- Netherlands

- /

- Logistics

- /

- ENXTAM:FERGR

European Hidden Treasures in Stocks for November 2025

Reviewed by Simply Wall St

As the European markets navigate concerns over artificial intelligence-related stock valuations and broader economic uncertainties, key indices like the STOXX Europe 600 have experienced a pullback, reflecting cautious investor sentiment. In this environment, identifying promising stocks involves looking for companies with solid fundamentals and growth potential that can weather market volatility and capitalize on emerging opportunities.

Top 10 Undiscovered Gems With Strong Fundamentals In Europe

| Name | Debt To Equity | Revenue Growth | Earnings Growth | Health Rating |

|---|---|---|---|---|

| Grenobloise d'Electronique et d'Automatismes Société Anonyme | 0.01% | 7.01% | -1.81% | ★★★★★☆ |

| KABE Group AB (publ.) | 3.82% | 6.17% | 5.42% | ★★★★★☆ |

| Inmocemento | 28.68% | 4.15% | 33.84% | ★★★★★☆ |

| Inversiones Doalca SOCIMI | 13.10% | 6.72% | 3.11% | ★★★★★☆ |

| Evergent Investments | 3.82% | 10.46% | 23.17% | ★★★★★☆ |

| VNV Global | 15.38% | -18.33% | -18.19% | ★★★★★☆ |

| ABG Sundal Collier Holding | 35.58% | -7.59% | -18.30% | ★★★★☆☆ |

| Practic | NA | 4.86% | 6.64% | ★★★★☆☆ |

| Alantra Partners | 11.36% | -6.39% | -33.69% | ★★★★☆☆ |

| MCH Group | 126.04% | 19.05% | 60.90% | ★★★★☆☆ |

Let's explore several standout options from the results in the screener.

Ferrari Group (ENXTAM:FERGR)

Simply Wall St Value Rating: ★★★★★☆

Overview: Ferrari Group PLC specializes in shipping, integrated logistics, and value-added services for jewelry and precious goods across Europe, Asia, North America, Brazil, and other international markets with a market cap of €748.66 million.

