As European markets show resilience with the STOXX Europe 600 Index climbing 2.35%, investors are keeping a close eye on dividend stocks that offer stable returns amidst subdued inflation and economic adjustments across the region. In this environment, identifying strong dividend stocks involves looking for companies with consistent cash flow and a track record of maintaining or increasing payouts, which can provide a buffer against market volatility.

Top 10 Dividend Stocks In Europe

| Name | Dividend Yield | Dividend Rating |

| Zurich Insurance Group (SWX:ZURN) | 4.32% | ★★★★★★ |

| Telekom Austria (WBAG:TKA) | 4.54% | ★★★★★★ |

| Swiss Re (SWX:SREN) | 4.18% | ★★★★★☆ |

| Sulzer (SWX:SUN) | 3.01% | ★★★★★☆ |

| Holcim (SWX:HOLN) | 4.13% | ★★★★★★ |

| HEXPOL (OM:HPOL B) | 4.84% | ★★★★★★ |

| Evolution (OM:EVO) | 4.70% | ★★★★★★ |

| DKSH Holding (SWX:DKSH) | 4.16% | ★★★★★★ |

| Cembra Money Bank (SWX:CMBN) | 4.45% | ★★★★★★ |

| Bravida Holding (OM:BRAV) | 4.56% | ★★★★★★ |

Click here to see the full list of 217 stocks from our Top European Dividend Stocks screener.

Let's review some notable picks from our screened stocks.

