As global markets react to the recent Federal Reserve rate cut, small-cap stocks have shown resilience despite remaining below their previous peaks. In France, the CAC 40 Index has seen modest gains, reflecting cautious optimism among investors. Identifying a good stock in this environment often involves looking for companies with strong fundamentals and growth potential that can thrive amid changing economic conditions.

Top 10 Undiscovered Gems With Strong Fundamentals In France

| Name | Debt To Equity | Revenue Growth | Earnings Growth | Health Rating |

|---|---|---|---|---|

| Caisse Régionale de Crédit Agricole Mutuel Brie Picardie Société coopérative | 34.89% | 3.23% | 3.61% | ★★★★★★ |

| EssoF | 1.19% | 11.14% | 41.41% | ★★★★★★ |

| Gévelot | 0.25% | 10.64% | 20.33% | ★★★★★★ |

| VIEL & Cie société anonyme | 72.14% | 5.72% | 19.86% | ★★★★★☆ |

| ADLPartner | 86.83% | 9.59% | 11.00% | ★★★★★☆ |

| CFM Indosuez Wealth Management | 239.60% | 10.01% | 13.52% | ★★★★★☆ |

| La Forestière Equatoriale | 0.00% | -50.76% | 49.41% | ★★★★★☆ |

| Caisse Régionale de Crédit Agricole Mutuel Alpes Provence Société coopérative | 391.01% | 4.67% | 17.31% | ★★★★☆☆ |

| Fiducial Real Estate | 33.77% | 1.63% | 3.30% | ★★★★☆☆ |

| Société Fermière du Casino Municipal de Cannes | 11.60% | 6.69% | 10.30% | ★★★★☆☆ |

We're going to check out a few of the best picks from our screener tool.

Axway Software (ENXTPA:AXW)

Simply Wall St Value Rating: ★★★★★☆

Overview: Axway Software SA is an infrastructure software publisher with operations spanning France, the rest of Europe, the Americas, and the Asia Pacific, and has a market cap of €685.50 million.

Operations: Axway Software generates revenue from four primary segments: License (€8.46 million), Maintenance (€77.04 million), Subscription (€201.19 million), and Services excluding Subscription (€35.49 million). The company has a market cap of €685.50 million.

