Lacklustre Performance Is Driving Cellectis S.A.'s (EPA:ALCLS) 26% Price Drop

The Cellectis S.A. (EPA:ALCLS) share price has softened a substantial 26% over the previous 30 days, handing back much of the gains the stock has made lately. Looking at the bigger picture, even after this poor month the stock is up 67% in the last year.

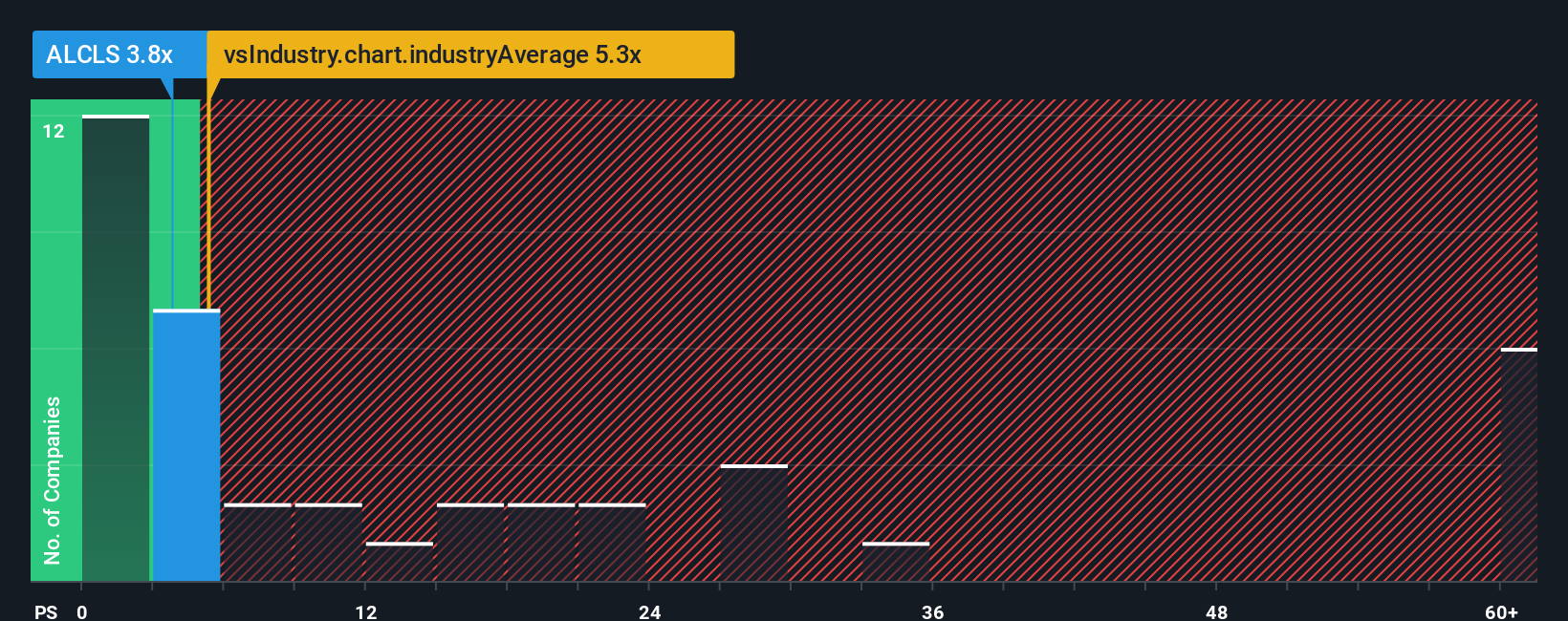

Following the heavy fall in price, Cellectis may be sending buy signals at present with its price-to-sales (or "P/S") ratio of 3.8x, considering almost half of all companies in the Biotechs industry in France have P/S ratios greater than 5.3x and even P/S higher than 19x aren't out of the ordinary. Although, it's not wise to just take the P/S at face value as there may be an explanation why it's limited.

View our latest analysis for Cellectis

How Has Cellectis Performed Recently?

With revenue growth that's superior to most other companies of late, Cellectis has been doing relatively well. One possibility is that the P/S ratio is low because investors think this strong revenue performance might be less impressive moving forward. If the company manages to stay the course, then investors should be rewarded with a share price that matches its revenue figures.

If you'd like to see what analysts are forecasting going forward, you should check out our free report on Cellectis.Is There Any Revenue Growth Forecasted For Cellectis?

The only time you'd be truly comfortable seeing a P/S as low as Cellectis' is when the company's growth is on track to lag the industry.

Taking a look back first, we see that the company grew revenue by an impressive 223% last year. The latest three year period has also seen an incredible overall rise in revenue, aided by its incredible short-term performance. Accordingly, shareholders would have been over the moon with those medium-term rates of revenue growth.

Looking ahead now, revenue is anticipated to climb by 8.6% per year during the coming three years according to the seven analysts following the company. With the industry predicted to deliver 86% growth per annum, the company is positioned for a weaker revenue result.

With this information, we can see why Cellectis is trading at a P/S lower than the industry. Apparently many shareholders weren't comfortable holding on while the company is potentially eyeing a less prosperous future.

What Does Cellectis' P/S Mean For Investors?

The southerly movements of Cellectis' shares means its P/S is now sitting at a pretty low level. Typically, we'd caution against reading too much into price-to-sales ratios when settling on investment decisions, though it can reveal plenty about what other market participants think about the company.

As expected, our analysis of Cellectis' analyst forecasts confirms that the company's underwhelming revenue outlook is a major contributor to its low P/S. Shareholders' pessimism on the revenue prospects for the company seems to be the main contributor to the depressed P/S. It's hard to see the share price rising strongly in the near future under these circumstances.

It is also worth noting that we have found 3 warning signs for Cellectis (2 are significant!) that you need to take into consideration.

Of course, profitable companies with a history of great earnings growth are generally safer bets. So you may wish to see this free collection of other companies that have reasonable P/E ratios and have grown earnings strongly.

New: AI Stock Screener & Alerts

Our new AI Stock Screener scans the market every day to uncover opportunities.

• Dividend Powerhouses (3%+ Yield)

• Undervalued Small Caps with Insider Buying

• High growth Tech and AI Companies

Or build your own from over 50 metrics.

Have feedback on this article? Concerned about the content? Get in touch with us directly. Alternatively, email editorial-team (at) simplywallst.com.

This article by Simply Wall St is general in nature. We provide commentary based on historical data and analyst forecasts only using an unbiased methodology and our articles are not intended to be financial advice. It does not constitute a recommendation to buy or sell any stock, and does not take account of your objectives, or your financial situation. We aim to bring you long-term focused analysis driven by fundamental data. Note that our analysis may not factor in the latest price-sensitive company announcements or qualitative material. Simply Wall St has no position in any stocks mentioned.

About ENXTPA:ALCLS

Cellectis

A clinical stage biotechnological company, develops products based on gene-editing with a portfolio of allogeneic chimeric antigen receptor T-cells product candidates in the field of immuno-oncology and gene therapy product candidates in other therapeutic indications.

Undervalued with adequate balance sheet.

Similar Companies

Market Insights

Community Narratives