- France

- /

- Hospitality

- /

- ENXTPA:BAIN

Société Anonyme des Bains de Mer et du Cercle des Étrangers à Monaco's (EPA:BAIN) Shares May Have Run Too Fast Too Soon

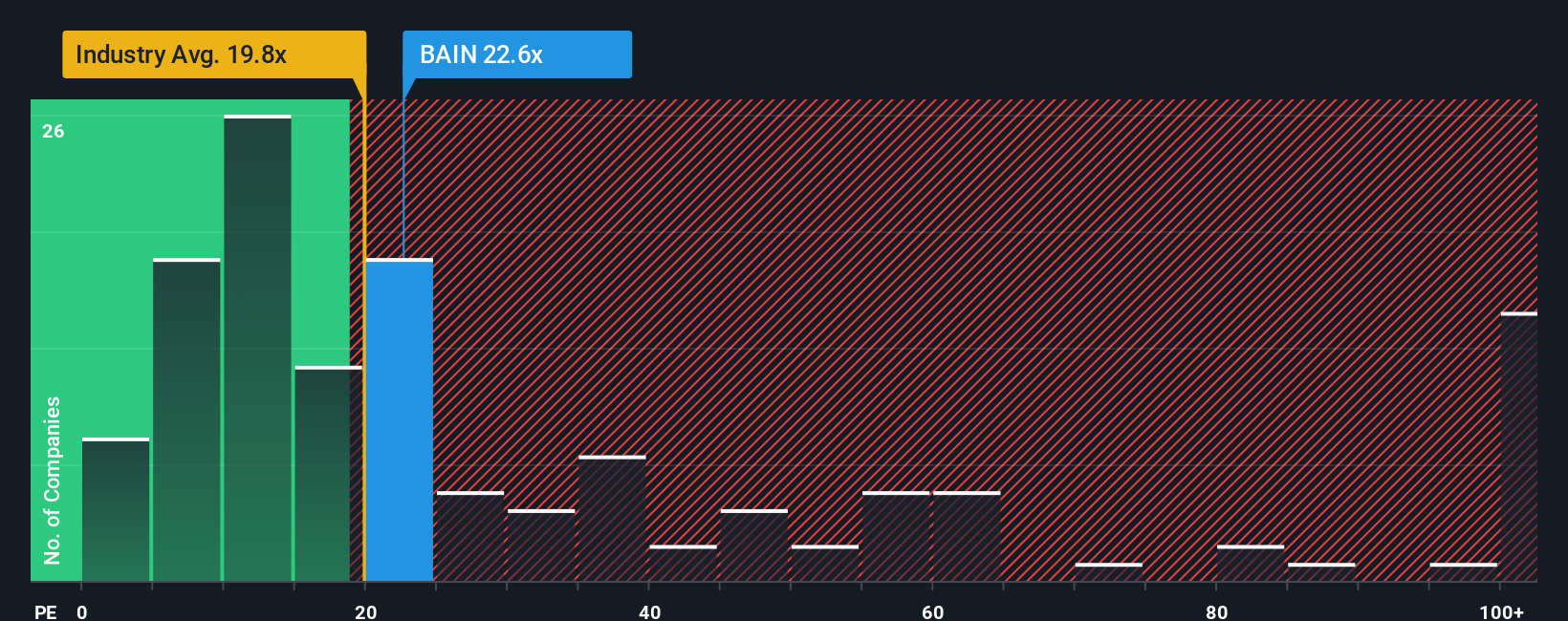

Société Anonyme des Bains de Mer et du Cercle des Étrangers à Monaco's (EPA:BAIN) price-to-earnings (or "P/E") ratio of 22.6x might make it look like a sell right now compared to the market in France, where around half of the companies have P/E ratios below 16x and even P/E's below 10x are quite common. However, the P/E might be high for a reason and it requires further investigation to determine if it's justified.

The recent earnings growth at Société Anonyme des Bains de Mer et du Cercle des Étrangers à Monaco would have to be considered satisfactory if not spectacular. One possibility is that the P/E is high because investors think this good earnings growth will be enough to outperform the broader market in the near future. You'd really hope so, otherwise you're paying a pretty hefty price for no particular reason.

View our latest analysis for Société Anonyme des Bains de Mer et du Cercle des Étrangers à Monaco

How Is Société Anonyme des Bains de Mer et du Cercle des Étrangers à Monaco's Growth Trending?

The only time you'd be truly comfortable seeing a P/E as high as Société Anonyme des Bains de Mer et du Cercle des Étrangers à Monaco's is when the company's growth is on track to outshine the market.

Taking a look back first, we see that the company managed to grow earnings per share by a handy 6.0% last year. Pleasingly, EPS has also lifted 44% in aggregate from three years ago, partly thanks to the last 12 months of growth. Therefore, it's fair to say the earnings growth recently has been superb for the company.

It's interesting to note that the rest of the market is similarly expected to grow by 15% over the next year, which is fairly even with the company's recent medium-term annualised growth rates.

In light of this, it's curious that Société Anonyme des Bains de Mer et du Cercle des Étrangers à Monaco's P/E sits above the majority of other companies. Apparently many investors in the company are more bullish than recent times would indicate and aren't willing to let go of their stock right now. Although, additional gains will be difficult to achieve as a continuation of recent earnings trends would weigh down the share price eventually.

The Final Word

Generally, our preference is to limit the use of the price-to-earnings ratio to establishing what the market thinks about the overall health of a company.

Our examination of Société Anonyme des Bains de Mer et du Cercle des Étrangers à Monaco revealed its three-year earnings trends aren't impacting its high P/E as much as we would have predicted, given they look similar to current market expectations. Right now we are uncomfortable with the high P/E as this earnings performance isn't likely to support such positive sentiment for long. Unless the recent medium-term conditions improve, it's challenging to accept these prices as being reasonable.

Many other vital risk factors can be found on the company's balance sheet. You can assess many of the main risks through our free balance sheet analysis for Société Anonyme des Bains de Mer et du Cercle des Étrangers à Monaco with six simple checks.

If P/E ratios interest you, you may wish to see this free collection of other companies with strong earnings growth and low P/E ratios.

New: Manage All Your Stock Portfolios in One Place

We've created the ultimate portfolio companion for stock investors, and it's free.

• Connect an unlimited number of Portfolios and see your total in one currency

• Be alerted to new Warning Signs or Risks via email or mobile

• Track the Fair Value of your stocks

Have feedback on this article? Concerned about the content? Get in touch with us directly. Alternatively, email editorial-team (at) simplywallst.com.

This article by Simply Wall St is general in nature. We provide commentary based on historical data and analyst forecasts only using an unbiased methodology and our articles are not intended to be financial advice. It does not constitute a recommendation to buy or sell any stock, and does not take account of your objectives, or your financial situation. We aim to bring you long-term focused analysis driven by fundamental data. Note that our analysis may not factor in the latest price-sensitive company announcements or qualitative material. Simply Wall St has no position in any stocks mentioned.

About ENXTPA:BAIN

Société Anonyme des Bains de Mer et du Cercle des Étrangers à Monaco

Operates in the gaming, hotels, and rental sectors in Monaco.

Flawless balance sheet with acceptable track record.

Market Insights

Community Narratives