- France

- /

- Entertainment

- /

- ENXTPA:BOL

High Growth Tech Stocks In France Featuring Esker And Two More

Reviewed by Simply Wall St

As the global markets react to the recent Federal Reserve rate cut, European indices have shown mixed performances with France's CAC 40 Index adding a modest 0.47%. Against this backdrop, we explore three high-growth tech stocks in France, including Esker, that are navigating these dynamic market conditions. Identifying strong stocks in such an environment often involves looking for companies with robust growth potential and resilience to economic fluctuations.

Top 10 High Growth Tech Companies In France

| Name | Revenue Growth | Earnings Growth | Growth Rating |

|---|---|---|---|

| Icape Holding | 14.08% | 28.13% | ★★★★★☆ |

| Cogelec | 11.33% | 23.96% | ★★★★★☆ |

| Valneva | 23.46% | 25.74% | ★★★★★☆ |

| Munic | 26.68% | 149.10% | ★★★★★☆ |

| VusionGroup | 28.35% | 82.32% | ★★★★★★ |

| Oncodesign Société Anonyme | 14.68% | 101.18% | ★★★★★☆ |

| Adocia | 70.20% | 63.97% | ★★★★★☆ |

| beaconsmind | 28.59% | 133.36% | ★★★★★★ |

| Pherecydes Pharma Société anonyme | 63.30% | 78.85% | ★★★★★☆ |

| OSE Immunotherapeutics | 30.02% | 5.91% | ★★★★★☆ |

We're going to check out a few of the best picks from our screener tool.

Esker (ENXTPA:ALESK)

