- Finland

- /

- Semiconductors

- /

- HLSE:CANATU

European Insider-Owned Growth Companies To Watch In December 2025

Reviewed by Simply Wall St

As European markets experience a notable upswing, with the STOXX Europe 600 Index and major single-country stock indexes posting gains, investor attention has increasingly turned towards growth companies exhibiting strong insider ownership. High insider ownership can be an attractive trait for investors seeking alignment of interests between company leaders and shareholders, particularly in a market environment where economic indicators suggest stability around the European Central Bank's inflation target.

Top 10 Growth Companies With High Insider Ownership In Europe

| Name | Insider Ownership | Earnings Growth |

| Pharma Mar (BME:PHM) | 12% | 41.5% |

| MilDef Group (OM:MILDEF) | 13.7% | 83% |

| MedinCell (ENXTPA:MEDCL) | 12.5% | 96.3% |

| KebNi (OM:KEBNI B) | 36.3% | 61.2% |

| Elliptic Laboratories (OB:ELABS) | 22.5% | 109.1% |

| DNO (OB:DNO) | 13.5% | 97.5% |

| CTT Systems (OM:CTT) | 17.5% | 52% |

| Circus (XTRA:CA1) | 24.1% | 65.8% |

| CD Projekt (WSE:CDR) | 29.7% | 52.1% |

| Bonesupport Holding (OM:BONEX) | 10.4% | 49.7% |

Here's a peek at a few of the choices from the screener.

Altri SGPS (ENXTLS:ALTR)

Simply Wall St Growth Rating: ★★★★☆☆

Overview: Altri SGPS is a company that produces and sells cellulosic fibers both in Portugal and internationally, with a market cap of €929.25 million.

Operations: The company's revenue is primarily derived from the production and commercialization of cellulosic fibers, amounting to €705.90 million.

Insider Ownership: 12.4%

Earnings Growth Forecast: 36.1% p.a.

Altri SGPS, a company with high insider ownership, is forecasted to experience significant earnings growth of 36.1% annually, outpacing the Portuguese market's 14.2%. However, recent financial results show challenges; Q3 sales decreased to €162.14 million from €203.51 million the previous year, and a net loss of €1.66 million was reported compared to prior net income of €27.6 million. Despite this downturn, analysts expect stock price increases by 23%.

- Get an in-depth perspective on Altri SGPS' performance by reading our analyst estimates report here.

- Our expertly prepared valuation report Altri SGPS implies its share price may be too high.

VusionGroup (ENXTPA:VU)

Simply Wall St Growth Rating: ★★★★★☆

Overview: VusionGroup S.A. provides digitalization solutions for commerce across Europe, Asia, and North America with a market cap of €3.45 billion.

Operations: The company's revenue is primarily derived from installing and maintaining electronic shelf labels, amounting to €1.16 billion.

Insider Ownership: 12.8%

Earnings Growth Forecast: 58.3% p.a.

VusionGroup, with significant insider ownership, is poised for robust growth. Recent strategic partnerships with OBI Germany and DM highlight its innovative digital solutions like smart electronic shelf labels and EdgeSense platform, enhancing operational efficiency across retail chains. VusionGroup's revenue is forecasted to grow at 19% annually, surpassing the French market average. Despite a net loss of €9.7 million in H1 2025, analysts anticipate a future stock price increase of 36.8%.

- Click here and access our complete growth analysis report to understand the dynamics of VusionGroup.

- The valuation report we've compiled suggests that VusionGroup's current price could be inflated.

Canatu Oyj (HLSE:CANATU)

Simply Wall St Growth Rating: ★★★★★☆

Overview: Canatu Oyj specializes in developing and selling carbon nanotubes and related products for the semiconductor, automotive, and medical diagnostics industries across Finland, the United States, Japan, and Taiwan, with a market cap of €287.89 million.

Operations: Revenue segments for the company include the semiconductor, automotive, and medical diagnostics industries across Finland, the United States, Japan, and Taiwan.

