- France

- /

- Telecom Services and Carriers

- /

- ENXTPA:ORA

Orange (ENXTPA:ORA): Examining Valuation Following a Surge in Shareholder Returns

Reviewed by Simply Wall St

Orange (ENXTPA:ORA) stock has been relatively steady this month with small price moves. This reflects ongoing activity in the European telecom market. Investors have kept an eye on Orange’s recent results and how its growth measures are playing out.

See our latest analysis for Orange.

Orange’s share price has climbed steadily, with a year-to-date share price return of 46.06%. Upbeat earnings and steady demand for telecom services have helped drive this momentum. The one-year total shareholder return is even more eye-catching at 52.99%, signaling that investors are noticing both stable performance and improving growth prospects in the sector.

If Orange’s momentum has you exploring broader telecom trends, take the next step and discover fast growing stocks with high insider ownership

Yet with shares trading close to their analyst price target and robust recent returns, the key question is whether Orange is undervalued or if the market has already priced in the company’s next phase of growth.

Price-to-Earnings of 41.3x: Is it justified?

Orange is currently trading at a price-to-earnings ratio of 41.3x, which far exceeds both its local and industry peers. At its last close of €14.17, the stock appears to command a significant premium.

The price-to-earnings (P/E) ratio measures how much investors are willing to pay for each euro of earnings. In the telecom sector, this metric helps compare profitability and growth potential across similar companies. A P/E as high as Orange's suggests strong expectations for future earnings growth, or possibly overenthusiasm from buyers.

However, Orange's P/E ratio is more than double the European telecom industry average of 16.9x and above the peer group average of 19x. The market is either highly optimistic about Orange’s prospects or overlooking headwinds in the company’s recent and forecasted performance. No fair ratio is available to offer further guidance on what the P/E could revert to, making this premium especially noteworthy.

See what the numbers say about this price — find out in our valuation breakdown.

Result: Price-to-Earnings of 41.3x (OVERVALUED)

However, tepid revenue growth and shares trading close to their target price could limit future upside if market expectations cool. This warrants cautious optimism.

Find out about the key risks to this Orange narrative.

