- Norway

- /

- Electrical

- /

- OB:OTOVO

3 European Penny Stocks With Market Caps Under €20M

Reviewed by Simply Wall St

The European market has shown mixed results recently, with the pan-European STOXX Europe 600 Index ending slightly lower as expectations for further interest rate cuts from the ECB diminished. In this context, penny stocks—though an outdated term—remain a relevant investment area, often representing smaller or newer companies that can offer surprising value. By focusing on those with strong financial health and potential for growth, investors may uncover opportunities that balance stability with upside potential.

Top 10 Penny Stocks In Europe

| Name | Share Price | Market Cap | Rewards & Risks |

| Ariston Holding (BIT:ARIS) | €3.95 | €1.37B | ✅ 5 ⚠️ 2 View Analysis > |

| Lucisano Media Group (BIT:LMG) | €1.08 | €16.04M | ✅ 4 ⚠️ 5 View Analysis > |

| Maps (BIT:MAPS) | €3.30 | €43.83M | ✅ 4 ⚠️ 1 View Analysis > |

| DigiTouch (BIT:DGT) | €2.01 | €27.77M | ✅ 3 ⚠️ 1 View Analysis > |

| Angler Gaming (NGM:ANGL) | SEK3.60 | SEK269.95M | ✅ 4 ⚠️ 2 View Analysis > |

| Angler Gaming (DB:0QM) | €0.37 | €221.96M | ✅ 2 ⚠️ 2 View Analysis > |

| Hifab Group (OM:HIFA B) | SEK3.42 | SEK208.07M | ✅ 2 ⚠️ 2 View Analysis > |

| Nurminen Logistics Oyj (HLSE:NLG1V) | €0.954 | €76.98M | ✅ 2 ⚠️ 4 View Analysis > |

| High (ENXTPA:HCO) | €3.85 | €75.31M | ✅ 1 ⚠️ 5 View Analysis > |

| Deceuninck (ENXTBR:DECB) | €2.015 | €278.51M | ✅ 4 ⚠️ 1 View Analysis > |

Click here to see the full list of 281 stocks from our European Penny Stocks screener.

Underneath we present a selection of stocks filtered out by our screen.

Nurminen Logistics Oyj (HLSE:NLG1V)

Simply Wall St Financial Health Rating: ★★★★★☆

Overview: Nurminen Logistics Oyj offers logistics services across Finland, Russia, Sweden, and the Baltic countries with a market cap of €76.98 million.

Operations: The company's revenue is primarily generated from its Transportation - Trucking segment, amounting to €107.08 million.

Market Cap: €76.98M

Nurminen Logistics Oyj, with a market cap of €76.98 million, operates primarily in the Transportation - Trucking segment generating €107.08 million in revenue. The company recently reported a decline in net income for Q3 2025 to €0.961 million from €5.13 million the previous year, reflecting lower profit margins of 4.3% compared to 12.3%. Despite this, its debt management is robust with a satisfactory net debt to equity ratio and well-covered interest payments by EBIT (3.8x coverage). The company has launched new rail operations between Italy and Sweden, enhancing its European logistics network and sustainability efforts amid growing demand for eco-friendly transport solutions.

- Navigate through the intricacies of Nurminen Logistics Oyj with our comprehensive balance sheet health report here.

- Gain insights into Nurminen Logistics Oyj's outlook and expected performance with our report on the company's earnings estimates.

Otovo (OB:OTOVO)

Simply Wall St Financial Health Rating: ★★★★☆☆

Overview: Otovo ASA operates an online marketplace for solar installations in Norway and has a market cap of NOK224.82 million.

Operations: The company generates NOK654.40 million in revenue from its B2C segment, with a segment adjustment of -NOK125.03 million.

