- France

- /

- Electrical

- /

- ENXTPA:SU

What Schneider Electric (ENXTPA:SU)'s New Tennessee Manufacturing Hub Means for Shareholders

Reviewed by Sasha Jovanovic

- Schneider Electric recently completed the first phase of its major manufacturing campus expansion in Mt. Juliet, Tennessee, launching a 500,000+ square foot facility to produce custom power distribution products for sectors including data centers and infrastructure.

- This expansion not only boosts Schneider Electric's U.S. production capacity and supply chain resilience, but also reinforces workforce growth through dedicated veteran hiring initiatives and recognition as a leading military-friendly employer.

- We'll explore how this increased manufacturing capacity and commitment to U.S. job creation could impact Schneider Electric's overall investment narrative.

The end of cancer? These 29 emerging AI stocks are developing tech that will allow early identification of life changing diseases like cancer and Alzheimer's.

Schneider Electric Investment Narrative Recap

To be a Schneider Electric shareholder, you must have confidence in the company's ability to capture sustained demand for electrification, digital infrastructure, and energy reliability, particularly in sectors like data centers and critical infrastructure. The Mt. Juliet expansion directly supports Schneider’s top catalyst of robust pipeline growth for data center and infrastructure solutions, though it does not materially change the short-term margin risk tied to mix pressures and inflation; these remain the key variables to watch going forward.

Among recent announcements, the launch of SE Advisory Services stands out, as it complements the Tennessee expansion by broadening support for organizations navigating energy efficiency, decarbonization, and digital transformation. This integrated consulting approach ties to Schneider’s multi-year strategy of driving higher-margin, recurring revenues from digital and services, helping to build resilience against short-term headwinds and regional volatility.

Yet in contrast, investors should be aware that heavier investments in manufacturing and R&D, while positive for long-term growth, may temporarily pressure free cash flow and margins if...

Read the full narrative on Schneider Electric (it's free!)

Schneider Electric's outlook anticipates €48.6 billion in revenue and €6.7 billion in earnings by 2028. This scenario depends on annual revenue growth of 7.3% and an increase in earnings of €2.4 billion from €4.3 billion currently.

Uncover how Schneider Electric's forecasts yield a €264.39 fair value, a 12% upside to its current price.

Exploring Other Perspectives

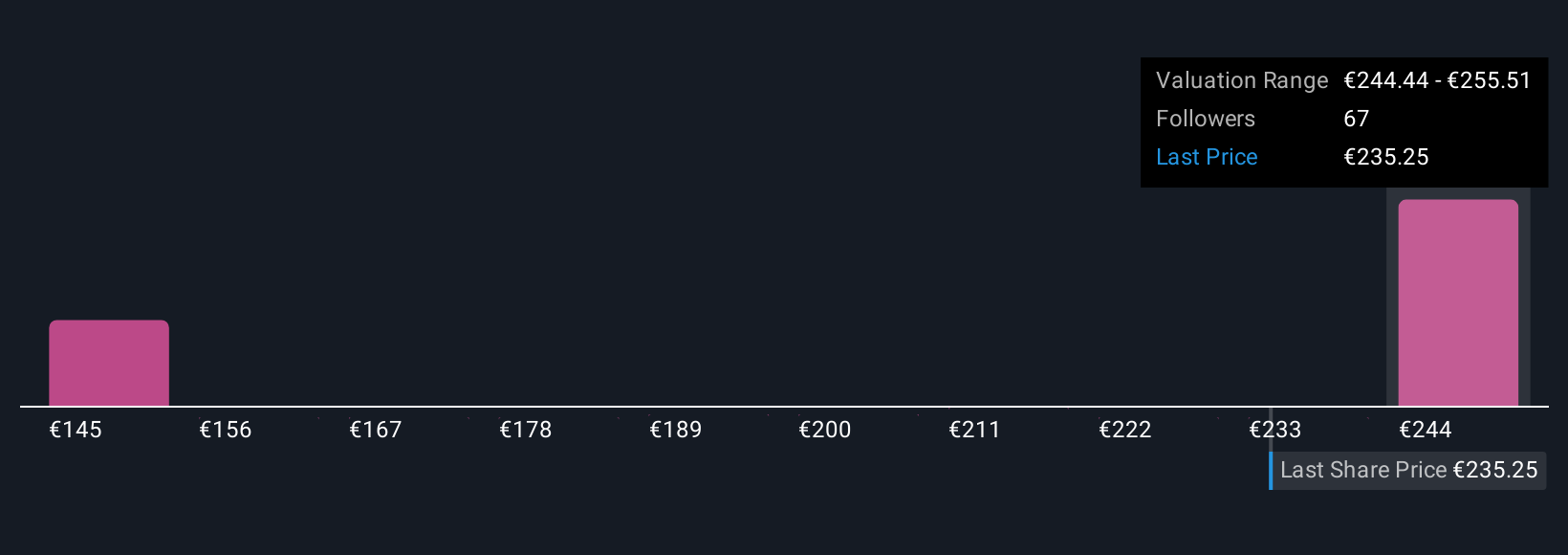

Eight members of the Simply Wall St Community estimate Schneider Electric’s fair value between €141.31 and €265.10, reflecting a wide spectrum of views. Consider how the company’s current margin headwinds might impact its near-term performance and see how your take aligns with these differing perspectives.

Explore 8 other fair value estimates on Schneider Electric - why the stock might be worth as much as 13% more than the current price!

Build Your Own Schneider Electric Narrative

Disagree with existing narratives? Create your own in under 3 minutes - extraordinary investment returns rarely come from following the herd.

- A great starting point for your Schneider Electric research is our analysis highlighting 2 key rewards and 1 important warning sign that could impact your investment decision.

- Our free Schneider Electric research report provides a comprehensive fundamental analysis summarized in a single visual - the Snowflake - making it easy to evaluate Schneider Electric's overall financial health at a glance.

Ready To Venture Into Other Investment Styles?

Our daily scans reveal stocks with breakout potential. Don't miss this chance:

- We've found 15 US stocks that are forecast to pay a dividend yield of over 6% next year. See the full list for free.

- This technology could replace computers: discover 27 stocks that are working to make quantum computing a reality.

- Uncover the next big thing with financially sound penny stocks that balance risk and reward.

This article by Simply Wall St is general in nature. We provide commentary based on historical data and analyst forecasts only using an unbiased methodology and our articles are not intended to be financial advice. It does not constitute a recommendation to buy or sell any stock, and does not take account of your objectives, or your financial situation. We aim to bring you long-term focused analysis driven by fundamental data. Note that our analysis may not factor in the latest price-sensitive company announcements or qualitative material. Simply Wall St has no position in any stocks mentioned.

New: Manage All Your Stock Portfolios in One Place

We've created the ultimate portfolio companion for stock investors, and it's free.

• Connect an unlimited number of Portfolios and see your total in one currency

• Be alerted to new Warning Signs or Risks via email or mobile

• Track the Fair Value of your stocks

Have feedback on this article? Concerned about the content? Get in touch with us directly. Alternatively, email editorial-team@simplywallst.com

About ENXTPA:SU

Schneider Electric

Engages in the energy management and industrial automation businesses worldwide.

Proven track record with adequate balance sheet and pays a dividend.

Similar Companies

Market Insights

Community Narratives