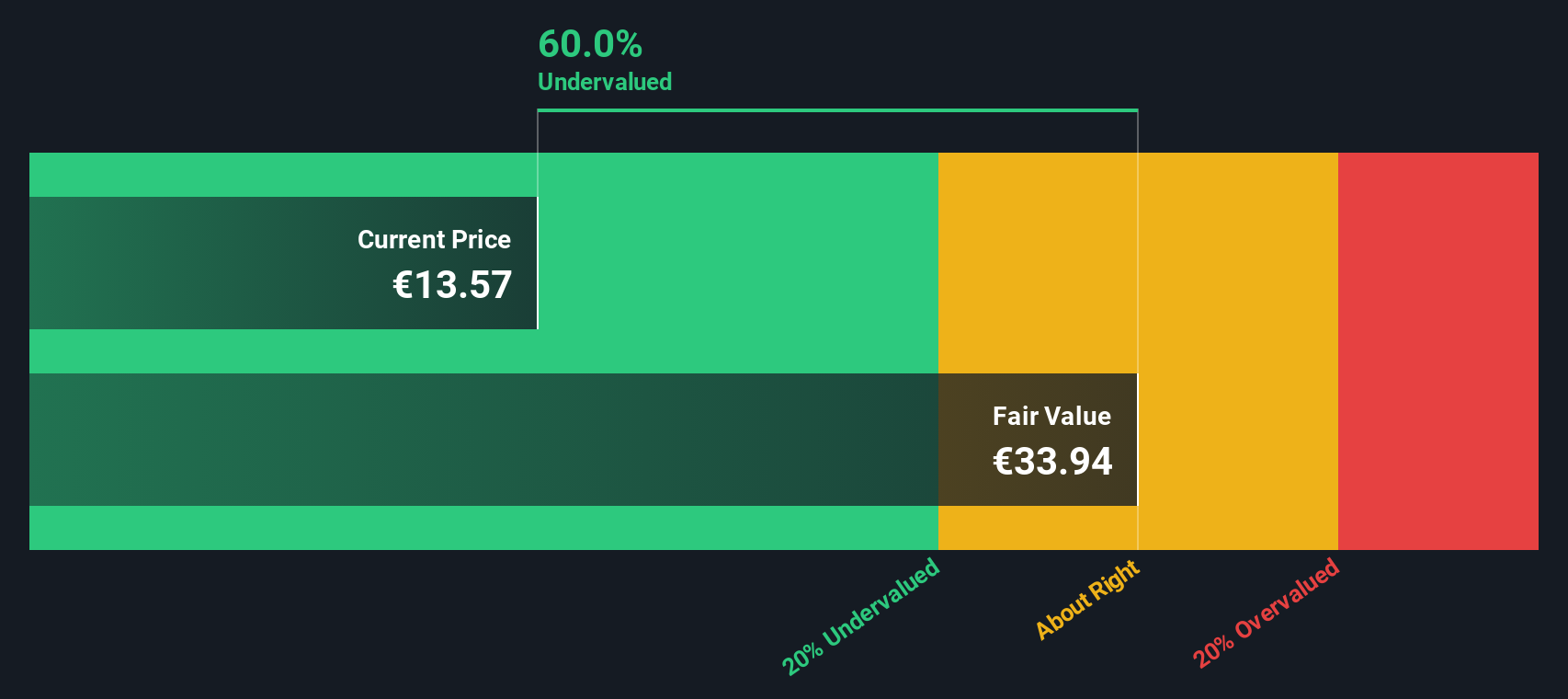

Another View: Discounted Cash Flow Says Undervalued

While the earnings multiple shows Orange as expensive, our DCF model offers a dramatic contrast. The SWS DCF model estimates Orange’s fair value at €29.13. In comparison, the current share price of €14.17 appears 51.4% undervalued. Could this wide gap reveal a value opportunity, or is the market right to be cautious?

Look into how the SWS DCF model arrives at its fair value.

Simply Wall St performs a discounted cash flow (DCF) on every stock in the world every day (check out Orange for example). We show the entire calculation in full. You can track the result in your watchlist or portfolio and be alerted when this changes, or use our stock screener to discover 870 undervalued stocks based on their cash flows. If you save a screener we even alert you when new companies match - so you never miss a potential opportunity.

Build Your Own Orange Narrative

If you see things differently or want to dig deeper, you can analyze the numbers yourself and shape your own perspective in just minutes. Do it your way

A great starting point for your Orange research is our analysis highlighting 2 key rewards and 3 important warning signs that could impact your investment decision.

Looking for more investment ideas?

Don’t limit your opportunities to just one story. Countless stocks are primed for growth, income, or innovation. Seize the chance to get ahead now.

- Tap into robust income streams by reviewing these 16 dividend stocks with yields > 3%, featuring shares with strong yields and steady financials for your portfolio.

- Catch the market’s disruptors shaking up AI breakthroughs by checking out these 24 AI penny stocks at the forefront of artificial intelligence.

- Uncover bargain investments with real upside when you scan these 870 undervalued stocks based on cash flows packed with companies trading well below their intrinsic value.

This article by Simply Wall St is general in nature. We provide commentary based on historical data and analyst forecasts only using an unbiased methodology and our articles are not intended to be financial advice. It does not constitute a recommendation to buy or sell any stock, and does not take account of your objectives, or your financial situation. We aim to bring you long-term focused analysis driven by fundamental data. Note that our analysis may not factor in the latest price-sensitive company announcements or qualitative material. Simply Wall St has no position in any stocks mentioned.

New: AI Stock Screener & Alerts

Our new AI Stock Screener scans the market every day to uncover opportunities.

• Dividend Powerhouses (3%+ Yield)

• Undervalued Small Caps with Insider Buying

• High growth Tech and AI Companies

Or build your own from over 50 metrics.

Have feedback on this article? Concerned about the content? Get in touch with us directly. Alternatively, email editorial-team@simplywallst.com

About ENXTPA:ORA

Orange

Operates as a telecommunications operator in France and internationally.

Average dividend payer with moderate growth potential.

Similar Companies

Market Insights

Community Narratives