- France

- /

- Basic Materials

- /

- ENXTPA:NK

Why Imerys (ENXTPA:NK) Is Up 8.1% After Profits Rebound Despite Softer Sales

Reviewed by Sasha Jovanovic

- Imerys S.A. recently reported its third quarter and nine-month 2025 results, revealing sales of €827 million and €2.58 billion, respectively, with net income turning positive at €39 million for the quarter and €110 million for the year-to-date, both reversing prior year losses.

- This turnaround in profitability occurred despite lower sales, indicating significant improvements in cost management or margin discipline for the company.

- With Imerys achieving a return to profit amidst softer revenue, we'll assess how this impacts the company's ongoing investment narrative.

Find companies with promising cash flow potential yet trading below their fair value.

Imerys Investment Narrative Recap

For investors considering Imerys, belief in the company’s ability to rebound in core European markets and execute profitability improvements is essential. The recent earnings turnaround is encouraging and hints at ongoing margin discipline, but lower sales underline that volume growth remains elusive; this does not materially change the current short-term catalyst, which centres on a sustained margin recovery, nor does it remove the major risk of prolonged end-market stagnation in European construction and automotive.

Looking at recent company developments, the continued divestment of low-margin paper assets, announced in March 2024, remains highly relevant, as it underpins Imerys’ focus on operational efficiency and supports its efforts to solidify margins despite top-line pressures. The improved bottom line reported for Q3 2025 signals early progress on this front, though the durability of these gains will depend on broader industry and demand factors.

However, despite stronger profitability, investors should be alert to the potential consequences of sustained weakness in Imerys’ traditional markets, especially since…

Read the full narrative on Imerys (it's free!)

Imerys is projected to reach €3.8 billion in revenue and €405.1 million in earnings by 2028. This outlook is based on an annual revenue growth rate of 3.6% and a turnaround in earnings from the current €-166.2 million, representing an increase of €571.3 million.

Uncover how Imerys' forecasts yield a €27.40 fair value, a 21% upside to its current price.

Exploring Other Perspectives

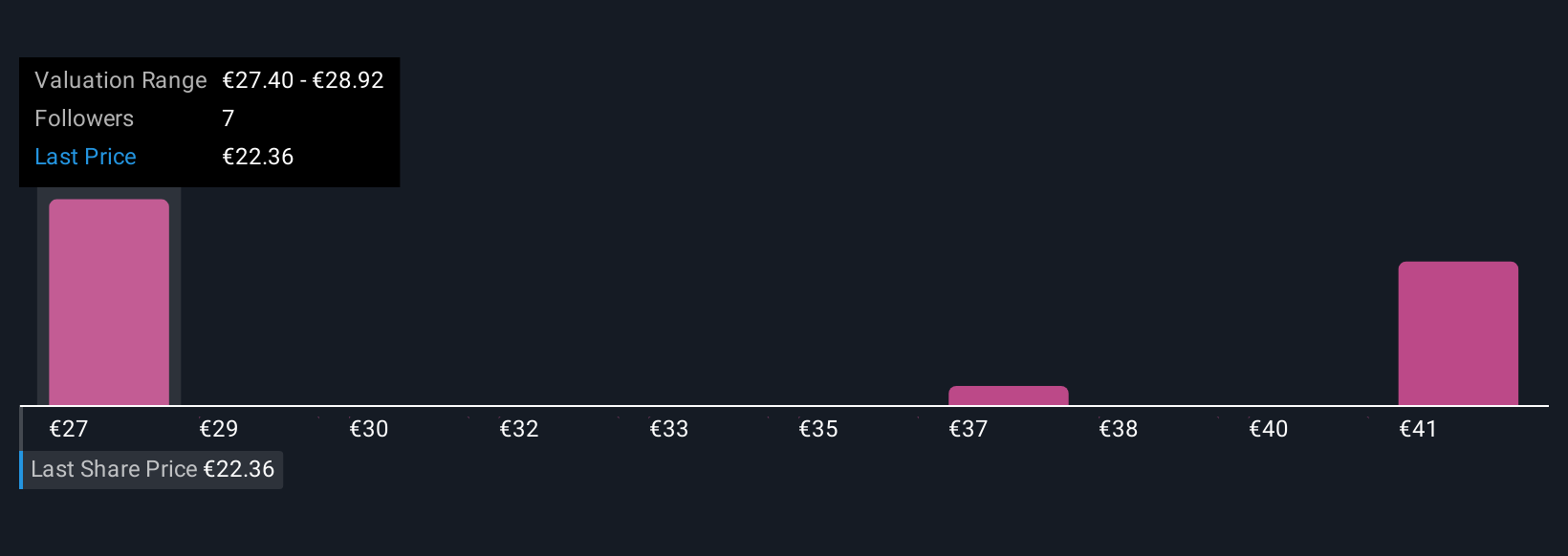

Simply Wall St Community members peg Imerys’ fair value between €27.40 and €42.43, drawing on three distinct valuations. This diversity of opinion comes as the company’s profitability improves, but macroeconomic risks in key markets still call for attention.

Explore 3 other fair value estimates on Imerys - why the stock might be worth just €27.40!

Build Your Own Imerys Narrative

Disagree with existing narratives? Create your own in under 3 minutes - extraordinary investment returns rarely come from following the herd.

- A great starting point for your Imerys research is our analysis highlighting 4 key rewards and 2 important warning signs that could impact your investment decision.

- Our free Imerys research report provides a comprehensive fundamental analysis summarized in a single visual - the Snowflake - making it easy to evaluate Imerys' overall financial health at a glance.

Seeking Other Investments?

Markets shift fast. These stocks won't stay hidden for long. Get the list while it matters:

- Trump has pledged to "unleash" American oil and gas and these 22 US stocks have developments that are poised to benefit.

- We've found 15 US stocks that are forecast to pay a dividend yield of over 6% next year. See the full list for free.

- Rare earth metals are the new gold rush. Find out which 37 stocks are leading the charge.

This article by Simply Wall St is general in nature. We provide commentary based on historical data and analyst forecasts only using an unbiased methodology and our articles are not intended to be financial advice. It does not constitute a recommendation to buy or sell any stock, and does not take account of your objectives, or your financial situation. We aim to bring you long-term focused analysis driven by fundamental data. Note that our analysis may not factor in the latest price-sensitive company announcements or qualitative material. Simply Wall St has no position in any stocks mentioned.

New: AI Stock Screener & Alerts

Our new AI Stock Screener scans the market every day to uncover opportunities.

• Dividend Powerhouses (3%+ Yield)

• Undervalued Small Caps with Insider Buying

• High growth Tech and AI Companies

Or build your own from over 50 metrics.

Have feedback on this article? Concerned about the content? Get in touch with us directly. Alternatively, email editorial-team@simplywallst.com

About ENXTPA:NK

Imerys

Engages in the supply of specialty minerals for various industries across Europe, the Middle East, Africa, Asia Pacific, and America.

Undervalued with adequate balance sheet.

Similar Companies

Market Insights

Community Narratives