- France

- /

- Medical Equipment

- /

- ENXTPA:BIM

Is bioMérieux (ENXTPA:BIM) Undervalued? A Closer Look at Market Sentiment and Fair Value

Reviewed by Simply Wall St

Something’s caught the eye of investors in bioMérieux (ENXTPA:BIM) lately, though there isn’t one standout event driving the conversation. Sometimes, that in itself is worth a pause. When share prices make moves without a big announcement, it raises questions about what the market might be anticipating underneath the surface. Are investors reacting to subtle shifts in sentiment, or does the market see hidden value that isn’t making headlines?

Over the past year, bioMérieux’s stock has climbed 6.7%, building gradually despite some turbulence in recent months. The year-to-date gain sits at just over 10%, but pressure has emerged in the past month, with shares sliding around 10%. For long-term followers, momentum feels mixed. Three-year returns remain solidly positive, even as performance over five years has dipped into the red. Meanwhile, the company’s steady revenue and net income growth hint at underlying strength, even if recent price movements have been uneven.

So with shares drifting and the last twelve months showing only modest progress, is there a buying opportunity here, or has the market already priced in bioMérieux’s next phase of growth?

Most Popular Narrative: 8% Undervalued

The prevailing narrative suggests bioMérieux shares are currently undervalued by roughly 8%, based on next-phase earnings and margin growth forecasts.

Continuous innovation, including new panel approvals and market leadership in instrument installations, supports sustainable revenue growth and market expansion over the long term. In addition, simple profitability improvement initiatives, such as automation and cost management, are already delivering tangible outcomes and are likely to enhance net margins and earnings over time.

Want to know what’s fueling these optimistic projections? The backbone of this narrative is a mix of accelerating revenue, stronger margins, and a bold earnings jump. The numbers behind this fair value might surprise you. Ready to discover what ambitious financial assumptions set this price target apart?

Result: Fair Value of €123.46 (UNDERVALUED)

Have a read of the narrative in full and understand what's behind the forecasts.However, volatility in BIOFIRE contracts and increased competition in the U.S. respiratory market could present challenges to bioMérieux’s growth outlook in the coming years.

