Euronext Paris Stocks That May Be Trading Below Fair Value In September 2024

Reviewed by Simply Wall St

As global markets react to the U.S. Federal Reserve's recent rate cut, European indices have shown mixed results, with France's CAC 40 Index experiencing a modest gain. Against this backdrop, investors are increasingly looking for opportunities in undervalued stocks that may offer strong potential for growth. Identifying such stocks involves examining companies trading below their intrinsic value, particularly those with solid fundamentals and resilience in the current economic climate.

Top 10 Undervalued Stocks Based On Cash Flows In France

| Name | Current Price | Fair Value (Est) | Discount (Est) |

| NSE (ENXTPA:ALNSE) | €30.00 | €57.49 | 47.8% |

| Vivendi (ENXTPA:VIV) | €10.185 | €18.04 | 43.5% |

| Guillemot (ENXTPA:GUI) | €5.36 | €9.01 | 40.5% |

| Lectra (ENXTPA:LSS) | €29.00 | €53.70 | 46% |

| Groupe Berkem Société anonyme (ENXTPA:ALKEM) | €3.06 | €5.11 | 40.1% |

| EKINOPS (ENXTPA:EKI) | €4.025 | €5.76 | 30.1% |

| Solutions 30 (ENXTPA:S30) | €1.39 | €2.50 | 44.5% |

| Pullup Entertainment Société anonyme (ENXTPA:ALPUL) | €21.60 | €38.72 | 44.2% |

| VusionGroup (ENXTPA:VU) | €147.50 | €257.45 | 42.7% |

| OVH Groupe (ENXTPA:OVH) | €6.115 | €8.79 | 30.4% |

We're going to check out a few of the best picks from our screener tool.

Edenred (ENXTPA:EDEN)

Overview: Edenred SE operates a digital platform offering services and payments for companies, employees, and merchants globally, with a market cap of €8.19 billion.

Operations: The company's revenue segment includes Business Services, generating €2.50 billion.

