- France

- /

- Hospitality

- /

- ENXTPA:SW

The Bull Case For Sodexo (ENXTPA:SW) Could Change Following Ganci’s U.S. Leadership Expansion Appointment

Reviewed by Sasha Jovanovic

- Sodexo recently promoted Joe Ganci to CEO, Corporate Services and Energy & Resources for the U.S., placing him in charge of roughly 400 clients across more than 1,000 sites and making him a member of the North America Leadership Team under Thierry Delaporte.

- His appointment comes as Sodexo works to revamp its largest market, with an emphasis on tighter operations and expanding branded offerings such as The Good Eating Company, Modern Recipe, and Kitchen Works.

- We’ll explore how Ganci’s expanded oversight of Sodexo’s U.S. Corporate Services and Energy & Resources operations could influence the company’s investment narrative.

The latest GPUs need a type of rare earth metal called Terbium and there are only 36 companies in the world exploring or producing it. Find the list for free.

Sodexo Investment Narrative Recap

To own Sodexo, you need to believe its efforts to sharpen operations and branded offerings can translate into steadier growth, especially in North America, where guidance has already been revised lower. Ganci’s promotion looks directionally aligned with that turnaround focus but does not, on its own, materially change the near term execution risk around weak net signings and delayed contract ramp ups.

The recent appointment of Thierry Delaporte as Group CEO, along with his upcoming direct oversight of North America, ties directly into the same U.S. turnaround story that Ganci is now part of. Together, these leadership changes sit alongside ongoing sales and retention initiatives centered on concepts like The Good Eating Company, which many investors see as key to unlocking the North American catalyst outlined in consensus expectations.

But while leadership changes can be encouraging, investors should still pay close attention to the risk that weak net signing in North America...

Read the full narrative on Sodexo (it's free!)

Sodexo's narrative projects €25.9 billion revenue and €831.3 million earnings by 2028. This requires 2.3% yearly revenue growth and about a €155 million earnings increase from €676.0 million today.

