- France

- /

- Telecom Services and Carriers

- /

- ENXTPA:ORA

How Investors May Respond To Orange (ENXTPA:ORA) Expanding Its Role in Europe’s GNSS Network Rollout

Reviewed by Sasha Jovanovic

- Earlier this month, Point One Navigation announced a new partnership with TOTEM and Orange to accelerate the rollout of Europe’s largest GNSS correction network, leveraging Orange’s advanced connectivity and TOTEM’s extensive telecom infrastructure across France and Spain.

- The collaboration will see Orange not only providing connectivity solutions but also acting as a commercial channel partner, expanding Orange’s involvement in both the technology and distribution of precision location services across diverse sectors.

- We’ll now explore how Orange’s dual role as infrastructure enabler and commercial partner could influence its long-term investment narrative.

These 15 companies survived and thrived after COVID and have the right ingredients to survive Trump's tariffs. Discover why before your portfolio feels the trade war pinch.

What Is Orange's Investment Narrative?

For Orange shareholders, the investment story continues to revolve around the group’s push to unlock value in its diverse telecom assets while demonstrating financial discipline in an environment of modest revenue growth and low profit margins. Short-term stock catalysts had been dominated by steady buybacks, dividend stability, and continued speculation around data center sales and new partnerships. The recent Point One Navigation deal brings a fresh angle; Orange is deepening its infrastructure role and gaining a new channel exposure in emerging precision location markets, possibly enriching future growth narratives, though it may not move the needle materially right away, considering the group’s overall revenue size and current earnings pressures. However, the collaboration signals Orange’s intent to broaden its positioning in high-value tech sectors, a direction that could shift focus away from purely traditional telecom risks toward broader digital transformation opportunities in the years ahead.

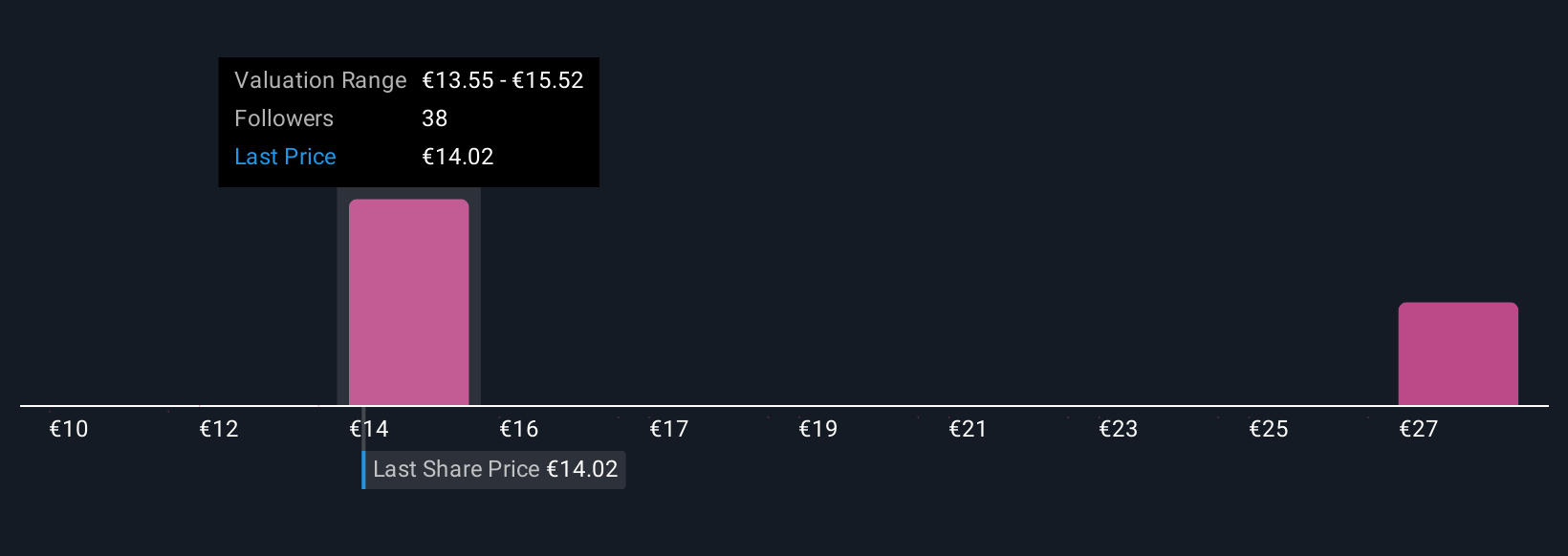

But beneath these new growth angles, Orange’s relatively high debt levels remain a point investors should keep in mind. Orange's shares have been on the rise but are still potentially undervalued. Find out how large the opportunity might be.Exploring Other Perspectives

Explore 5 other fair value estimates on Orange - why the stock might be worth over 2x more than the current price!

Build Your Own Orange Narrative

Disagree with this assessment? Create your own narrative in under 3 minutes - extraordinary investment returns rarely come from following the herd.

- A great starting point for your Orange research is our analysis highlighting 2 key rewards and 3 important warning signs that could impact your investment decision.

- Our free Orange research report provides a comprehensive fundamental analysis summarized in a single visual - the Snowflake - making it easy to evaluate Orange's overall financial health at a glance.

Seeking Other Investments?

Opportunities like this don't last. These are today's most promising picks. Check them out now:

- Find companies with promising cash flow potential yet trading below their fair value.

- Explore 27 top quantum computing companies leading the revolution in next-gen technology and shaping the future with breakthroughs in quantum algorithms, superconducting qubits, and cutting-edge research.

- Outshine the giants: these 27 early-stage AI stocks could fund your retirement.

This article by Simply Wall St is general in nature. We provide commentary based on historical data and analyst forecasts only using an unbiased methodology and our articles are not intended to be financial advice. It does not constitute a recommendation to buy or sell any stock, and does not take account of your objectives, or your financial situation. We aim to bring you long-term focused analysis driven by fundamental data. Note that our analysis may not factor in the latest price-sensitive company announcements or qualitative material. Simply Wall St has no position in any stocks mentioned.

New: AI Stock Screener & Alerts

Our new AI Stock Screener scans the market every day to uncover opportunities.

• Dividend Powerhouses (3%+ Yield)

• Undervalued Small Caps with Insider Buying

• High growth Tech and AI Companies

Or build your own from over 50 metrics.

Have feedback on this article? Concerned about the content? Get in touch with us directly. Alternatively, email editorial-team@simplywallst.com

About ENXTPA:ORA

Orange

Operates as a telecommunications operator in France and internationally.

Average dividend payer with moderate growth potential.

Similar Companies

Market Insights

Community Narratives