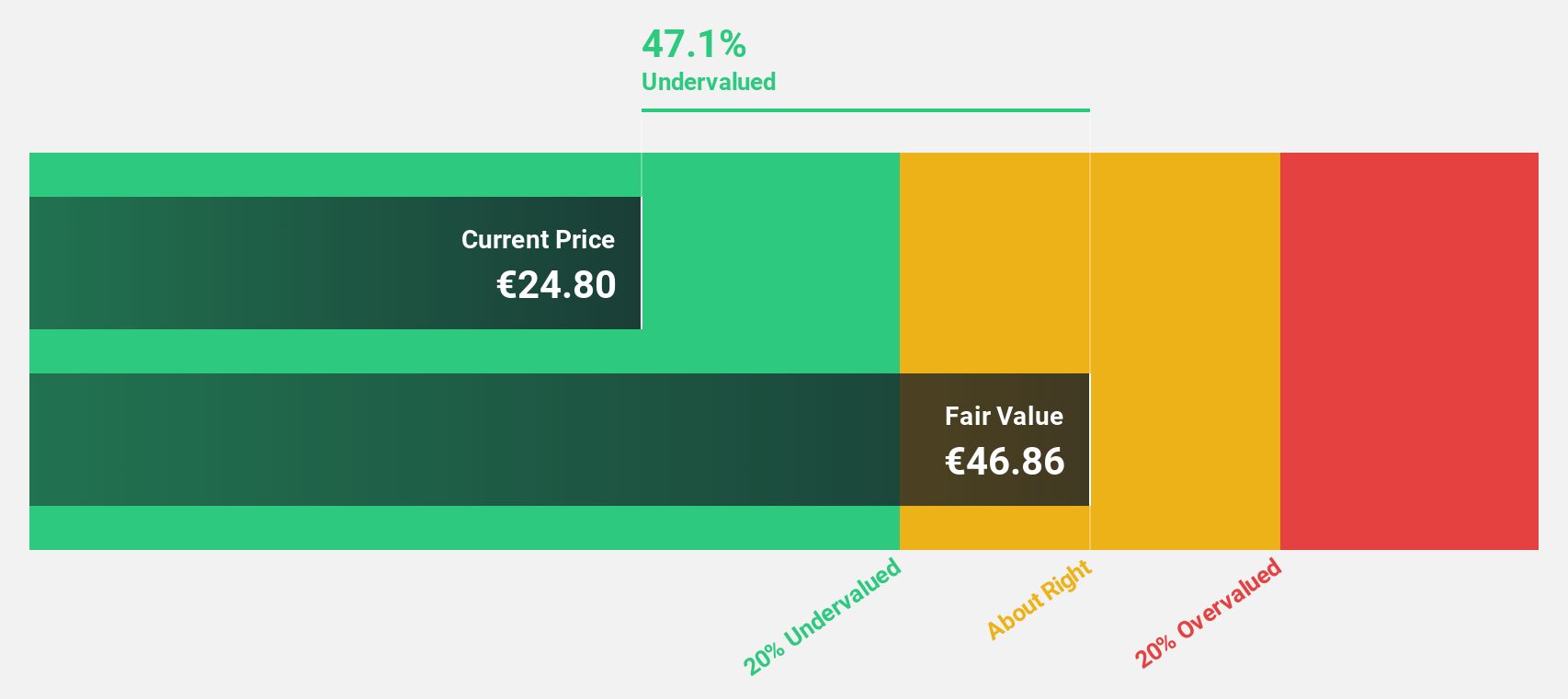

Estimated Discount To Fair Value: 17.2%

Edenred is trading 17.2% below its estimated fair value of €40.3, with a current price of €33.36. Despite a high level of debt and lower profit margins compared to last year, the company shows strong cash flow potential and robust earnings growth forecasts at 19.34% annually, outpacing the French market's 12.3%. Recent half-year results reported sales of €1.27 billion and net income of €235 million, reflecting solid financial performance amidst strategic share buybacks totaling €115 million.

- Our comprehensive growth report raises the possibility that Edenred is poised for substantial financial growth.

- Take a closer look at Edenred's balance sheet health here in our report.

Lectra (ENXTPA:LSS)

Overview: Lectra SA provides industrial intelligence solutions for the fashion, automotive, and furniture markets across Northern Europe, Southern Europe, the Americas, and the Asia Pacific with a market cap of €1.10 billion.

Operations: Revenue segments for the company include €172.65 million from the Americas and €118.54 million from the Asia-Pacific region, with a segment adjustment of €209.13 million.

