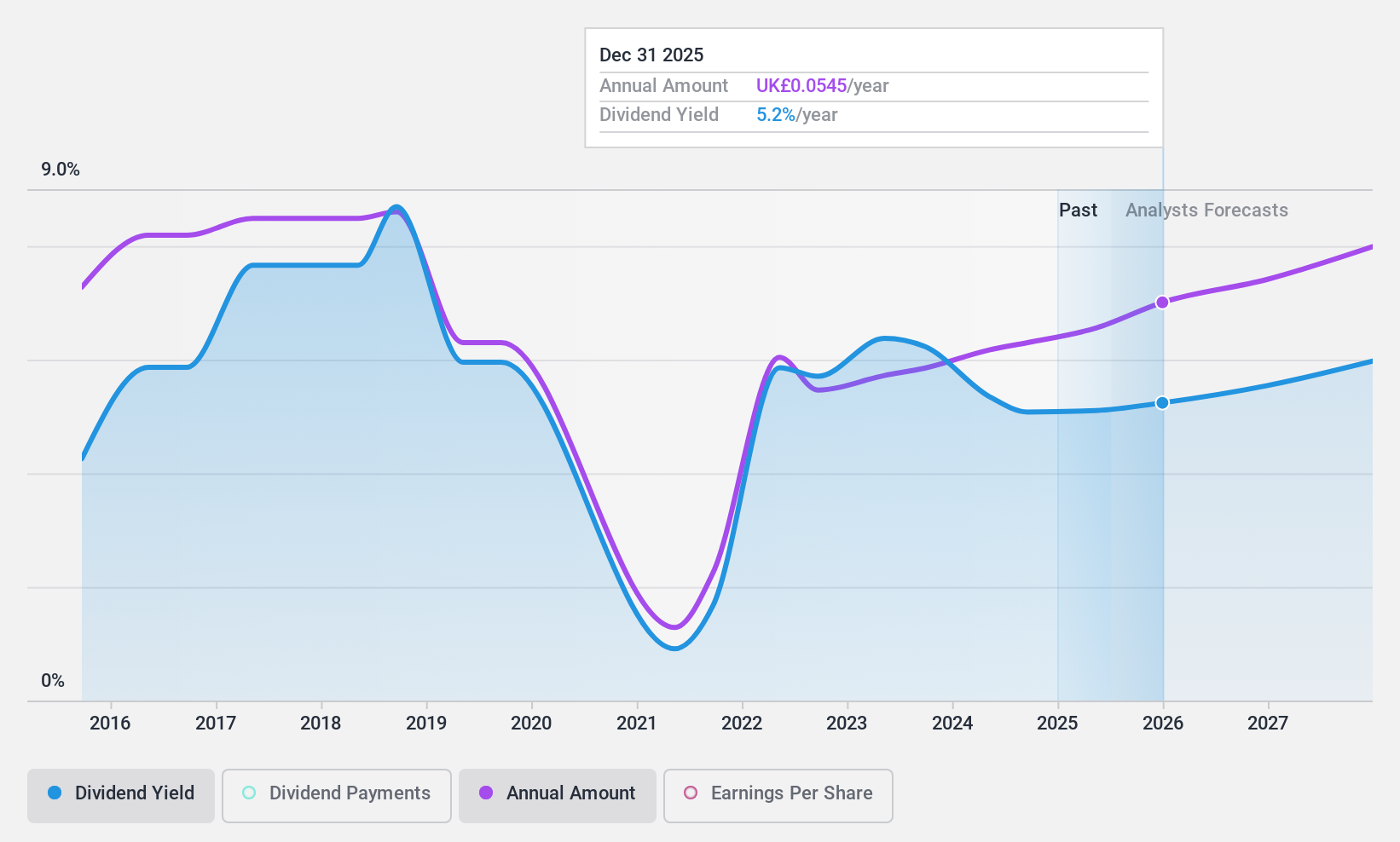

Dividend Yield: 5.4%

Epwin Group's dividend payments have been volatile over the past decade, yet recent increases suggest a commitment to growth. The dividend is well-covered by both earnings (43.4% payout ratio) and cash flows (21% cash payout ratio), indicating sustainability despite past instability. Although its 5.43% yield is below top-tier UK payers, the stock offers good value with a price-to-earnings ratio of 7.7x, supported by strong earnings growth last year and strategic share buybacks totaling £7.5 million.

- Unlock comprehensive insights into our analysis of Epwin Group stock in this dividend report.

- Our valuation report here indicates Epwin Group may be undervalued.

NWF Group (AIM:NWF)

Simply Wall St Dividend Rating: ★★★★★☆

Overview: NWF Group plc, with a market cap of £83.57 million, primarily engages in the sale and distribution of fuel oils in the United Kingdom through its subsidiaries.

