Is Kering’s Rebound Justified After 2025 L’Oréal Beauty Deal and High Valuation Metrics?

Reviewed by Bailey Pemberton

- If you are wondering whether Kering’s recent rebound makes it a bargain or a value trap, you are not alone. This article is here to unpack exactly that.

- The share price has climbed 25.3% year to date and 27.9% over the last year, but that bounce comes after a tough multi year stretch where the stock is still down 37.8% over three years and 41.2% over five.

- Recent moves have been driven largely by shifting sentiment around the luxury sector, with investors weighing slowing demand in key markets against Kering’s strategic brand repositioning and management changes. The modest 0.9% gain over the last week and slight 2.4% pullback over the past month suggest the market is still trying to decide whether the turnaround narrative really sticks.

- Despite all that noise, Kering currently scores just 0 out of 6 on our undervaluation checks. We will walk through what different valuation methods say about the stock today and then finish with a more nuanced way of thinking about its true worth.

Kering scores just 0/6 on our valuation checks. See what other red flags we found in the full valuation breakdown.

Approach 1: Kering Discounted Cash Flow (DCF) Analysis

A Discounted Cash Flow, or DCF, model estimates what a business is worth today by projecting its future cash flows and discounting them back to their present value. For Kering, the model used is a 2 stage Free Cash Flow to Equity approach built on cash flow projections in €.

Kering generated roughly €1.70 billion in free cash flow over the last twelve months, and analysts expect this to rise steadily over the coming years. For example, projections climb from about €1.79 billion in 2026 to around €2.55 billion by 2029, with later years extrapolated by Simply Wall St to reach roughly €3.48 billion by 2035.

When all of these projected cash flows are discounted back to today, the DCF model arrives at an intrinsic value of about €283.49 per share. That is roughly 4.2% above the current share price, suggesting that Kering is priced close to this estimate of intrinsic value and that the market valuation is broadly in line with the model.

Result: ABOUT RIGHT

Kering is fairly valued according to our Discounted Cash Flow (DCF), but this can change at a moment's notice. Track the value in your watchlist or portfolio and be alerted on when to act.