Simply Wall St Growth Rating: ★★★★☆☆

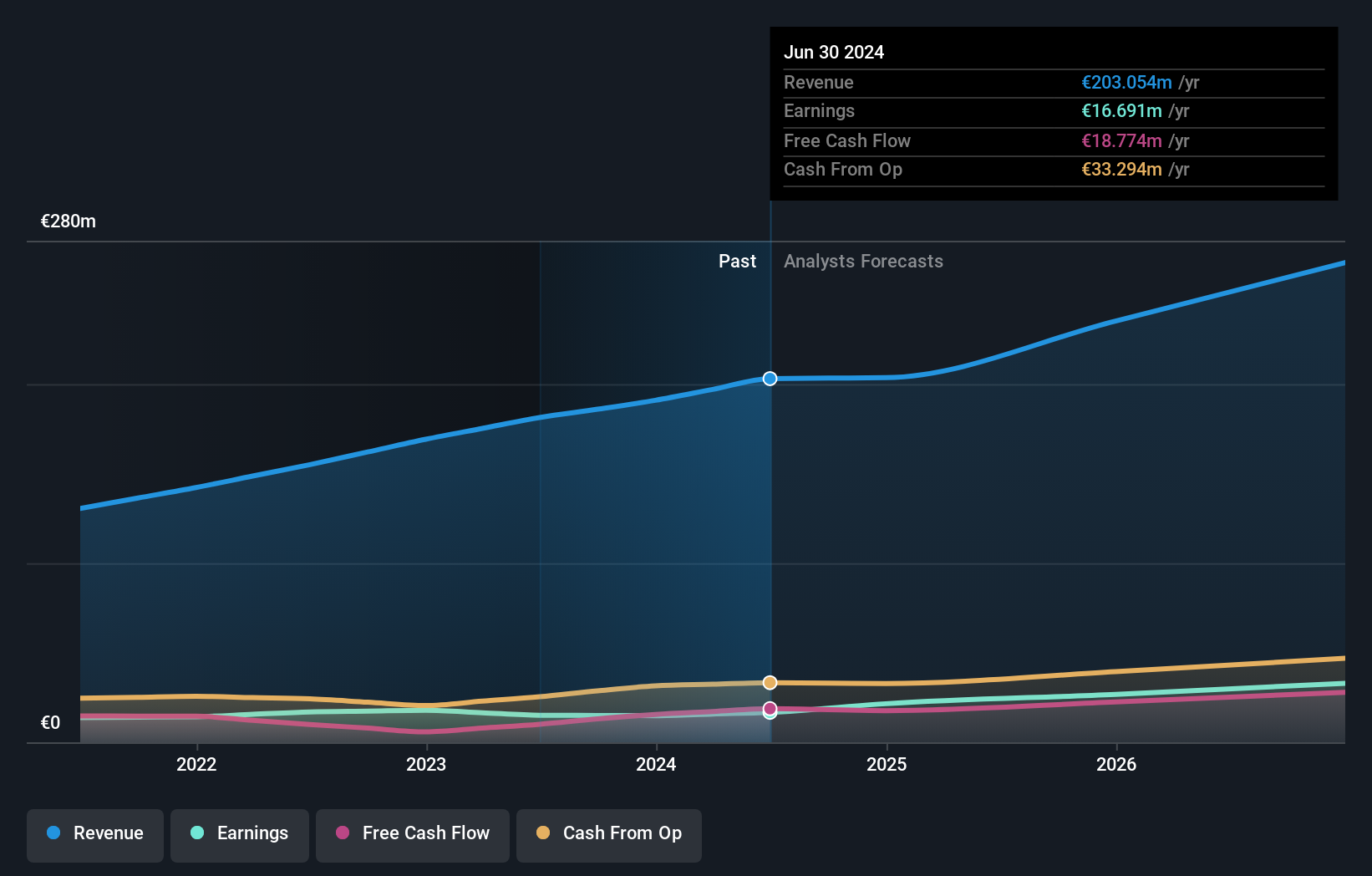

Overview: Esker SA operates a cloud platform for finance and customer service professionals in France and internationally, with a market cap of approximately €1.56 billion.

Operations: Esker SA generates revenue primarily from its software and programming segment, which accounted for €202.22 million. The company focuses on providing cloud solutions tailored to finance and customer service sectors across various regions.

Esker, a Paris-listed software provider, is navigating an increasingly competitive landscape with its strategic focus on R&D and recent M&A activities. The company's R&D expenses have been pivotal, aligning with its revenue growth at 12.4% annually, which outpaces the French market's 5.7%. This investment in innovation is reflected in Esker's projected earnings growth of 27% per year, significantly above the market average of 12.3%. Recent developments include a proposed acquisition by General Atlantic and Bridgepoint Group for €1.58 billion, underscoring confidence in Esker’s robust integration of sustainable practices within its Source-to-Pay suite. This move could potentially enhance Esker’s market position by expanding its technological capabilities and reinforcing client relationships amidst evolving environmental regulations.

- Delve into the full analysis health report here for a deeper understanding of Esker.

Explore historical data to track Esker's performance over time in our Past section.

Bolloré (ENXTPA:BOL)

