Discovering Hidden Treasures Sidetrade And 2 Other French Small Caps

Reviewed by Simply Wall St

As the pan-European STOXX Europe 600 Index ended 2.46% higher and France's CAC 40 advanced by 2.48%, investor sentiment towards small-cap stocks in France remains optimistic amid hopes for potential interest rate cuts. In this environment, discovering hidden gems such as Sidetrade and other promising French small caps can offer unique opportunities for growth. Identifying a good stock often involves looking at companies that show resilience and innovation within their sectors, especially during times of positive market sentiment and economic indicators suggesting stability or growth.

Top 10 Undiscovered Gems With Strong Fundamentals In France

| Name | Debt To Equity | Revenue Growth | Earnings Growth | Health Rating |

|---|---|---|---|---|

| Caisse Régionale de Crédit Agricole Mutuel Brie Picardie Société coopérative | 34.89% | 3.23% | 3.61% | ★★★★★★ |

| Gévelot | 0.25% | 10.64% | 20.33% | ★★★★★★ |

| EssoF | 1.19% | 11.14% | 41.41% | ★★★★★★ |

| VIEL & Cie société anonyme | 63.16% | 5.00% | 16.26% | ★★★★★☆ |

| Exacompta Clairefontaine | 30.44% | 6.92% | 31.73% | ★★★★★☆ |

| ADLPartner | 86.83% | 9.59% | 11.00% | ★★★★★☆ |

| La Forestière Equatoriale | 0.00% | -50.76% | 49.41% | ★★★★★☆ |

| Caisse Régionale de Crédit Agricole Mutuel Alpes Provence Société coopérative | 391.01% | 4.67% | 17.31% | ★★★★☆☆ |

| Société Fermière du Casino Municipal de Cannes | 11.60% | 6.69% | 10.30% | ★★★★☆☆ |

| Société Industrielle et Financière de l'Artois Société anonyme | 2.93% | -1.09% | 8.31% | ★★★★☆☆ |

Underneath we present a selection of stocks filtered out by our screen.

Sidetrade (ENXTPA:ALBFR)

Simply Wall St Value Rating: ★★★★★☆

Overview: Sidetrade SA offers AI-powered order-to-cash (O2C) software as a service platform in France and internationally, with a market cap of €313.54 million.

Operations: Sidetrade SA generates revenue primarily from its software and programming segment, totaling €43.96 million. The company's net profit margin stands at 10.5%.

