LVMH (ENXTPA:MC): Examining Valuation as Interim Dividend Announcement Draws Investor Focus

Reviewed by Simply Wall St

LVMH Moët Hennessy Louis Vuitton Société Européenne (ENXTPA:MC) just confirmed an interim dividend of €5.50 per share, set for payment on December 4, 2025. Key dates surrounding this dividend are now top of mind for investors.

See our latest analysis for LVMH Moët Hennessy - Louis Vuitton Société Européenne.

LVMH’s announcement of a fresh interim dividend comes as momentum builds in its shares. This is highlighted by a strong 25% share price return over the past 90 days and an 8.6% total shareholder return for the last year. While the luxury leader’s recent performance points to renewed optimism among investors, longer-term returns still outpace the broader sector by a healthy margin.

If LVMH’s robust rebound has you rethinking your portfolio, now’s the perfect moment to discover fast growing stocks with high insider ownership

Yet with shares rebounding sharply, investors are left to wonder if the market is undervaluing LVMH, or if expectations for future growth have already been fully priced in, leaving limited room for upside.

Most Popular Narrative: 4.9% Overvalued

With the narrative’s fair value at €612.40 and LVMH’s last close at €642.70, the stock is trading above analyst consensus estimates. This puts investor focus on the projections and catalysts in the most widely followed view.

Continued investment in product innovation and portfolio diversification, including launches like Louis Vuitton beauty, new creative leadership at major brands, and luxury hospitality expansions, supports long-term growth and margin resilience by reinforcing brand desirability and tapping into the rising demand for luxury as a lifestyle among younger, affluent consumers.

Want to decode the drivers behind this premium valuation? It centers on ambitious growth assumptions and a strategic shift that could redefine profit margins and market reach. What financial wildcards are embedded in the narrative’s baseline? Only a deeper read reveals the full picture behind these bold numbers.

Result: Fair Value of €612.40 (OVERVALUED)

Have a read of the narrative in full and understand what's behind the forecasts.

However, continued weakness in Asian demand or persistent cost inflation could quickly challenge these optimistic projections for LVMH’s turnaround.