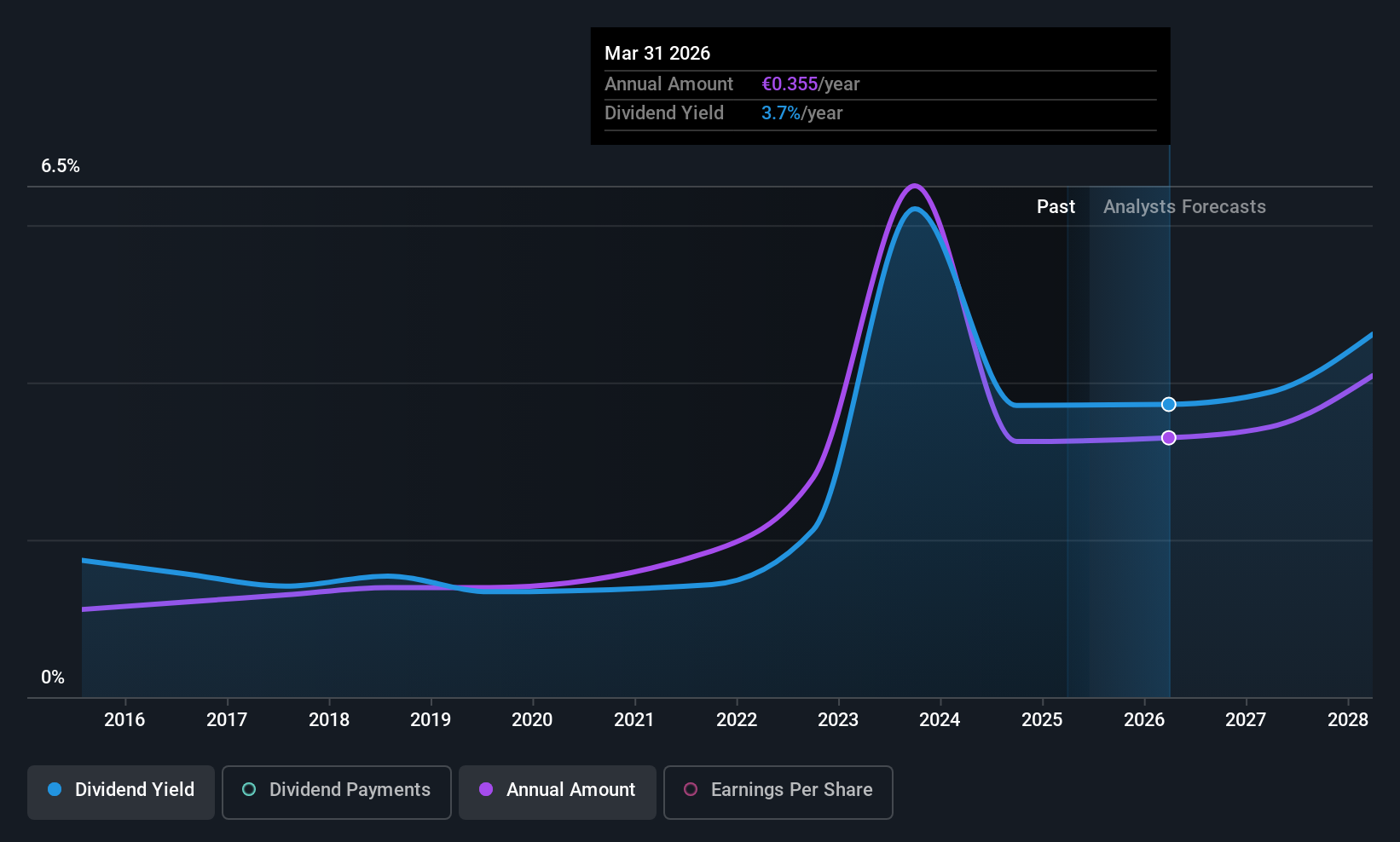

Oeneo (ENXTPA:SBT)

Simply Wall St Dividend Rating: ★★★★☆☆

Overview: Oeneo SA operates in the wine industry worldwide and has a market cap of €602.14 million.

Operations: Oeneo SA generates its revenue primarily from two segments: Closures, which accounts for €222.47 million, and Winemaking, contributing €82.65 million.

Dividend Yield: 3.7%

Oeneo's dividend profile shows a mixed outlook. The company's dividends are covered by earnings with a payout ratio of 75.3% and cash flows with a cash payout ratio of 59.1%. However, its dividend yield of 3.72% is below the top tier in France, and past payments have been volatile and unreliable, experiencing significant drops over the last decade despite recent growth trends.

- Unlock comprehensive insights into our analysis of Oeneo stock in this dividend report.

- According our valuation report, there's an indication that Oeneo's share price might be on the expensive side.