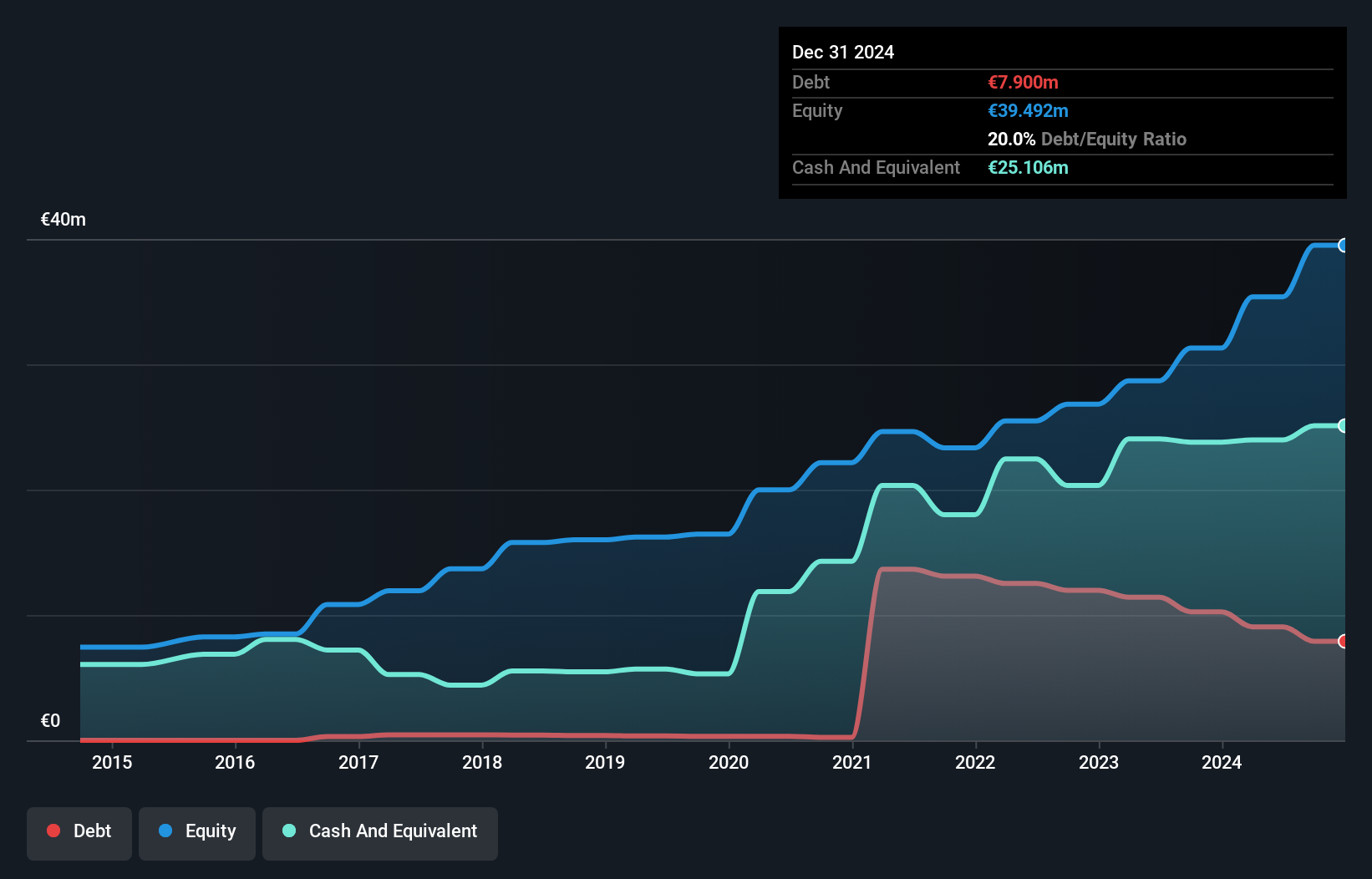

Sidetrade, a promising player in the AI-driven Order-to-Cash market, reported €24.8 million revenue for H1 2024, up from €20.9 million last year. The company recently launched 'Ask Aimie,' a generative AI feature that enhances user experience by summarizing lengthy emails and generating replies. With earnings growth of 66.7% over the past year and trading at 12.7% below estimated fair value, Sidetrade's innovative approach seems poised to drive further expansion and efficiency gains in its sector.

Financière Moncey Société anonyme (ENXTPA:FMONC)

Simply Wall St Value Rating: ★★★★★★

Overview: Financière Moncey Société anonyme operates as a holding company managing a portfolio of investments in France, with a market cap of €1.51 billion.

Operations: Financière Moncey Société anonyme generates revenue through its portfolio of investments in France, with a market cap of €1.51 billion. The company's net profit margin stands at 15%, reflecting its profitability from these investments.