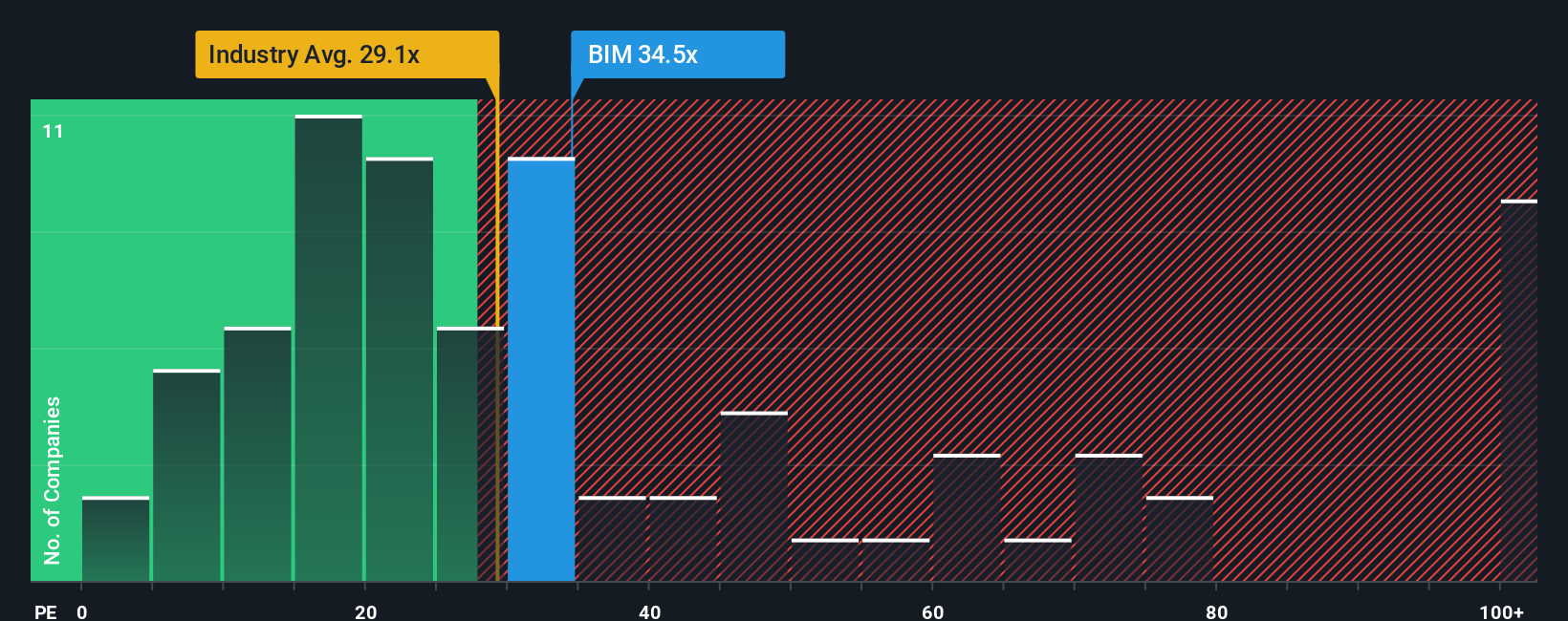

Find out about the key risks to this bioMérieux narrative.Another View: A High Price by Industry Standards

Looking at things through a different lens, the going price for bioMérieux's shares appears expensive compared to the industry average when measured by earnings. Does this signal excessive optimism, or is there growth the market is betting on?

See what the numbers say about this price — find out in our valuation breakdown.

Stay updated when valuation signals shift by adding bioMérieux to your watchlist or portfolio. Alternatively, explore our screener to discover other companies that fit your criteria.

Build Your Own bioMérieux Narrative

If you see things differently or want to dig deeper into the numbers yourself, you can shape your own take in just a few minutes. Do it your way

A great starting point for your bioMérieux research is our analysis highlighting 2 key rewards and 1 important warning sign that could impact your investment decision.

Looking for more investment ideas?

Don’t limit your strategy to just one stock. Open the door to bold new opportunities using our powerful filters to find investments others might overlook.

- Spot emerging companies with strong balance sheets and growth outlooks by tapping into our curated list of penny stocks with strong financials.

- Target stable income streams from companies consistently delivering yields above expectations through our handpicked selection of dividend stocks with yields > 3%.

- Boost your portfolio with under-the-radar bargains using our exclusive access to undervalued stocks based on cash flows.

This article by Simply Wall St is general in nature. We provide commentary based on historical data and analyst forecasts only using an unbiased methodology and our articles are not intended to be financial advice. It does not constitute a recommendation to buy or sell any stock, and does not take account of your objectives, or your financial situation. We aim to bring you long-term focused analysis driven by fundamental data. Note that our analysis may not factor in the latest price-sensitive company announcements or qualitative material. Simply Wall St has no position in any stocks mentioned.

New: Manage All Your Stock Portfolios in One Place

We've created the ultimate portfolio companion for stock investors, and it's free.

• Connect an unlimited number of Portfolios and see your total in one currency

• Be alerted to new Warning Signs or Risks via email or mobile

• Track the Fair Value of your stocks

Have feedback on this article? Concerned about the content? Get in touch with us directly. Alternatively, email editorial-team@simplywallst.com

About ENXTPA:BIM

bioMérieux

Develops, manufactures, and markets in vitro diagnostic solutions for infectious diseases in France, Europe, Africa, the Middle East, North and South America, the Asia Pacific, and internationally.

Flawless balance sheet with moderate growth potential.

Similar Companies

Market Insights

Community Narratives