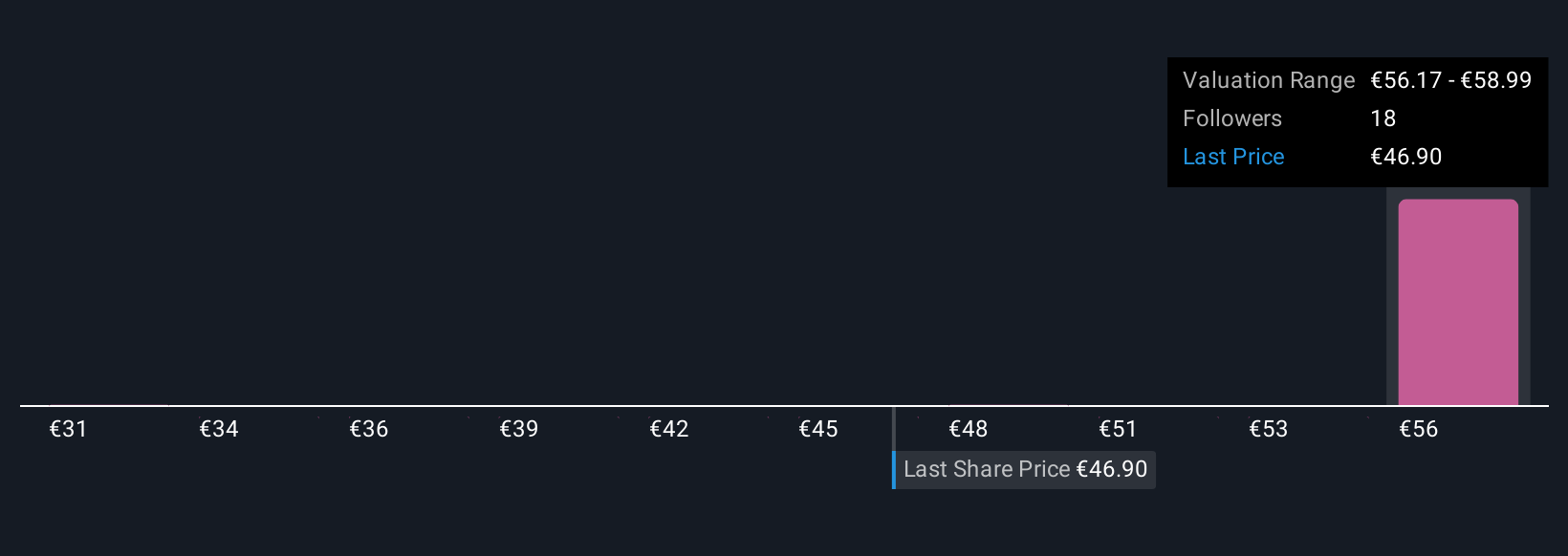

Uncover how Sodexo's forecasts yield a €57.74 fair value, a 27% upside to its current price.

Exploring Other Perspectives

Four members of the Simply Wall St Community currently estimate Sodexo’s fair value between €30.81 and €60.14, reflecting a wide spread in expectations. When you set those views against concerns about weaker North American growth and execution on delayed contracts, it becomes clear why checking multiple perspectives before forming an opinion on Sodexo’s prospects can be useful.

Explore 4 other fair value estimates on Sodexo - why the stock might be worth as much as 33% more than the current price!

Build Your Own Sodexo Narrative

Disagree with existing narratives? Create your own in under 3 minutes - extraordinary investment returns rarely come from following the herd.

- A great starting point for your Sodexo research is our analysis highlighting 4 key rewards and 2 important warning signs that could impact your investment decision.

- Our free Sodexo research report provides a comprehensive fundamental analysis summarized in a single visual - the Snowflake - making it easy to evaluate Sodexo's overall financial health at a glance.

Contemplating Other Strategies?

The market won't wait. These fast-moving stocks are hot now. Grab the list before they run:

- We've found 15 US stocks that are forecast to pay a dividend yield of over 6% next year. See the full list for free.

- This technology could replace computers: discover 28 stocks that are working to make quantum computing a reality.

- Trump has pledged to "unleash" American oil and gas and these 22 US stocks have developments that are poised to benefit.

This article by Simply Wall St is general in nature. We provide commentary based on historical data and analyst forecasts only using an unbiased methodology and our articles are not intended to be financial advice. It does not constitute a recommendation to buy or sell any stock, and does not take account of your objectives, or your financial situation. We aim to bring you long-term focused analysis driven by fundamental data. Note that our analysis may not factor in the latest price-sensitive company announcements or qualitative material. Simply Wall St has no position in any stocks mentioned.

New: Manage All Your Stock Portfolios in One Place

We've created the ultimate portfolio companion for stock investors, and it's free.

• Connect an unlimited number of Portfolios and see your total in one currency

• Be alerted to new Warning Signs or Risks via email or mobile

• Track the Fair Value of your stocks

Have feedback on this article? Concerned about the content? Get in touch with us directly. Alternatively, email editorial-team@simplywallst.com

About ENXTPA:SW

Sodexo

Provides food services and facilities management services in North America, Europe, and internationally.

Very undervalued with excellent balance sheet and pays a dividend.

Similar Companies

Market Insights

Weekly Picks

Crazy Undervalued 42 Baggers Silver Play (Active & Running Mine)

Fiducian: Compliance Clouds or Value Opportunity?

Willamette Valley Vineyards (WVVI): Not-So-Great Value

Recently Updated Narratives

The "Molecular Pencil": Why Beam's Technology is Built to Win

ADNOC Gas future shines with a 21.4% revenue surge

Watch Pulse Seismic Outperform with 13.6% Revenue Growth in the Coming Years

Popular Narratives

MicroVision will explode future revenue by 380.37% with a vision towards success

NVDA: Expanding AI Demand Will Drive Major Data Center Investments Through 2026