Eutelsat Communications (ENXTPA:ETL): Is the Current Valuation Justified After Mixed Performance?

Reviewed by Simply Wall St

Eutelsat Communications (ENXTPA:ETL) in Focus: Exploring What’s Next for Investors

If you’ve been watching Eutelsat Communications (ENXTPA:ETL) lately, you might be wondering if the recent swings are a sign of something bigger. With shares showing modest movement over the past day and contrasting trends over the past month, investors are left to decide if this is simply routine noise or a clue to future direction. For those weighing their next move, the focus now shifts to whether the current setup presents a window of opportunity or just another pause in a challenging market cycle.

Looking at a broader timeframe, Eutelsat Communications has had a mixed twelve months. While the stock climbed nearly 16% in the past three months and posted a 29% gain so far this year, it is still down 33% when considering total return for the last year. Over a longer horizon, returns remain firmly negative. Despite annual revenue growth, there has also been a sharp swing in net income, keeping risk perceptions front and center.

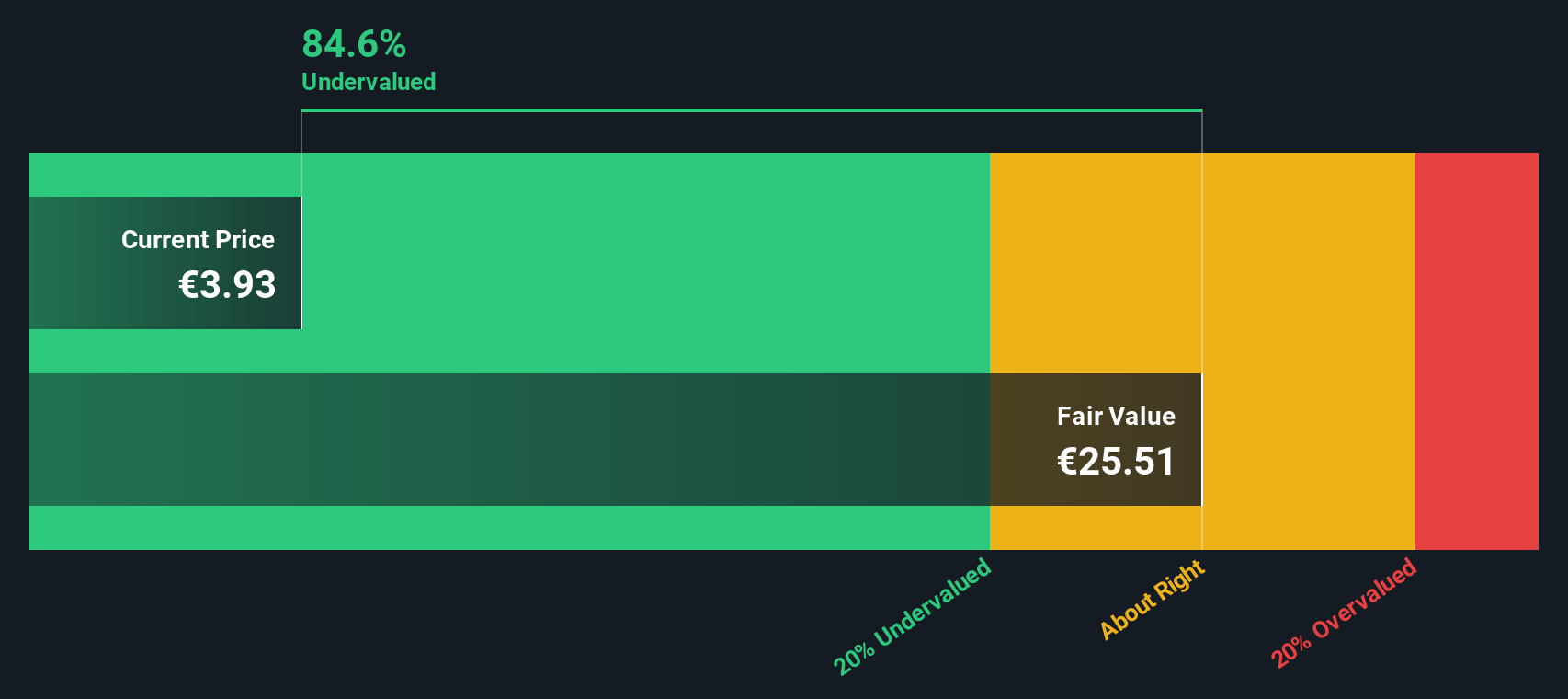

After this run of uneven results, is Eutelsat Communications undervalued, or is the market already looking ahead and pricing in the next chapter of growth?

Most Popular Narrative: 15.9% Undervalued

According to the most widely followed valuation, Eutelsat Communications is considered notably undervalued on the basis of future earnings and revenue projections.

The signing of the SpaceRISE consortium agreement and the IRIS² multi-orbit constellation project is a catalyst for growth, as it represents significant investment in future satellite infrastructure and is expected to generate around €6.5 billion in revenues over a 12-year concession period, which will positively impact future revenue streams.

What big assumptions push this valuation so high, despite persistent losses today? Curious about the exact financial leaps the narrative expects, such as that profit turnaround and aggressive multiple? See which transformative metrics underpin this outlook and why analysts are projecting such a striking fair value gap right now.

Result: Fair Value of €3.39 (UNDERVALUED)

Have a read of the narrative in full and understand what's behind the forecasts.However, if setbacks in the GEO segment occur or contract delays continue for a longer period, these risks could quickly undermine the optimistic growth projections.

Find out about the key risks to this Eutelsat Communications narrative.Another View: Our DCF Model Challenges the Consensus

