- United Kingdom

- /

- Trade Distributors

- /

- AIM:ASY

Unveiling 3 Undiscovered Gems in United Kingdom Markets

Reviewed by Simply Wall St

In the current landscape, the United Kingdom's markets are experiencing a downturn, as evidenced by the FTSE 100 and FTSE 250 indices closing lower amid weak trade data from China, which has impacted companies with strong ties to the Chinese economy. This challenging environment highlights the importance of identifying resilient stocks that can withstand global economic pressures and offer potential growth opportunities.

Top 10 Undiscovered Gems With Strong Fundamentals In The United Kingdom

| Name | Debt To Equity | Revenue Growth | Earnings Growth | Health Rating |

|---|---|---|---|---|

| Anglo-Eastern Plantations | NA | 5.55% | 5.38% | ★★★★★★ |

| B.P. Marsh & Partners | NA | 42.17% | 45.70% | ★★★★★★ |

| Andrews Sykes Group | NA | 2.01% | 5.12% | ★★★★★★ |

| BioPharma Credit | NA | 7.73% | 7.94% | ★★★★★★ |

| Georgia Capital | NA | 2.23% | 16.34% | ★★★★★★ |

| MS INTERNATIONAL | NA | 15.73% | 53.22% | ★★★★★★ |

| Vectron Systems | NA | 2.48% | 28.82% | ★★★★★★ |

| Nationwide Building Society | 277.32% | 10.61% | 23.42% | ★★★★★☆ |

| Distribution Finance Capital Holdings | 9.37% | 48.09% | 66.49% | ★★★★★☆ |

| FW Thorpe | 2.12% | 10.94% | 13.25% | ★★★★★☆ |

Here's a peek at a few of the choices from the screener.

Andrews Sykes Group (AIM:ASY)

Simply Wall St Value Rating: ★★★★★★

Overview: Andrews Sykes Group plc is an investment holding company that operates in the hire, sale, and installation of environmental control equipment across the United Kingdom, Europe, the Middle East, Africa, and internationally with a market cap of £212.64 million.

Operations: Revenue primarily comes from hiring, selling, and installing environmental control equipment across various regions. The company has a market cap of £212.64 million.

