Should Crédit Agricole’s (ENXTPA:ACA) Debt Redemptions and Profit Gains Spur Investor Action?

Reviewed by Sasha Jovanovic

- Crédit Agricole S.A. announced the redemption of all its outstanding ¥17.70 billion Japanese Yen senior non-preferred bonds issued in December 2022, and will also redeem the remaining US$457.69 million in undated deeply subordinated additional Tier 1 notes, following a prior tender offer, with payments set for December 2025.

- The company also reported higher net income and earnings per share for both the third quarter and the first nine months of 2025 compared to the previous year, underlining operational resilience even as it actively manages its capital structure.

- With Crédit Agricole’s strong quarterly profit growth and substantial debt redemptions, we’ll examine how these developments factor into its investment outlook.

This technology could replace computers: discover 27 stocks that are working to make quantum computing a reality.

Crédit Agricole Investment Narrative Recap

To be a shareholder in Crédit Agricole, you need confidence in its ability to deliver stable earnings in the face of macroeconomic uncertainty and regulatory risks. The fresh news of significant debt redemptions, paired with higher net income, is positive for balance sheet flexibility, but does not materially shift the biggest short-term catalyst, continued growth in digital banking and fee-based services, nor does it resolve integration or volatility risks tied to acquisitions or the Italian market.

Most relevant to this is the company’s recent earnings report, which shows net income and earnings per share rising again quarter-on-quarter. While this helps underpin resilience, medium-term earnings growth may still be challenged by factors outside these latest capital management actions, especially if new risks emerge from shifting interest rates or changing deposit behaviors.

However, investors should also consider that despite these reassuring results, uncertainties tied to future Italian banking exposure and the planned accounting change might still affect Crédit Agricole's...

Read the full narrative on Crédit Agricole (it's free!)

Crédit Agricole's narrative projects €29.8 billion revenue and €7.6 billion earnings by 2028. This requires a 6.2% yearly revenue decline and a decrease of €1.4 billion in earnings from €9.0 billion today.

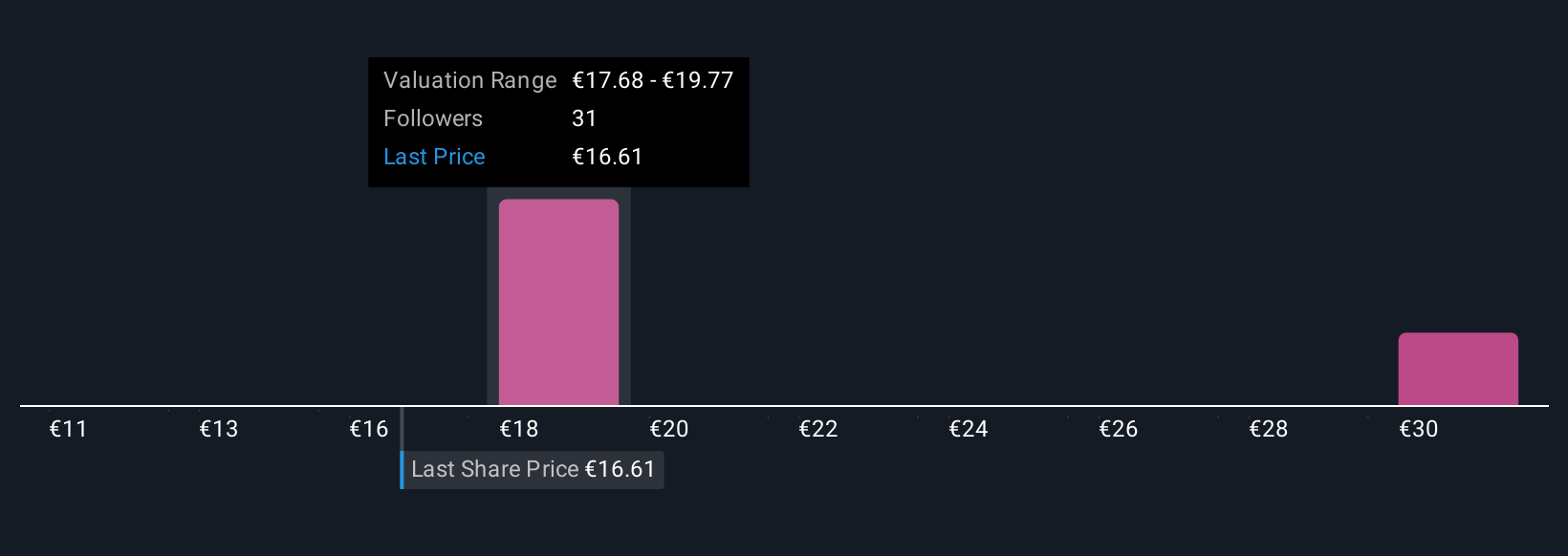

Uncover how Crédit Agricole's forecasts yield a €18.64 fair value, a 16% upside to its current price.

Exploring Other Perspectives

Community fair value estimates for Crédit Agricole range from €14.98 to €18.64, based on four individual Simply Wall St Community forecasts. Yet, even with this diversity of opinion, ongoing cost pressures in French retail banking may weigh on longer-term returns, reminding you to examine multiple viewpoints before deciding.

Explore 4 other fair value estimates on Crédit Agricole - why the stock might be worth 6% less than the current price!

Build Your Own Crédit Agricole Narrative

Disagree with existing narratives? Create your own in under 3 minutes - extraordinary investment returns rarely come from following the herd.

- A great starting point for your Crédit Agricole research is our analysis highlighting 4 key rewards and 3 important warning signs that could impact your investment decision.

- Our free Crédit Agricole research report provides a comprehensive fundamental analysis summarized in a single visual - the Snowflake - making it easy to evaluate Crédit Agricole's overall financial health at a glance.

Contemplating Other Strategies?

The market won't wait. These fast-moving stocks are hot now. Grab the list before they run:

- Rare earth metals are the new gold rush. Find out which 37 stocks are leading the charge.

- AI is about to change healthcare. These 32 stocks are working on everything from early diagnostics to drug discovery. The best part - they are all under $10b in market cap - there's still time to get in early.

- These 13 companies survived and thrived after COVID and have the right ingredients to survive Trump's tariffs. Discover why before your portfolio feels the trade war pinch.

This article by Simply Wall St is general in nature. We provide commentary based on historical data and analyst forecasts only using an unbiased methodology and our articles are not intended to be financial advice. It does not constitute a recommendation to buy or sell any stock, and does not take account of your objectives, or your financial situation. We aim to bring you long-term focused analysis driven by fundamental data. Note that our analysis may not factor in the latest price-sensitive company announcements or qualitative material. Simply Wall St has no position in any stocks mentioned.

New: AI Stock Screener & Alerts

Our new AI Stock Screener scans the market every day to uncover opportunities.

• Dividend Powerhouses (3%+ Yield)

• Undervalued Small Caps with Insider Buying

• High growth Tech and AI Companies

Or build your own from over 50 metrics.

Have feedback on this article? Concerned about the content? Get in touch with us directly. Alternatively, email editorial-team@simplywallst.com

About ENXTPA:ACA

Crédit Agricole

Provides retail, corporate, insurance, and investment banking products and services in France and internationally.

Established dividend payer and good value.

Similar Companies

Market Insights

Community Narratives