- United Kingdom

- /

- Capital Markets

- /

- LSE:N91

3 Top Dividend Stocks In UK Yielding Up To 7.3%

Reviewed by Simply Wall St

The London markets have recently faced downward pressure, with the FTSE 100 closing lower due to weak trade data from China and a sluggish global economic recovery. Despite these challenges, dividend stocks remain a compelling option for investors seeking steady income, particularly in uncertain market conditions.

Top 10 Dividend Stocks In The United Kingdom

| Name | Dividend Yield | Dividend Rating |

| James Latham (AIM:LTHM) | 5.83% | ★★★★★★ |

| Impax Asset Management Group (AIM:IPX) | 7.05% | ★★★★★☆ |

| Big Yellow Group (LSE:BYG) | 3.60% | ★★★★★☆ |

| 4imprint Group (LSE:FOUR) | 3.04% | ★★★★★☆ |

| Burberry Group (LSE:BRBY) | 8.77% | ★★★★★☆ |

| Dunelm Group (LSE:DNLM) | 6.37% | ★★★★★☆ |

| Plus500 (LSE:PLUS) | 5.65% | ★★★★★☆ |

| DCC (LSE:DCC) | 3.74% | ★★★★★☆ |

| NWF Group (AIM:NWF) | 4.84% | ★★★★★☆ |

| Grafton Group (LSE:GFTU) | 3.47% | ★★★★★☆ |

Click here to see the full list of 55 stocks from our Top UK Dividend Stocks screener.

Let's explore several standout options from the results in the screener.

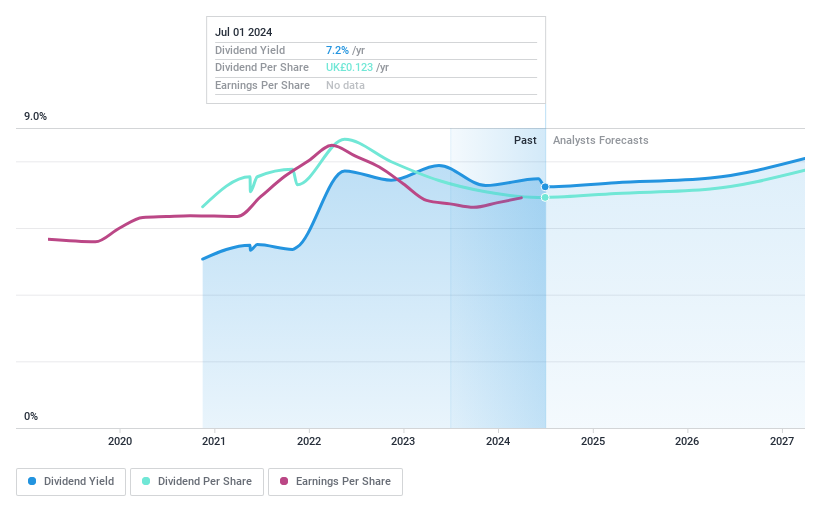

Alumasc Group (AIM:ALU)

Simply Wall St Dividend Rating: ★★★★☆☆

Overview: The Alumasc Group plc, with a market cap of £90.35 million, manufactures and sells building products, systems, and solutions across the United Kingdom and various international markets including Europe, North America, the Middle East, and the Far East.

Operations: The Alumasc Group plc's revenue is derived from three main segments: Water Management (£42.29 million), Building Envelope (£34.92 million), and Housebuilding Products (£14.79 million).

Dividend Yield: 4.1%

Alumasc Group's dividend payments have been volatile over the past decade, though they have increased overall. Despite a relatively low yield of 4.12%, dividends are well-covered by earnings (payout ratio: 46.6%) and cash flows (cash payout ratio: 31.2%). The company trades at a good value, approximately 27.9% below fair value estimates, and has issued positive guidance for FY2024 with expected organic revenue growth of around 6.5%.

- Click here and access our complete dividend analysis report to understand the dynamics of Alumasc Group.

- Upon reviewing our latest valuation report, Alumasc Group's share price might be too pessimistic.