Operations: NWF Group plc generates revenue through its segments: Food (£82.30 million), Feeds (£204.10 million), and Fuels (£653.10 million).

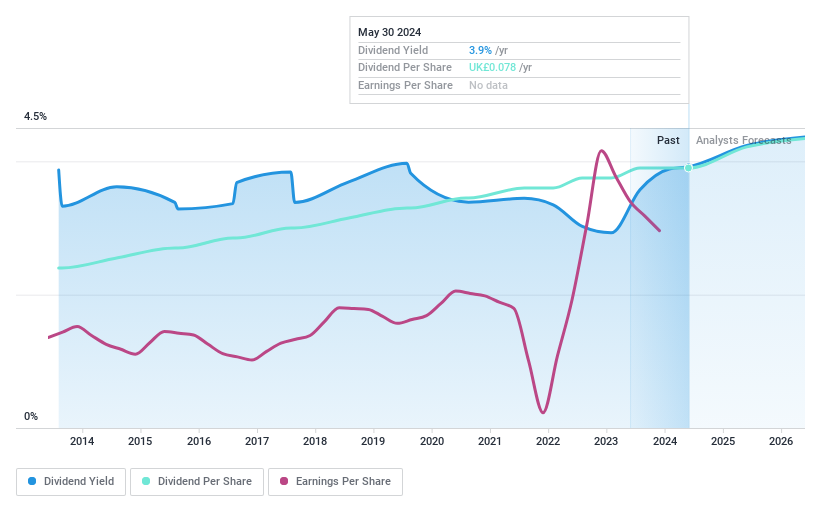

Dividend Yield: 4.8%

NWF Group's dividend is well-supported by earnings (50.1% payout ratio) and cash flows (32.3% cash payout ratio), reflecting sustainability and reliability over the past decade. Although its 4.79% yield is lower than the top UK dividend payers, it remains attractive due to consistent growth in payouts over 10 years. Despite a slight decline in profit margins, NWF trades at a significant discount of 49.7% below estimated fair value, suggesting potential investment appeal.

- Click here to discover the nuances of NWF Group with our detailed analytical dividend report.

- In light of our recent valuation report, it seems possible that NWF Group is trading behind its estimated value.

Vesuvius (LSE:VSVS)

Simply Wall St Dividend Rating: ★★★★☆☆

Overview: Vesuvius plc offers molten metal flow engineering and technology services to steel and foundry casting industries globally, with a market cap of approximately £896.65 million.

Operations: Vesuvius plc generates its revenue from several segments, including Foundry (£476.30 million), Steel - Flow Control (£769 million), Steel - Sensors & Probes (£39.20 million), and Steel - Advanced Refractories (£535.60 million).