While analyst targets see plenty of upside, our SWS DCF model tells a very different story. This suggests the market may be even more optimistic than reality supports. Which reading do you trust on value? What could tip the balance?

Look into how the SWS DCF model arrives at its fair value.

Build Your Own Eutelsat Communications Narrative

If the current outlook does not match your view or you would rather dig into the numbers independently, you can shape your own perspective in just a few minutes. Do it your way.

A great starting point for your Eutelsat Communications research is our analysis highlighting 1 key reward and 2 important warning signs that could impact your investment decision.

Looking for More Investment Ideas?

Level up your next move and keep your strategy ahead of the crowd with these handpicked investing opportunities you will not want to miss.

- Spot hidden value by targeting companies with compelling fundamentals using our undervalued stocks based on cash flows and start narrowing in on potential bargains others may overlook.

- Capture the excitement in artificial intelligence breakthroughs and gain an edge with our exclusive picks of AI penny stocks at the forefront of the AI revolution.

- Unlock steady streams of income and invest in companies offering robust yields above 3% through our selection of dividend stocks with yields > 3%.

This article by Simply Wall St is general in nature. We provide commentary based on historical data and analyst forecasts only using an unbiased methodology and our articles are not intended to be financial advice. It does not constitute a recommendation to buy or sell any stock, and does not take account of your objectives, or your financial situation. We aim to bring you long-term focused analysis driven by fundamental data. Note that our analysis may not factor in the latest price-sensitive company announcements or qualitative material. Simply Wall St has no position in any stocks mentioned.

Valuation is complex, but we're here to simplify it.

Discover if Eutelsat Communications might be undervalued or overvalued with our detailed analysis, featuring fair value estimates, potential risks, dividends, insider trades, and its financial condition.

Access Free AnalysisHave feedback on this article? Concerned about the content? Get in touch with us directly. Alternatively, email editorial-team@simplywallst.com

Kshitija Bhandaru

Kshitija (or Keisha) Bhandaru is an Equity Analyst at Simply Wall St and has over 6 years of experience in the finance industry and describes herself as a lifelong learner driven by her intellectual curiosity. She previously worked with Market Realist for 5 years as an Equity Analyst.

About ENXTPA:ETL

Fair value with imperfect balance sheet.

Similar Companies

Market Insights

Community Narratives