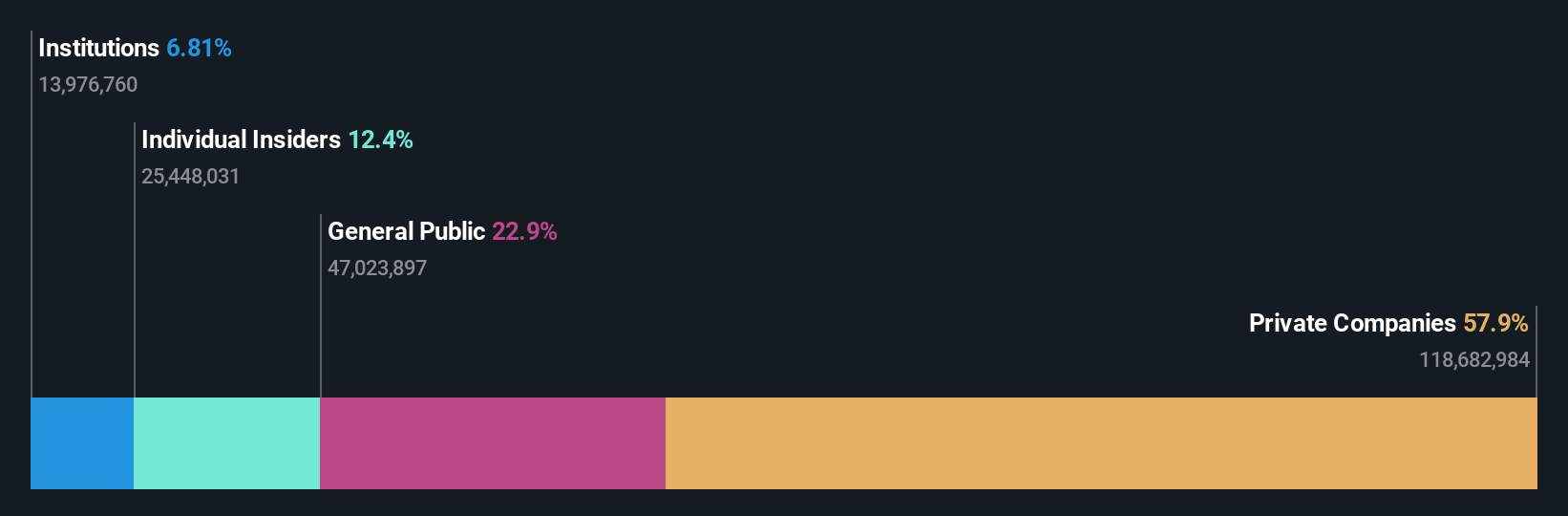

Insider Ownership: 12.5%

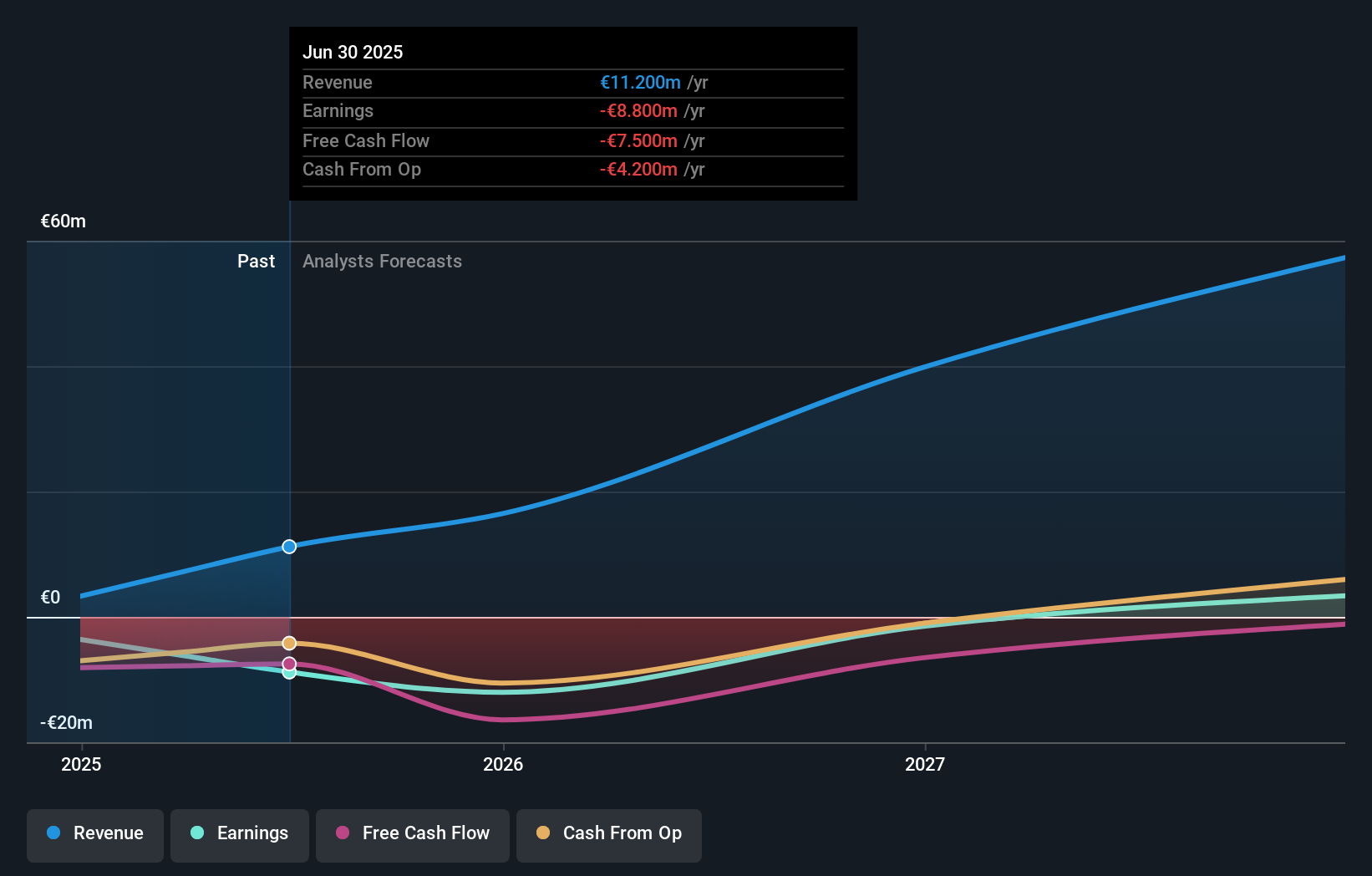

Earnings Growth Forecast: 66.3% p.a.

Canatu Oyj, with considerable insider ownership, is set for significant growth in the advanced carbon nanotube sector. Recent developments include a commercial production license agreement with FINE SEMITECH CORPORATION, introducing new revenue streams through consumables and royalties. Canatu's revenue is forecasted to grow at 41.6% annually, outpacing the Finnish market significantly. Despite share price volatility and low return on equity forecasts, analysts expect profitability within three years and a potential stock price increase of 26.2%.

- Click to explore a detailed breakdown of our findings in Canatu Oyj's earnings growth report.

- Insights from our recent valuation report point to the potential undervaluation of Canatu Oyj shares in the market.

Where To Now?

- Embark on your investment journey to our 204 Fast Growing European Companies With High Insider Ownership selection here.

- Ready To Venture Into Other Investment Styles? The end of cancer? These 29 emerging AI stocks are developing tech that will allow early idenification of life changing disesaes like cancer and Alzheimer's.

This article by Simply Wall St is general in nature. We provide commentary based on historical data and analyst forecasts only using an unbiased methodology and our articles are not intended to be financial advice. It does not constitute a recommendation to buy or sell any stock, and does not take account of your objectives, or your financial situation. We aim to bring you long-term focused analysis driven by fundamental data. Note