- France

- /

- Electronic Equipment and Components

- /

- ENXTPA:VU

Will the DM EdgeSense Partnership Accelerate VusionGroup’s (ENXTPA:VU) Retail Digital Transformation Narrative?

Reviewed by Sasha Jovanovic

- On October 31, 2025, DM announced a partnership with VusionGroup to implement the EdgeSense digital shelf platform across approximately 70 stores, with around 20 stores already activated.

- This rollout leverages advanced IoT, computer vision, and AI capabilities to reduce operational complexity and improve both employee workflows and the customer experience in DM stores.

- We'll explore how the EdgeSense partnership supports VusionGroup’s strategy of driving retail digital transformation through advanced technology solutions.

Uncover the next big thing with financially sound penny stocks that balance risk and reward.

VusionGroup Investment Narrative Recap

To be a VusionGroup shareholder, you need confidence in the company's ability to maintain rapid technology-driven growth and broaden its client base beyond Walmart. The new DM partnership showcases continued traction for EdgeSense and is a positive development, but the company's most important short-term catalyst, widespread adoption of value-added services and digital platforms, remains largely tied to execution at scale. The biggest risk continues to be revenue concentration, particularly if new contracts like DM's do not offset any unanticipated changes in core relationships.

Among recent announcements, the Morrisons partnership stands out for its scale, with VusionGroup delivering electronic shelf labels to nearly 500 supermarkets in the UK. This underscores rising demand for digital transformation in retail, reinforcing catalysts like accelerating value-added services adoption, a potential earnings driver if deployments remain on track and competitor pressure is contained.

By contrast, investors should be aware of the potential revenue volatility if key new partnerships fail to deliver at the anticipated pace or if customer concentration remains high...

Read the full narrative on VusionGroup (it's free!)

VusionGroup's outlook anticipates €2.2 billion in revenue and €228.2 million in earnings by 2028. This scenario assumes 32.2% annual revenue growth and an increase in earnings of €256 million from the current level of €-27.8 million.

Uncover how VusionGroup's forecasts yield a €281.57 fair value, a 31% upside to its current price.

Exploring Other Perspectives

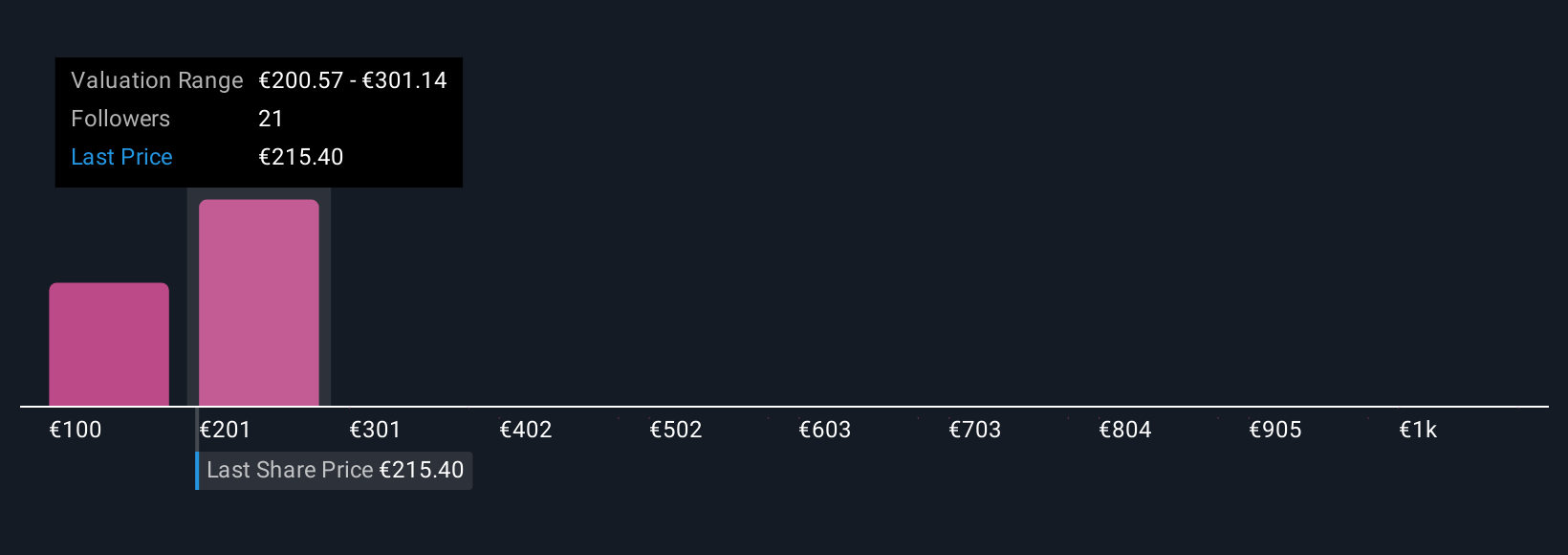

Thirteen fair value estimates from the Simply Wall St Community put VusionGroup's worth anywhere from €100 to over €1,100 per share. With execution on large digital transformation contracts remaining a critical issue, you can compare multiple views on how these opportunities could shape returns.

Explore 13 other fair value estimates on VusionGroup - why the stock might be worth less than half the current price!

Build Your Own VusionGroup Narrative

Disagree with existing narratives? Create your own in under 3 minutes - extraordinary investment returns rarely come from following the herd.

- A great starting point for your VusionGroup research is our analysis highlighting 3 key rewards that could impact your investment decision.

- Our free VusionGroup research report provides a comprehensive fundamental analysis summarized in a single visual - the Snowflake - making it easy to evaluate VusionGroup's overall financial health at a glance.

Want Some Alternatives?

Markets shift fast. These stocks won't stay hidden for long. Get the list while it matters:

- We've found 15 US stocks that are forecast to pay a dividend yield of over 6% next year. See the full list for free.

- Rare earth metals are an input to most high-tech devices, military and defence systems and electric vehicles. The global race is on to secure supply of these critical minerals. Beat the pack to uncover the 37 best rare earth metal stocks of the very few that mine this essential strategic resource.

- These 15 companies survived and thrived after COVID and have the right ingredients to survive Trump's tariffs. Discover why before your portfolio feels the trade war pinch.

This article by Simply Wall St is general in nature. We provide commentary based on historical data and analyst forecasts only using an unbiased methodology and our articles are not intended to be financial advice. It does not constitute a recommendation to buy or sell any stock, and does not take account of your objectives, or your financial situation. We aim to bring you long-term focused analysis driven by fundamental data. Note that our analysis may not factor in the latest price-sensitive company announcements or qualitative material. Simply Wall St has no position in any stocks mentioned.

New: Manage All Your Stock Portfolios in One Place

We've created the ultimate portfolio companion for stock investors, and it's free.

• Connect an unlimited number of Portfolios and see your total in one currency

• Be alerted to new Warning Signs or Risks via email or mobile

• Track the Fair Value of your stocks

Have feedback on this article? Concerned about the content? Get in touch with us directly. Alternatively, email editorial-team@simplywallst.com

About ENXTPA:VU

VusionGroup

Engages in the provision of digitalization solutions for commerce in Europe, Asia, and North America.

High growth potential with adequate balance sheet.

Similar Companies

Market Insights

Community Narratives