- France

- /

- Other Utilities

- /

- ENXTPA:ENGI

The Bull Case For Engie (ENXTPA:ENGI) Could Change Following Upgraded Earnings Guidance and Apple PPA Partnership – Learn Why

Reviewed by Sasha Jovanovic

- Earlier this month, Engie confirmed its 2025 earnings guidance, projecting net recurring income at the upper end of its €4.4–€5.0 billion range and EBIT excluding nuclear near the top of its €8.0–€9.0 billion estimate, while also announcing a major renewable energy partnership with Apple to deliver 173 MW of new capacity in Italy under a 15-year PPA.

- The collaboration with Apple underscores Engie's growing position in global renewable energy markets and highlights its ability to secure large-scale, long-duration client contracts supporting decarbonization goals.

- We'll look at how Engie's upgraded 2025 earnings guidance and Apple partnership could shape its investment outlook and growth narrative.

Trump's oil boom is here - pipelines are primed to profit. Discover the 22 US stocks riding the wave.

Engie Investment Narrative Recap

At the core, investors in Engie are typically attracted by its ambition to lead the global transition to renewable energy, aiming for stable returns through growth in regulated and contracted revenues. The recent confirmation of 2025 earnings guidance and Apple partnership supports near-term confidence, but the most important short-term catalyst remains Engie's push to bring new renewables online; the biggest risk is ongoing exposure to weather volatility, especially hydro output, which the recent news does not materially reduce.

The new Italy-Apple renewable deal stands out as most relevant, underlining Engie's progress in securing long-term, high-profile PPAs that support predictable revenue streams. This not only enhances visibility on project delivery but also supports the company’s growth pipeline, a key driver amid competitive and policy-related risks in renewables.

However, investors should also consider that, despite strengthened guidance and new contracts, exposure to unpredictable hydro volumes could still...

Read the full narrative on Engie (it's free!)

Engie's narrative projects €75.8 billion revenue and €4.5 billion earnings by 2028. This requires a 0.6% yearly revenue decline and a €0.5 billion earnings decrease from €5.0 billion currently.

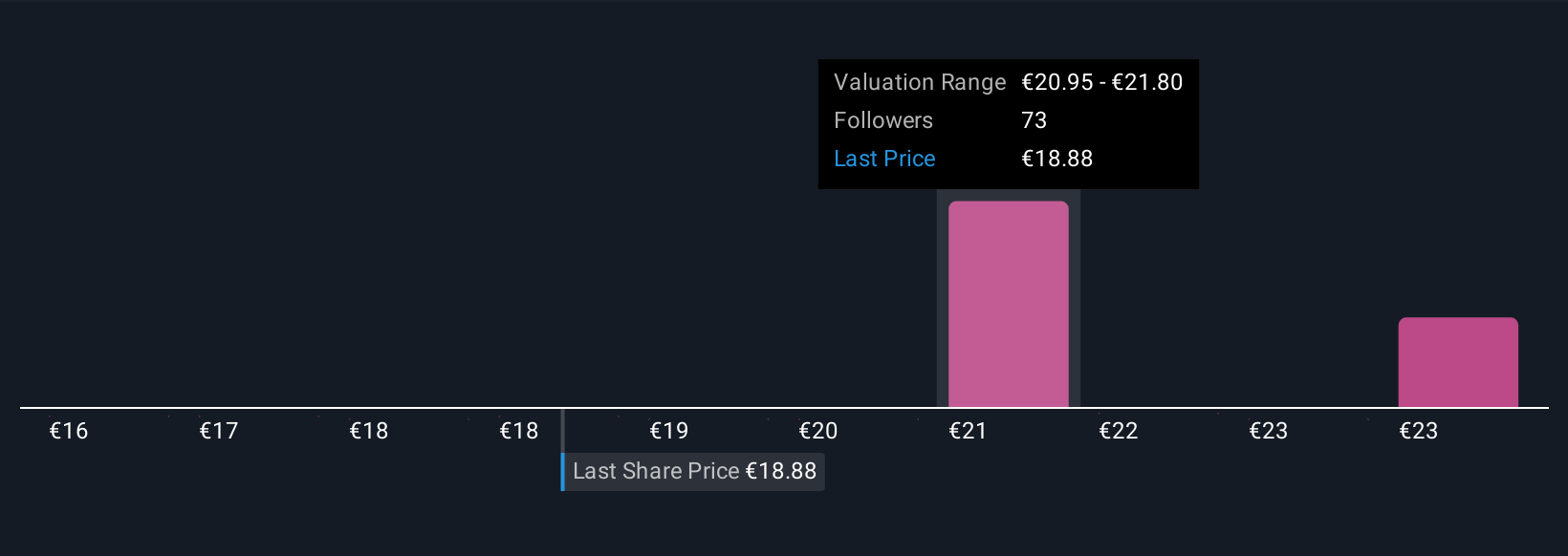

Uncover how Engie's forecasts yield a €21.48 fair value, in line with its current price.

Exploring Other Perspectives

Five individual fair value estimates from the Simply Wall St Community range from €17.51 to €21.80, reflecting a broad set of expectations for Engie. While community perspectives differ, the group’s high reliance on successful renewables rollouts remains a decisive factor for future company performance.

Explore 5 other fair value estimates on Engie - why the stock might be worth as much as €21.80!

Build Your Own Engie Narrative

Disagree with existing narratives? Create your own in under 3 minutes - extraordinary investment returns rarely come from following the herd.

- A great starting point for your Engie research is our analysis highlighting 3 key rewards and 3 important warning signs that could impact your investment decision.

- Our free Engie research report provides a comprehensive fundamental analysis summarized in a single visual - the Snowflake - making it easy to evaluate Engie's overall financial health at a glance.

Searching For A Fresh Perspective?

Opportunities like this don't last. These are today's most promising picks. Check them out now:

- The end of cancer? These 29 emerging AI stocks are developing tech that will allow early identification of life changing diseases like cancer and Alzheimer's.

- Outshine the giants: these 26 early-stage AI stocks could fund your retirement.

- These 13 companies survived and thrived after COVID and have the right ingredients to survive Trump's tariffs. Discover why before your portfolio feels the trade war pinch.

This article by Simply Wall St is general in nature. We provide commentary based on historical data and analyst forecasts only using an unbiased methodology and our articles are not intended to be financial advice. It does not constitute a recommendation to buy or sell any stock, and does not take account of your objectives, or your financial situation. We aim to bring you long-term focused analysis driven by fundamental data. Note that our analysis may not factor in the latest price-sensitive company announcements or qualitative material. Simply Wall St has no position in any stocks mentioned.

Valuation is complex, but we're here to simplify it.

Discover if Engie might be undervalued or overvalued with our detailed analysis, featuring fair value estimates, potential risks, dividends, insider trades, and its financial condition.

Access Free AnalysisHave feedback on this article? Concerned about the content? Get in touch with us directly. Alternatively, email editorial-team@simplywallst.com

About ENXTPA:ENGI

Engie

Operates as an energy company, engages in the renewables and decentralized, low-carbon energy networks, and energy services businesses in France, Europe, North America, Asia, the Middle East, Oceania, South America, Africa, and internationally.

Average dividend payer and fair value.

Similar Companies

Market Insights

Community Narratives