- France

- /

- Entertainment

- /

- ENXTPA:VIV

Vivendi (ENXTPA:VIV): Exploring the Valuation Narrative Behind Recent Share Price Fluctuations

Reviewed by Simply Wall St

Vivendi (ENXTPA:VIV) has recently caught the market’s eye with a series of shifts that have many investors pausing to consider their next move. While there hasn’t been a headline-grabbing event driving the latest moves, the stock’s ongoing fluctuations suggest there may be underlying factors at work. This is enough to warrant a closer look at whether the current price properly reflects the company’s prospects.

Looking at the bigger picture, Vivendi’s share price tells a nuanced story. The company has demonstrated overall momentum over the past year, climbing 42% while swinging up 19% since the start of this year. However, the past month saw a dip that interrupted the longer-term uptrend. These shifts come after ongoing news flow and earlier strategic moves, reminding investors that price swings can quickly alter the near-term narrative without changing the underlying fundamentals.

So, does Vivendi’s current valuation offer a window for buyers, or is the market already baking in all the future growth the company has to offer?

Most Popular Narrative: 13.4% Undervalued

The prevailing narrative deems Vivendi shares undervalued, with its fair value set above today’s market price. For investors, this suggests a meaningful gap between the current stock price and what analysts believe the company could be worth.

“Vivendi's ongoing transformation and restructuring, including the spin-off of major assets, are expected to unlock value for stakeholders. This could lead to future revenue and earnings growth as the company focuses more dynamically on its portfolio of listed investments.

The exceptional performance of newly listed entities like Havas and Louis Hachette, along with their potential synergies, are likely to enhance revenue streams and net margins in the future.”

Curious about the numbers behind this bullish view? This popular narrative is built on bold projections, including massive swings in profitability, a future valuation in line with industry leaders, and the promise of double-digit returns. Want to see what financial milestones analysts are betting on to justify a price jump? The story behind this consensus might surprise you.

Result: Fair Value of €3.55 (UNDERVALUED)

Have a read of the narrative in full and understand what's behind the forecasts.However, ongoing losses at Gameloft and high debt levels could derail Vivendi's turnaround if not carefully managed in the coming quarters.