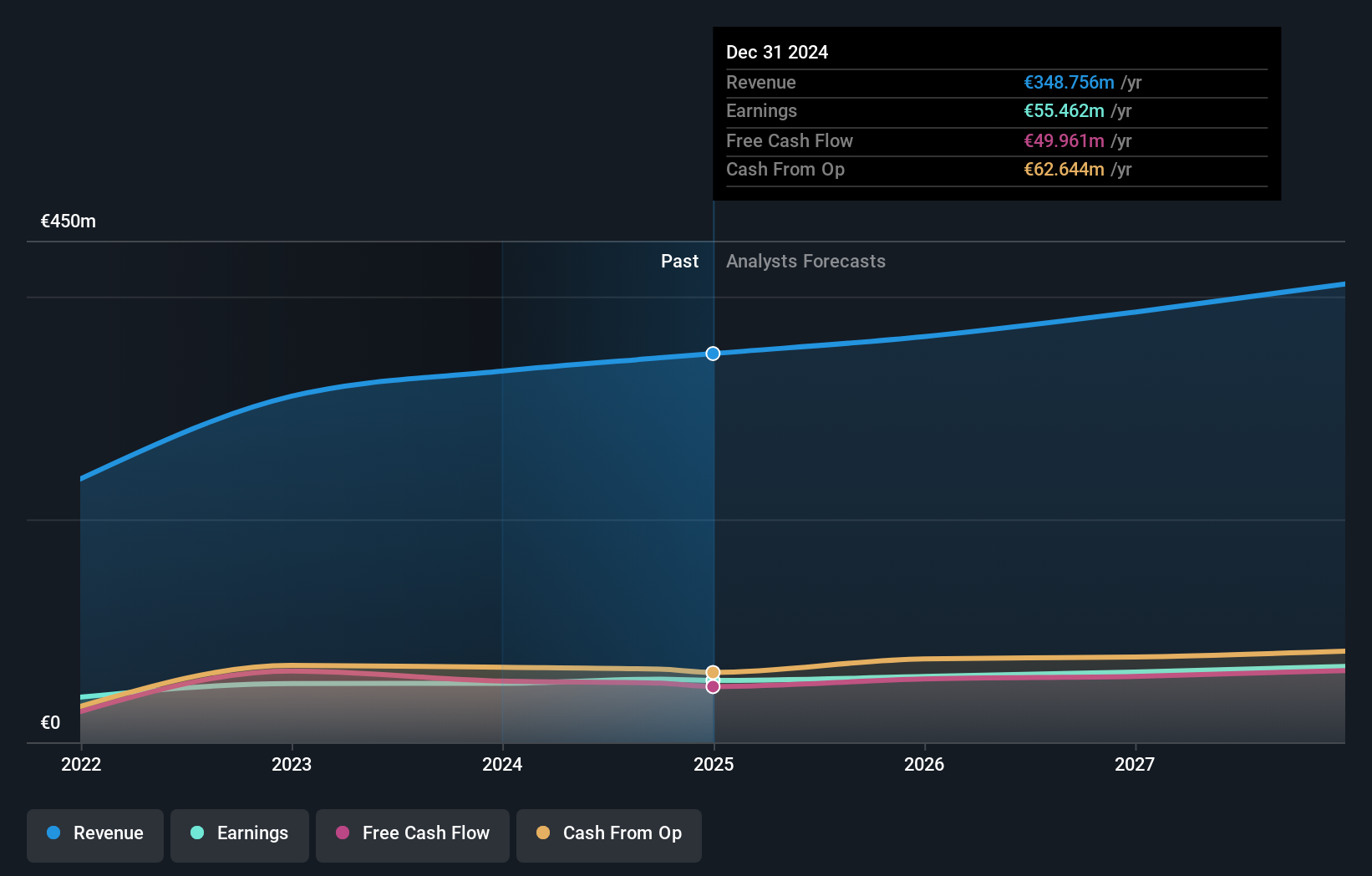

Operations: Ferrari Group's revenue primarily comes from its business services segment, generating €355.25 million. The company operates with a market cap of €748.66 million.

Trading at 47.1% below its estimated fair value, Ferrari Group's financials present a mixed bag. Despite a challenging year with earnings dropping by 27.1%, the company remains free cash flow positive and comfortably covers its interest payments, indicating financial resilience. In the first half of 2025, sales climbed to €179.58 million from €173.08 million in the previous year, yet net income saw a dip to €12.36 million from €27.45 million, reflecting pressures on profitability with basic earnings per share falling to €0.14 from €0.3 last year amidst industry challenges and strategic investments likely impacting performance metrics.

Caisse Régionale de Crédit Agricole Mutuel Loire Haute-Loire Société coopérative (ENXTPA:CRLO)

Simply Wall St Value Rating: ★★★★☆☆

Overview: Caisse Régionale de Crédit Agricole Mutuel Loire Haute-Loire Société coopérative offers a range of banking products and services to diverse customer segments in France, with a market capitalization of approximately €741.51 million.

Operations: Caisse Régionale de Crédit Agricole Mutuel Loire Haute-Loire Société coopérative generates revenue primarily from its local banking operations in France, amounting to €240.36 million, and leasing activities contributing €151.48 million. The net profit margin for the company is a key indicator of its financial health.