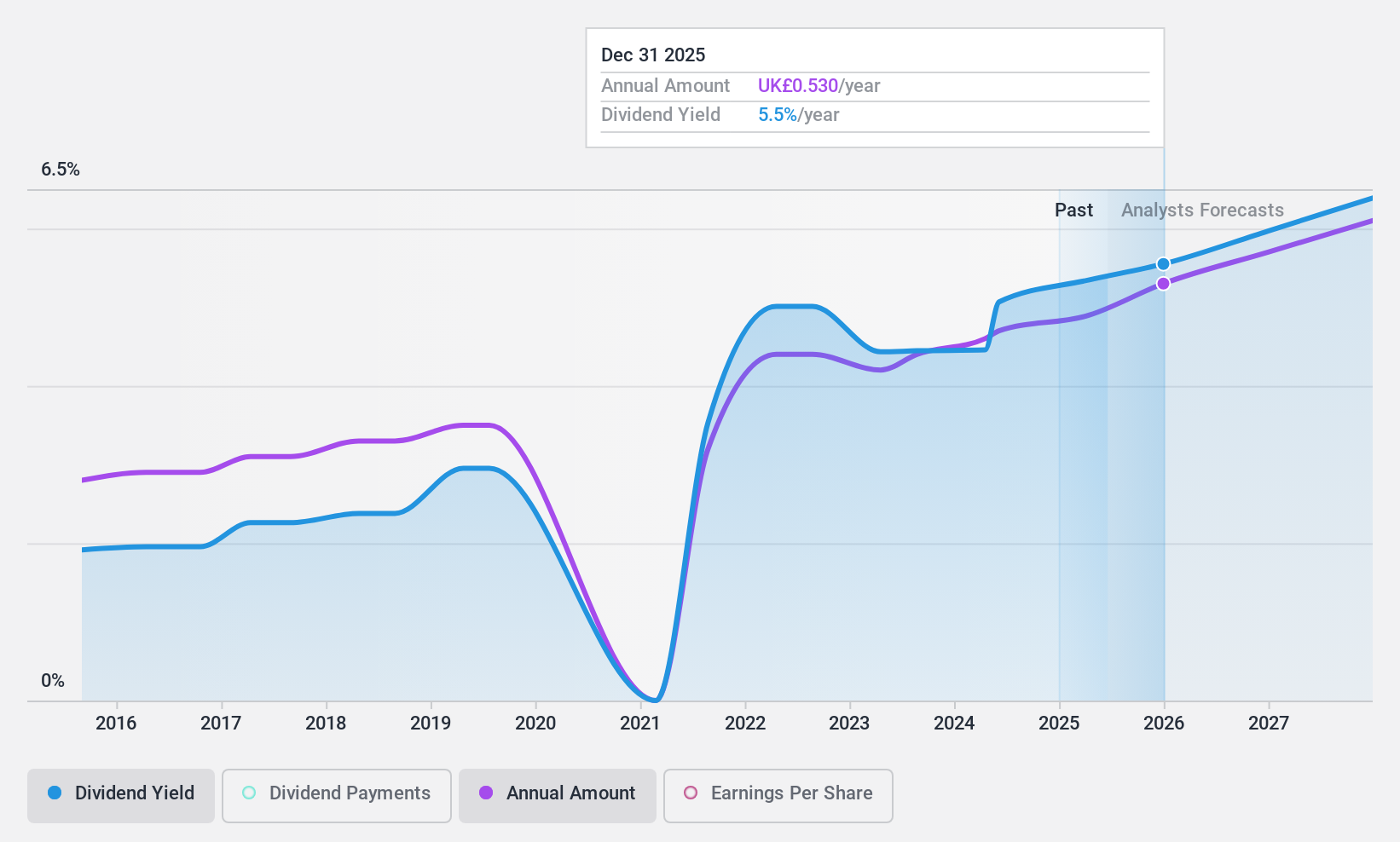

Arbuthnot Banking Group (AIM:ARBB)

Simply Wall St Dividend Rating: ★★★★☆☆

Overview: Arbuthnot Banking Group PLC, with a market cap of £153.85 million, offers private and commercial banking products and services in the United Kingdom through its subsidiaries.

Operations: Arbuthnot Banking Group PLC generates revenue from several segments, including Wealth Management (£12.32 million), Asset Alliance Group (£14.81 million), Renaissance Asset Finance (£9.42 million), and Arbuthnot Commercial Asset Based Lending (£16.03 million).

Dividend Yield: 4.9%

Arbuthnot Banking Group has shown a mixed dividend performance, with recent increases including a special dividend of £0.20 per share. Despite a low payout ratio of 24.9%, indicating dividends are well-covered by earnings, the company's dividend history has been volatile over the past decade. Recent earnings reports show declines in net income and interest income compared to last year, while bad loan allowances remain low at 8%.

- Take a closer look at Arbuthnot Banking Group's potential here in our dividend report.

- Our expertly prepared valuation report Arbuthnot Banking Group implies its share price may be lower than expected.

