- United Kingdom

- /

- Banks

- /

- LSE:BARC

Barclays (LSE:BARC): Is the Market Overlooking True Value After a Quiet Rally?

Reviewed by Simply Wall St

Barclays (LSE:BARC) has caught the eye of many investors lately, and it is not because of one headline-grabbing event. Sometimes, even a subtle shift in a familiar name gets people asking whether something bigger might be taking shape. Right now, there is no specific trigger forcing a change in sentiment for Barclays, but the stock’s underlying performance is raising fresh questions about what is really priced in.

Taking a step back, Barclays has quietly posted an impressive run over the past year, with the stock climbing almost 68%. While weekly price movements have been modest and the past month has been flat, the longer-term momentum is hard to ignore. This comes amid steady annual growth in both revenue and net income, even as the broader banking sector has faced its own share of uncertainty.

So after this year’s strong rally, are investors overlooking a new chapter of growth at Barclays, or has the market already factored in everything that matters?

Most Popular Narrative: 9.9% Undervalued

According to the most widely followed narrative, Barclays appears undervalued compared to its intrinsic worth, based on widely held financial projections and market assumptions.

Ongoing investments in digital banking and technology platforms, including integration of fintech partnerships and sustained client onboarding in corporate banking, are expected to drive operational efficiency and expand Barclays' digital revenue streams. This supports stronger net margins and long-term earnings growth.

Barclays' fair value is more than just a number; it is the outcome of ambitious growth forecasts, profit margin bets, and a belief that today's pricing does not reflect tomorrow's potential. Want to unravel the assumptions fueling this bold upside? The real story is in the projections and expectations shaping this double-digit discount. Curious to see what the analysts are counting on for this price?

Result: Fair Value of £4.07 (UNDERVALUED)

Have a read of the narrative in full and understand what's behind the forecasts.However, risks remain, such as heightened competition in investment banking or potential macroeconomic headwinds. Either of these factors could quickly alter current growth expectations.

Find out about the key risks to this Barclays narrative.Another View: The SWS DCF Model

