- France

- /

- Aerospace & Defense

- /

- ENXTPA:FII

Lisi's (EPA:FII) three-year earnings growth trails the 36% YoY shareholder returns

It might seem bad, but the worst that can happen when you buy a stock (without leverage) is that its share price goes to zero. But if you buy shares in a really great company, you can more than double your money. For instance the Lisi S.A. (EPA:FII) share price is 143% higher than it was three years ago. That sort of return is as solid as granite. Also pleasing for shareholders was the 37% gain in the last three months.

The past week has proven to be lucrative for Lisi investors, so let's see if fundamentals drove the company's three-year performance.

In his essay The Superinvestors of Graham-and-Doddsville Warren Buffett described how share prices do not always rationally reflect the value of a business. By comparing earnings per share (EPS) and share price changes over time, we can get a feel for how investor attitudes to a company have morphed over time.

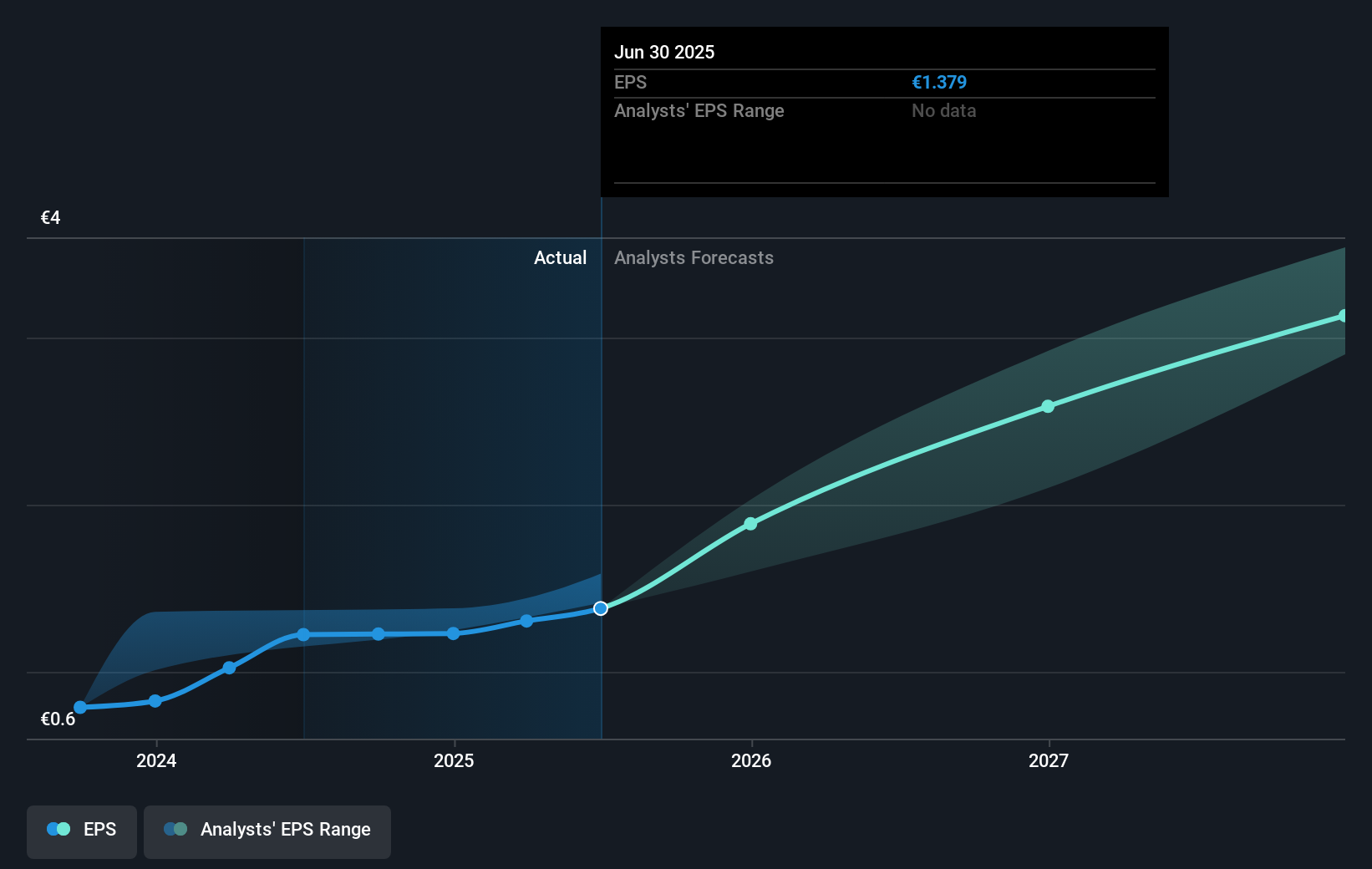

Lisi was able to grow its EPS at 15% per year over three years, sending the share price higher. This EPS growth is lower than the 35% average annual increase in the share price. This suggests that, as the business progressed over the last few years, it gained the confidence of market participants. It's not unusual to see the market 're-rate' a stock, after a few years of growth.

The image below shows how EPS has tracked over time (if you click on the image you can see greater detail).

We know that Lisi has improved its bottom line lately, but is it going to grow revenue? If you're interested, you could check this free report showing consensus revenue forecasts.

What About Dividends?

When looking at investment returns, it is important to consider the difference between total shareholder return (TSR) and share price return. The TSR incorporates the value of any spin-offs or discounted capital raisings, along with any dividends, based on the assumption that the dividends are reinvested. Arguably, the TSR gives a more comprehensive picture of the return generated by a stock. We note that for Lisi the TSR over the last 3 years was 151%, which is better than the share price return mentioned above. And there's no prize for guessing that the dividend payments largely explain the divergence!

A Different Perspective

It's nice to see that Lisi shareholders have received a total shareholder return of 70% over the last year. Of course, that includes the dividend. That gain is better than the annual TSR over five years, which is 20%. Therefore it seems like sentiment around the company has been positive lately. Someone with an optimistic perspective could view the recent improvement in TSR as indicating that the business itself is getting better with time. It's always interesting to track share price performance over the longer term. But to understand Lisi better, we need to consider many other factors. Even so, be aware that Lisi is showing 2 warning signs in our investment analysis , you should know about...

But note: Lisi may not be the best stock to buy. So take a peek at this free list of interesting companies with past earnings growth (and further growth forecast).

Please note, the market returns quoted in this article reflect the market weighted average returns of stocks that currently trade on French exchanges.

New: AI Stock Screener & Alerts

Our new AI Stock Screener scans the market every day to uncover opportunities.

• Dividend Powerhouses (3%+ Yield)

• Undervalued Small Caps with Insider Buying

• High growth Tech and AI Companies

Or build your own from over 50 metrics.

Have feedback on this article? Concerned about the content? Get in touch with us directly. Alternatively, email editorial-team (at) simplywallst.com.

This article by Simply Wall St is general in nature. We provide commentary based on historical data and analyst forecasts only using an unbiased methodology and our articles are not intended to be financial advice. It does not constitute a recommendation to buy or sell any stock, and does not take account of your objectives, or your financial situation. We aim to bring you long-term focused analysis driven by fundamental data. Note that our analysis may not factor in the latest price-sensitive company announcements or qualitative material. Simply Wall St has no position in any stocks mentioned.

About ENXTPA:FII

Lisi

Designs and produces assembly and component solutions for the aerospace, automotive, and medical sectors in France and internationally.

Reasonable growth potential with adequate balance sheet.

Market Insights

Community Narratives