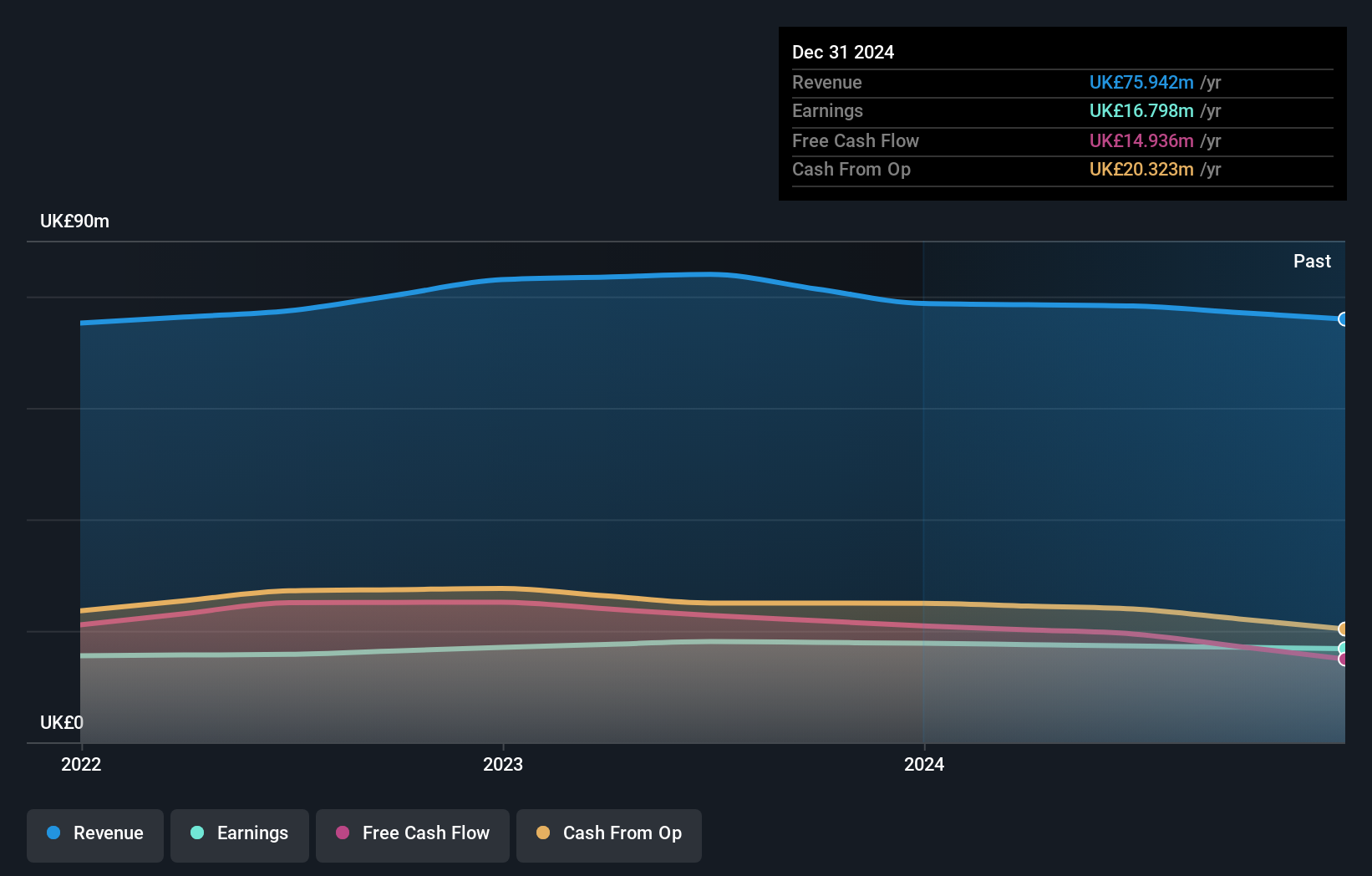

Andrews Sykes Group, a UK-based company, stands out with zero debt today compared to a 5.4% debt-to-equity ratio five years ago. Trading at 21% below its estimated fair value, it offers potential upside for investors. The firm reported net income of £7.44 million for the first half of 2025, up from £7.08 million the previous year, and declared an interim dividend of 11.90 pence per share amounting to £5 million in total dividends paid recently. Despite negative earnings growth of -0.8%, its high-quality earnings and positive free cash flow indicate resilience in challenging industry conditions.

- Click here and access our complete health analysis report to understand the dynamics of Andrews Sykes Group.

Gain insights into Andrews Sykes Group's past trends and performance with our Past report.

Yü Group (AIM:YU.)

Simply Wall St Value Rating: ★★★★★☆

Overview: Yü Group PLC, with a market cap of £266.14 million, supplies energy and utility solutions primarily in the United Kingdom through its subsidiaries.

Operations: The company generates revenue from supplying energy and utility solutions in the UK. It has a market cap of £266.14 million.