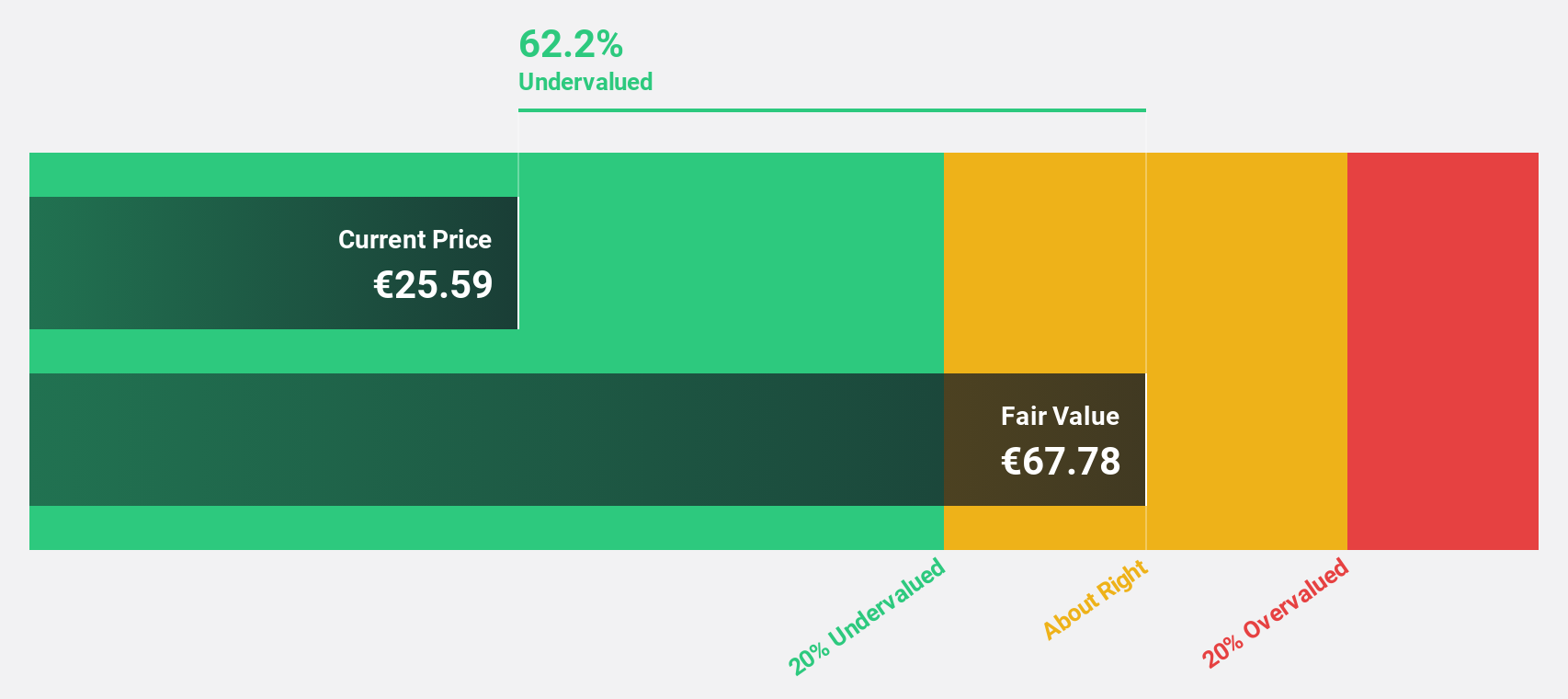

Estimated Discount To Fair Value: 46%

Lectra is trading 46% below its estimated fair value of €53.7, with a current price of €29. Despite being dropped from the S&P Global BMI Index, Lectra's earnings are forecast to grow significantly at 29.3% annually, outpacing the French market's 12.3%. However, recent half-year results showed a decline in net income to €12.51 million from €14.47 million last year, though sales increased to €262.29 million from €239.55 million.

- The growth report we've compiled suggests that Lectra's future prospects could be on the up.

- Unlock comprehensive insights into our analysis of Lectra stock in this financial health report.

Safran (ENXTPA:SAF)

Overview: Safran SA, with a market cap of €88.87 billion, operates globally in the aerospace and defense sectors through its subsidiaries.

Operations: Safran's revenue segments include Aircraft Interiors (€2.73 billion), Aerospace Propulsion (€12.66 billion), and Aeronautical Equipment, Defense and Aerosystems (€9.91 billion).

