- France

- /

- Oil and Gas

- /

- ENXTPA:ES

Will EssoF's (ENXTPA:ES) Index Exit Shift Its Appeal to Long-Term Institutional Investors?

Reviewed by Sasha Jovanovic

- Esso S.A.F. was removed from the Euronext 150 Index on October 31, 2025, following a rebalancing of the index's constituents.

- This change is significant as index removals can affect trading volumes and visibility among both institutional and passive investors tracking major benchmarks.

- We’ll examine how Esso S.A.F.’s exit from the Euronext 150 Index could alter the company’s investment narrative for shareholders.

Find companies with promising cash flow potential yet trading below their fair value.

What Is EssoF's Investment Narrative?

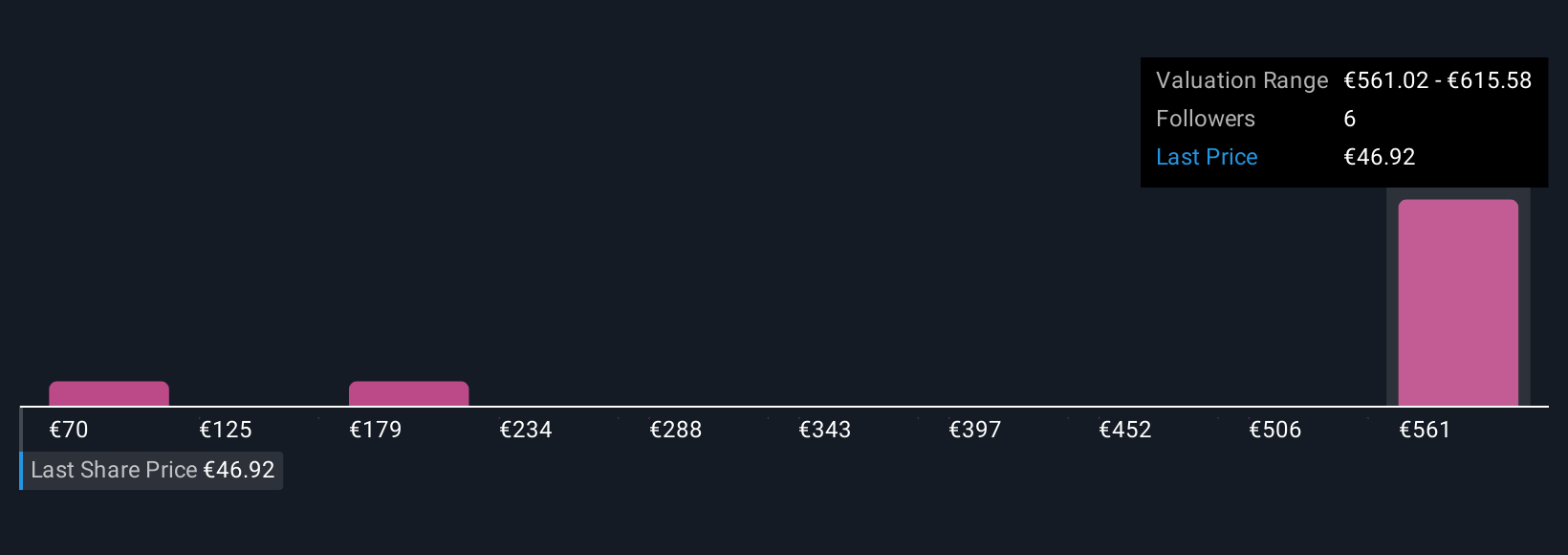

To stay invested in Esso S.A.F., shareholders typically have to believe in the potential for transformation as the company undergoes an ownership change and significant restructuring. The big question now is whether Esso S.A.F.’s removal from the Euronext 150 Index meaningfully shifts the dynamic for upcoming short-term catalysts or risk factors. While index exclusion can diminish visibility and reduce passive fund flows, possibly contributing to the recent sharp drop in share price, ongoing events like the North Atlantic France SAS takeover, the prospective rebranding, and the extraordinary €60.21 per share dividend look set to remain the central near-term narrative. Previously identified risks, such as heavy board turnover, unprofitability, and reliance on regulatory approvals, now need to be considered against the backdrop of lower liquidity and reduced index participation. For most investors, the core catalysts and risks appear unchanged, but the path forward may feel less predictable. On the other hand, the upcoming shareholder vote on the large dividend is a decision every investor should be watching.

Despite retreating, EssoF's shares might still be trading above their fair value and there could be some more downside. Discover how much.Exploring Other Perspectives

Explore 3 other fair value estimates on EssoF - why the stock might be a potential multi-bagger!

Build Your Own EssoF Narrative

Disagree with this assessment? Create your own narrative in under 3 minutes - extraordinary investment returns rarely come from following the herd.

- A great starting point for your EssoF research is our analysis highlighting 1 key reward and 2 important warning signs that could impact your investment decision.

- Our free EssoF research report provides a comprehensive fundamental analysis summarized in a single visual - the Snowflake - making it easy to evaluate EssoF's overall financial health at a glance.

Curious About Other Options?

Every day counts. These free picks are already gaining attention. See them before the crowd does:

- These 13 companies survived and thrived after COVID and have the right ingredients to survive Trump's tariffs. Discover why before your portfolio feels the trade war pinch.

- Trump has pledged to "unleash" American oil and gas and these 22 US stocks have developments that are poised to benefit.

- AI is about to change healthcare. These 32 stocks are working on everything from early diagnostics to drug discovery. The best part - they are all under $10b in market cap - there's still time to get in early.

This article by Simply Wall St is general in nature. We provide commentary based on historical data and analyst forecasts only using an unbiased methodology and our articles are not intended to be financial advice. It does not constitute a recommendation to buy or sell any stock, and does not take account of your objectives, or your financial situation. We aim to bring you long-term focused analysis driven by fundamental data. Note that our analysis may not factor in the latest price-sensitive company announcements or qualitative material. Simply Wall St has no position in any stocks mentioned.

Valuation is complex, but we're here to simplify it.

Discover if EssoF might be undervalued or overvalued with our detailed analysis, featuring fair value estimates, potential risks, dividends, insider trades, and its financial condition.

Access Free AnalysisHave feedback on this article? Concerned about the content? Get in touch with us directly. Alternatively, email editorial-team@simplywallst.com

About ENXTPA:ES

EssoF

Esso S.A.F. refines, distributes, and markets oil products in France and internationally.

Excellent balance sheet and good value.

Similar Companies

Market Insights

Community Narratives