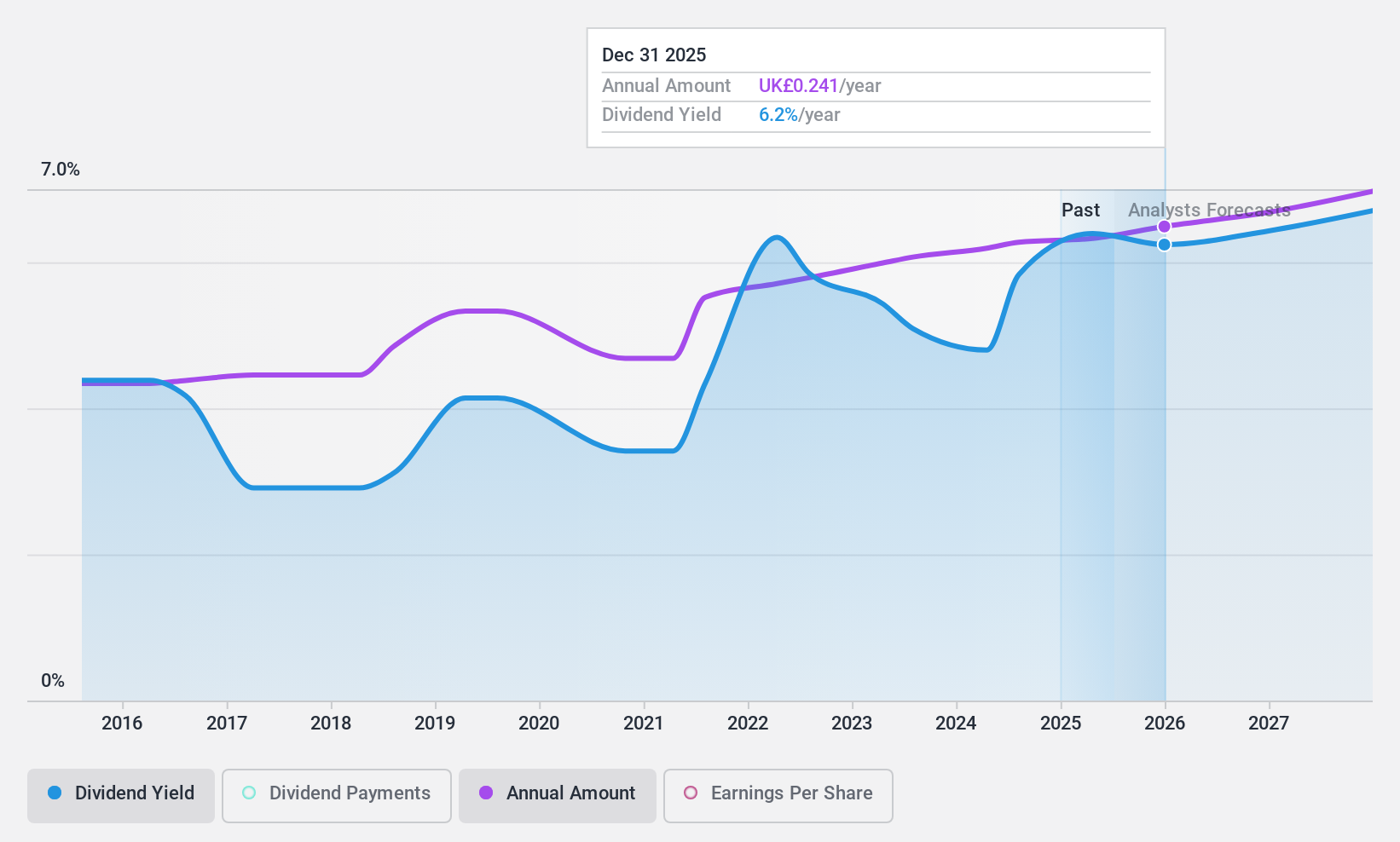

Dividend Yield: 6.4%

Vesuvius offers a dividend yield of 6.4%, placing it among the top 25% of UK dividend payers, though its dividends have been volatile over the past decade. The recent increase to a full-year dividend of 23.5 pence per share highlights growth, yet sustainability concerns arise as dividends are not fully covered by cash flows, with a high cash payout ratio of 99.2%. Trading at 55.7% below estimated fair value may indicate an attractive valuation despite these challenges.

- Click to explore a detailed breakdown of our findings in Vesuvius' dividend report.

- Our comprehensive valuation report raises the possibility that Vesuvius is priced lower than what may be justified by its financials.

Next Steps

- Unlock more gems! Our Top UK Dividend Stocks screener has unearthed 56 more companies for you to explore.Click here to unveil our expertly curated list of 59 Top UK Dividend Stocks.

- Got skin in the game with these stocks? Elevate how you manage them by using Simply Wall St's portfolio, where intuitive tools await to help optimize your investment outcomes.

- Maximize your investment potential with Simply Wall St, the comprehensive app that offers global market insights for free.

Ready To Venture Into Other Investment Styles?

- Explore high-performing small cap companies that haven't yet garnered significant analyst attention.

- Fuel your portfolio with companies showing strong growth potential, backed by optimistic outlooks both from analysts and management.

- Find companies with promising cash flow potential yet trading below their fair value.

This article by Simply Wall St is general in nature. We provide commentary based on historical data and analyst forecasts only using an unbiased methodology and our articles are not intended to be financial advice. It does not constitute a recommendation to buy or sell any stock, and does not take account of your objectives, or your financial situation. We aim to bring you long-term focused analysis driven by fundamental data. Note that our analysis may not factor in the latest price-sensitive company announcements or qualitative material. Simply Wall St has no position in any stocks mentioned.

If you're looking to trade NWF Group, open an account with the lowest-cost platform trusted by professionals, Interactive Brokers.

With clients in over 200 countries and territories, and access to 160 markets, IBKR lets you trade stocks, options, futures, forex, bonds and funds from a single integrated account.

Enjoy no hidden fees, no account minimums, and FX conversion rates as low as 0.03%, far better than what most brokers offer.

Sponsored ContentValuation is complex, but we're here to simplify it.

Discover if NWF Group might be undervalued or overvalued with our detailed analysis, featuring fair value estimates, potential risks, dividends, insider trades, and its financial condition.

Access Free AnalysisHave feedback on this article? Concerned about the content? Get in touch with us directly. Alternatively, email editorial-team@simplywallst.com

About AIM:NWF

NWF Group

Primarily engages in the sale and distribution of fuel oils in the United Kingdom.

Flawless balance sheet established dividend payer.

Market Insights

Community Narratives