Simply Wall St Growth Rating: ★★★★☆☆

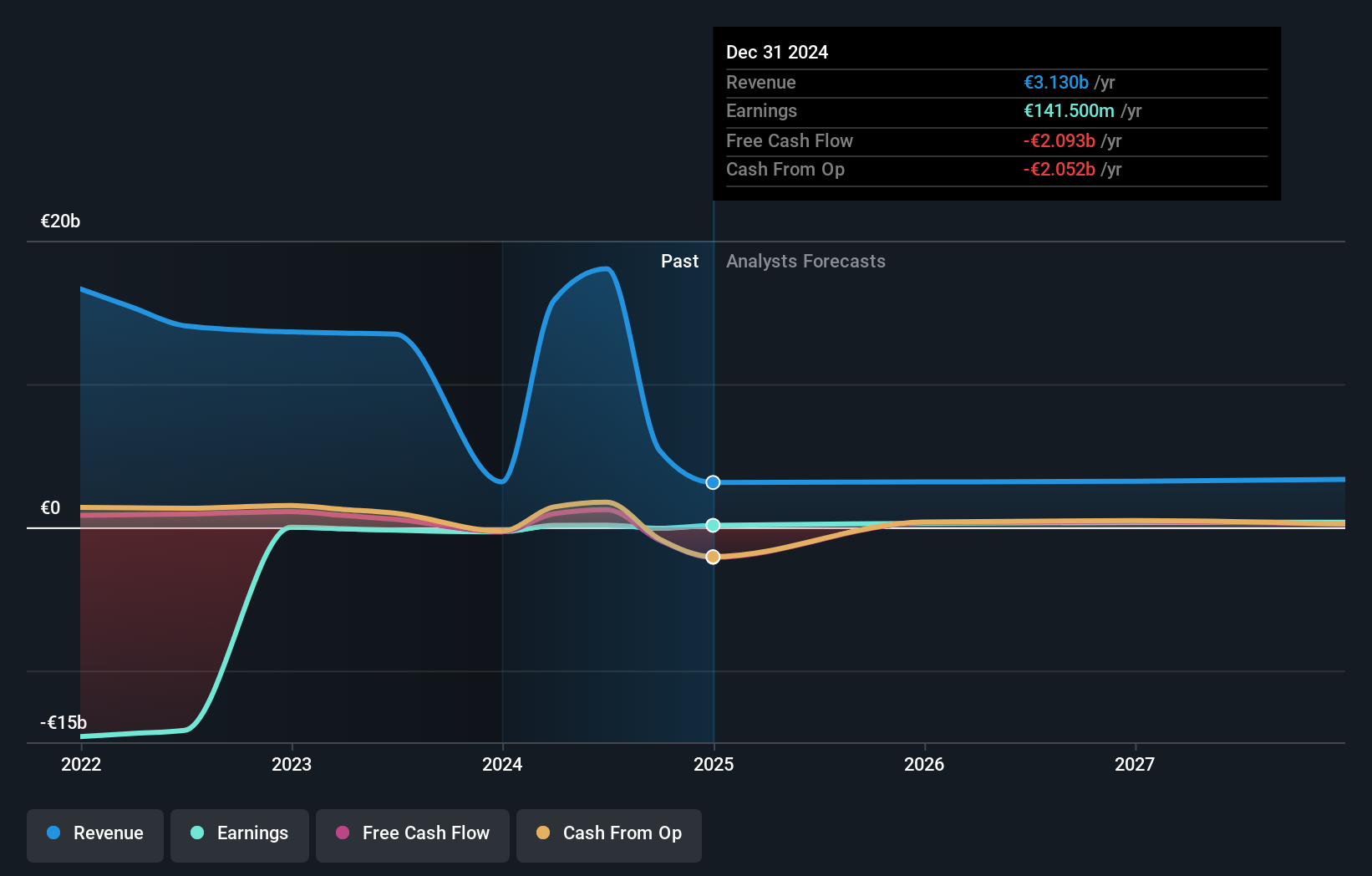

Overview: Bolloré SE operates in transportation and logistics, communications, and industry sectors across France, Europe, the Americas, Asia, Oceania, and Africa with a market cap of €17.09 billion.

Operations: Bolloré SE generates revenue primarily from its communications segment (€14.86 billion) and Bollore Energy (€2.75 billion). The industry segment contributes €353 million to the overall revenue.

Bolloré SE, a diversified conglomerate with significant tech investments, has recently shown a remarkable financial turnaround. In the first half of 2024, the company reported sales of €10.59 billion, up from €6.23 billion in the previous year, and net income surged to €3.76 billion from just €114 million. This resurgence is underpinned by strategic R&D investments that align with its revenue growth at 8.3% per year—outstripping the French market's average of 5.7%. With earnings projected to grow by an impressive 32.7% annually, Bolloré is poised to capitalize on its technological advancements and robust market positioning despite a competitive landscape marked by rapid changes in consumer demands and digital transformation pressures.

- Click here and access our complete health analysis report to understand the dynamics of Bolloré.

Gain insights into Bolloré's past trends and performance with our Past report.

Vivendi (ENXTPA:VIV)

