- France

- /

- Oil and Gas

- /

- ENXTPA:TTE

How Investors Are Reacting To TotalEnergies (ENXTPA:TTE) Strong Q3 Results and Dividend Increase

Reviewed by Sasha Jovanovic

- TotalEnergies announced a strong third quarter performance with net income rising to US$3.68 billion, boosted by higher production volumes, a 7.6% interim dividend increase to €0.85 per share, and completion of a €2.87 billion share buyback tranche, while also progressing renewable energy supply agreements and exploration partnerships in Guyana.

- This combination of improved profitability, enhanced capital returns to shareholders, and continued diversification into renewables reflects TotalEnergies' commitment to balancing operational growth with the energy transition.

- We will examine how TotalEnergies' robust earnings growth and dividend boost reinforce its long-term investment outlook amid an evolving energy mix.

Trump's oil boom is here - pipelines are primed to profit. Discover the 22 US stocks riding the wave.

TotalEnergies Investment Narrative Recap

To be comfortable as a TotalEnergies shareholder, you need to believe in a balanced future where global hydrocarbon demand remains meaningful while the company accelerates its transition into renewables and power. The recent profit surge and dividend hike strengthen confidence in near-term capital returns, but the most important short-term catalyst, robust gas and power expansion, remains largely unaffected. The biggest risk continues to be the potential for prolonged oil market oversupply, which could pressure margins if energy demand slows further; this also hasn’t materially changed due to recent developments.

Among the latest announcements, the long-term renewable power purchase agreement with Data4 stands out, reflecting TotalEnergies’ commitment to building resilient revenue streams outside of traditional hydrocarbons. This diversified approach directly supports the company's efforts to lessen its exposure to oil price cycles and positions it to capture value as electrification trends strengthen.

But on the other hand, investors should be aware that prolonged periods of global oil oversupply can still...

Read the full narrative on TotalEnergies (it's free!)

TotalEnergies' outlook anticipates $194.9 billion in revenue and $15.8 billion in earnings by 2028. This is based on a projected annual revenue growth rate of 1.4% and a $3.0 billion increase in earnings from the current $12.8 billion.

Uncover how TotalEnergies' forecasts yield a €63.31 fair value, a 14% upside to its current price.

Exploring Other Perspectives

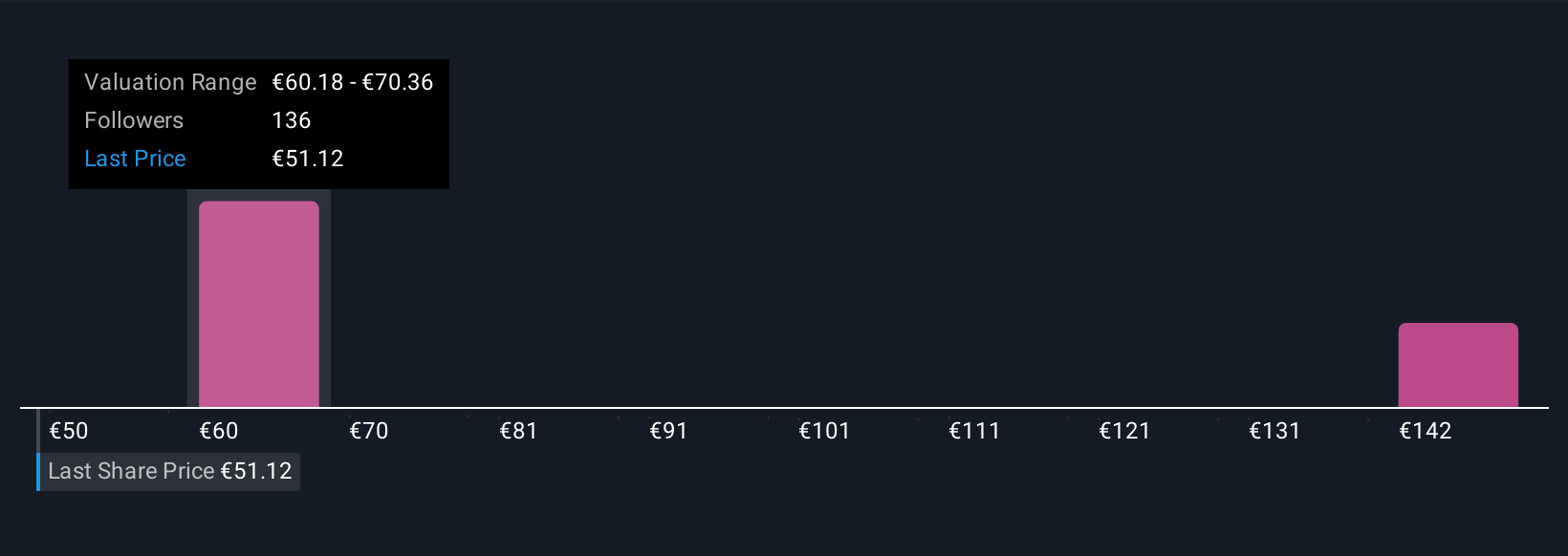

Retail investors in the Simply Wall St Community have set fair value targets for TotalEnergies ranging widely from €48.99 up to €135.72 based on 20 different analyses. With such a spread in expectations and ongoing expansion in renewables, it is worth comparing these varied perspectives while considering how prolonged oil oversupply could influence the company’s future performance.

Explore 20 other fair value estimates on TotalEnergies - why the stock might be worth 11% less than the current price!

Build Your Own TotalEnergies Narrative

Disagree with existing narratives? Create your own in under 3 minutes - extraordinary investment returns rarely come from following the herd.

- A great starting point for your TotalEnergies research is our analysis highlighting 3 key rewards and 1 important warning sign that could impact your investment decision.

- Our free TotalEnergies research report provides a comprehensive fundamental analysis summarized in a single visual - the Snowflake - making it easy to evaluate TotalEnergies' overall financial health at a glance.

No Opportunity In TotalEnergies?

Don't miss your shot at the next 10-bagger. Our latest stock picks just dropped:

- Find companies with promising cash flow potential yet trading below their fair value.

- We've found 15 US stocks that are forecast to pay a dividend yield of over 6% next year. See the full list for free.

- Uncover the next big thing with financially sound penny stocks that balance risk and reward.

This article by Simply Wall St is general in nature. We provide commentary based on historical data and analyst forecasts only using an unbiased methodology and our articles are not intended to be financial advice. It does not constitute a recommendation to buy or sell any stock, and does not take account of your objectives, or your financial situation. We aim to bring you long-term focused analysis driven by fundamental data. Note that our analysis may not factor in the latest price-sensitive company announcements or qualitative material. Simply Wall St has no position in any stocks mentioned.

Valuation is complex, but we're here to simplify it.

Discover if TotalEnergies might be undervalued or overvalued with our detailed analysis, featuring fair value estimates, potential risks, dividends, insider trades, and its financial condition.

Access Free AnalysisHave feedback on this article? Concerned about the content? Get in touch with us directly. Alternatively, email editorial-team@simplywallst.com

About ENXTPA:TTE

TotalEnergies

A multi-energy company, produces and markets oil and biofuels, natural gas, biogas and low-carbon hydrogen, renewables, and electricity in France, rest of Europe, and internationally.

Flawless balance sheet, undervalued and pays a dividend.

Similar Companies

Market Insights

Community Narratives