Saint-Gobain (ENXTPA:SGO) Valuation in Focus as Share Price Momentum Stalls

Reviewed by Simply Wall St

Compagnie de Saint-Gobain (ENXTPA:SGO) might not be flashing across headlines today, but its recent share price moves are still giving investors plenty to think about. With markets always scanning for signals beneath the surface, even a period without big announcements can be a cue for a closer look. When a stock quietly shifts direction without a clear catalyst, it often leaves shareholders and prospective buyers asking if the story is changing or if there are attractive value opportunities emerging.

Over the past year, Saint-Gobain’s stock is up 24%, continuing its outperformance from the longer term. However, it has cooled off in recent months. Momentum has eased, with the shares slipping 5% in the past month and about 6% over the past three months. Still, the bigger picture shows healthy annual revenue and net income growth, even if the near-term price action feels more cautious following a string of gains stretching back several years.

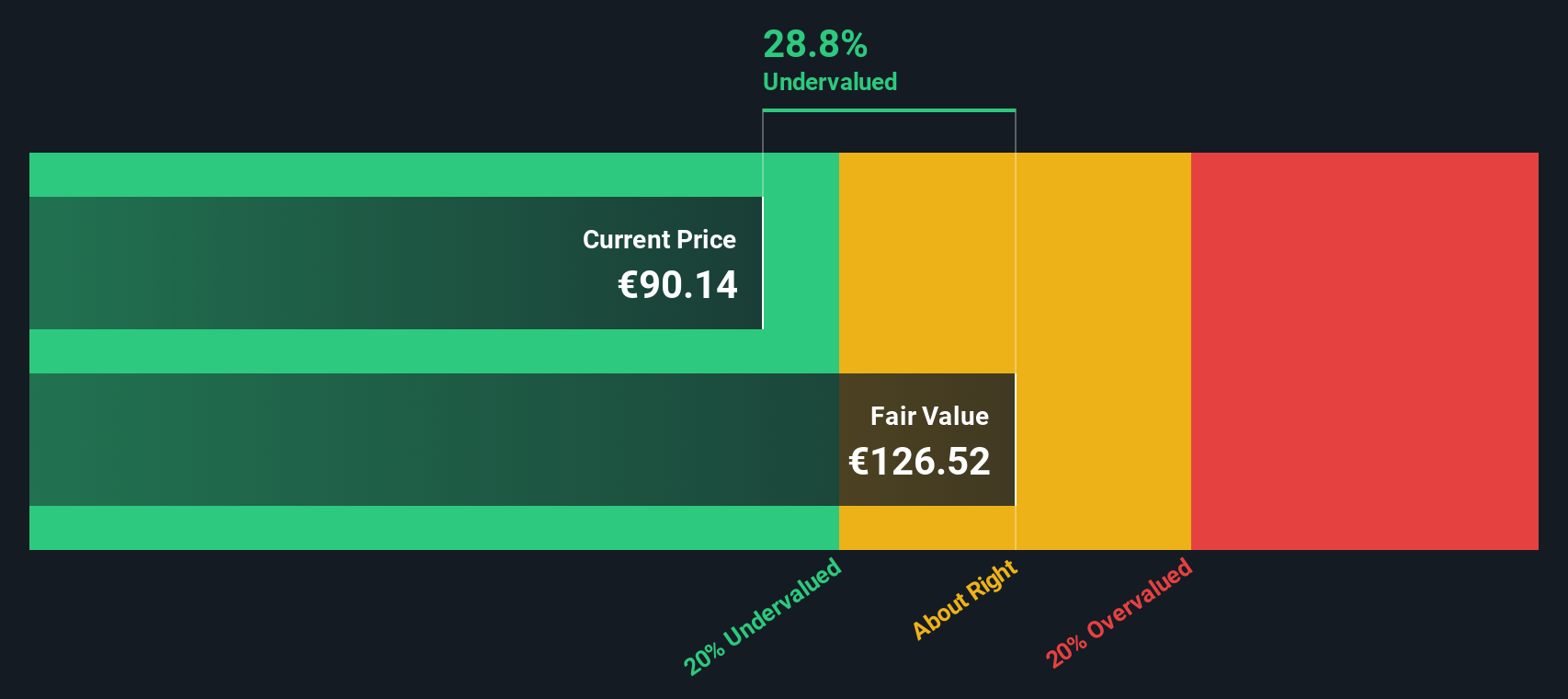

After this pause in momentum, are investors looking at an undervalued opportunity in Saint-Gobain, or is the market already factoring in everything the future holds?

