- France

- /

- Construction

- /

- ENXTPA:EN

Is Bouygues’ (ENXTPA:EN) Response to Currency Shifts Revealing a Deeper Operational Strength?

Reviewed by Sasha Jovanovic

- Bouygues SA recently held a board meeting to approve its nine-month financial statements and updated its 2025 earnings guidance, now expecting a slight increase in operating profit but sales to remain close to 2024 levels due to currency changes.

- This revision reflects Bouygues' acknowledgment of currency headwinds linked to the US dollar while maintaining confidence in underlying operational performance.

- We'll assess how Bouygues' adjusted 2025 sales outlook amid currency volatility could influence its medium-term investment narrative.

Trump's oil boom is here - pipelines are primed to profit. Discover the 22 US stocks riding the wave.

Bouygues Investment Narrative Recap

To own Bouygues, you need faith in the group’s ability to generate stable, diversified cash flows across construction, telecom, and energy infrastructure. The latest update, confirming operating profit growth but flagging sales stasis due to currency impacts, does not materially alter its medium-term catalyst, which hinges on securing and executing its large, international infrastructure backlog. However, foreign exchange volatility remains a meaningful short-term risk that could influence reported figures and investor perception, even if underlying activity is unchanged.

Among recent announcements, Bouygues’ provisional earnings for the first nine months of 2025, showing sales growth of less than 1% and essentially flat net income compared to last year, are closely linked to this guidance adjustment. While the group's robust backlog supports multi-year visibility, the muted bottom-line progression in the face of ongoing currency swings highlights why execution and market conditions outside France remain under scrutiny. Yet, for those tracking catalysts, the order book’s stability is still the focal point rather than short-term quarterly variation.

On the other hand, investors should pay close attention to how persistent currency pressure could unexpectedly...

Read the full narrative on Bouygues (it's free!)

Bouygues' outlook anticipates €59.1 billion in revenue and €1.4 billion in earnings by 2028. This scenario is based on an annual revenue growth rate of 1.1% and an earnings increase of €0.4 billion from the current earnings of €1.0 billion.

Uncover how Bouygues' forecasts yield a €43.65 fair value, a 7% upside to its current price.

Exploring Other Perspectives

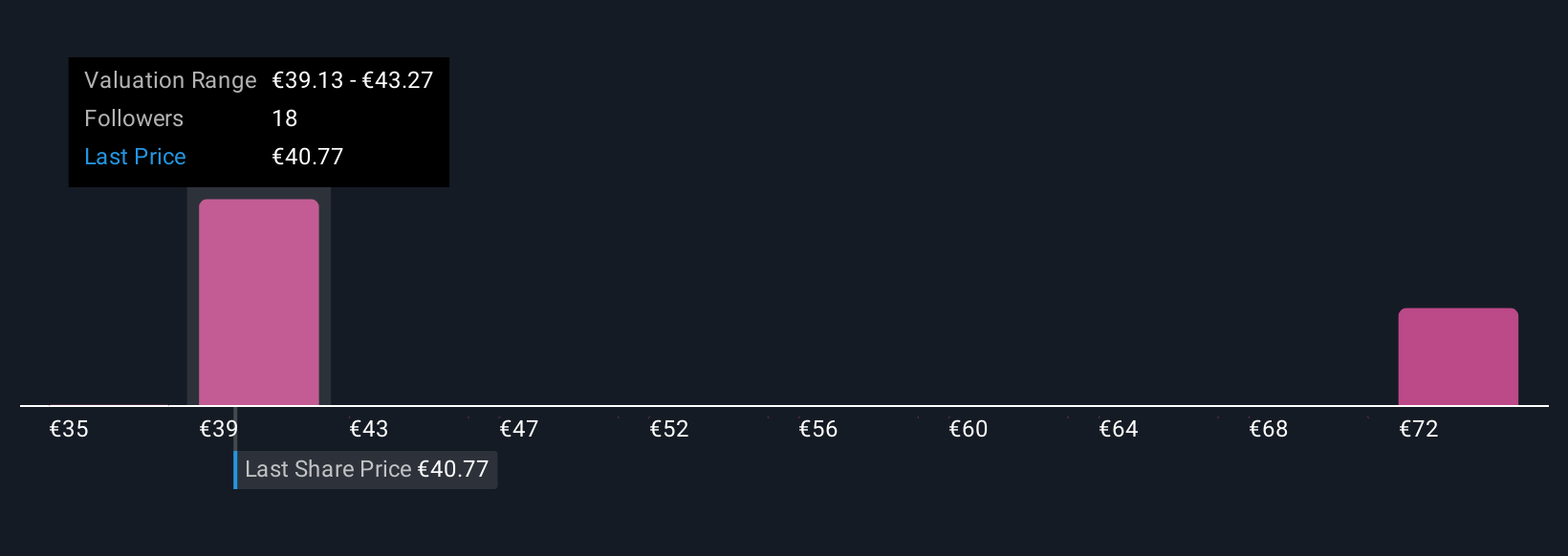

Simply Wall St Community members value Bouygues from €35 up to €73.83 across three estimates, reflecting a wide spectrum of approaches. With currency risks now flagged by management, these sharply differing views highlight why it pays to compare multiple analyses before forming your own outlook.

Explore 3 other fair value estimates on Bouygues - why the stock might be worth as much as 81% more than the current price!

Build Your Own Bouygues Narrative

Disagree with existing narratives? Create your own in under 3 minutes - extraordinary investment returns rarely come from following the herd.

- A great starting point for your Bouygues research is our analysis highlighting 3 key rewards and 1 important warning sign that could impact your investment decision.

- Our free Bouygues research report provides a comprehensive fundamental analysis summarized in a single visual - the Snowflake - making it easy to evaluate Bouygues' overall financial health at a glance.

Want Some Alternatives?

Our daily scans reveal stocks with breakout potential. Don't miss this chance:

- AI is about to change healthcare. These 32 stocks are working on everything from early diagnostics to drug discovery. The best part - they are all under $10b in market cap - there's still time to get in early.

- Find companies with promising cash flow potential yet trading below their fair value.

- We've found 15 US stocks that are forecast to pay a dividend yield of over 6% next year. See the full list for free.

This article by Simply Wall St is general in nature. We provide commentary based on historical data and analyst forecasts only using an unbiased methodology and our articles are not intended to be financial advice. It does not constitute a recommendation to buy or sell any stock, and does not take account of your objectives, or your financial situation. We aim to bring you long-term focused analysis driven by fundamental data. Note that our analysis may not factor in the latest price-sensitive company announcements or qualitative material. Simply Wall St has no position in any stocks mentioned.

Valuation is complex, but we're here to simplify it.

Discover if Bouygues might be undervalued or overvalued with our detailed analysis, featuring fair value estimates, potential risks, dividends, insider trades, and its financial condition.

Access Free AnalysisHave feedback on this article? Concerned about the content? Get in touch with us directly. Alternatively, email editorial-team@simplywallst.com

About ENXTPA:EN

Bouygues

Operates in the construction, energy, telecom, media, and transport infrastructure sectors in France and internationally.

Established dividend payer and good value.

Similar Companies

Market Insights

Community Narratives