Examining Virbac (ENXTPA:VIRP) Valuation as Shares Gain 8% Over the Past Month

Reviewed by Simply Wall St

See our latest analysis for Virbac.

Virbac’s recent run is part of a longer story. A one-month share price return of nearly 8.5% signals renewed interest after a steady period, though the 1-year total shareholder return remains just below flat. Momentum seems to be building again as investors reassess growth potential and the company’s track record.

If Virbac’s recent surge has you thinking about what else might offer hidden upside, consider broadening your search and discover fast growing stocks with high insider ownership

But with Virbac’s shares gaining steam and sitting below analyst targets, the big question remains: is the market underestimating the company’s prospects, or is future growth already fully accounted for in today’s price?

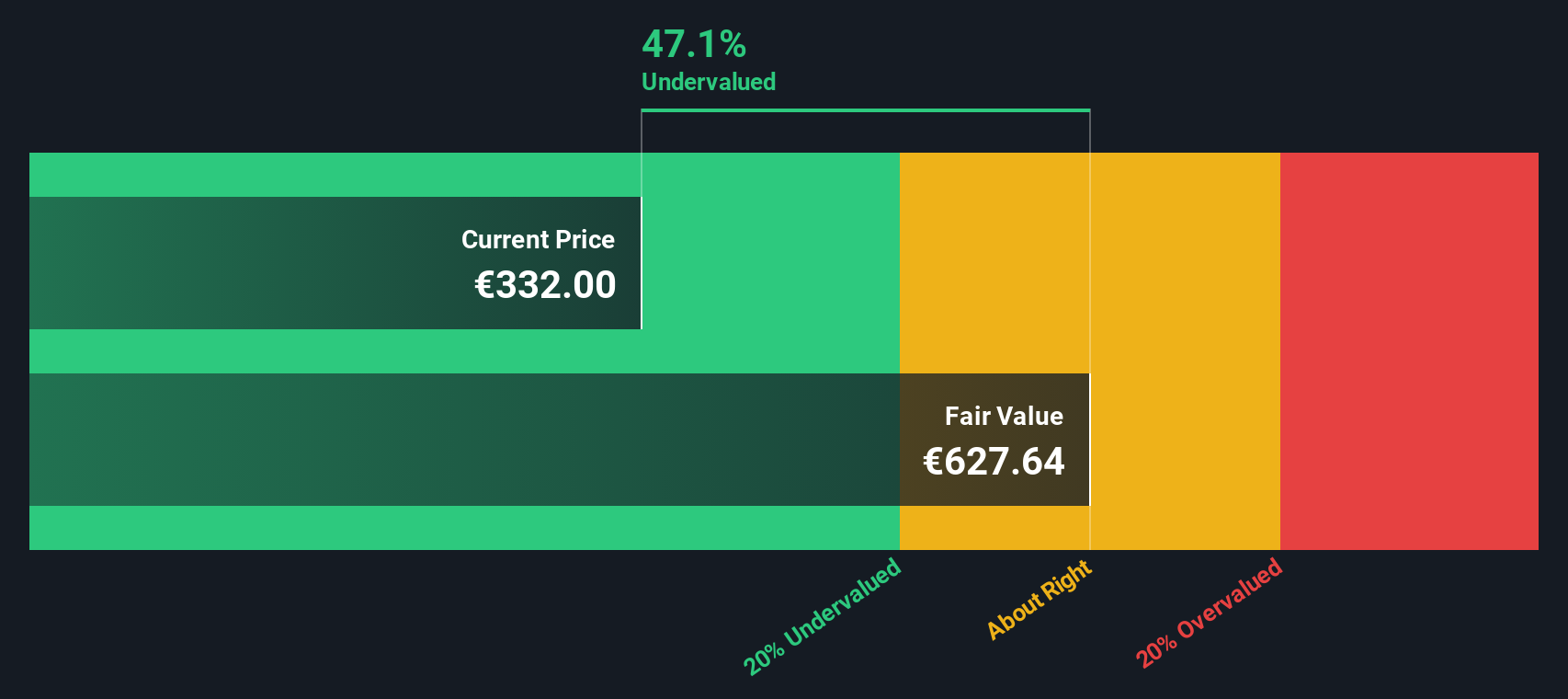

Most Popular Narrative: 14.4% Undervalued

At €345, Virbac’s last close trails the narrative’s fair value estimate of €403.20. This pricing gap is fueling renewed discussions around future earnings catalysts and margin potential.

Continuous operational improvements and successful market penetration in new territories support analysts’ positive outlook on medium-term prospects. Stronger fundamentals and a broader regional growth base are expected to sustain revenue expansion and margin improvements.

Curious about which company milestones drive this valuation? There are bold assumptions and future margin targets that only get revealed in the full narrative. See the key forecasts and discover what makes this story so compelling.

Result: Fair Value of €403.20 (UNDERVALUED)

Have a read of the narrative in full and understand what's behind the forecasts.

However, elevated R&D spending and adverse currency swings could curb margins and temper the upbeat outlook if expected returns take longer to materialize.

Find out about the key risks to this Virbac narrative.

Another View: Looking Beyond Analyst Price Targets

While analysts see Virbac as undervalued based on future growth, our DCF model offers an even bolder perspective. It estimates fair value at €718.62, which is more than double the current price, suggesting there is substantial hidden potential if long-term growth plays out. But how confident can investors be in these forecasts?

Look into how the SWS DCF model arrives at its fair value.

Build Your Own Virbac Narrative

If you have your own take or want to dig into the numbers yourself, you can build a custom narrative in just a few minutes, your way with Do it your way.

A good starting point is our analysis highlighting 2 key rewards investors are optimistic about regarding Virbac.

Looking for More Investment Ideas?

Unlock even more opportunities. Don’t just watch from the sidelines while others move ahead. Use the power of smart data to shape your next big investment.

- Amplify your growth strategy by targeting strong financials among these 3591 penny stocks with strong financials and seize momentum before these under-the-radar companies take off.

- Position yourself for the next technological leap by following the breakthroughs of these 24 AI penny stocks, putting yourself at the forefront of AI-driven innovation.

- Secure steady income streams with these 16 dividend stocks with yields > 3% so you’re not missing out on resilient yield opportunities in today’s market.

This article by Simply Wall St is general in nature. We provide commentary based on historical data and analyst forecasts only using an unbiased methodology and our articles are not intended to be financial advice. It does not constitute a recommendation to buy or sell any stock, and does not take account of your objectives, or your financial situation. We aim to bring you long-term focused analysis driven by fundamental data. Note that our analysis may not factor in the latest price-sensitive company announcements or qualitative material. Simply Wall St has no position in any stocks mentioned.

New: Manage All Your Stock Portfolios in One Place

We've created the ultimate portfolio companion for stock investors, and it's free.

• Connect an unlimited number of Portfolios and see your total in one currency

• Be alerted to new Warning Signs or Risks via email or mobile

• Track the Fair Value of your stocks

Have feedback on this article? Concerned about the content? Get in touch with us directly. Alternatively, email editorial-team@simplywallst.com

About ENXTPA:VIRP

Virbac

Manufactures and sells a range of products and services for companion and farm animals in Europe, North America, Latin America, East Asia, India, Africa, the Middle East, and the Pacific.

Flawless balance sheet and fair value.

Similar Companies

Market Insights

Community Narratives