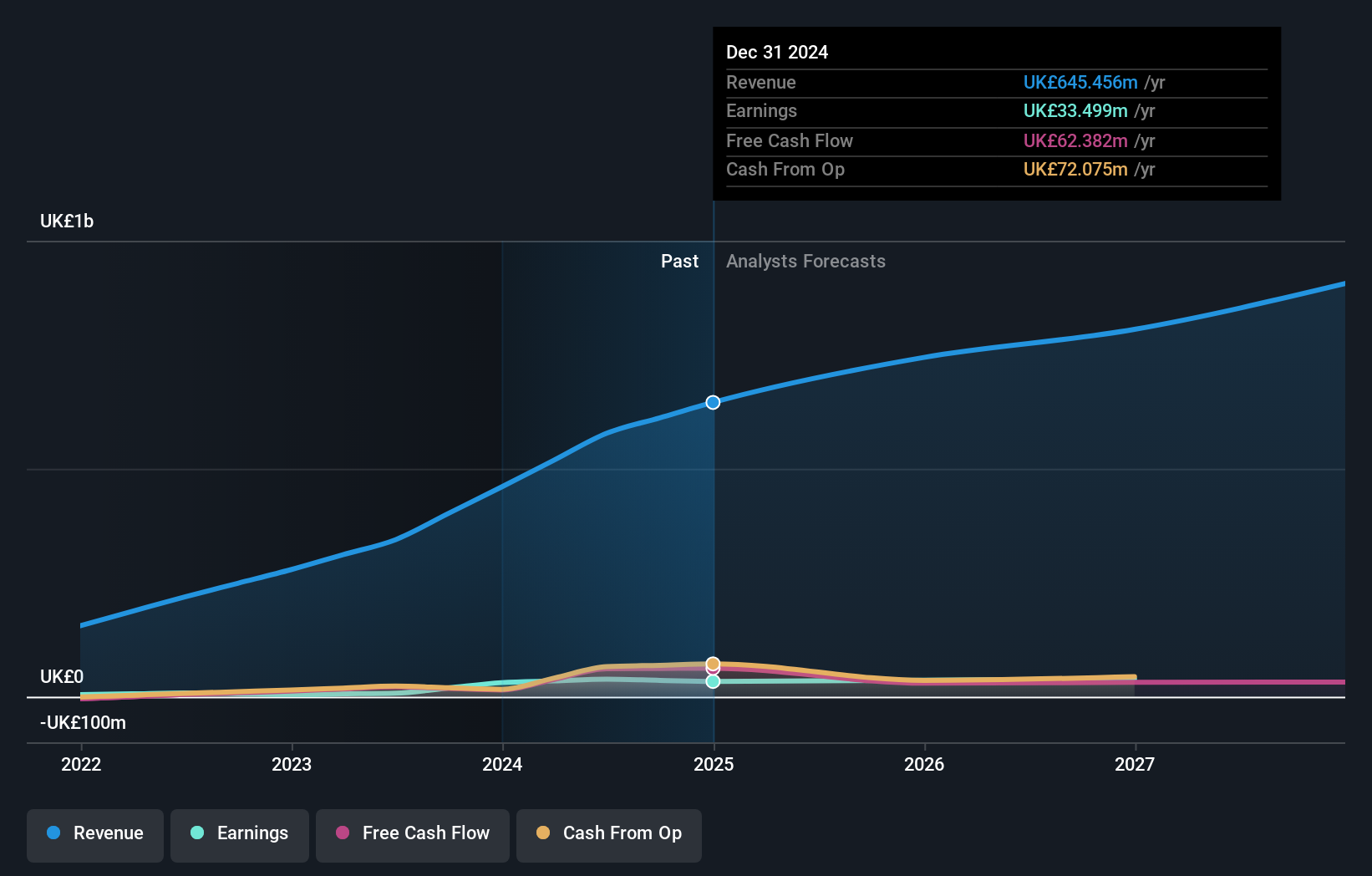

Yü Group, a small cap player in the energy sector, is trading at 64.3% below its estimated fair value, suggesting potential undervaluation. Over the past five years, its debt to equity ratio has risen from 0% to 10.3%, yet it holds more cash than total debt, indicating financial stability. Recent performance shows net income of £16.52 million for H1 2025 compared to £14.69 million a year earlier, with basic earnings per share increasing from £0.88 to £0.98. Despite negative earnings growth of -7.6% last year against industry averages, forecasts suggest a rebound with projected annual growth of 6%.

- Delve into the full analysis health report here for a deeper understanding of Yü Group.

Explore historical data to track Yü Group's performance over time in our Past section.

Pinewood Technologies Group (LSE:PINE)

Simply Wall St Value Rating: ★★★★★★

Overview: Pinewood Technologies Group PLC is a cloud-based dealer management software provider with operations in the United Kingdom, Europe, Africa, Asia, the Middle East, and internationally, and has a market cap of £341.83 million.

Operations: Pinewood Technologies Group generates revenue primarily from its cloud-based dealer management software services across multiple regions. The company has a market capitalization of £341.83 million.

