Can Atos (ENXTPA:ATO) Leverage AI Partnerships to Strengthen Its Position in Regulated Markets?

Reviewed by Sasha Jovanovic

- Atos recently launched Atos Managed OpenShift AI (AMOS-AI), incorporating Red Hat OpenShift AI to deliver secure, flexible AI-driven automation and predictive analytics across hybrid and multi-cloud environments, while supporting sovereign cloud requirements for regulated sectors.

- This initiative reflects Atos’ deepening collaboration with Red Hat and reinforces its focus on data governance, operationalizing AI, and innovation in public sector digitalization, highlighted by new contracts such as its partnership with Madrid City Council and expanded cybersecurity presence in Spain.

- We'll examine how the introduction of AMOS-AI and new AI contracts may influence Atos' investment outlook amid industry changes.

This technology could replace computers: discover 27 stocks that are working to make quantum computing a reality.

Atos Investment Narrative Recap

Atos investors need confidence in the company’s shift toward AI-driven services and digital transformation, believing that new offerings like AMOS-AI can offset pressures on its legacy IT outsourcing business. While the AMOS-AI launch showcases innovation and could help Atos compete for higher-value contracts, its near-term effect on resolving high debt and improving financial stability may not be material given ongoing headwinds in traditional segments.

Among several recent developments, the Madrid City Council contract stands out for its direct use of Atos’ AI technologies, reflecting early traction for solutions like AMOS-AI within highly regulated, public-sector environments. This supports Atos’ focus on data governance and sovereign cloud, aligning with key business catalysts but leaving near-term margin and revenue growth questions unresolved.

However, even as Atos pursues new AI wins, investors should be aware that persistent high debt and a negative equity position...

Read the full narrative on Atos (it's free!)

Atos is projected to reach €8.5 billion in revenue and €527.4 million in earnings by 2028. This outlook assumes a 0.4% annual revenue decline and a decrease in earnings of approximately €973 million from current earnings of €1.5 billion.

Uncover how Atos' forecasts yield a €43.00 fair value, a 5% downside to its current price.

Exploring Other Perspectives

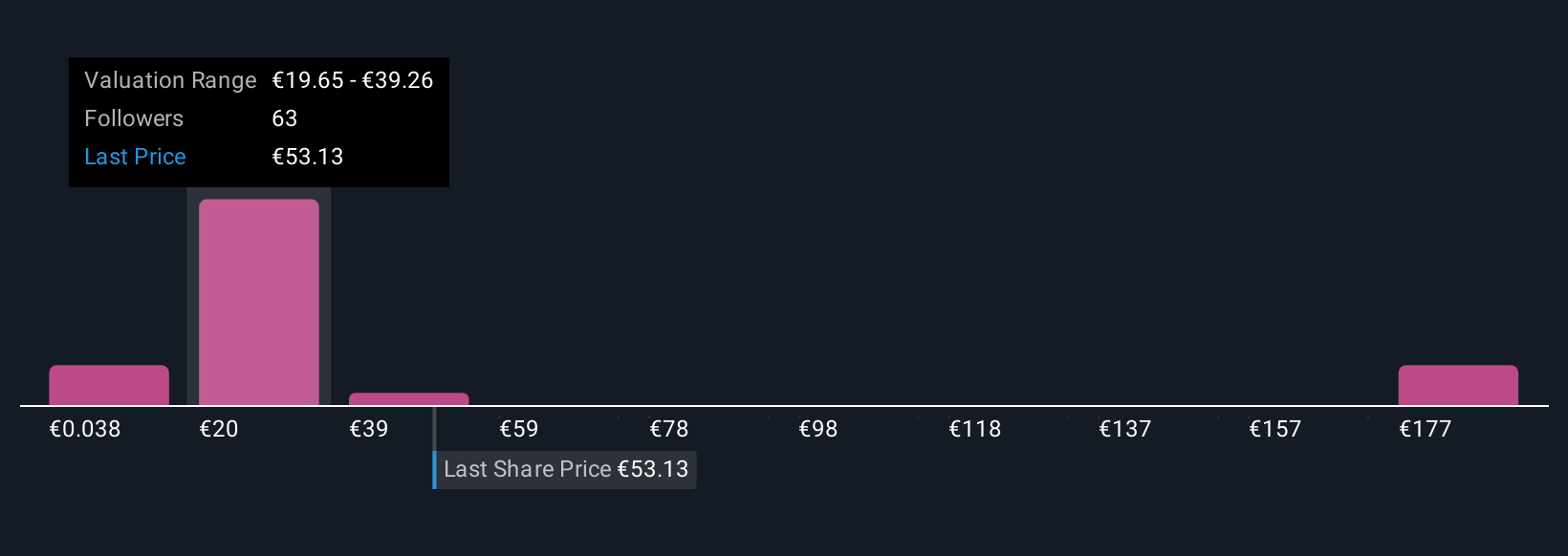

Simply Wall St Community members have 21 individual fair value estimates for Atos, ranging widely from €0.04 to €253.09 per share. Against this spread of opinion, persistent high debt remains a central issue that could restrict future investment and impact returns if not addressed, reinforcing why exploring divergent views may be valuable.

Explore 21 other fair value estimates on Atos - why the stock might be worth over 5x more than the current price!

Build Your Own Atos Narrative

Disagree with existing narratives? Create your own in under 3 minutes - extraordinary investment returns rarely come from following the herd.

- A great starting point for your Atos research is our analysis highlighting 3 key rewards and 6 important warning signs that could impact your investment decision.

- Our free Atos research report provides a comprehensive fundamental analysis summarized in a single visual - the Snowflake - making it easy to evaluate Atos' overall financial health at a glance.

Contemplating Other Strategies?

Opportunities like this don't last. These are today's most promising picks. Check them out now:

- Trump has pledged to "unleash" American oil and gas and these 22 US stocks have developments that are poised to benefit.

- We've found 15 US stocks that are forecast to pay a dividend yield of over 6% next year. See the full list for free.

- The best AI stocks today may lie beyond giants like Nvidia and Microsoft. Find the next big opportunity with these 27 smaller AI-focused companies with strong growth potential through early-stage innovation in machine learning, automation, and data intelligence that could fund your retirement.

This article by Simply Wall St is general in nature. We provide commentary based on historical data and analyst forecasts only using an unbiased methodology and our articles are not intended to be financial advice. It does not constitute a recommendation to buy or sell any stock, and does not take account of your objectives, or your financial situation. We aim to bring you long-term focused analysis driven by fundamental data. Note that our analysis may not factor in the latest price-sensitive company announcements or qualitative material. Simply Wall St has no position in any stocks mentioned.

New: Manage All Your Stock Portfolios in One Place

We've created the ultimate portfolio companion for stock investors, and it's free.

• Connect an unlimited number of Portfolios and see your total in one currency

• Be alerted to new Warning Signs or Risks via email or mobile

• Track the Fair Value of your stocks

Have feedback on this article? Concerned about the content? Get in touch with us directly. Alternatively, email editorial-team@simplywallst.com

About ENXTPA:ATO

Atos

Provides digital transformation solutions and services in France and internationally.

Medium-low risk and undervalued.

Similar Companies

Market Insights

Community Narratives