- France

- /

- Healthcare Services

- /

- ENXTPA:EMEIS

emeis Société anonyme (ENXTPA:EMEIS): Assessing Valuation After Recent Share Price Fluctuations

Reviewed by Simply Wall St

emeis Société anonyme (ENXTPA:EMEIS) has seen price swings lately that have left many investors scratching their heads. There is no headline-grabbing event or earnings surprise to point to; just steady movement that some might interpret as a signal. In cases like this, it pays to step back and consider what the market is telling us about value and potential.

Over the past year, the share price has climbed an impressive 46%, driven largely by shifting expectations for the healthcare sector and internal company developments. More recently, performance has been mixed, with a modest uptick over the past 3 months but declines in the month and past week. Momentum that once seemed to favor emeis Société anonyme is now showing signs of hesitation, raising the stakes for those watching from the sidelines.

So is there hidden upside at today’s valuation, or is the recent run a sign that markets are already baking in the company’s future growth?

Price-to-Sales of 0.3x: Is it justified?

Based on the price-to-sales ratio, emeis Société anonyme is considered undervalued compared to its industry and peer group. The current multiple stands well below both the average for European healthcare companies and direct competitors. This suggests the market assigns a steep discount to future prospects.

The price-to-sales ratio measures how much investors are willing to pay for each euro of a company's sales. It is especially useful for companies where earnings are currently negative, as in the case of emeis, and provides a sense of market optimism or skepticism regarding future growth potential.

Such a low ratio could hint at overlooked potential or persistent doubt in the company’s ability to translate revenue into profitable growth. Whether this discount is an opportunity or a warning depends on underlying factors driving future sales, which investors will need to investigate further.

Result: Fair Value of €17.68 (UNDERVALUED)

See our latest analysis for emeis Société anonyme.However, persistent negative net income and slow revenue growth remain significant risks that could undermine the undervaluation thesis if not addressed soon.

Find out about the key risks to this emeis Société anonyme narrative.Another View: Our DCF Model Says Undervalued