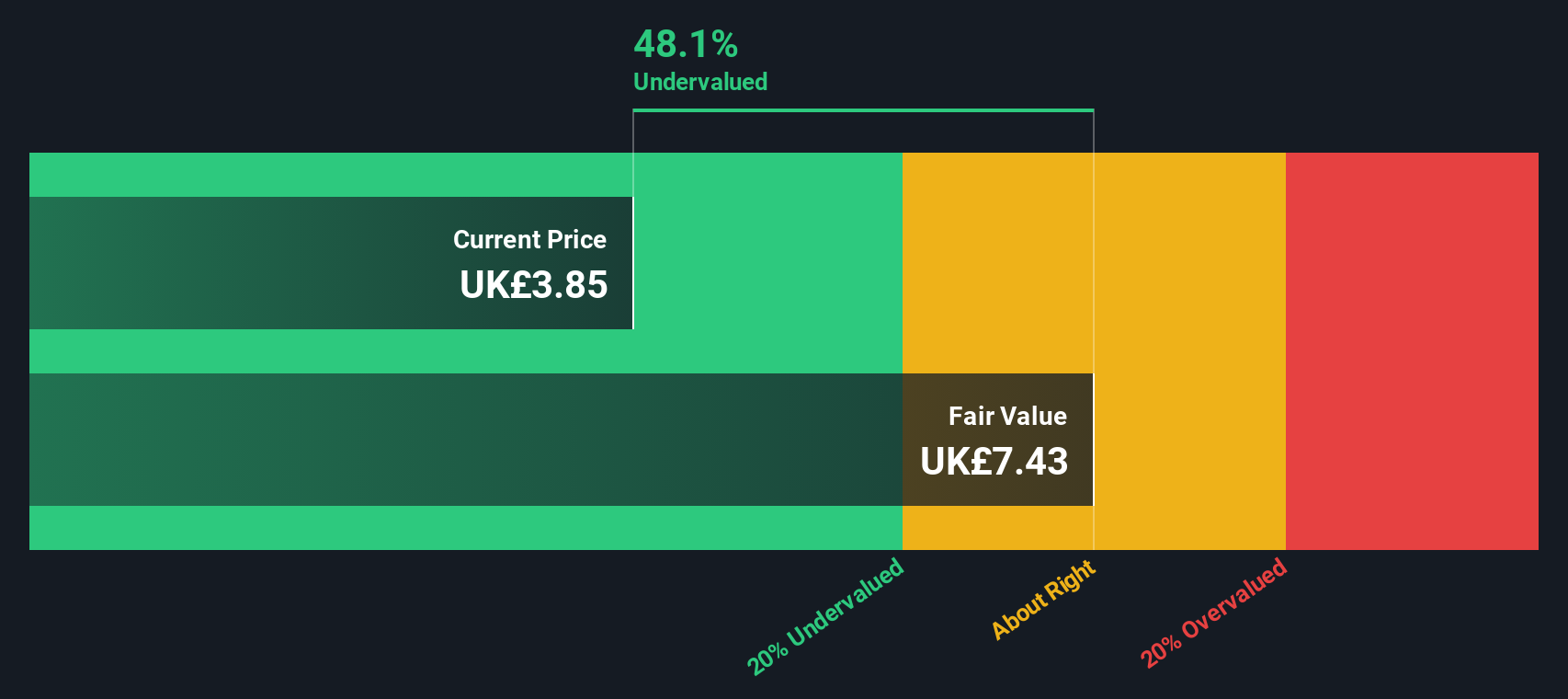

While many analysts focus on market ratios to gauge value, our SWS DCF model comes to a different conclusion. This approach projects future cash flows in order to estimate whether the stock is really undervalued. Could this model be seeing something others have missed?

Look into how the SWS DCF model arrives at its fair value.

Build Your Own Barclays Narrative

If you see things differently or believe your own analysis might shed fresh light on the story, you can craft your perspective in just a few minutes. Do it your way.

A great starting point for your Barclays research is our analysis highlighting 3 key rewards and 5 important warning signs that could impact your investment decision.

Looking for more investment ideas?

There are countless opportunities beyond Barclays, and some of the most compelling companies are hiding in plain sight. Act now to turn information into real advantage with these powerful stock ideas before the crowd catches on.

- Unlock long-term income potential with companies offering attractive yields by checking out our dividend stocks with yields > 3% to see who’s consistently rewarding shareholders.

- Tap into breakthroughs in medicine and technology by using our healthcare AI stocks to spot leaders blending healthcare with artificial intelligence innovations.

- Capitalize on undervalued gems flying under the radar through our undervalued stocks based on cash flows and put smart bargains on your investment radar.

This article by Simply Wall St is general in nature. We provide commentary based on historical data and analyst forecasts only using an unbiased methodology and our articles are not intended to be financial advice. It does not constitute a recommendation to buy or sell any stock, and does not take account of your objectives, or your financial situation. We aim to bring you long-term focused analysis driven by fundamental data. Note that our analysis may not factor in the latest price-sensitive company announcements or qualitative material. Simply Wall St has no position in any stocks mentioned.

Valuation is complex, but we're here to simplify it.

Discover if Barclays might be undervalued or overvalued with our detailed analysis, featuring fair value estimates, potential risks, dividends, insider trades, and its financial condition.

Access Free AnalysisHave feedback on this article? Concerned about the content? Get in touch with us directly. Alternatively, email editorial-team@simplywallst.com

Kshitija Bhandaru

Kshitija (or Keisha) Bhandaru is an Equity Analyst at Simply Wall St and has over 6 years of experience in the finance industry and describes herself as a lifelong learner driven by her intellectual curiosity. She previously worked with Market Realist for 5 years as an Equity Analyst.

About LSE:BARC

Barclays

Provides various financial services in the United Kingdom, Europe, the Americas, Africa, the Middle East, and Asia.

Solid track record and good value.

Similar Companies

Market Insights

Community Narratives