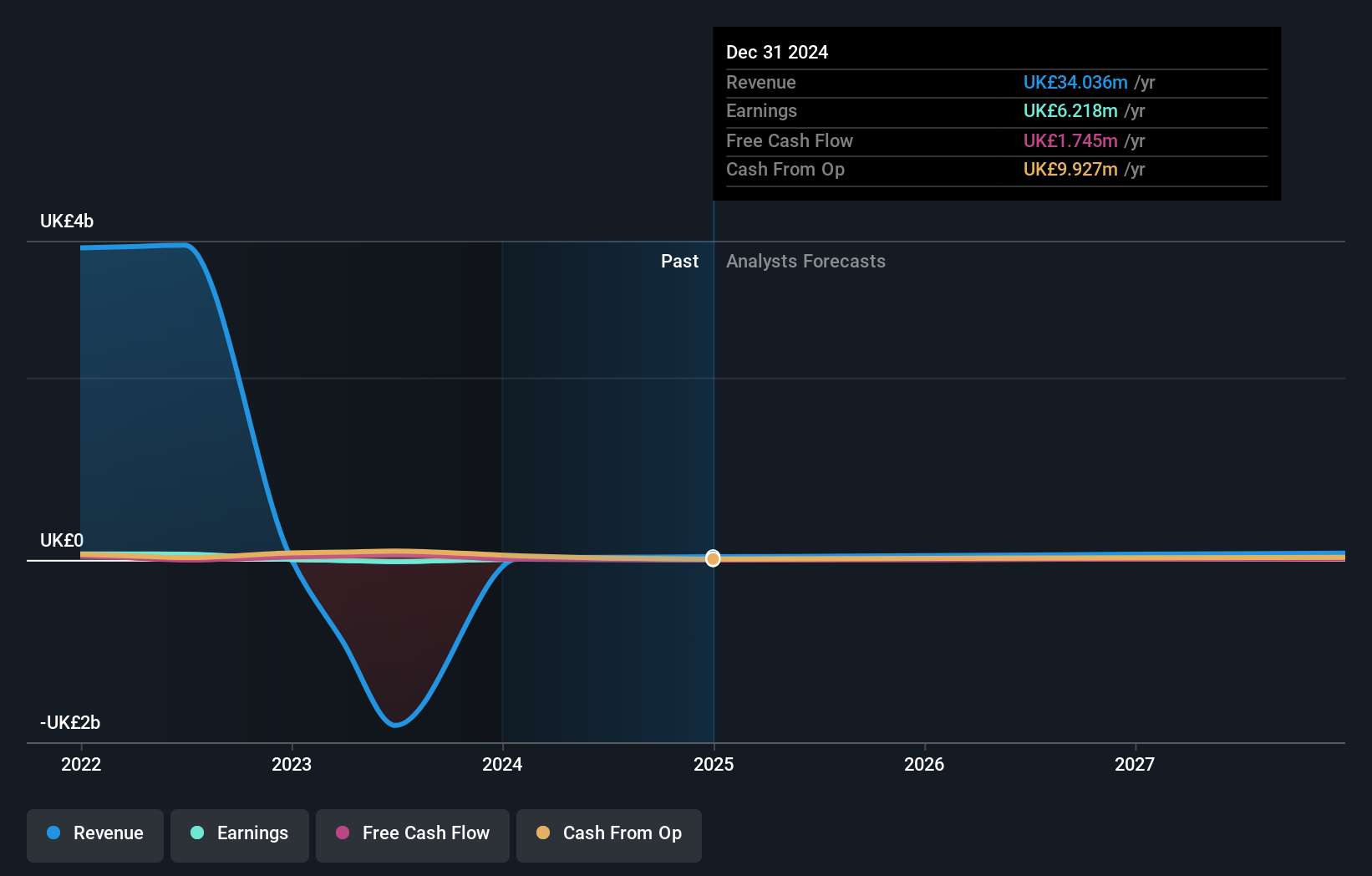

Pinewood Technologies Group, a player in the automotive software sector, is making strides with its acquisition of Seez AI to enhance dealer network efficiency and revenue. This move supports Pinewood's expansion into North America, bolstered by an oversubscribed equity raise. Despite a net loss of £0.7 million for the half year ending June 2025, sales increased to £19.6 million from £16.1 million previously. The company's debt-to-equity ratio has impressively decreased from 103.8% to 0.5% over five years, reflecting strong financial management amidst challenges like high operating costs and integration hurdles with Seez AI.

Where To Now?

- Delve into our full catalog of 56 UK Undiscovered Gems With Strong Fundamentals here.

- Already own these companies? Link your portfolio to Simply Wall St and get alerts on any new warning signs to your stocks.

- Unlock the power of informed investing with Simply Wall St, your free guide to navigating stock markets worldwide.

Searching for a Fresh Perspective?

- Explore high-performing small cap companies that haven't yet garnered significant analyst attention.

- Fuel your portfolio with companies showing strong growth potential, backed by optimistic outlooks both from analysts and management.

- Find companies with promising cash flow potential yet trading below their fair value.

This article by Simply Wall St is general in nature. We provide commentary based on historical data and analyst forecasts only using an unbiased methodology and our articles are not intended to be financial advice. It does not constitute a recommendation to buy or sell any stock, and does not take account of your objectives, or your financial situation. We aim to bring you long-term focused analysis driven by fundamental data. Note that our analysis may not factor in the latest price-sensitive company announcements or qualitative material. Simply Wall St has no position in any stocks mentioned.

New: Manage All Your Stock Portfolios in One Place

We've created the ultimate portfolio companion for stock investors, and it's free.

• Connect an unlimited number of Portfolios and see your total in one currency

• Be alerted to new Warning Signs or Risks via email or mobile

• Track the Fair Value of your stocks

Have feedback on this article? Concerned about the content? Get in touch with us directly. Alternatively, email editorial-team@simplywallst.com

About AIM:ASY

Andrews Sykes Group

An investment holding company, engages in the hire, sale, and installation of environmental control equipment in the United Kingdom, Rest of Europe, the Middle East, Africa, and internationally.

Flawless balance sheet, good value and pays a dividend.

Market Insights

Community Narratives