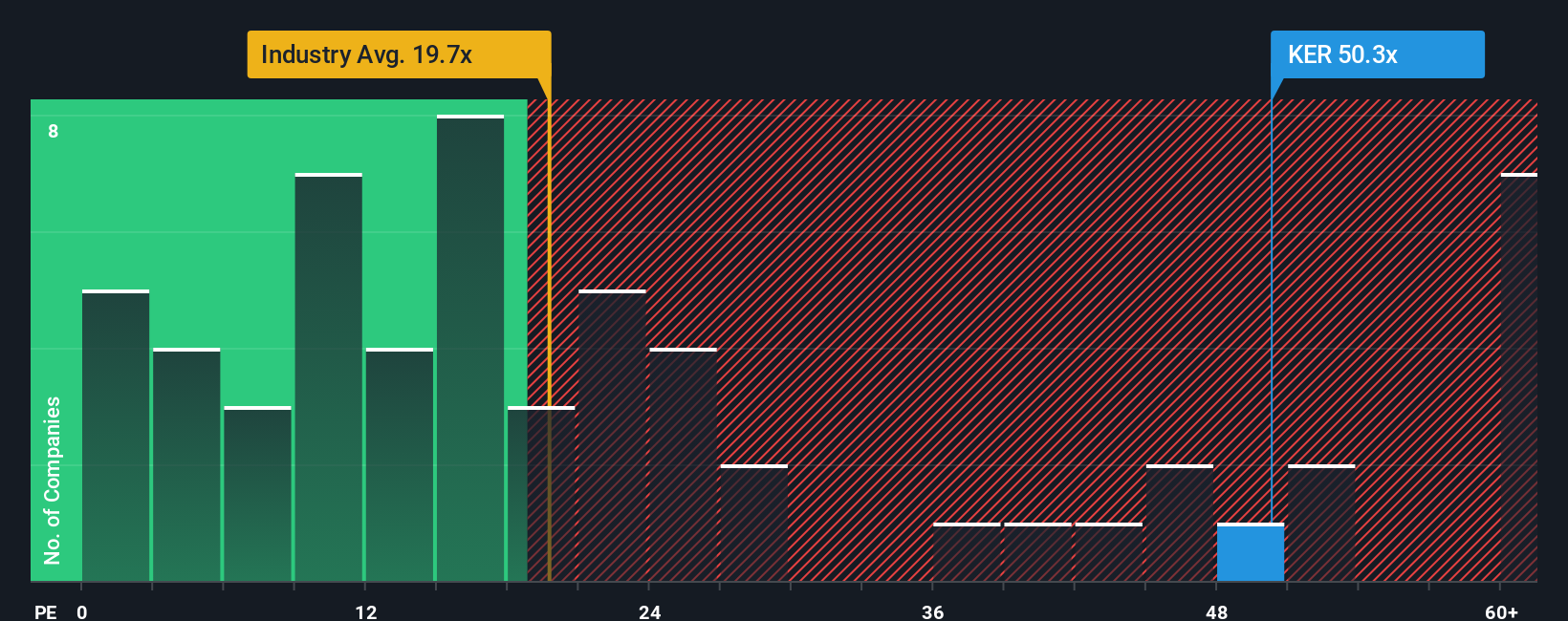

Approach 2: Kering Price vs Earnings

For a profitable business like Kering, the price to earnings, or PE, ratio is a useful way to gauge how much investors are willing to pay for each euro of current earnings. In general, companies with stronger growth prospects and lower perceived risk deserve a higher PE multiple, while slower growth or greater uncertainty usually justifies a lower one.

