- France

- /

- Energy Services

- /

- ENXTPA:VK

Does Vallourec’s US$48 Million Ohio Expansion Signal a Strategic Shift for ENXTPA:VK?

Reviewed by Sasha Jovanovic

- On November 10, 2025, Vallourec announced it will invest up to US$48 million to expand its Youngstown, Ohio facility, adding new threading capacity for VAM® high-torque connections and creating 40 full-time jobs.

- This expansion highlights Vallourec’s focus on advanced tubular solutions and its enduring commitment to strengthening U.S. manufacturing and the local energy supply chain.

- We’ll examine how Vallourec’s substantial U.S. investment supports its focus on premium products and positions it within the evolving energy sector.

Uncover the next big thing with financially sound penny stocks that balance risk and reward.

Vallourec Investment Narrative Recap

To be a Vallourec shareholder, one has to believe in the continued demand for premium tubular solutions and the company’s ability to capitalize on regional sourcing trends, especially in the U.S. While the announced US$48 million investment in Ohio aligns with this narrative, its immediate impact on the main short-term catalyst, strong order intake from global oil and gas projects, remains limited. The most significant risk is Vallourec’s concentrated exposure to oil and gas, making its revenues vulnerable to sector downturns and decarbonization efforts.

One closely related recent development is Vallourec’s repeat contract win to supply premium casing and tubing for TotalEnergies’ AGUP2 Project in Iraq. This underlines the catalyst of sustained demand for high-specification products in energy expansion projects worldwide and demonstrates how share value may hinge on the firm’s ability to secure large-scale client orders amid energy transition pressures.

Yet, even as orders and local investments offer support, investors must remain mindful that...

Read the full narrative on Vallourec (it's free!)

Vallourec's outlook anticipates €4.4 billion in revenue and €608.1 million in earnings by 2028. This scenario is based on 4.8% annual revenue growth and an earnings increase of €246.4 million from the current €361.7 million.

Uncover how Vallourec's forecasts yield a €20.33 fair value, a 23% upside to its current price.

Exploring Other Perspectives

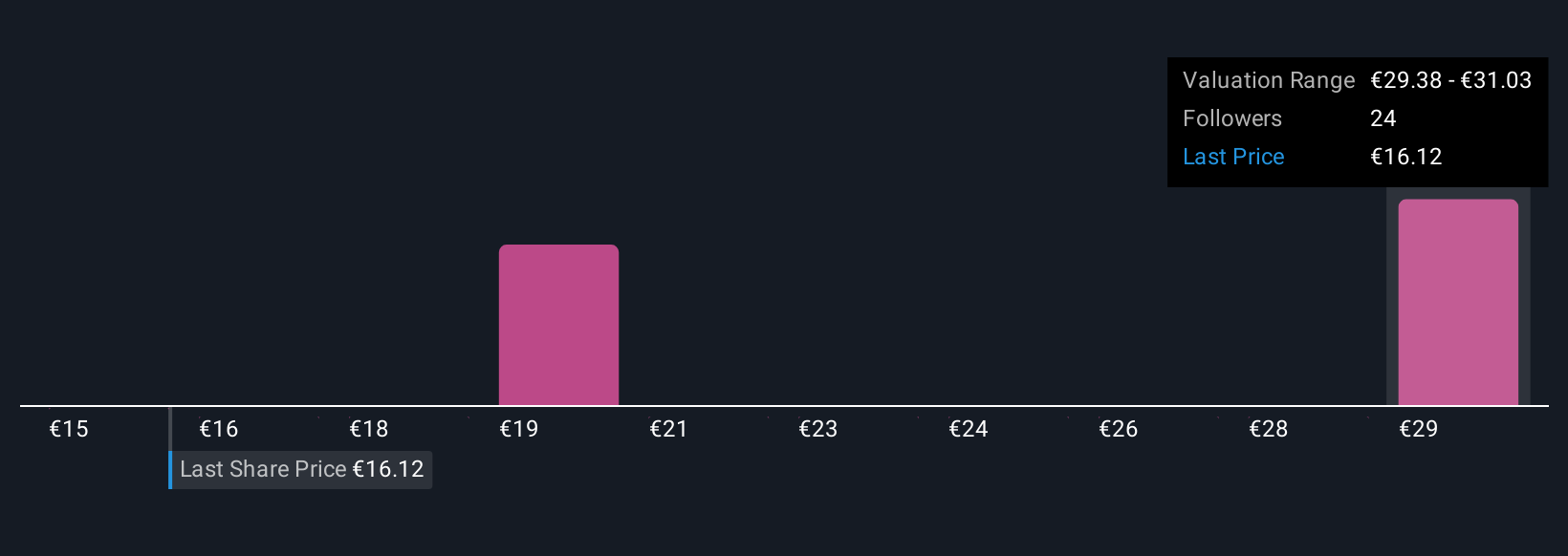

Fair value estimates from two Simply Wall St Community contributors range widely, from €20.33 to €37.81 per share, reflecting sharply divergent views. While order wins support demand for Vallourec’s advanced products, your peers are considering how sector reliance shapes their outlook, review a spectrum of perspectives on potential risks and rewards before deciding how this could impact your stance.

Explore 2 other fair value estimates on Vallourec - why the stock might be worth over 2x more than the current price!

Build Your Own Vallourec Narrative

Disagree with existing narratives? Create your own in under 3 minutes - extraordinary investment returns rarely come from following the herd.

- A great starting point for your Vallourec research is our analysis highlighting 4 key rewards and 1 important warning sign that could impact your investment decision.

- Our free Vallourec research report provides a comprehensive fundamental analysis summarized in a single visual - the Snowflake - making it easy to evaluate Vallourec's overall financial health at a glance.

No Opportunity In Vallourec?

Markets shift fast. These stocks won't stay hidden for long. Get the list while it matters:

- These 13 companies survived and thrived after COVID and have the right ingredients to survive Trump's tariffs. Discover why before your portfolio feels the trade war pinch.

- AI is about to change healthcare. These 32 stocks are working on everything from early diagnostics to drug discovery. The best part - they are all under $10b in market cap - there's still time to get in early.

- Trump's oil boom is here - pipelines are primed to profit. Discover the 22 US stocks riding the wave.

This article by Simply Wall St is general in nature. We provide commentary based on historical data and analyst forecasts only using an unbiased methodology and our articles are not intended to be financial advice. It does not constitute a recommendation to buy or sell any stock, and does not take account of your objectives, or your financial situation. We aim to bring you long-term focused analysis driven by fundamental data. Note that our analysis may not factor in the latest price-sensitive company announcements or qualitative material. Simply Wall St has no position in any stocks mentioned.

New: Manage All Your Stock Portfolios in One Place

We've created the ultimate portfolio companion for stock investors, and it's free.

• Connect an unlimited number of Portfolios and see your total in one currency

• Be alerted to new Warning Signs or Risks via email or mobile

• Track the Fair Value of your stocks

Have feedback on this article? Concerned about the content? Get in touch with us directly. Alternatively, email editorial-team@simplywallst.com

About ENXTPA:VK

Vallourec

Through its subsidiaries, provides tubular solutions for the oil and gas, industry, and new energies markets in Europe, North America, South America, Asia, the Middle East, and internationally.

Very undervalued with flawless balance sheet.

Similar Companies

Market Insights

Community Narratives