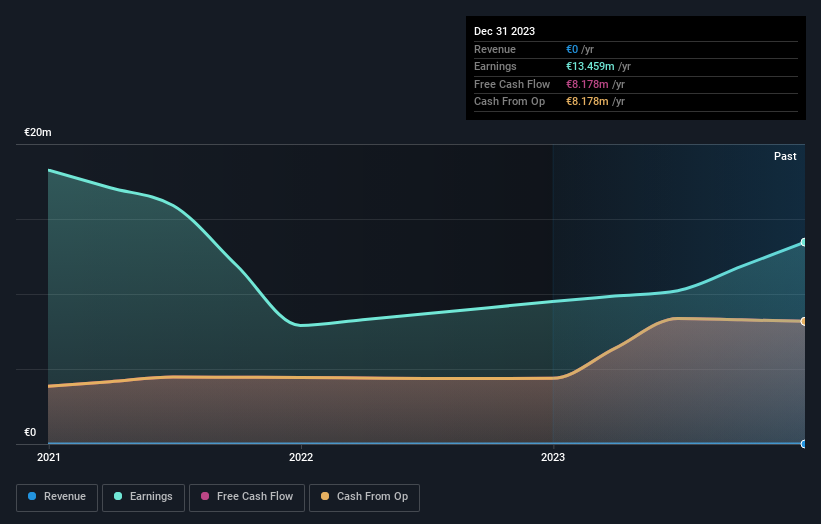

Financière Moncey Société anonyme, a small yet intriguing player in France's financial sector, has shown impressive earnings growth of 41.7% over the past year. Notably, FMONC is debt-free, a significant improvement from five years ago when its debt to equity ratio was 0.02%. The company repurchased shares in the latest year and boasts high-quality earnings while making less than US$1m (€0) in revenue. This performance outstrips the Diversified Financial industry’s -3.9% earnings growth rate, highlighting its potential as an undiscovered gem.

- Unlock comprehensive insights into our analysis of Financière Moncey Société anonyme stock in this health report.

Understand Financière Moncey Société anonyme's track record by examining our Past report.

CFM Indosuez Wealth Management (ENXTPA:MLCFM)

Simply Wall St Value Rating: ★★★★★☆

Overview: CFM Indosuez Wealth Management SA, along with its subsidiaries, offers banking and financial solutions to private investors, businesses, institutions, and professionals in Monaco and internationally with a market cap of €630.30 million.

Operations: CFM Indosuez Wealth Management SA generates revenue primarily from its wealth management segment, totaling €196.38 million.