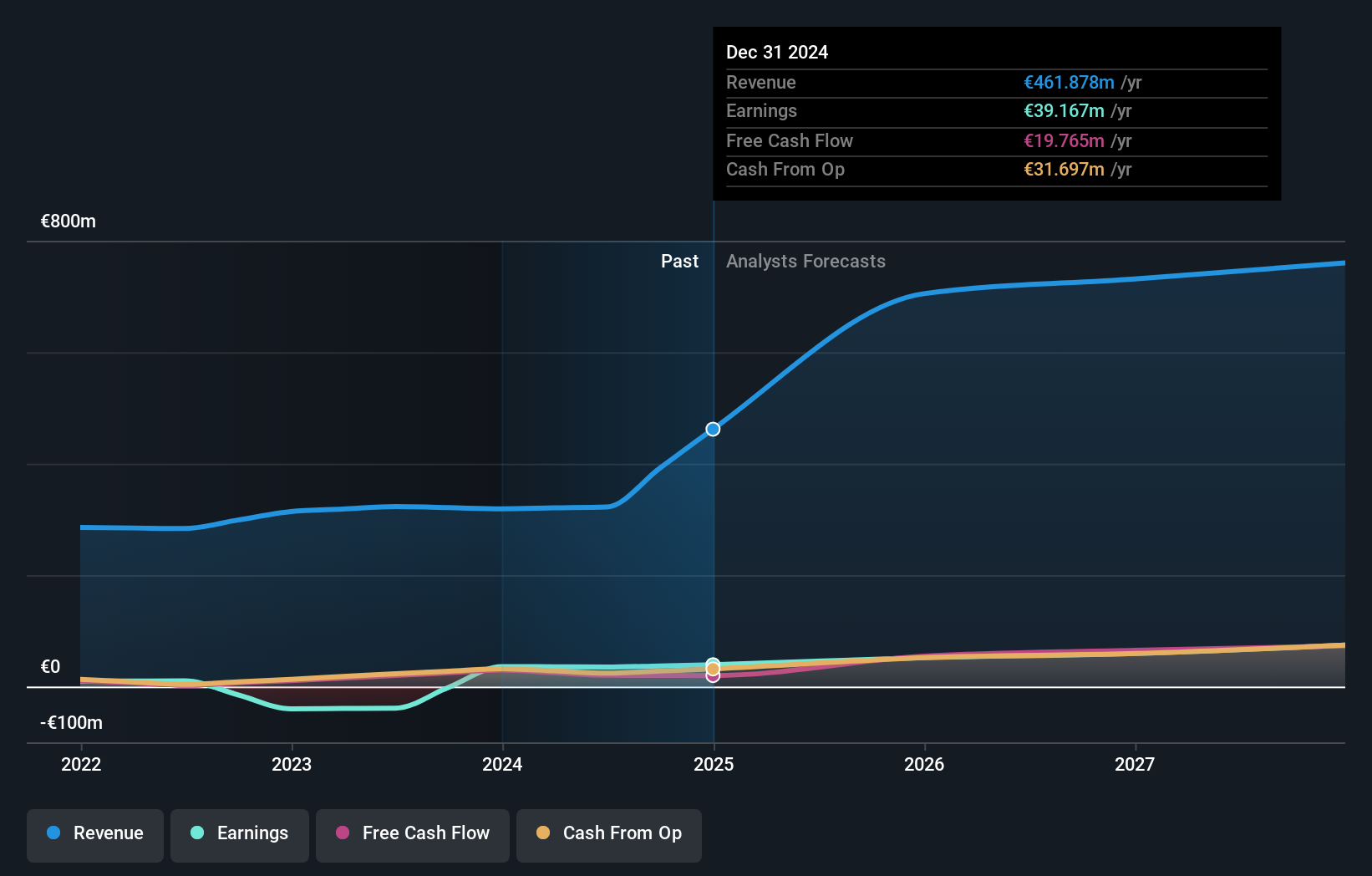

Axway Software has shown notable progress, becoming profitable this year with high-quality earnings. The debt to equity ratio increased from 12.5% to 24.6% over the past five years, yet remains satisfactory at 19.9%. Recently, Axway completed a €130.61 million follow-on equity offering and announced new revenue targets of €460 million for 2024 and €700 million by 2025, reflecting its strategic growth initiatives and integration of Sopra Banking Software activities.

- Get an in-depth perspective on Axway Software's performance by reading our health report here.

Examine Axway Software's past performance report to understand how it has performed in the past.

Caisse Régionale de Crédit Agricole Mutuel de Normandie-Seine Société coopérative (ENXTPA:CCN)

Simply Wall St Value Rating: ★★★★☆☆

Overview: Caisse Régionale de Crédit Agricole Mutuel de Normandie-Seine Société coopérative provides a range of banking products and services to individuals, professionals, farmers, associations, and companies in France with a market cap of €433.60 million.

Operations: The company's revenue streams are derived from providing various banking products and services to a diverse clientele in France. It has a market cap of €433.60 million.