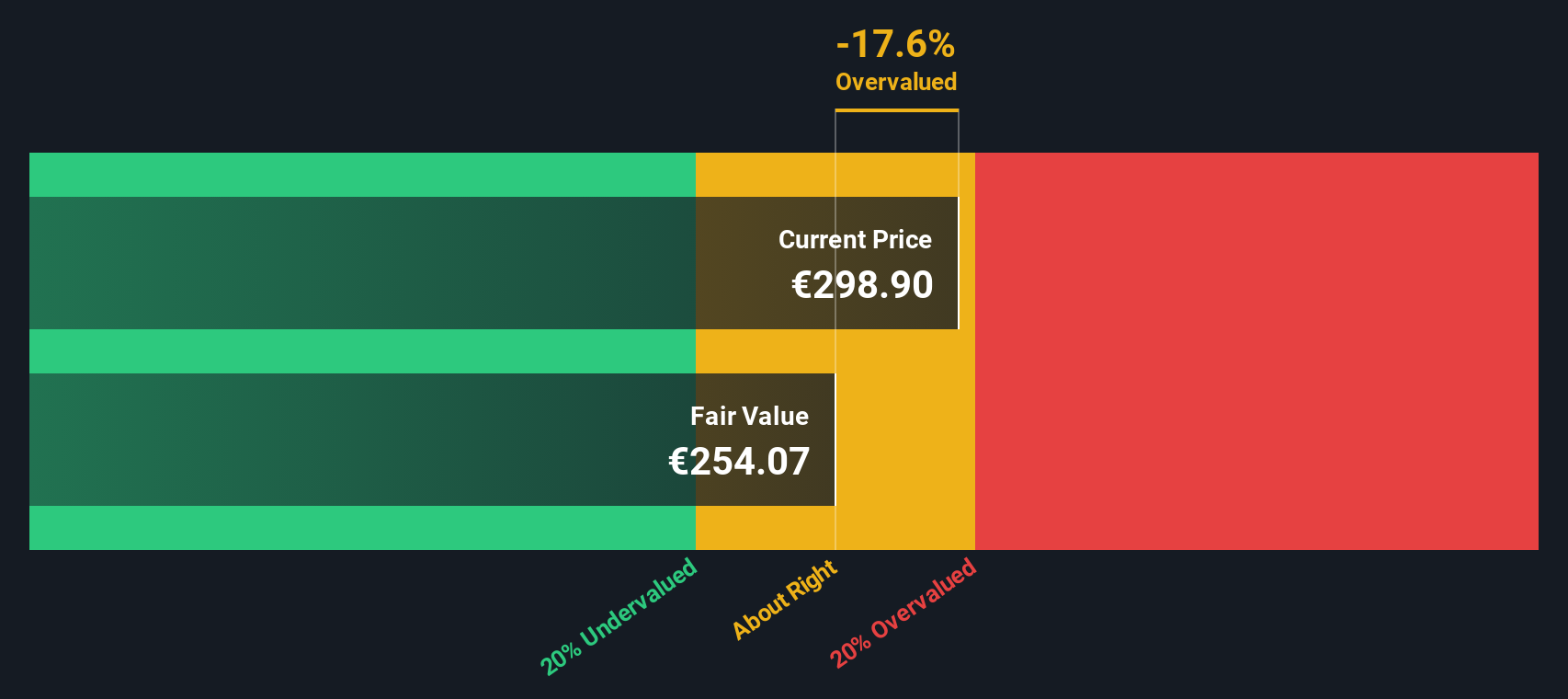

Kering currently trades on a PE of about 49.7x, which is much richer than both the broader Luxury industry average of around 17.8x and the peer group average of roughly 31.9x. To move beyond these blunt comparisons, Simply Wall St uses a proprietary Fair Ratio, which estimates what PE you would reasonably expect for Kering given its earnings growth outlook, profitability, industry, size and risk profile. For Kering, this Fair PE Ratio is about 32.9x.

Because the Fair Ratio builds in more company specific factors, it offers a more nuanced benchmark than just looking at sector or peer averages. Comparing Kering’s current 49.7x PE to the 32.9x Fair Ratio suggests the stock is trading materially above what its fundamentals justify.

Result: OVERVALUED

PE ratios tell one story, but what if the real opportunity lies elsewhere? Discover 1442 companies where insiders are betting big on explosive growth.