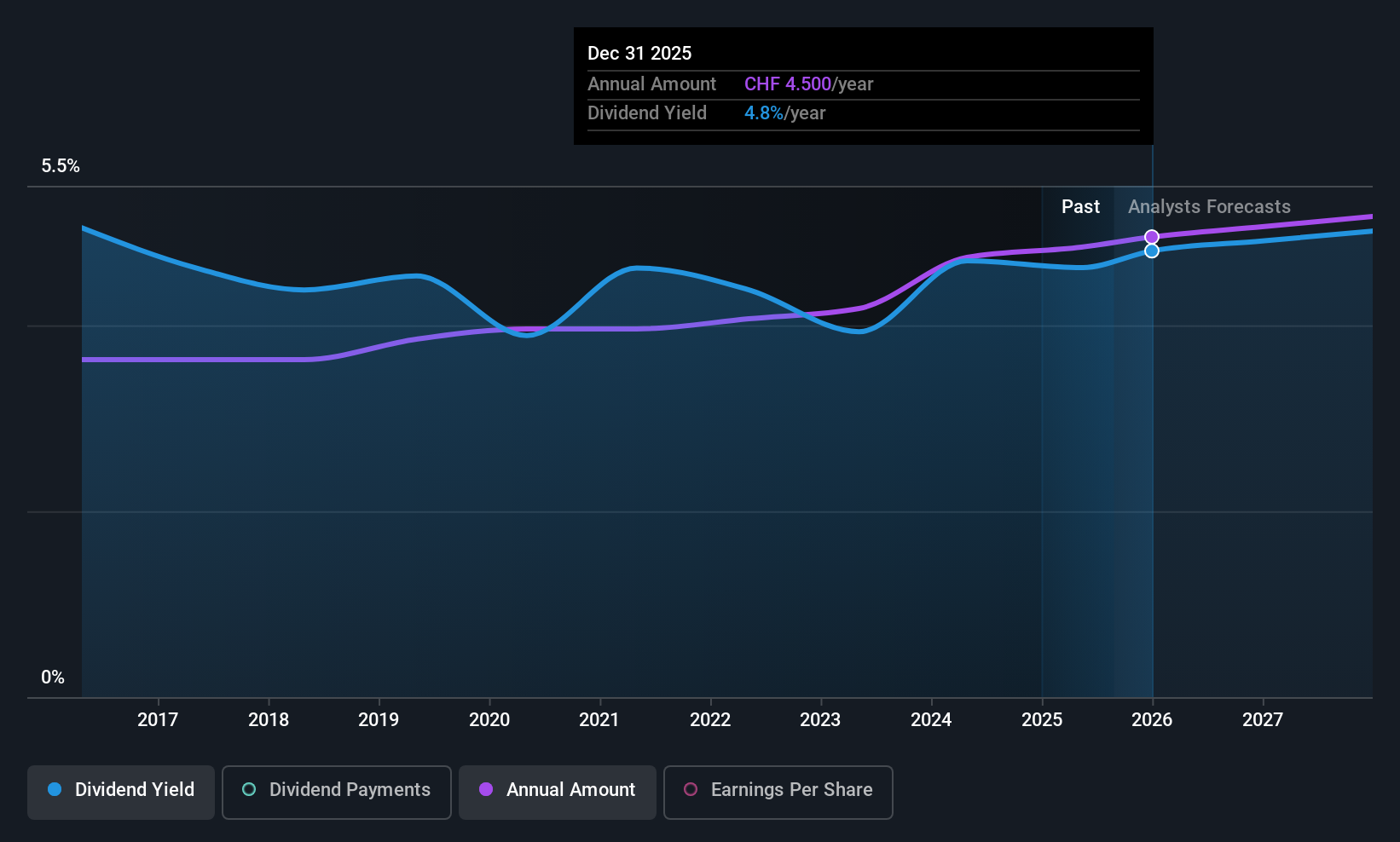

Banque Cantonale Vaudoise (SWX:BCVN)

Simply Wall St Dividend Rating: ★★★★★☆

Overview: Banque Cantonale Vaudoise provides a range of financial services in Vaud Canton, Switzerland, the European Union, North America, and internationally with a market cap of CHF8.46 billion.

Operations: Banque Cantonale Vaudoise generates revenue through several segments: Trading (CHF64.10 million), Retail Banking (CHF292.60 million), Corporate Banking (CHF278.20 million), and Wealth Management (CHF475.60 million).

Dividend Yield: 4.5%

Banque Cantonale Vaudoise offers a dividend yield of 4.47%, placing it among the top 25% in Switzerland, with stable and growing payments over the past decade. However, its dividends are not fully covered by earnings, with an 85.8% payout ratio currently and a forecasted 91.4% in three years, indicating potential sustainability issues. The stock trades at a discount to estimated fair value but has low bad loan allowances (74%), which may impact financial stability.

- Take a closer look at Banque Cantonale Vaudoise's potential here in our dividend report.

- The analysis detailed in our Banque Cantonale Vaudoise valuation report hints at an inflated share price compared to its estimated value.