that our analysis may not factor in the latest price-sensitive company announcements or qualitative material. Simply Wall St has no position in any stocks mentioned.The analysis only considers stock directly held by insiders. It does not include indirectly owned stock through other vehicles such as corporate and/or trust entities. All forecast revenue and earnings growth rates quoted are in terms of annualised (per annum) growth rates over 1-3 years.

New: AI Stock Screener & Alerts

Our new AI Stock Screener scans the market every day to uncover opportunities.

• Dividend Powerhouses (3%+ Yield)

• Undervalued Small Caps with Insider Buying

• High growth Tech and AI Companies

Or build your own from over 50 metrics.

Have feedback on this article? Concerned about the content? Get in touch with us directly. Alternatively, email editorial-team@simplywallst.com

About HLSE:CANATU

Canatu Oyj

Develops and sells carbon nanotubes (CNTs) and related products for the semiconductor, automotive, and medical diagnostics industries in Finland, the United States, Japan, and Taiwan.

High growth potential and good value.

Market Insights

Weekly Picks

Solutions by stc: 34% Upside in Saudi's Digital Transformation Leader

The AI Infrastructure Giant Grows Into Its Valuation

Recently Updated Narratives

Perdana Petroleum Berhad is a Zombie Business with a 27.34% Profit Margin and inflation adjusted revenue Business

Many trends acting at the same time

Engineered for Stability. Positioned for Growth.

Popular Narratives

MicroVision will explode future revenue by 380.37% with a vision towards success

NVDA: Expanding AI Demand Will Drive Major Data Center Investments Through 2026