Manitou BF SA (EPA:MTU) shareholders won't be pleased to see that the share price has had a very rough month, dropping 33% and undoing the prior period's positive performance. The drop over the last 30 days has capped off a tough year for shareholders, with the share price down 37% in that time.

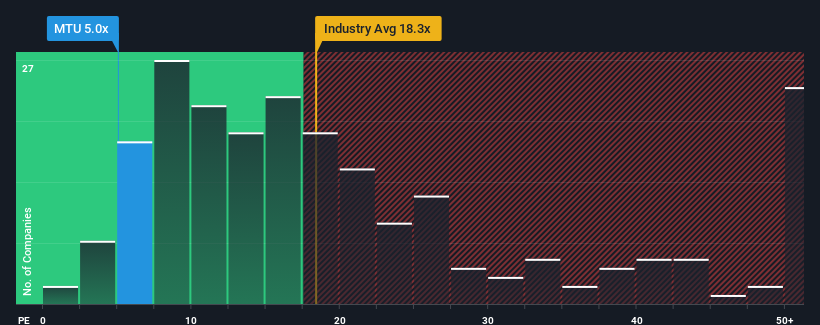

Although its price has dipped substantially, Manitou BF may still be sending very bullish signals at the moment with its price-to-earnings (or "P/E") ratio of 5x, since almost half of all companies in France have P/E ratios greater than 14x and even P/E's higher than 25x are not unusual. Nonetheless, we'd need to dig a little deeper to determine if there is a rational basis for the highly reduced P/E.

Recent times have been quite advantageous for Manitou BF as its earnings have been rising very briskly. It might be that many expect the strong earnings performance to degrade substantially, which has repressed the P/E. If you like the company, you'd be hoping this isn't the case so that you could potentially pick up some stock while it's out of favour.

View our latest analysis for Manitou BF

Is There Any Growth For Manitou BF?

In order to justify its P/E ratio, Manitou BF would need to produce anemic growth that's substantially trailing the market.

If we review the last year of earnings growth, the company posted a terrific increase of 85%. The strong recent performance means it was also able to grow EPS by 41% in total over the last three years. Accordingly, shareholders would have probably welcomed those medium-term rates of earnings growth.

It's interesting to note that the rest of the market is similarly expected to grow by 13% over the next year, which is fairly even with the company's recent medium-term annualised growth rates.

In light of this, it's peculiar that Manitou BF's P/E sits below the majority of other companies. Apparently some shareholders are more bearish than recent times would indicate and have been accepting lower selling prices.

The Bottom Line On Manitou BF's P/E

Having almost fallen off a cliff, Manitou BF's share price has pulled its P/E way down as well. It's argued the price-to-earnings ratio is an inferior measure of value within certain industries, but it can be a powerful business sentiment indicator.

Our examination of Manitou BF revealed its three-year earnings trends aren't contributing to its P/E as much as we would have predicted, given they look similar to current market expectations. When we see average earnings with market-like growth, we assume potential risks are what might be placing pressure on the P/E ratio. At least the risk of a price drop looks to be subdued if recent medium-term earnings trends continue, but investors seem to think future earnings could see some volatility.

Before you take the next step, you should know about the 3 warning signs for Manitou BF (1 can't be ignored!) that we have uncovered.

If these risks are making you reconsider your opinion on Manitou BF, explore our interactive list of high quality stocks to get an idea of what else is out there.

New: Manage All Your Stock Portfolios in One Place

We've created the ultimate portfolio companion for stock investors, and it's free.

• Connect an unlimited number of Portfolios and see your total in one currency

• Be alerted to new Warning Signs or Risks via email or mobile

• Track the Fair Value of your stocks

Have feedback on this article? Concerned about the content? Get in touch with us directly. Alternatively, email editorial-team (at) simplywallst.com.

This article by Simply Wall St is general in nature. We provide commentary based on historical data and analyst forecasts only using an unbiased methodology and our articles are not intended to be financial advice. It does not constitute a recommendation to buy or sell any stock, and does not take account of your objectives, or your financial situation. We aim to bring you long-term focused analysis driven by fundamental data. Note that our analysis may not factor in the latest price-sensitive company announcements or qualitative material. Simply Wall St has no position in any stocks mentioned.

About ENXTPA:MTU

Manitou BF

Engages in the development, manufacture, and distribution of equipment and services in France, Southern Europe, Northern Europe, the Americas, Asia, the Pacific, Africa, and the Middle East.

Very undervalued with flawless balance sheet and pays a dividend.

Similar Companies

Market Insights

Community Narratives