- France

- /

- Diversified Financial

- /

- ENXTPA:MF

Wendel (ENXTPA:MF): Evaluating Value After Subtle Share Price Shifts

Reviewed by Simply Wall St

Most Popular Narrative: 30.4% Undervalued

According to the most widely followed valuation narrative, Wendel shares are trading at a steep discount to their estimated fair value, with analysts projecting around 30% upside.

Expansion in asset management and digital transformation initiatives is driving higher earnings, revenue growth, and improved margins through new products and increased global capital inflows. Strategic portfolio rebalancing and a strengthened ESG focus are enhancing liquidity, reinvestment capacity, and access to institutional capital. These factors are boosting growth and valuation.

Wondering why Wendel might unlock such a dramatic re-rating? The most influential valuation narrative banks on ambitious earnings growth, accelerating revenue, and the potential for profitability levels not seen in years. Feeling the FOMO yet? Uncover the bold projections powering this price target and reveal what could send Wendel soaring.

Result: Fair Value of €117.0 (UNDERVALUED)

Have a read of the narrative in full and understand what's behind the forecasts.However, disappointing results from key holdings and ongoing foreign exchange volatility could undermine Wendel’s turnaround story and put pressure on its long-term growth outlook.

Find out about the key risks to this Wendel narrative.Another View: Discounted Cash Flow Model Weighs In

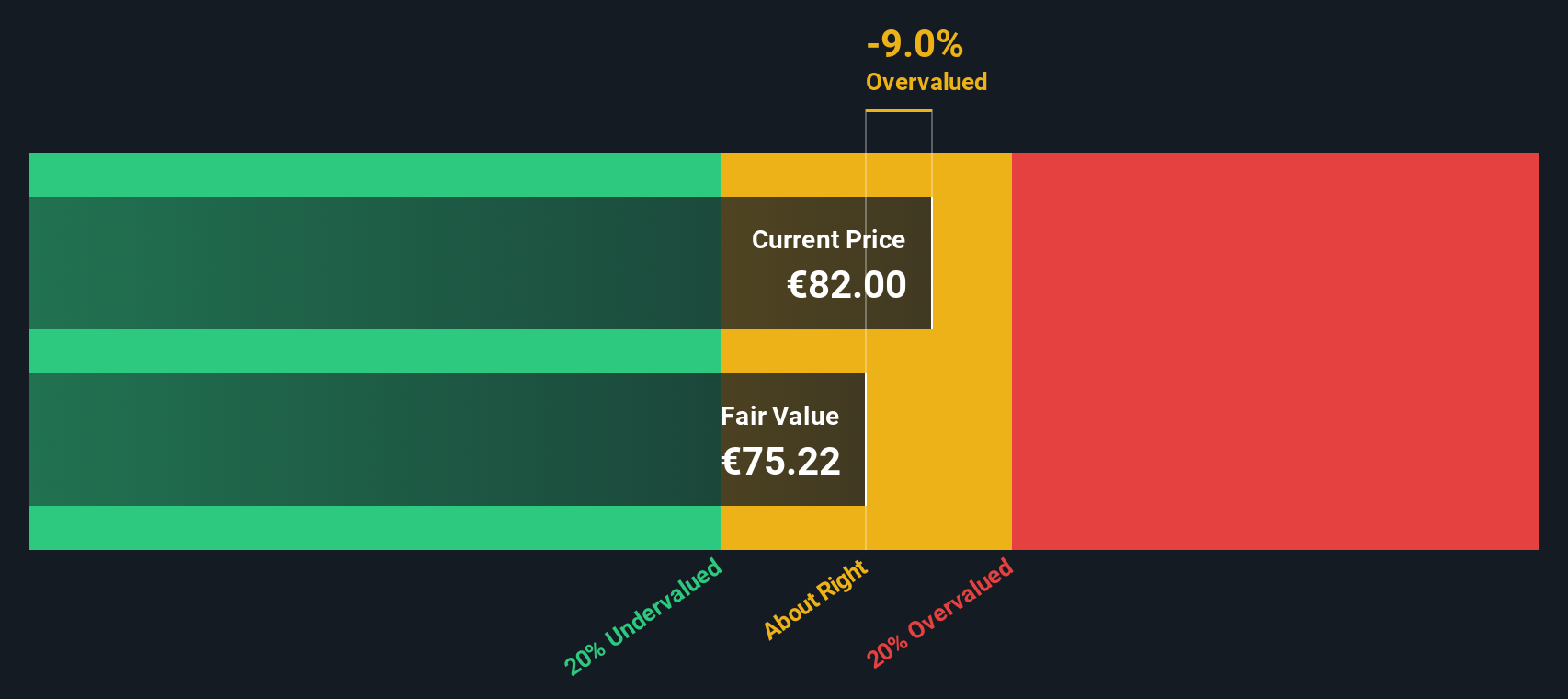

While the fair value narrative points to Wendel being meaningfully undervalued, our DCF model arrives at a more conservative result. It suggests the current price is above its calculated fair value. So which story should investors believe?

Look into how the SWS DCF model arrives at its fair value.

Build Your Own Wendel Narrative

If you see Wendel’s story differently, or enjoy running your own numbers, you can craft a personal outlook in just minutes. Do it your way.

A great starting point for your Wendel research is our analysis highlighting 3 key rewards and 1 important warning sign that could impact your investment decision.

Looking for More Investment Ideas?

Don't get left behind while others spot tomorrow's winners. Put your strategy into action with handpicked investment themes, tailored to different goals and interests:

- Start earning more from your capital by targeting companies with proven income potential, using the power of dividend stocks with yields > 3% to access businesses offering yields above 3%.

- Surf the next wave in artificial intelligence, where innovation meets opportunity, by tapping into AI penny stocks, the home of rapid-growth AI-driven stocks.

- Seize value like a seasoned investor by zeroing in on stocks the market has overlooked, guided by undervalued stocks based on cash flows for smart picks based on strong cash flows.

This article by Simply Wall St is general in nature. We provide commentary based on historical data and analyst forecasts only using an unbiased methodology and our articles are not intended to be financial advice. It does not constitute a recommendation to buy or sell any stock, and does not take account of your objectives, or your financial situation. We aim to bring you long-term focused analysis driven by fundamental data. Note that our analysis may not factor in the latest price-sensitive company announcements or qualitative material. Simply Wall St has no position in any stocks mentioned.

Valuation is complex, but we're here to simplify it.

Discover if Wendel might be undervalued or overvalued with our detailed analysis, featuring fair value estimates, potential risks, dividends, insider trades, and its financial condition.

Access Free AnalysisHave feedback on this article? Concerned about the content? Get in touch with us directly. Alternatively, email editorial-team@simplywallst.com

Kshitija Bhandaru

Kshitija (or Keisha) Bhandaru is an Equity Analyst at Simply Wall St and has over 6 years of experience in the finance industry and describes herself as a lifelong learner driven by her intellectual curiosity. She previously worked with Market Realist for 5 years as an Equity Analyst.

About ENXTPA:MF

Wendel

A private equity firm specializing in equity financing in middle markets and later stages through leveraged buy-out and transactions and acquisitions.

Established dividend payer and good value.

Similar Companies

Market Insights

Community Narratives