Simply Wall St Growth Rating: ★★★★☆☆

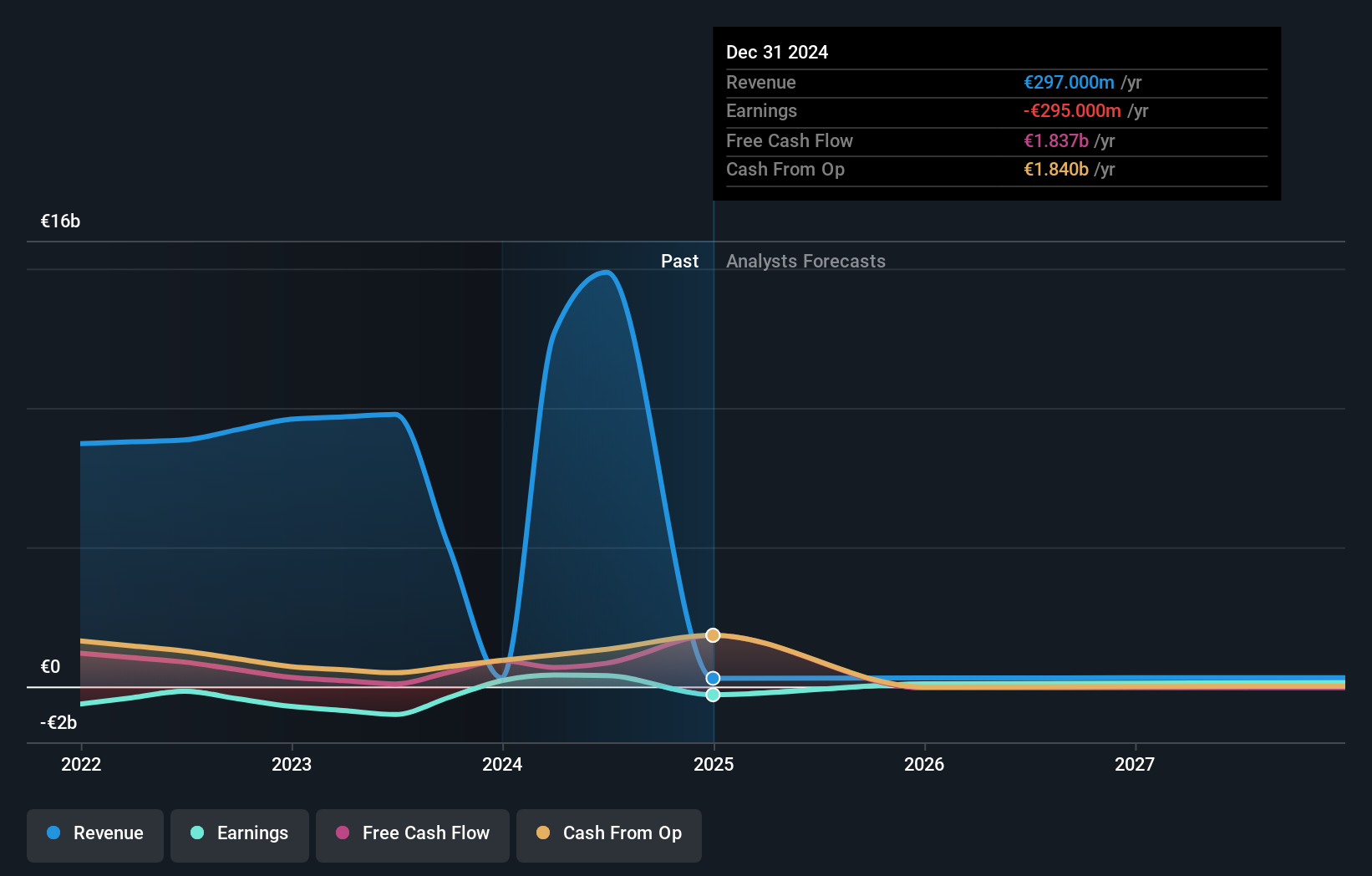

Overview: Vivendi SE is a global entertainment, media, and communication company with operations spanning France, Europe, the Americas, Asia/Oceania, and Africa and has a market cap of approximately €10.27 billion.

Operations: Vivendi SE generates revenue primarily through its Canal+ Group (€6.20 billion) and Havas Group (€2.92 billion), with additional contributions from Gameloft (€304 million) and Prisma Media (€303 million). The company also engages in new initiatives and operates Vivendi Village, contributing €176 million and €151 million, respectively.

Vivendi SE, amidst a dynamic tech landscape in France, reported a notable revenue increase to €9.05 billion for the first half of 2024, up from €4.7 billion the previous year, reflecting a rise of over 92%. This surge accompanies an earnings forecast promising a 30.6% annual growth rate, outpacing the French market's average by more than double. The company's strategic focus on R&D is evident as it aligns with these financial metrics; however, its R&D expenses have not been disclosed in detail for this period. Additionally, Vivendi has actively repurchased shares worth €184 million since January 2024, signaling confidence in its operational strategy and future prospects despite recent legal settlements that concluded longstanding disputes without admitting fault.

- Unlock comprehensive insights into our analysis of Vivendi stock in this health report.

Assess Vivendi's past performance with our detailed historical performance reports.

Summing It All Up

- Click here to access our complete index of 45 Euronext Paris High Growth Tech and AI Stocks.

- Got skin in the game with these stocks? Elevate how you manage them by using Simply Wall St's portfolio, where intuitive tools await to help optimize your investment outcomes.

- Maximize your investment potential with Simply Wall St, the comprehensive app that offers global market insights for free.

Curious About Other Options?

- Explore high-performing small cap companies that haven't yet garnered significant analyst attention.

- Fuel your portfolio with companies showing strong growth potential, backed by optimistic outlooks both from analysts and management.

- Find companies with promising cash flow potential yet trading below their fair value.

This article by Simply Wall St is general in nature. We provide commentary based on historical data and analyst forecasts only using an unbiased methodology and our articles are not intended to be financial advice. It does not constitute a recommendation to buy or sell any stock, and does not take account of your objectives, or your financial situation. We aim to bring you long-term focused analysis driven by fundamental data. Note that our analysis may not factor in the latest price-sensitive company announcements or qualitative material. Simply Wall St has no position in any stocks mentioned.

Valuation is complex, but we're here to simplify it.

Discover if Bolloré might be undervalued or overvalued with our detailed analysis, featuring fair value estimates, potential risks, dividends, insider trades, and its financial condition.

Access Free AnalysisHave feedback on this article? Concerned about the content? Get in touch with us directly. Alternatively, email editorial-team@simplywallst.com

About ENXTPA:BOL

Bolloré

Engages in the transportation and logistics, communications, and industry businesses in France, rest of Europe, the Americas, Asia, Oceania, and Africa.

Flawless balance sheet with reasonable growth potential.