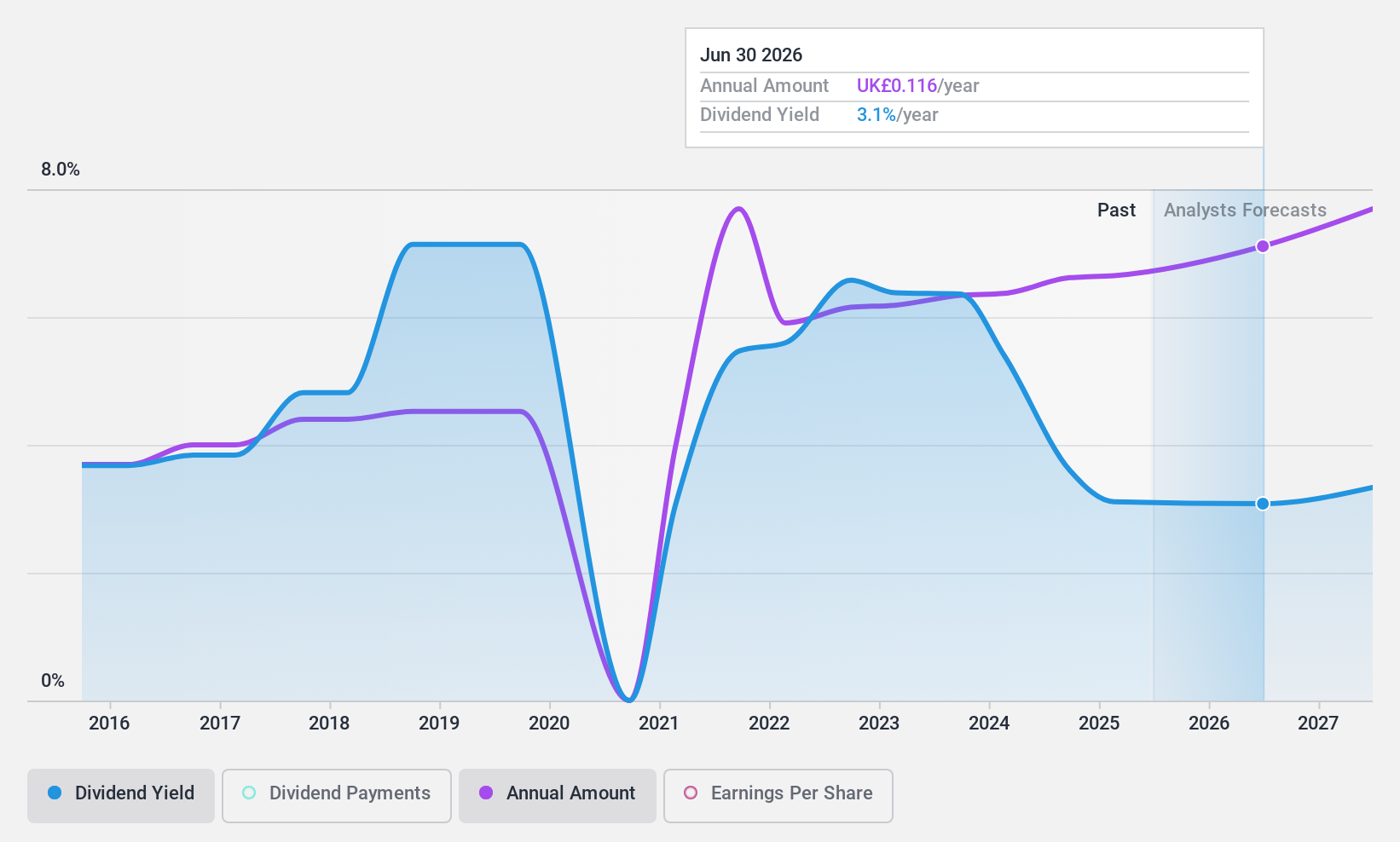

Ninety One Group (LSE:N91)

Simply Wall St Dividend Rating: ★★★★☆☆

Overview: Ninety One Group is an independent global asset manager with a market cap of £1.49 billion.

Operations: Ninety One Group generates £588.50 million in revenue from its investment management business.

Dividend Yield: 7.4%

Ninety One Group trades at a good value, 22.3% below our fair value estimate, with a dividend yield in the top 25% of UK payers. Its dividends are well-covered by earnings (66.8%) and cash flows (65.3%), though its track record is under a decade. The company reported stable net income for FY2024 despite lower sales and revenue compared to the previous year, and recently appointed Duane Cable as CIO South Africa to enhance investment excellence.

- Click to explore a detailed breakdown of our findings in Ninety One Group's dividend report.

- The valuation report we've compiled suggests that Ninety One Group's current price could be quite moderate.

Key Takeaways

- Discover the full array of 55 Top UK Dividend Stocks right here.

- Got skin in the game with these stocks? Elevate how you manage them by using Simply Wall St's portfolio, where intuitive tools await to help optimize your investment outcomes.

- Maximize your investment potential with Simply Wall St, the comprehensive app that offers global market insights for free.

Ready For A Different Approach?

- Explore high-performing small cap companies that haven't yet garnered significant analyst attention.

- Fuel your portfolio with companies showing strong growth potential, backed by optimistic outlooks both from analysts and management.

- Find companies with promising cash flow potential yet trading below their fair value.

This article by Simply Wall St is general in nature. We provide commentary based on historical data and analyst forecasts only using an unbiased methodology and our articles are not intended to be financial advice. It does not constitute a recommendation to buy or sell any stock, and does not take account of your objectives, or your financial situation. We aim to bring you long-term focused analysis driven by fundamental data. Note that our analysis may not factor in the latest price-sensitive company announcements or qualitative material. Simply Wall St has no position in any stocks mentioned.

Valuation is complex, but we're here to simplify it.

Discover if Ninety One Group might be undervalued or overvalued with our detailed analysis, featuring fair value estimates, potential risks, dividends, insider trades, and its financial condition.

Access Free AnalysisHave feedback on this article? Concerned about the content? Get in touch with us directly. Alternatively, email editorial-team@simplywallst.com

About LSE:N91

Ninety One Group

Operates as an independent global asset manager worldwide.

Flawless balance sheet, good value and pays a dividend.