Upgrade Your Decision Making: Choose your Kering Narrative

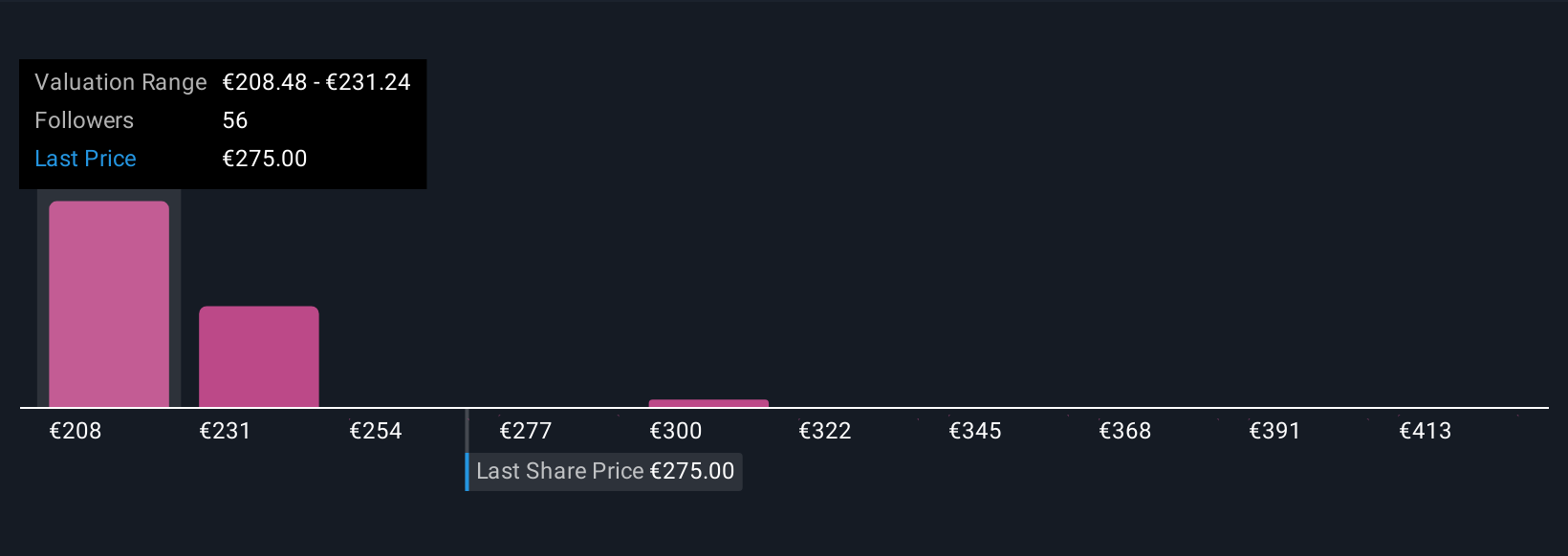

Earlier we mentioned that there is an even better way to understand valuation, so let us introduce you to Narratives, a simple way to connect your view of Kering’s story with a concrete financial forecast and a Fair Value that you can compare to today’s share price.

On Simply Wall St’s Community page, Narratives let you spell out your assumptions about future revenue, earnings and margins, then translate those into a forecast and a Fair Value estimate that automatically updates when new information, such as earnings results or major news like the L’Oréal beauty deal, comes in.

This makes it easy to see, at a glance, whether your Fair Value is above or below Kering’s current share price. It also helps you assess whether your Narrative points toward buying, holding or selling, rather than relying only on static metrics like the PE ratio.

For example, one Kering Narrative on the platform might lean bullish, assuming that store optimization, digital expansion and stronger margins justify a Fair Value close to €360 per share. A more cautious Narrative, focused on slower luxury growth, brand risks and the impact of beauty licensing changes, could land nearer €135. Your own view can sit anywhere along that spectrum.

Do you think there's more to the story for Kering? Head over to our Community to see what others are saying!

This article by Simply Wall St is general in nature. We provide commentary based on historical data and analyst forecasts only using an unbiased methodology and our articles are not intended to be financial advice. It does not constitute a recommendation to buy or sell any stock, and does not take account of your objectives, or your financial situation. We aim to bring you long-term focused analysis driven by fundamental data. Note that our analysis may not factor in the latest price-sensitive company announcements or qualitative material. Simply Wall St has no position in any stocks mentioned.

Valuation is complex, but we're here to simplify it.

Discover if Kering might be undervalued or overvalued with our detailed analysis, featuring fair value estimates, potential risks, dividends, insider trades, and its financial condition.

Access Free AnalysisHave feedback on this article? Concerned about the content? Get in touch with us directly. Alternatively, email editorial-team@simplywallst.com

About ENXTPA:KER

Kering

Manages the development of a collection of renowned houses in fashion, leather goods, and jewelry in the Asia Pacific, Western Europe, North America, Japan, and internationally.

Average dividend payer with moderate growth potential.

Market Insights

Weekly Picks

Crazy Undervalued 42 Baggers Silver Play (Active & Running Mine)

Fiducian: Compliance Clouds or Value Opportunity?

Willamette Valley Vineyards (WVVI): Not-So-Great Value

Recently Updated Narratives

Watch Pulse Seismic Outperform with 13.6% Revenue Growth in the Coming Years

Significantly undervalued gold explorer in Timmins, finally getting traction

Moderation and Stabilisation: HOLD: Fair Price based on a 4-year Cycle is $12.08

Popular Narratives

MicroVision will explode future revenue by 380.37% with a vision towards success

NVDA: Expanding AI Demand Will Drive Major Data Center Investments Through 2026