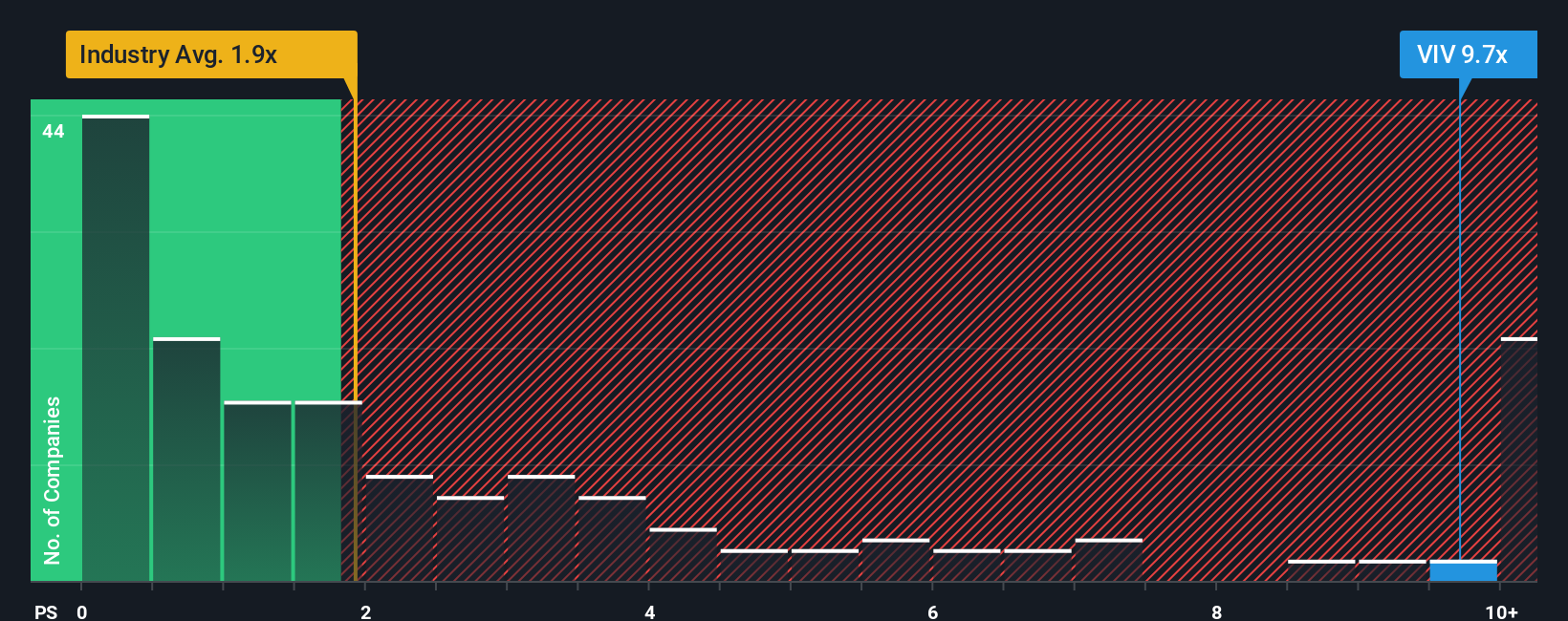

Find out about the key risks to this Vivendi narrative.Another View: What Do Valuation Ratios Say?

Looking at the same company with a different lens, Vivendi does not appear to be a bargain compared to its sector’s benchmarks. This perspective challenges the more optimistic forecasts. Which story will play out in the end?

See what the numbers say about this price — find out in our valuation breakdown.

Stay updated when valuation signals shift by adding Vivendi to your watchlist or portfolio. Alternatively, explore our screener to discover other companies that fit your criteria.

Build Your Own Vivendi Narrative

If you believe there’s more to the story or you’re keen to shape your own perspective, you can dive into the data and craft a narrative of your own in just a few minutes. Do it your way.

A good starting point is our analysis highlighting 1 key reward investors are optimistic about regarding Vivendi.

Looking for More Investment Opportunities?

Smart investors always keep an eye on the next big thing. Don’t miss your chance to spot high-quality stocks with strong potential using these top picks from our tools below.

- Spot companies offering stability and consistent passive income, then build your watchlist with dividend stocks with yields > 3%.

- Tap into the future of medicine with cutting-edge innovations and breakthroughs in healthcare AI stocks.

- Catch undervalued gems overlooked by the crowd. Your best opportunity might be hidden among undervalued stocks based on cash flows.

This article by Simply Wall St is general in nature. We provide commentary based on historical data and analyst forecasts only using an unbiased methodology and our articles are not intended to be financial advice. It does not constitute a recommendation to buy or sell any stock, and does not take account of your objectives, or your financial situation. We aim to bring you long-term focused analysis driven by fundamental data. Note that our analysis may not factor in the latest price-sensitive company announcements or qualitative material. Simply Wall St has no position in any stocks mentioned.

New: Manage All Your Stock Portfolios in One Place

We've created the ultimate portfolio companion for stock investors, and it's free.

• Connect an unlimited number of Portfolios and see your total in one currency

• Be alerted to new Warning Signs or Risks via email or mobile

• Track the Fair Value of your stocks

Have feedback on this article? Concerned about the content? Get in touch with us directly. Alternatively, email editorial-team@simplywallst.com

Kshitija Bhandaru

Kshitija (or Keisha) Bhandaru is an Equity Analyst at Simply Wall St and has over 6 years of experience in the finance industry and describes herself as a lifelong learner driven by her intellectual curiosity. She previously worked with Market Realist for 5 years as an Equity Analyst.

About ENXTPA:VIV

Vivendi

Operates in the content, media, and entertainment industries in France, rest of Europe, the Americas, Asia/Oceania, and Africa.

Moderate growth potential with imperfect balance sheet.

Similar Companies

Market Insights

Community Narratives