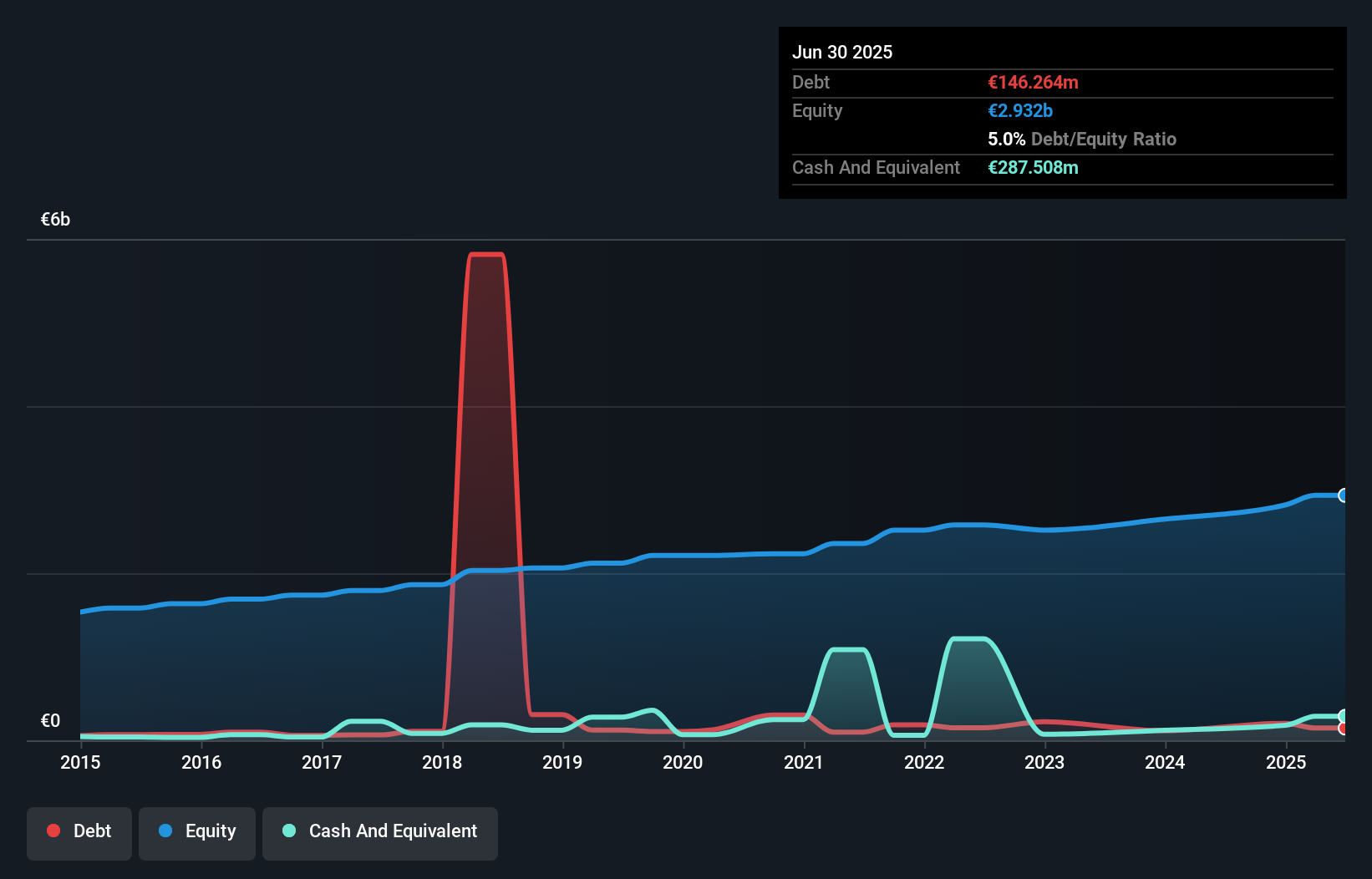

With total assets of €15.5 billion and equity at €2.9 billion, Crédit Agricole Loire Haute-Loire operates with a focus on stability, as 95% of its liabilities are low-risk customer deposits. Despite a high bad loans ratio at 3.1%, its allowance for these loans is relatively low at 79%. The cooperative's price-to-earnings ratio stands attractively below the French market average, sitting at 9.6x compared to 16.4x. Recent earnings growth of 10.1% outpaced the industry’s -0.3%, although over five years, earnings have slightly dipped by an annual rate of 0.2%.

BioGaia (OM:BIOG B)

Simply Wall St Value Rating: ★★★★★★

Overview: BioGaia AB (publ) is a healthcare company that focuses on developing, manufacturing, marketing, and selling probiotic products aimed at improving gut, oral, and immune health across various global regions including Europe, the Middle East, Africa, the United States, Asia-Pacific, Australia, and New Zealand with a market capitalization of approximately SEK10.12 billion.

