- United Kingdom

- /

- Construction

- /

- LSE:COST

Undiscovered Gems in the United Kingdom for August 2024

Reviewed by Simply Wall St

In recent months, the United Kingdom's market has faced headwinds, with the FTSE 100 and FTSE 250 indices experiencing declines amid weak trade data from China and global economic uncertainties. Despite these challenges, there remain promising opportunities within the small-cap sector for discerning investors. Identifying strong stocks in this environment requires a focus on companies that demonstrate resilience and potential for growth despite broader market volatility.

Top 10 Undiscovered Gems With Strong Fundamentals In The United Kingdom

| Name | Debt To Equity | Revenue Growth | Earnings Growth | Health Rating |

|---|---|---|---|---|

| Andrews Sykes Group | NA | 1.69% | 3.16% | ★★★★★★ |

| Globaltrans Investment | 15.40% | 2.68% | 16.51% | ★★★★★★ |

| Impellam Group | 31.12% | -5.43% | -6.86% | ★★★★★★ |

| London Security | 0.31% | 9.47% | 7.41% | ★★★★★★ |

| M&G Credit Income Investment Trust | NA | -0.35% | 1.18% | ★★★★★★ |

| Rights and Issues Investment Trust | NA | -3.68% | -4.07% | ★★★★★★ |

| FW Thorpe | 3.34% | 11.37% | 9.41% | ★★★★★☆ |

| Goodwin | 59.96% | 9.26% | 13.12% | ★★★★★☆ |

| BBGI Global Infrastructure | 0.02% | 6.58% | 9.90% | ★★★★★☆ |

| Mountview Estates | 16.64% | 4.50% | -0.59% | ★★★★☆☆ |

Here's a peek at a few of the choices from the screener.

Andrews Sykes Group (AIM:ASY)

Simply Wall St Value Rating: ★★★★★★

Overview: Andrews Sykes Group plc is an investment holding company that specializes in the hire, sale, and installation of environmental control equipment across the UK, Europe, the Middle East, Africa, and other international markets with a market cap of £249.06 million.

Operations: Andrews Sykes Group generates revenue primarily from the hire and sale of environmental control equipment, with notable contributions from the UK (£44.61 million) and Europe (£27.59 million). The Middle East segment adds £5.71 million, while installation and maintenance services contribute £2.11 million to the overall revenue.