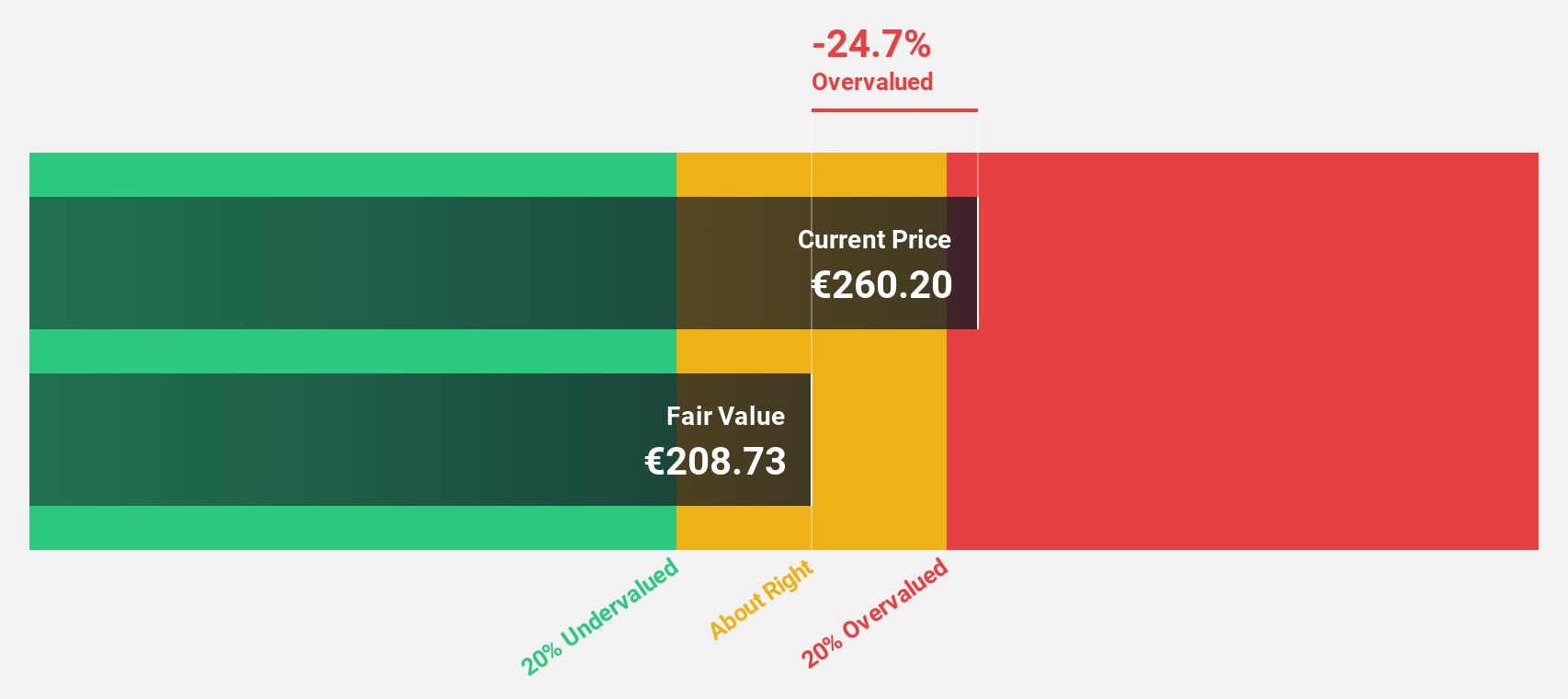

Estimated Discount To Fair Value: 25.5%

Safran SA is trading 25.5% below its estimated fair value of €283.72, with a current price of €211.4. Despite a significant drop in net income to €57 million from €1.86 billion last year, revenue increased to €13.41 billion from €11.36 billion year-over-year for H1 2024, and earnings are forecasted to grow at 20% annually over the next three years, outpacing the French market's growth rate of 12%.

- Our earnings growth report unveils the potential for significant increases in Safran's future results.

- Dive into the specifics of Safran here with our thorough financial health report.

Next Steps

- Click here to access our complete index of 19 Undervalued Euronext Paris Stocks Based On Cash Flows.

- Shareholder in one or more of these companies? Ensure you're never caught off-guard by adding your portfolio in Simply Wall St for timely alerts on significant stock developments.

- Elevate your portfolio with Simply Wall St, the ultimate app for investors seeking global market coverage.

Searching for a Fresh Perspective?

- Explore high-performing small cap companies that haven't yet garnered significant analyst attention.

- Diversify your portfolio with solid dividend payers offering reliable income streams to weather potential market turbulence.

- Fuel your portfolio with companies showing strong growth potential, backed by optimistic outlooks both from analysts and management.

This article by Simply Wall St is general in nature. We provide commentary based on historical data and analyst forecasts only using an unbiased methodology and our articles are not intended to be financial advice. It does not constitute a recommendation to buy or sell any stock, and does not take account of your objectives, or your financial situation. We aim to bring you long-term focused analysis driven by fundamental data. Note that our analysis may not factor in the latest price-sensitive company announcements or qualitative material. Simply Wall St has no position in any stocks mentioned.

New: AI Stock Screener & Alerts

Our new AI Stock Screener scans the market every day to uncover opportunities.

• Dividend Powerhouses (3%+ Yield)

• Undervalued Small Caps with Insider Buying

• High growth Tech and AI Companies

Or build your own from over 50 metrics.

Have feedback on this article? Concerned about the content? Get in touch with us directly. Alternatively, email editorial-team@simplywallst.com

About ENXTPA:LSS

Lectra

Provides industrial intelligence solutions for fashion, automotive, and furniture markets in Northern Europe, Southern Europe, the Americas, and the Asia Pacific.

Reasonable growth potential and fair value.