- France

- /

- Commercial Services

- /

- ENXTPA:ELIS

Elis (ENXTPA:ELIS): Exploring Valuation as Investors Notice Shifts in Share Momentum

Reviewed by Simply Wall St

Most Popular Narrative: 15.1% Undervalued

According to the most widely followed narrative, Elis is currently trading at a significant discount to what analysts consider its fair value. The narrative is based on expectations of both continued earnings growth and a willingness among investors to pay a premium for Elis’s future profitability.

"Persistent outsourcing momentum across healthcare, workwear, and cleanroom segments, supported by stricter hygiene requirements and regulations, continues to drive new contract wins and organic revenue growth. This aligns Elis with high-visibility, recurring revenue streams. Rising client and regulatory focus on sustainability and the circular economy is enabling Elis to leverage its expertise in closed-loop textile management and demonstrable decarbonisation initiatives. This is evidenced by improved ESG scores and tangible client engagement, which should support pricing power and margin expansion."

Looking for the logic behind this bullish valuation? The analyst consensus is built on assumptions about sustained expansion, stronger margins, and a profit multiple that exceeds the industry standard. Curious about what makes Elis’s future earnings so valuable in their eyes and what critical levers drive their price target? The full narrative reveals the bold projections and strategic bets pushing this fair value far above today’s price.