Most Popular Narrative: 12.7% Undervalued

According to the most widely followed narrative on Saint-Gobain, the shares are trading below fair value and remain attractively priced compared to their projected growth profile and analyst expectations.

Rising global demand for energy-efficient, sustainable building solutions is accelerating, with governments increasing renovation stimulus and regulation (notably in Europe and North America). Saint-Gobain's leadership in insulation, glazing, and renovation positions it to outperform as new green requirements drive both volume growth and premium pricing. This supports long-term revenue and margin expansion.

There's a bold forecast built into this narrative. It hinges on big leaps in revenue and margins, plus a bet on stronger profits ahead. Want the full story revealing the quantitative backbone at the heart of this valuation? Find out which ambitious financial assumptions are fueling the expected upside in Saint-Gobain’s future share price.

Result: Fair Value of €106.52 (UNDERVALUED)

Have a read of the narrative in full and understand what's behind the forecasts.However, stricter recycling mandates or weaker European demand could dampen Saint-Gobain’s future growth and challenge the prevailing undervaluation narrative.

Find out about the key risks to this Compagnie de Saint-Gobain narrative.Another View: Cash Flows Tell the Story

Looking at our SWS DCF model, the numbers also suggest the shares could be undervalued. This backs up the earlier analysis in a different way. But are both approaches missing something in the current market?

Look into how the SWS DCF model arrives at its fair value.

Build Your Own Compagnie de Saint-Gobain Narrative

If you want to dig deeper or see things differently, you can quickly build your own view of Saint-Gobain’s story and test your perspective. Do it your way

A great starting point for your Compagnie de Saint-Gobain research is our analysis highlighting 3 key rewards and 2 important warning signs that could impact your investment decision.

Looking for More Smart Investment Ideas?

Don’t miss your chance to seize unique opportunities. Screen for strong growth, untapped value, or reliable returns that align with your portfolio goals today.

- Maximize your income potential by checking out dividend stocks with yields over 3 percent using the dividend stocks with yields > 3%. This approach is ideal if you want steady, proven cash flows in your investments.

- Capture tomorrow’s technology winners by checking for breakthrough businesses advancing quantum computing. Kickstart your search with the quantum computing stocks and get ahead of the crowd.

- Spot high-potential companies trading below their worth by tapping into undervalued stocks based on cash flows. This can give you the edge on overlooked value before the market catches on.

This article by Simply Wall St is general in nature. We provide commentary based on historical data and analyst forecasts only using an unbiased methodology and our articles are not intended to be financial advice. It does not constitute a recommendation to buy or sell any stock, and does not take account of your objectives, or your financial situation. We aim to bring you long-term focused analysis driven by fundamental data. Note that our analysis may not factor in the latest price-sensitive company announcements or qualitative material. Simply Wall St has no position in any stocks mentioned.

New: AI Stock Screener & Alerts

Our new AI Stock Screener scans the market every day to uncover opportunities.

• Dividend Powerhouses (3%+ Yield)

• Undervalued Small Caps with Insider Buying

• High growth Tech and AI Companies

Or build your own from over 50 metrics.

Have feedback on this article? Concerned about the content? Get in touch with us directly. Alternatively, email editorial-team@simplywallst.com

Kshitija Bhandaru

Kshitija (or Keisha) Bhandaru is an Equity Analyst at Simply Wall St and has over 6 years of experience in the finance industry and describes herself as a lifelong learner driven by her intellectual curiosity. She previously worked with Market Realist for 5 years as an Equity Analyst.

About ENXTPA:SGO

Compagnie de Saint-Gobain

Designs, manufactures, and distributes materials and solutions for the construction and industrial markets worldwide.

Very undervalued with excellent balance sheet and pays a dividend.

Similar Companies

Market Insights

Community Narratives