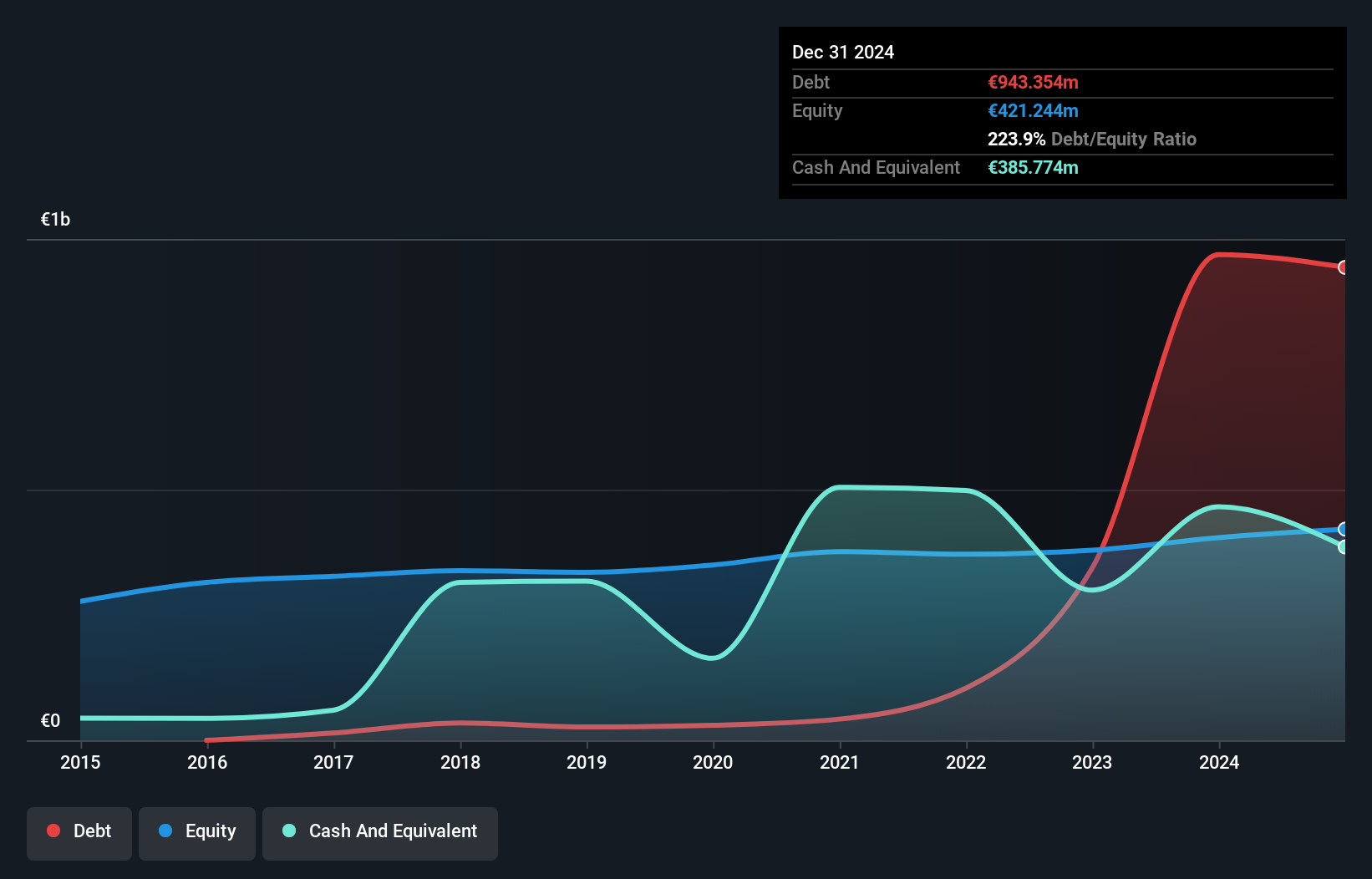

CFM Indosuez Wealth Management, with total assets of €7.7B and equity of €404.3M, leverages customer deposits as its primary funding source, reducing risk compared to external borrowing. The company has a low allowance for bad loans at 34% and maintains an appropriate level of non-performing loans at 0.8%. Its earnings growth over the past year was 40.1%, outpacing the industry average decline of -11%. With a price-to-earnings ratio of 10.4x, it is valued below the French market average (14.8x).

Next Steps

- Unlock our comprehensive list of 34 Euronext Paris Undiscovered Gems With Strong Fundamentals by clicking here.

- Are any of these part of your asset mix? Tap into the analytical power of Simply Wall St's portfolio to get a 360-degree view on how they're shaping up.

- Unlock the power of informed investing with Simply Wall St, your free guide to navigating stock markets worldwide.

Want To Explore Some Alternatives?

- Explore high-performing small cap companies that haven't yet garnered significant analyst attention.

- Fuel your portfolio with companies showing strong growth potential, backed by optimistic outlooks both from analysts and management.

- Find companies with promising cash flow potential yet trading below their fair value.

This article by Simply Wall St is general in nature. We provide commentary based on historical data and analyst forecasts only using an unbiased methodology and our articles are not intended to be financial advice. It does not constitute a recommendation to buy or sell any stock, and does not take account of your objectives, or your financial situation. We aim to bring you long-term focused analysis driven by fundamental data. Note that our analysis may not factor in the latest price-sensitive company announcements or qualitative material. Simply Wall St has no position in any stocks mentioned.

New: Manage All Your Stock Portfolios in One Place

We've created the ultimate portfolio companion for stock investors, and it's free.

• Connect an unlimited number of Portfolios and see your total in one currency

• Be alerted to new Warning Signs or Risks via email or mobile

• Track the Fair Value of your stocks

Have feedback on this article? Concerned about the content? Get in touch with us directly. Alternatively, email editorial-team@simplywallst.com

About ENXTPA:ALBFR

Sidetrade

Provides AI-powered order-to-cash (O2C) software as a service platform in France and internationally.

Solid track record with excellent balance sheet.