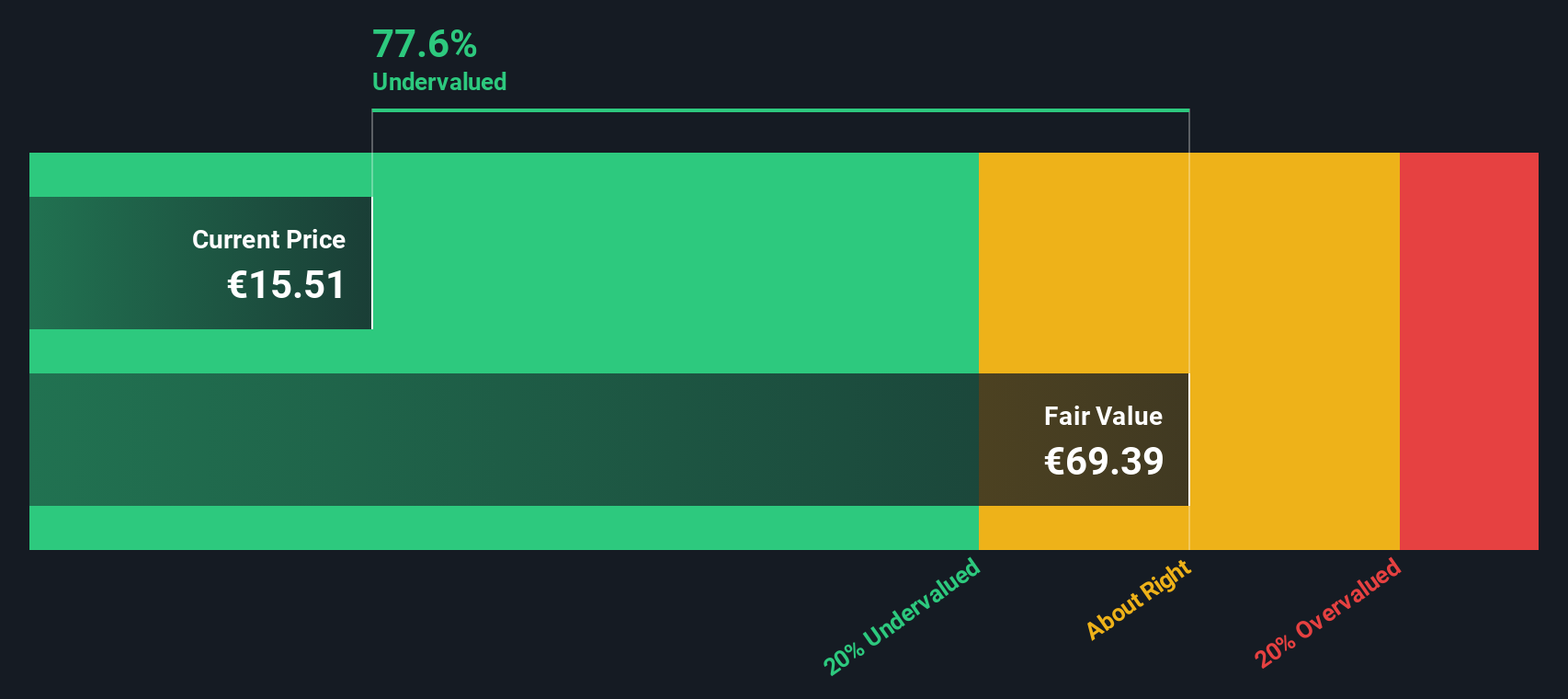

Taking a different approach, our DCF model also points to emeis Société anonyme being undervalued. This method focuses on cash flow potential rather than market multiples. This raises an interesting challenge to the narrative. Could the underlying business hold more promise than the market suspects?

Look into how the SWS DCF model arrives at its fair value.

Build Your Own emeis Société anonyme Narrative

If you see the story differently or have your own insights to add, you always have the option to craft a narrative yourself in just a few minutes. Do it your way

A great starting point for your emeis Société anonyme research is our analysis highlighting 2 key rewards and 2 important warning signs that could impact your investment decision.

Looking for More Investment Ideas?

Smart investors keep an eye on emerging opportunities beyond a single stock. Don’t limit yourself. Expand your shortlist with these handpicked Simply Wall Street strategies:

- Accelerate your search for bargain opportunities by scanning undervalued gems using our undervalued stocks based on cash flows, which spotlights mispriced stocks with strong fundamentals.

- Boost your potential for steady returns by tapping into reliable income streams with our dividend stocks with yields > 3%, showcasing companies offering yields above 3%.

- Seize early access to innovative breakthroughs shaping tomorrow's industries with our healthcare AI stocks, focused on healthcare leaders using artificial intelligence to disrupt the market.

This article by Simply Wall St is general in nature. We provide commentary based on historical data and analyst forecasts only using an unbiased methodology and our articles are not intended to be financial advice. It does not constitute a recommendation to buy or sell any stock, and does not take account of your objectives, or your financial situation. We aim to bring you long-term focused analysis driven by fundamental data. Note that our analysis may not factor in the latest price-sensitive company announcements or qualitative material. Simply Wall St has no position in any stocks mentioned.

New: Manage All Your Stock Portfolios in One Place

We've created the ultimate portfolio companion for stock investors, and it's free.

• Connect an unlimited number of Portfolios and see your total in one currency

• Be alerted to new Warning Signs or Risks via email or mobile

• Track the Fair Value of your stocks

Have feedback on this article? Concerned about the content? Get in touch with us directly. Alternatively, email editorial-team@simplywallst.com

Kshitija Bhandaru

Kshitija (or Keisha) Bhandaru is an Equity Analyst at Simply Wall St and has over 6 years of experience in the finance industry and describes herself as a lifelong learner driven by her intellectual curiosity. She previously worked with Market Realist for 5 years as an Equity Analyst.

About ENXTPA:EMEIS

emeis Société anonyme

Operates nursing homes, assisted-living facilities, post-acute and rehabilitation hospitals, and psychiatric hospitals.

Undervalued with imperfect balance sheet.

Similar Companies

Market Insights

Community Narratives