MedinCell S.A.'s (EPA:MEDCL) 27% Cheaper Price Remains In Tune With Revenues

MedinCell S.A. (EPA:MEDCL) shares have retraced a considerable 27% in the last month, reversing a fair amount of their solid recent performance. Still, a bad month hasn't completely ruined the past year with the stock gaining 71%, which is great even in a bull market.

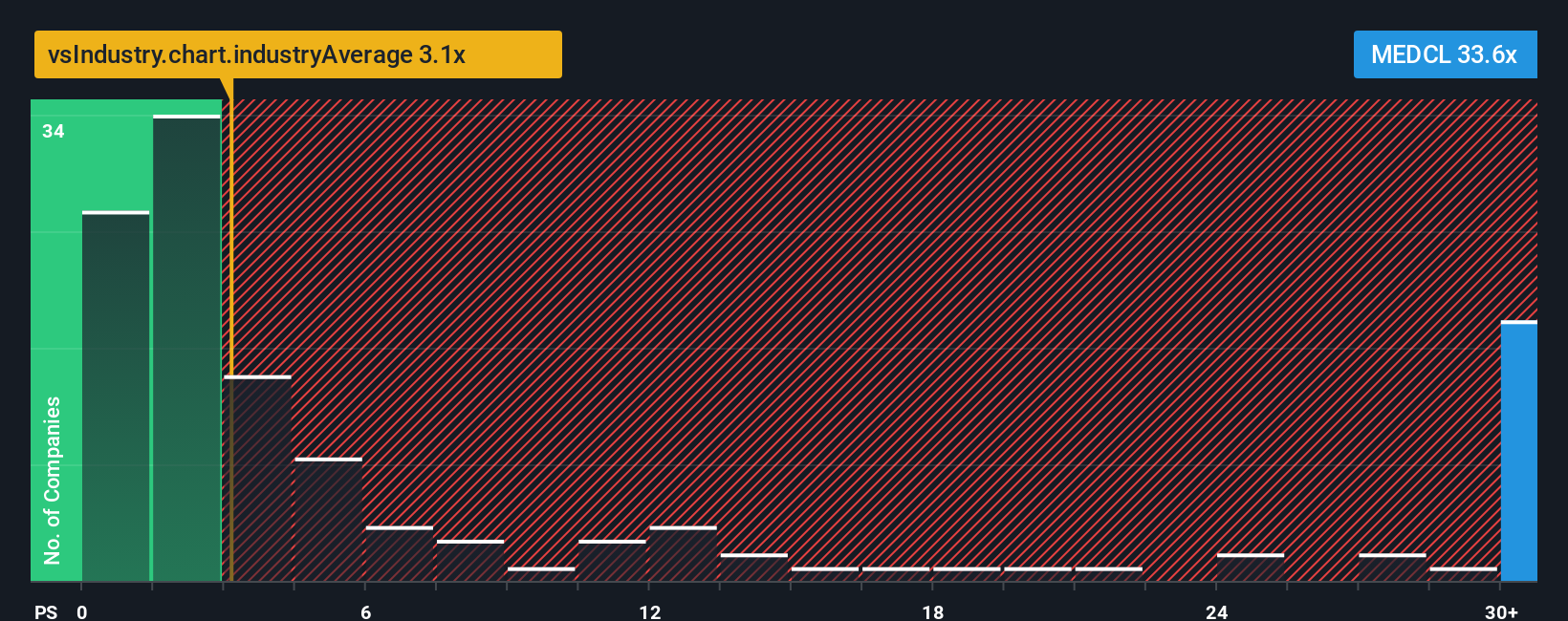

Even after such a large drop in price, given around half the companies in France's Pharmaceuticals industry have price-to-sales ratios (or "P/S") below 1.9x, you may still consider MedinCell as a stock to avoid entirely with its 33.6x P/S ratio. Although, it's not wise to just take the P/S at face value as there may be an explanation why it's so lofty.

Check out our latest analysis for MedinCell

What Does MedinCell's P/S Mean For Shareholders?

MedinCell certainly has been doing a good job lately as its revenue growth has been positive while most other companies have been seeing their revenue go backwards. Perhaps the market is expecting the company's future revenue growth to buck the trend of the industry, contributing to a higher P/S. However, if this isn't the case, investors might get caught out paying too much for the stock.

If you'd like to see what analysts are forecasting going forward, you should check out our free report on MedinCell.Is There Enough Revenue Growth Forecasted For MedinCell?

There's an inherent assumption that a company should far outperform the industry for P/S ratios like MedinCell's to be considered reasonable.

Retrospectively, the last year delivered an exceptional 132% gain to the company's top line. The strong recent performance means it was also able to grow revenue by 233% in total over the last three years. Accordingly, shareholders would have definitely welcomed those medium-term rates of revenue growth.

Turning to the outlook, the next three years should generate growth of 69% each year as estimated by the six analysts watching the company. With the industry only predicted to deliver 4.1% per annum, the company is positioned for a stronger revenue result.

In light of this, it's understandable that MedinCell's P/S sits above the majority of other companies. Apparently shareholders aren't keen to offload something that is potentially eyeing a more prosperous future.

What Does MedinCell's P/S Mean For Investors?

MedinCell's shares may have suffered, but its P/S remains high. Generally, our preference is to limit the use of the price-to-sales ratio to establishing what the market thinks about the overall health of a company.

We've established that MedinCell maintains its high P/S on the strength of its forecasted revenue growth being higher than the the rest of the Pharmaceuticals industry, as expected. At this stage investors feel the potential for a deterioration in revenues is quite remote, justifying the elevated P/S ratio. It's hard to see the share price falling strongly in the near future under these circumstances.

It is also worth noting that we have found 2 warning signs for MedinCell (1 makes us a bit uncomfortable!) that you need to take into consideration.

Of course, profitable companies with a history of great earnings growth are generally safer bets. So you may wish to see this free collection of other companies that have reasonable P/E ratios and have grown earnings strongly.

New: Manage All Your Stock Portfolios in One Place

We've created the ultimate portfolio companion for stock investors, and it's free.

• Connect an unlimited number of Portfolios and see your total in one currency

• Be alerted to new Warning Signs or Risks via email or mobile

• Track the Fair Value of your stocks

Have feedback on this article? Concerned about the content? Get in touch with us directly. Alternatively, email editorial-team (at) simplywallst.com.

This article by Simply Wall St is general in nature. We provide commentary based on historical data and analyst forecasts only using an unbiased methodology and our articles are not intended to be financial advice. It does not constitute a recommendation to buy or sell any stock, and does not take account of your objectives, or your financial situation. We aim to bring you long-term focused analysis driven by fundamental data. Note that our analysis may not factor in the latest price-sensitive company announcements or qualitative material. Simply Wall St has no position in any stocks mentioned.

About ENXTPA:MEDCL

MedinCell

A pharmaceutical company, develops long acting injectables in various therapeutic areas in France.

Exceptional growth potential and slightly overvalued.

Similar Companies

Market Insights

Community Narratives

Recently Updated Narratives

Constellation Energy Dividends and Growth

CoreWeave's Revenue Expected to Rocket 77.88% in 5-Year Forecast

Bisalloy Steel Group will shine with a projected profit margin increase of 12.8%

Popular Narratives

MicroVision will explode future revenue by 380.37% with a vision towards success

NVDA: Expanding AI Demand Will Drive Major Data Center Investments Through 2026