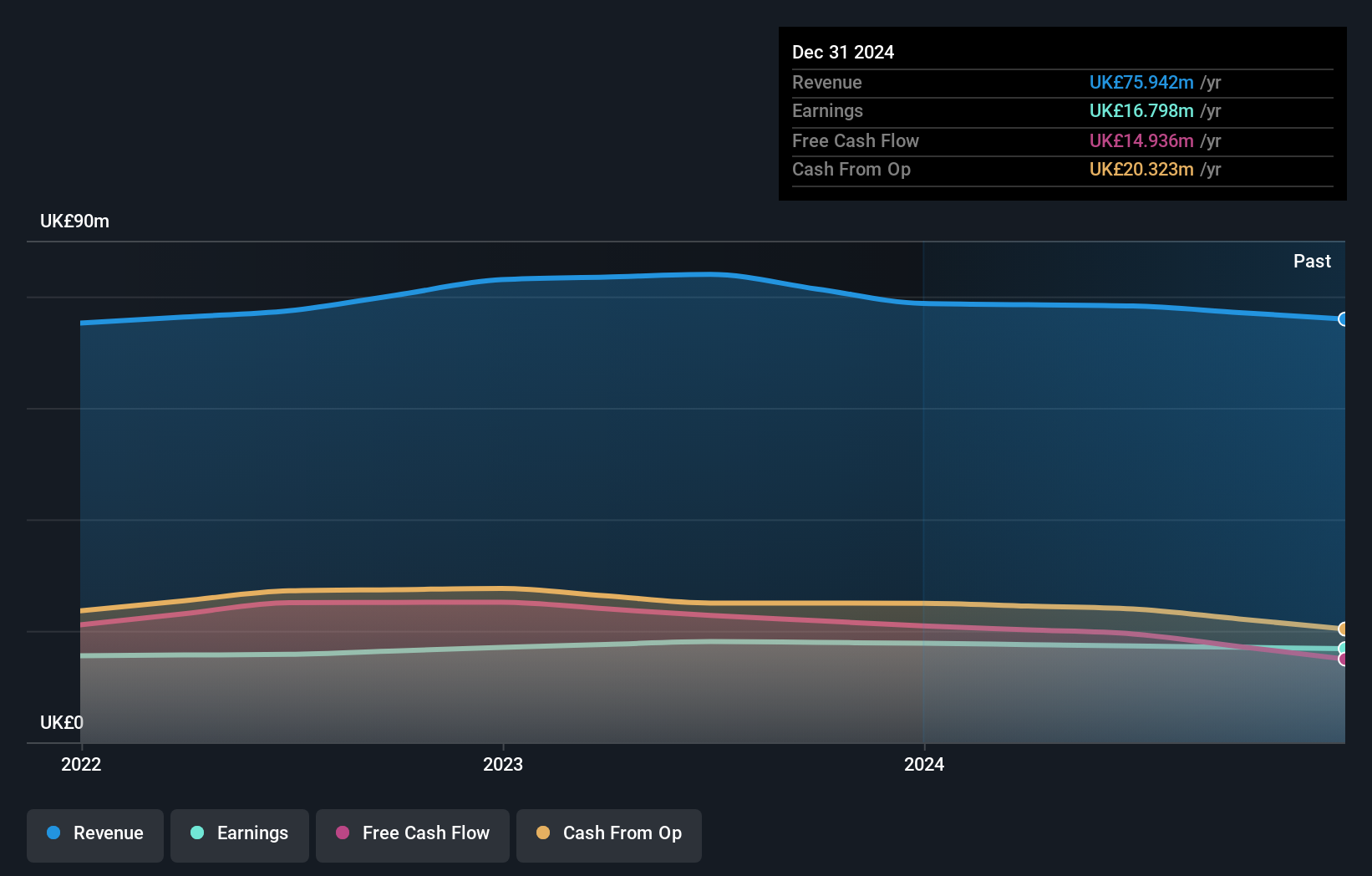

Andrews Sykes Group, a UK-based company, has seen its earnings grow by 4.3% over the past year, outpacing the Trade Distributors industry which saw a -6.5% shift. The firm operates debt-free and has significantly improved from five years ago when its debt to equity ratio was 7.6%. Trading at 27% below estimated fair value, it offers high-quality earnings and positive free cash flow. Recently, it declared a final dividend of £0.14 per share at its AGM in June 2024.

- Unlock comprehensive insights into our analysis of Andrews Sykes Group stock in this health report.

Explore historical data to track Andrews Sykes Group's performance over time in our Past section.

Griffin Mining (AIM:GFM)

Simply Wall St Value Rating: ★★★★★★

Overview: Griffin Mining Limited is a mining and investment company focused on the exploration, development, and operation of mineral properties with a market cap of £236.47 million.

Operations: Revenue for Griffin Mining Limited primarily comes from the Caijiaying Zinc Gold Mine, generating $146.02 million.

Griffin Mining has shown impressive growth, with earnings up 97.8% in the past year, significantly outpacing the Metals and Mining industry’s 7.6%. The company is debt-free, enhancing its financial stability. Recent production results for Q2 2024 revealed ore mined at 429,448 tonnes and zinc concentrate produced at 14,779 tonnes. Trading at 71% below estimated fair value suggests potential upside. Future earnings are forecasted to grow by approximately 4.27% annually.

- Take a closer look at Griffin Mining's potential here in our health report.

Gain insights into Griffin Mining's past trends and performance with our Past report.

Costain Group (LSE:COST)

Simply Wall St Value Rating: ★★★★★★

Overview: Costain Group PLC offers smart infrastructure solutions for the transportation, energy, water, and defense sectors in the UK and has a market cap of £288.21 million.

Operations: Costain Group PLC generates revenue primarily from providing smart infrastructure solutions across the transportation, energy, water, and defense sectors in the UK. The company has a market cap of £288.21 million.