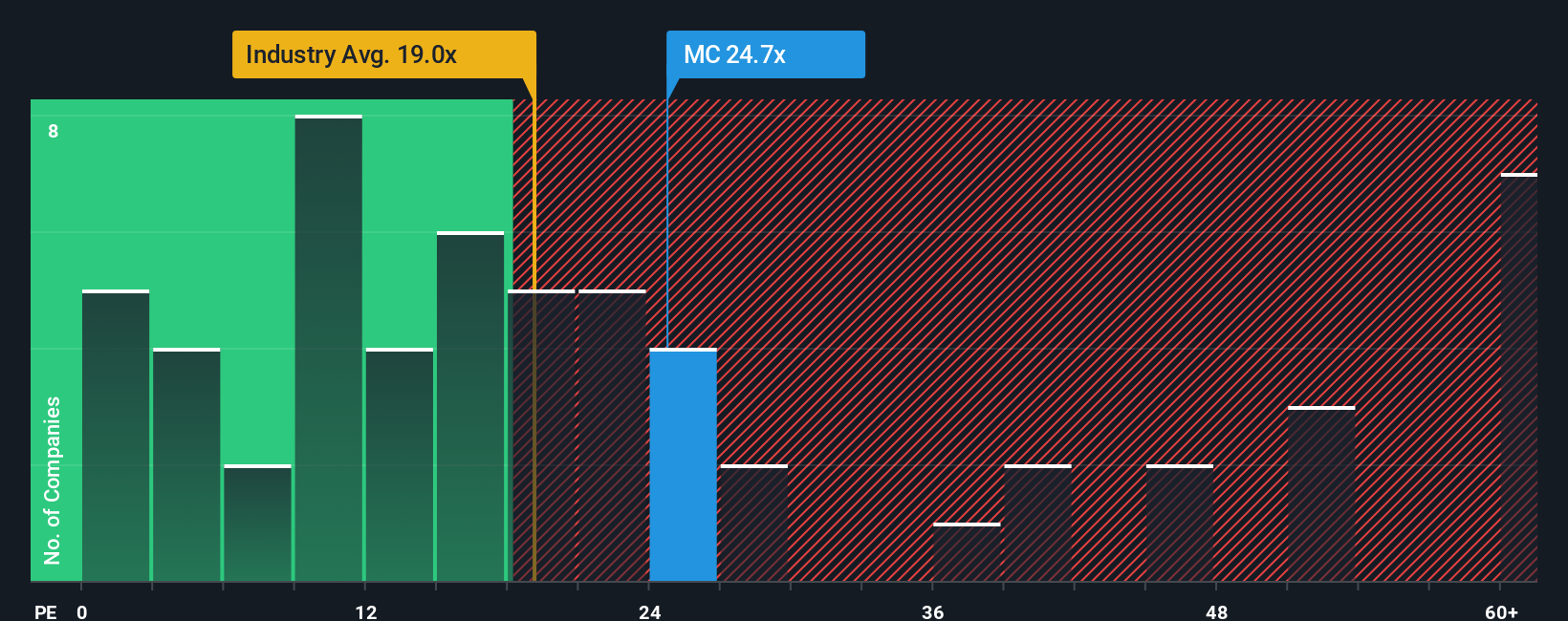

Another View: Market Ratios Paint a Different Picture

Looking through the lens of earnings-based market ratios, LVMH trades at 29.1 times earnings. That is well above the European luxury average of 20.6 times but just under its own fair ratio of 30.9 times. This suggests the market is pricing in a sizeable premium, but not necessarily excess. Does this premium reflect lasting brand leadership, or are investors downplaying future risks?

See what the numbers say about this price — find out in our valuation breakdown.

Build Your Own LVMH Moët Hennessy - Louis Vuitton Société Européenne Narrative

If you see the numbers differently or want your own angle on LVMH’s story, you can dive in and craft your perspective in just a few minutes. Do it your way

A great starting point for your LVMH Moët Hennessy - Louis Vuitton Société Européenne research is our analysis highlighting 1 key reward and 1 important warning sign that could impact your investment decision.

Looking for More Investment Ideas?

Smart investors are always searching for the next opportunity before it becomes obvious. Don’t let lucrative frontiers or overlooked gems slip past. Use these handpicked screens to get ahead:

- Capitalize on the race for secure, scalable financial networks by using these 81 cryptocurrency and blockchain stocks, shaping blockchain innovation and new digital payment landscapes.

- Unlock steady income streams with these 14 dividend stocks with yields > 3%, featuring proven companies offering yields above 3% to strengthen your portfolio’s resilience.

- Tap into tomorrow’s medicine with these 30 healthcare AI stocks as AI-driven advances revolutionize patient care and biotech breakthroughs.

This article by Simply Wall St is general in nature. We provide commentary based on historical data and analyst forecasts only using an unbiased methodology and our articles are not intended to be financial advice. It does not constitute a recommendation to buy or sell any stock, and does not take account of your objectives, or your financial situation. We aim to bring you long-term focused analysis driven by fundamental data. Note that our analysis may not factor in the latest price-sensitive company announcements or qualitative material. Simply Wall St has no position in any stocks mentioned.

New: AI Stock Screener & Alerts

Our new AI Stock Screener scans the market every day to uncover opportunities.

• Dividend Powerhouses (3%+ Yield)

• Undervalued Small Caps with Insider Buying

• High growth Tech and AI Companies

Or build your own from over 50 metrics.

Have feedback on this article? Concerned about the content? Get in touch with us directly. Alternatively, email editorial-team@simplywallst.com

About ENXTPA:MC

LVMH Moët Hennessy - Louis Vuitton Société Européenne

Operates as a luxury goods company worldwide.

Flawless balance sheet average dividend payer.

Market Insights

Weekly Picks

Solutions by stc: 34% Upside in Saudi's Digital Transformation Leader

The AI Infrastructure Giant Grows Into Its Valuation

Recently Updated Narratives

The Hidden Gem of AI Hardware – Solving the Data Center Bottleneck

Moving from "Science Fiction" to "Science Fact" – A Bullish Valuation Case

Perdana Petroleum Berhad is a Zombie Business with a 27.34% Profit Margin and inflation adjusted revenue Business

Popular Narratives

MicroVision will explode future revenue by 380.37% with a vision towards success

NVDA: Expanding AI Demand Will Drive Major Data Center Investments Through 2026