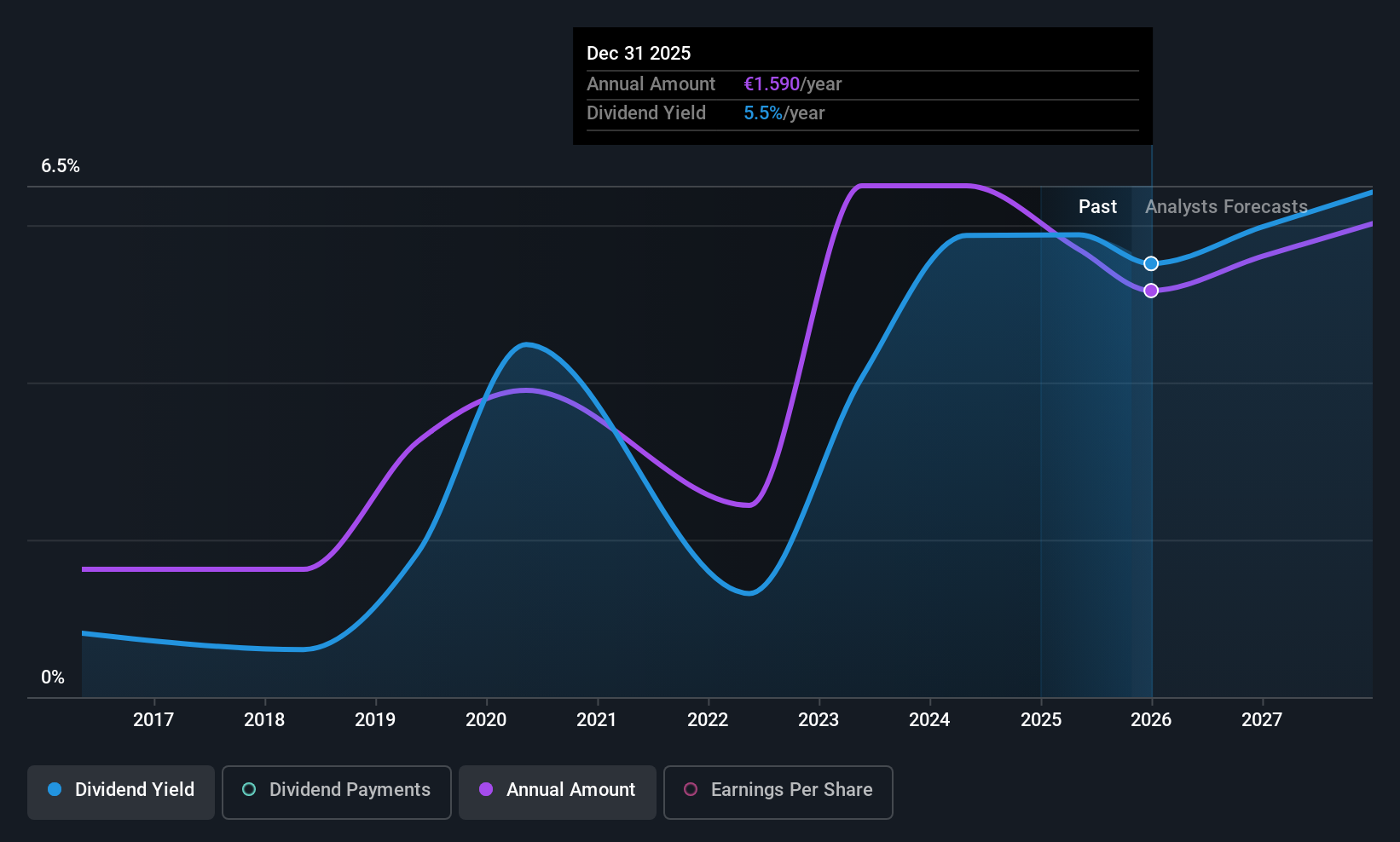

SBO (WBAG:SBO)

Simply Wall St Dividend Rating: ★★★★★☆

Overview: SBO AG manufactures and sells steel products worldwide, with a market cap of €444.42 million.

Operations: SBO AG's revenue is primarily derived from its Energy Equipment segment, contributing €309.79 million, and its Precision Technology segment, adding €282.44 million.

Dividend Yield: 6.2%

SBO AG's dividend yield of 6.21% ranks it in the top 25% of Austrian payers, supported by an earnings payout ratio of 84.8% and a cash payout ratio of 52.4%. Despite recent declines in sales and net income, dividends have grown over the past decade but remain volatile with periods of significant drops. Analysts expect stock price appreciation, trading below fair value estimates by 56.2%, yet its dividend sustainability is questioned due to historical unreliability.

- Click here to discover the nuances of SBO with our detailed analytical dividend report.

- The analysis detailed in our SBO valuation report hints at an deflated share price compared to its estimated value.

Key Takeaways

- Navigate through the entire inventory of 217 Top European Dividend Stocks here.

- Invested in any of these stocks? Simplify your portfolio management with Simply Wall St and stay ahead with our alerts for any critical updates on your stocks.

- Unlock the power of informed investing with Simply Wall St, your free guide to navigating stock markets worldwide.

Ready For A Different Approach?

- Explore high-performing small cap companies that haven't yet garnered significant analyst attention.

- Fuel your portfolio with companies showing strong growth potential, backed by optimistic outlooks both from analysts and management.

- Find companies with promising cash flow potential yet trading below their fair value.

This article by Simply Wall St is general in nature. We provide commentary based on historical data and analyst forecasts only using an unbiased methodology and our articles are not intended to be financial advice. It does not constitute a recommendation to buy or sell any stock, and does not take account of your objectives, or your financial situation. We aim to bring you long-term focused analysis driven by fundamental data. Note that our analysis may not factor in the latest price-sensitive company announcements or qualitative material. Simply Wall St has no position in any stocks mentioned.

New: AI Stock Screener & Alerts

Our new AI Stock Screener scans the market every day to uncover opportunities.

• Dividend Powerhouses (3%+ Yield)

• Undervalued Small Caps with Insider Buying

• High growth Tech and AI Companies

Or build your own from over 50 metrics.

Have feedback on this article? Concerned about the content? Get in touch with us directly. Alternatively, email editorial-team@simplywallst.com

About ENXTPA:SBT

Flawless balance sheet with solid track record and pays a dividend.

Market Insights

Weekly Picks

Solutions by stc: 34% Upside in Saudi's Digital Transformation Leader

The AI Infrastructure Giant Grows Into Its Valuation

Recently Updated Narratives

Perdana Petroleum Berhad is a Zombie Business with a 27.34% Profit Margin and inflation adjusted revenue Business

Many trends acting at the same time

Engineered for Stability. Positioned for Growth.

Popular Narratives

MicroVision will explode future revenue by 380.37% with a vision towards success

NVDA: Expanding AI Demand Will Drive Major Data Center Investments Through 2026