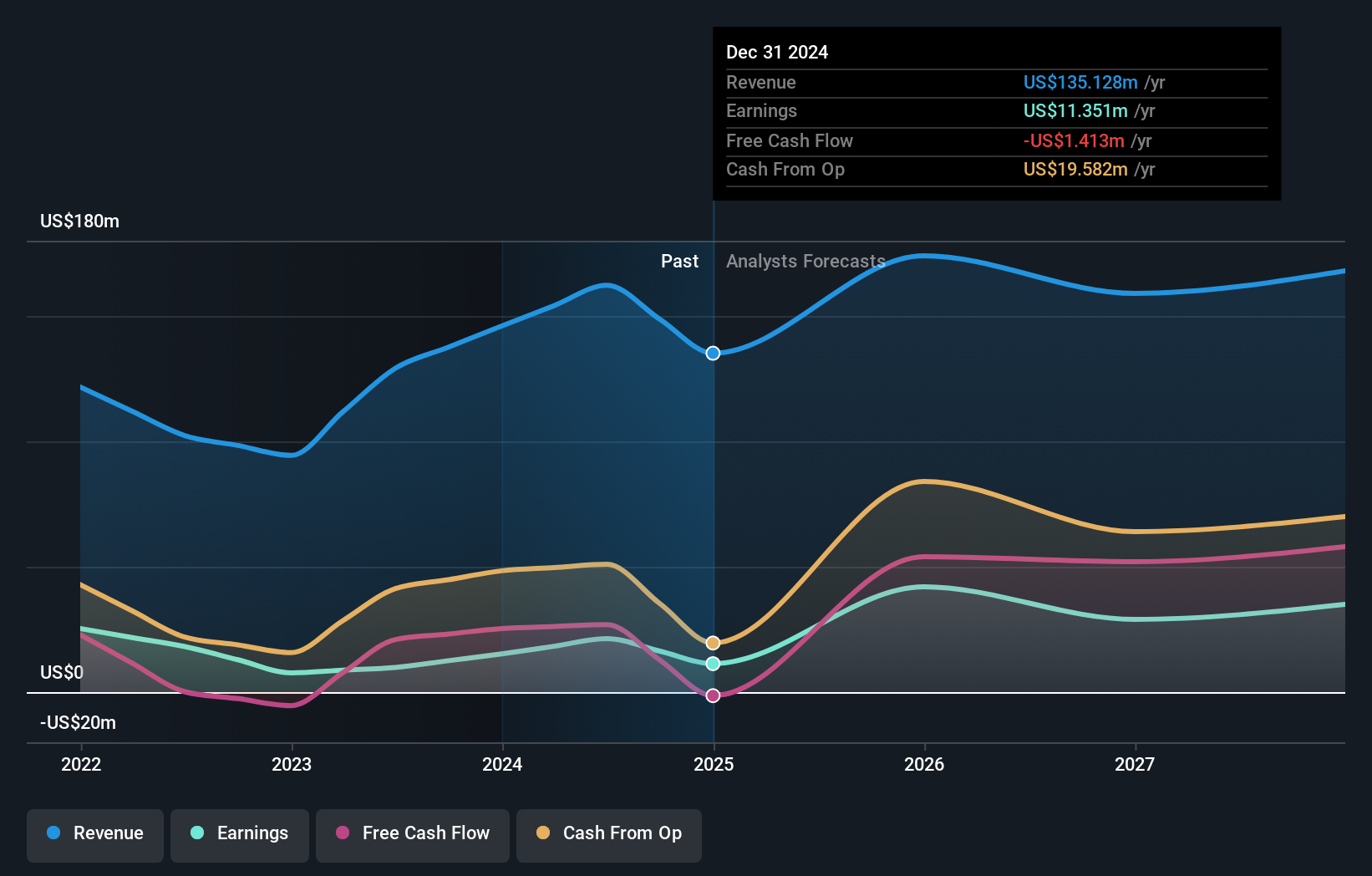

Costain Group, a noteworthy player in the UK construction sector, has shown impressive earnings growth of 39.3% over the past year, significantly outpacing its industry. Trading at 50% below fair value estimates and debt-free for five years (previously a 50.3% debt-to-equity ratio), it offers attractive investment potential. Recent highlights include securing £65 million contracts from Southern Water and being selected by United Utilities for a £3 billion strategic investment programme until 2030.

- Dive into the specifics of Costain Group here with our thorough health report.

Understand Costain Group's track record by examining our Past report.

Next Steps

- Explore the 78 names from our UK Undiscovered Gems With Strong Fundamentals screener here.

- Invested in any of these stocks? Simplify your portfolio management with Simply Wall St and stay ahead with our alerts for any critical updates on your stocks.

- Elevate your portfolio with Simply Wall St, the ultimate app for investors seeking global market coverage.

Seeking Other Investments?

- Explore high-performing small cap companies that haven't yet garnered significant analyst attention.

- Fuel your portfolio with companies showing strong growth potential, backed by optimistic outlooks both from analysts and management.

- Find companies with promising cash flow potential yet trading below their fair value.

This article by Simply Wall St is general in nature. We provide commentary based on historical data and analyst forecasts only using an unbiased methodology and our articles are not intended to be financial advice. It does not constitute a recommendation to buy or sell any stock, and does not take account of your objectives, or your financial situation. We aim to bring you long-term focused analysis driven by fundamental data. Note that our analysis may not factor in the latest price-sensitive company announcements or qualitative material. Simply Wall St has no position in any stocks mentioned.

New: AI Stock Screener & Alerts

Our new AI Stock Screener scans the market every day to uncover opportunities.

• Dividend Powerhouses (3%+ Yield)

• Undervalued Small Caps with Insider Buying

• High growth Tech and AI Companies

Or build your own from over 50 metrics.

Have feedback on this article? Concerned about the content? Get in touch with us directly. Alternatively, email editorial-team@simplywallst.com

About LSE:COST

Costain Group

Provides smart infrastructure solutions for the transportation, energy, water, and defense markets in the United Kingdom.

Flawless balance sheet and undervalued.