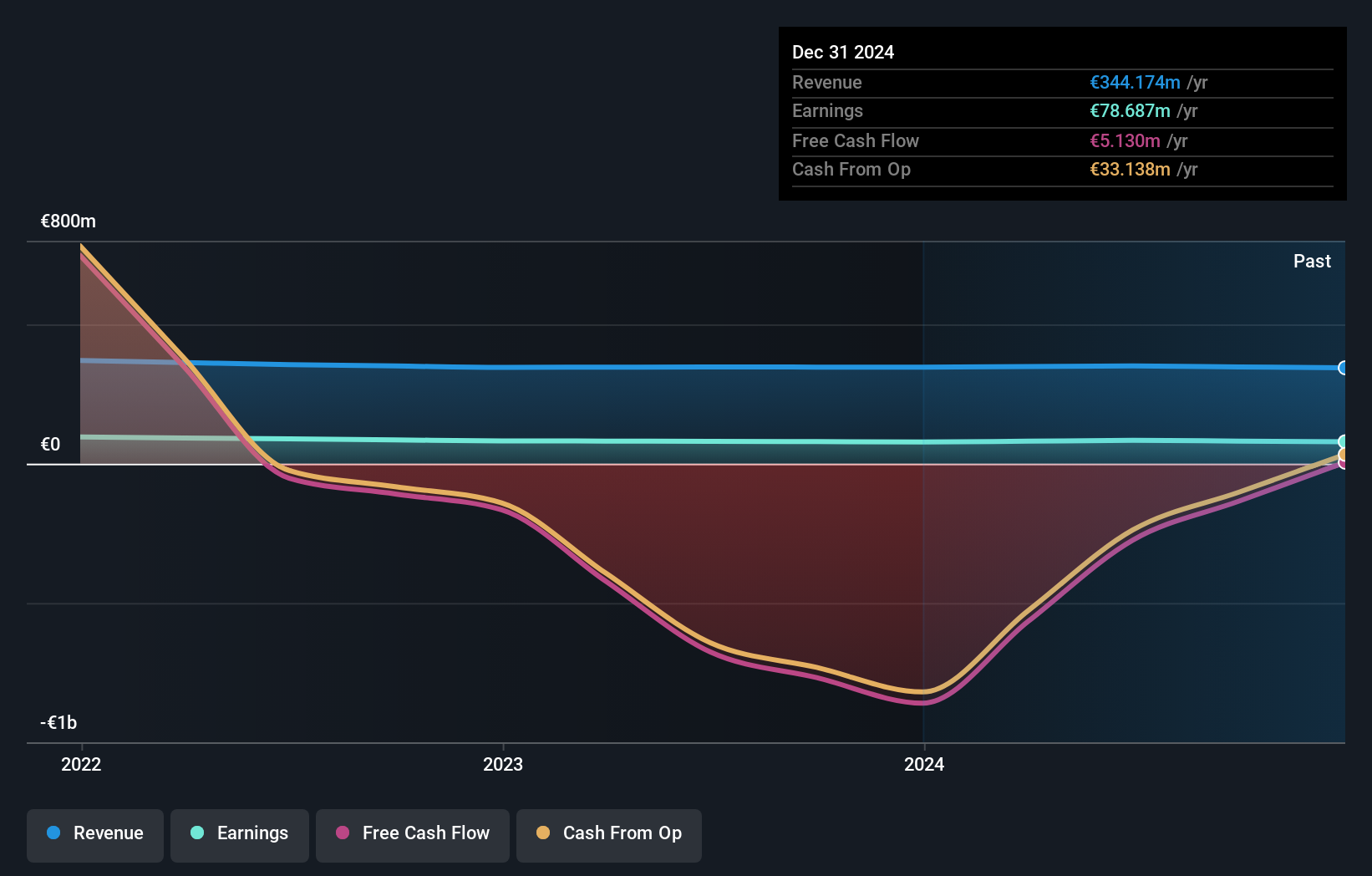

Caisse Régionale de Crédit Agricole Mutuel de Normandie-Seine Société coopérative, with total assets of €25.5B and total equity of €3.0B, reported earnings growth of 4% over the past year, outpacing the -2.7% industry average. The bank has a sufficient allowance for bad loans at 115%, covering its appropriate level of bad loans (1%). Total deposits stand at €7.9B against total loans of €22.0B, reflecting robust financial health despite higher-risk funding sources making up 65% of liabilities.

Neurones (ENXTPA:NRO)

Simply Wall St Value Rating: ★★★★★☆

Overview: Neurones S.A. is an IT services company offering infrastructure, application, and consulting services in France and internationally, with a market cap of €1.04 billion.

Operations: Neurones generates revenue primarily from infrastructure, application, and consulting services. The company has a market cap of €1.04 billion.