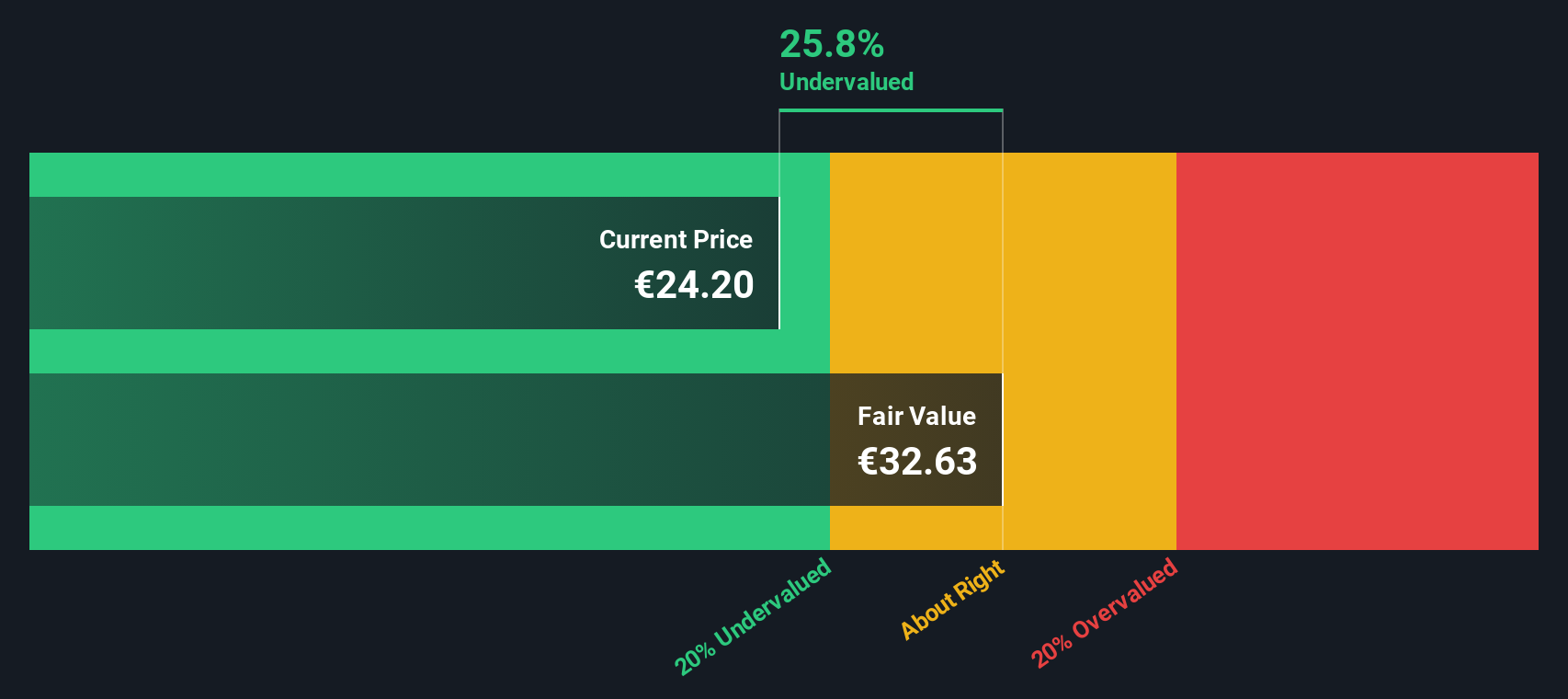

Result: Fair Value of €27.53 (UNDERVALUED)

Have a read of the narrative in full and understand what's behind the forecasts.However, persistent margin pressure in key growth regions or heightened currency volatility could quickly challenge these optimistic projections and undermine Elis’s long-term outlook.

Find out about the key risks to this Elis narrative.Another View: Discounted Cash Flow

Taking a different approach, our SWS DCF model also suggests Elis is undervalued based on the company’s future cash flows rather than market multiples. However, it remains to be seen whether cash flow forecasts will hold steady as conditions change.

Look into how the SWS DCF model arrives at its fair value.

Build Your Own Elis Narrative

If you have your own perspective or prefer hands-on analysis, you can easily develop your own Elis narrative and challenge the consensus in just a few minutes. Do it your way

A great starting point for your Elis research is our analysis highlighting 4 key rewards and 1 important warning sign that could impact your investment decision.

Ready for More Intelligent Investment Opportunities?

Don’t let your search for standout stocks stop here. The Simply Wall Street Screener surfaces handpicked investment ideas you might be missing. Broaden your horizon, spark new strategies, and gain an edge that others overlook.

- Spot companies delivering reliable cash flows and strong fundamentals that are flying under the radar with our handpicked list of undervalued stocks based on cash flows.

- Uncover tech trailblazers at the forefront of artificial intelligence by starting your search among the most promising future-shaping businesses through our exclusive AI penny stocks.

- Capture income potential by targeting high-yield businesses making consistent payouts. Find your next portfolio stalwart via our select rundown of dividend stocks with yields > 3%.

This article by Simply Wall St is general in nature. We provide commentary based on historical data and analyst forecasts only using an unbiased methodology and our articles are not intended to be financial advice. It does not constitute a recommendation to buy or sell any stock, and does not take account of your objectives, or your financial situation. We aim to bring you long-term focused analysis driven by fundamental data. Note that our analysis may not factor in the latest price-sensitive company announcements or qualitative material. Simply Wall St has no position in any stocks mentioned.

Valuation is complex, but we're here to simplify it.

Discover if Elis might be undervalued or overvalued with our detailed analysis, featuring fair value estimates, potential risks, dividends, insider trades, and its financial condition.

Access Free AnalysisHave feedback on this article? Concerned about the content? Get in touch with us directly. Alternatively, email editorial-team@simplywallst.com

Kshitija Bhandaru

Kshitija (or Keisha) Bhandaru is an Equity Analyst at Simply Wall St and has over 6 years of experience in the finance industry and describes herself as a lifelong learner driven by her intellectual curiosity. She previously worked with Market Realist for 5 years as an Equity Analyst.

About ENXTPA:ELIS

Elis

Engages in the provision of flat linen, workwear, and hygiene and well-being solutions in France, Central Europe, Scandinavia, Eastern Europe, the United Kingdom, Ireland, Latin America, Southern Europe, and internationally.

Solid track record and fair value.

Similar Companies

Market Insights

Community Narratives