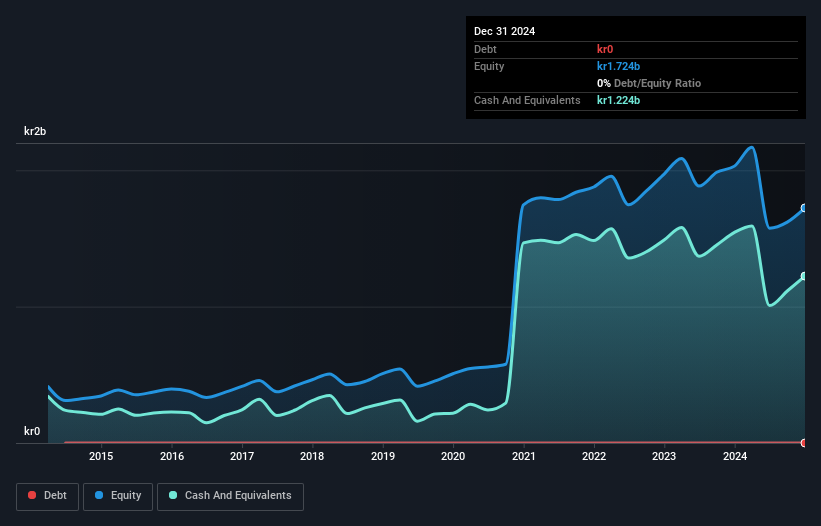

Operations: BioGaia generates revenue primarily from its Pediatrics segment, accounting for SEK 1.09 billion, and the Adult Health segment contributing SEK 357.59 million.

BioGaia, a niche player in probiotics, is making strides with innovative products like Prodentis FRESH BREATH lozenges and expanding its footprint in the U.S. market. Despite facing earnings pressure from high operating costs, the company reported third-quarter sales of SEK 326 million and net income of SEK 66 million, up from last year. BioGaia's debt-free status and positive free cash flow position it well for growth as it explores new market opportunities in Germany and Austria. Analysts forecast earnings growth at 21% annually, suggesting potential for value appreciation as consumer demand for natural health solutions rises.

Make It Happen

- Reveal the 324 hidden gems among our European Undiscovered Gems With Strong Fundamentals screener with a single click here.

- Shareholder in one or more of these companies? Ensure you're never caught off-guard by adding your portfolio in Simply Wall St for timely alerts on significant stock developments.

- Simply Wall St is a revolutionary app designed for long-term stock investors, it's free and covers every market in the world.

Searching for a Fresh Perspective?

- Explore high-performing small cap companies that haven't yet garnered significant analyst attention.

- Fuel your portfolio with companies showing strong growth potential, backed by optimistic outlooks both from analysts and management.

- Find companies with promising cash flow potential yet trading below their fair value.

This article by Simply Wall St is general in nature. We provide commentary based on historical data and analyst forecasts only using an unbiased methodology and our articles are not intended to be financial advice. It does not constitute a recommendation to buy or sell any stock, and does not take account of your objectives, or your financial situation. We aim to bring you long-term focused analysis driven by fundamental data. Note that our analysis may not factor in the latest price-sensitive company announcements or qualitative material. Simply Wall St has no position in any stocks mentioned.

New: AI Stock Screener & Alerts

Our new AI Stock Screener scans the market every day to uncover opportunities.

• Dividend Powerhouses (3%+ Yield)

• Undervalued Small Caps with Insider Buying

• High growth Tech and AI Companies

Or build your own from over 50 metrics.

Have feedback on this article? Concerned about the content? Get in touch with us directly. Alternatively, email editorial-team@simplywallst.com

About ENXTAM:FERGR

Ferrari Group

Provides shipping, integrated logistics, and value-added services for jewelry and precious goods in Europe, Asia, North America, Brazil, and internationally.

Excellent balance sheet and good value.

Similar Companies

Market Insights

Community Narratives