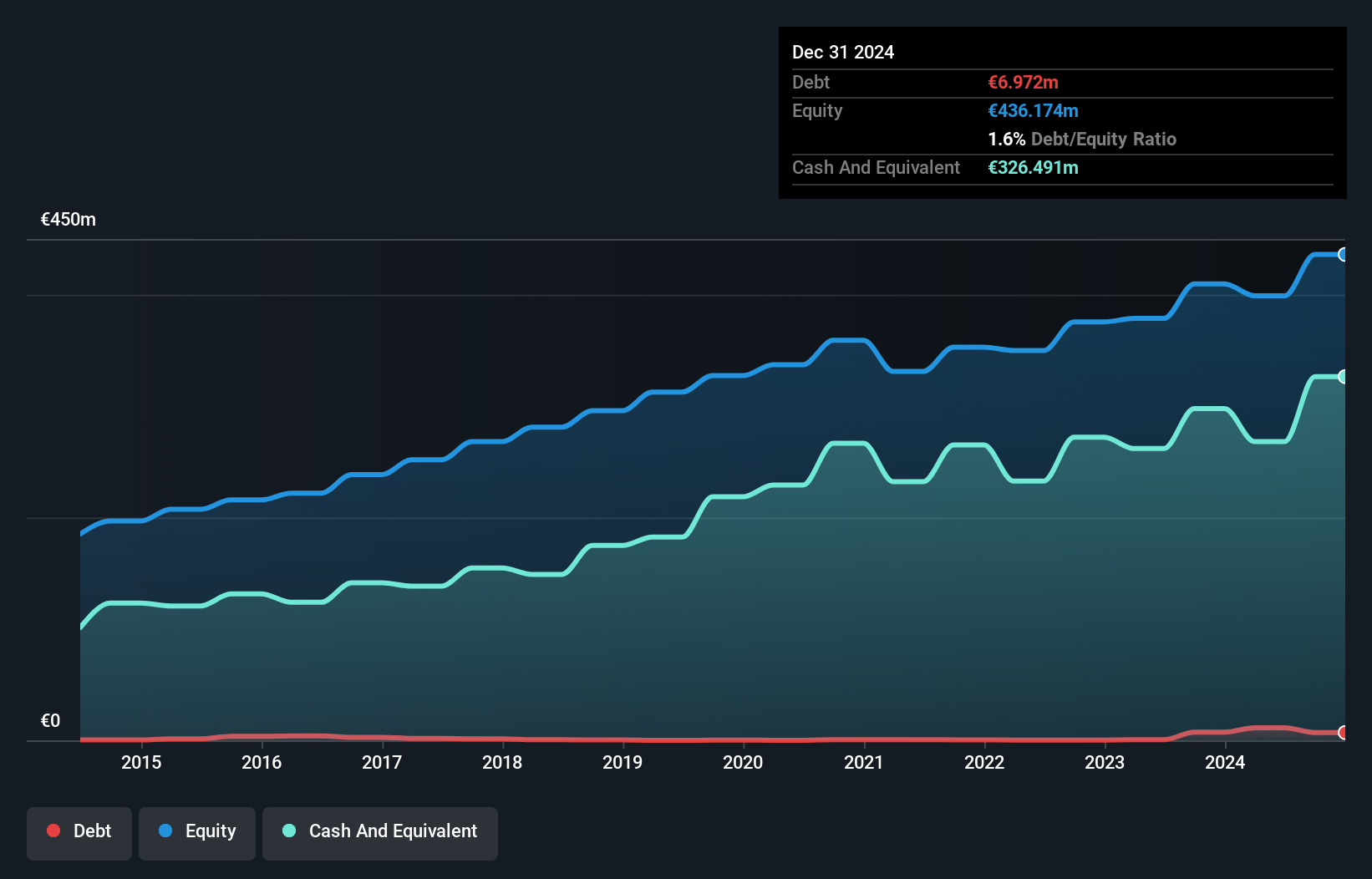

Neurones reported half-year revenue of €402.43 million, up from €368.69 million last year, with net income slightly down to €24.5 million from €25.42 million. Basic earnings per share were stable at €1.01 compared to the previous year's €1.05. Over the past year, earnings grew by 1.8%, outpacing the IT industry's -7.4%. The debt-to-equity ratio rose to 2.8% over five years, but Neurones has more cash than total debt and generates high-quality earnings.

- Unlock comprehensive insights into our analysis of Neurones stock in this health report.

Review our historical performance report to gain insights into Neurones''s past performance.

Where To Now?

- Click through to start exploring the rest of the 28 Euronext Paris Undiscovered Gems With Strong Fundamentals now.

- Already own these companies? Link your portfolio to Simply Wall St and get alerts on any new warning signs to your stocks.

- Simply Wall St is a revolutionary app designed for long-term stock investors, it's free and covers every market in the world.

Ready For A Different Approach?

- Explore high-performing small cap companies that haven't yet garnered significant analyst attention.

- Fuel your portfolio with companies showing strong growth potential, backed by optimistic outlooks both from analysts and management.

- Find companies with promising cash flow potential yet trading below their fair value.

This article by Simply Wall St is general in nature. We provide commentary based on historical data and analyst forecasts only using an unbiased methodology and our articles are not intended to be financial advice. It does not constitute a recommendation to buy or sell any stock, and does not take account of your objectives, or your financial situation. We aim to bring you long-term focused analysis driven by fundamental data. Note that our analysis may not factor in the latest price-sensitive company announcements or qualitative material. Simply Wall St has no position in any stocks mentioned.

New: Manage All Your Stock Portfolios in One Place

We've created the ultimate portfolio companion for stock investors, and it's free.

• Connect an unlimited number of Portfolios and see your total in one currency

• Be alerted to new Warning Signs or Risks via email or mobile

• Track the Fair Value of your stocks

Have feedback on this article? Concerned about the content? Get in touch with us directly. Alternatively, email editorial-team@simplywallst.com

About ENXTPA:AXW

Axway Software

Operates as an infrastructure software publisher in France, rest of Europe, the Americas, and the Asia Pacific.

Excellent balance sheet with acceptable track record.