Market Cap: NOK224.82M

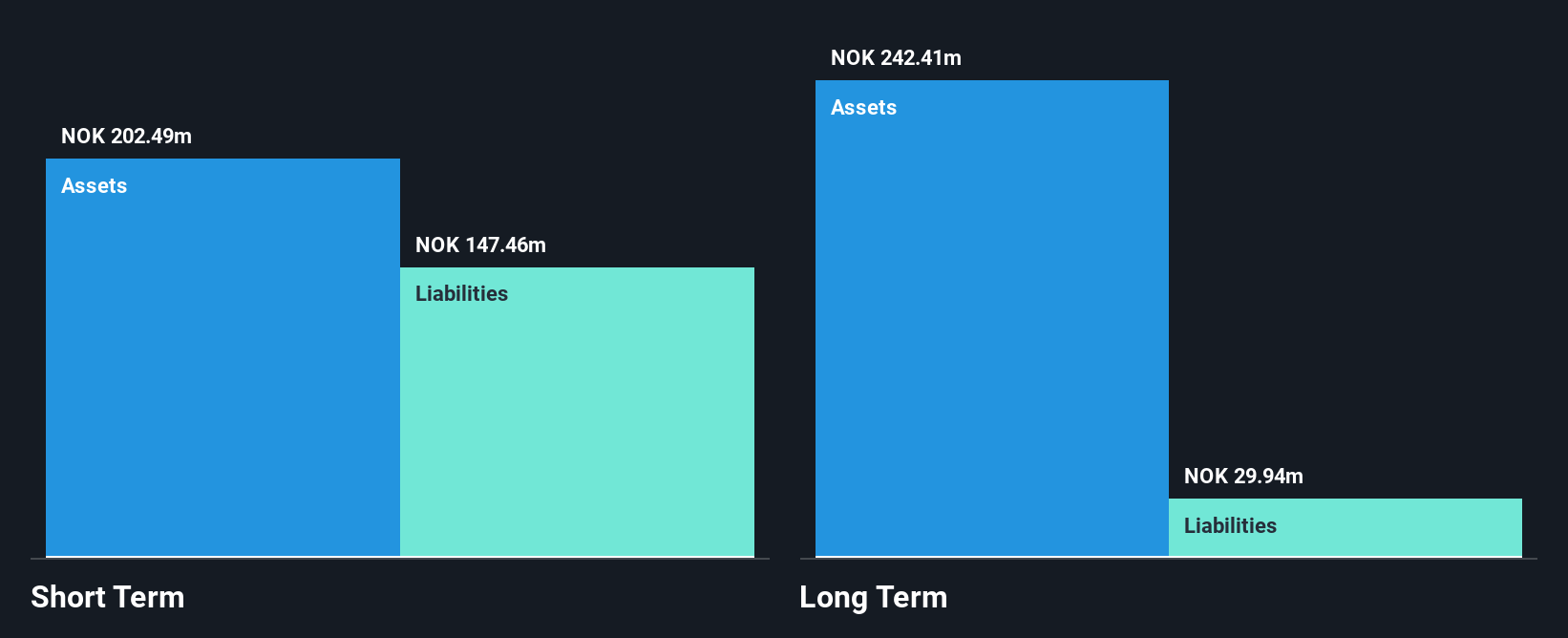

Otovo ASA, with a market cap of NOK224.82 million, is navigating the competitive landscape with an innovative service offering that has attracted 3,000 customers in Germany, Norway, Spain, and Sweden. This move generates EUR350,000 in annual recurring revenue from its new remote monitoring and diagnostics services. Despite being unprofitable and not expected to achieve profitability within the next three years, Otovo's short-term assets exceed its liabilities while maintaining more cash than total debt. The company's recent expansion into the U.S., backed by over $4 million in funding for Otovo USA's integrated home energy services platform Endurance™, highlights strategic growth efforts amidst high share price volatility.

- Jump into the full analysis health report here for a deeper understanding of Otovo.

- Learn about Otovo's future growth trajectory here.

Heidelberg Pharma (XTRA:HPHA)

Simply Wall St Financial Health Rating: ★★★★☆☆

Overview: Heidelberg Pharma AG is a biopharmaceutical company specializing in oncology and antibody targeted amanitin conjugates (ATAC) with operations in Germany, the United States, and internationally, and has a market cap of €146.42 million.

Operations: The company generates its revenue of €3.04 million from ADC Technology and Customer Specific Research.

Market Cap: €146.42M

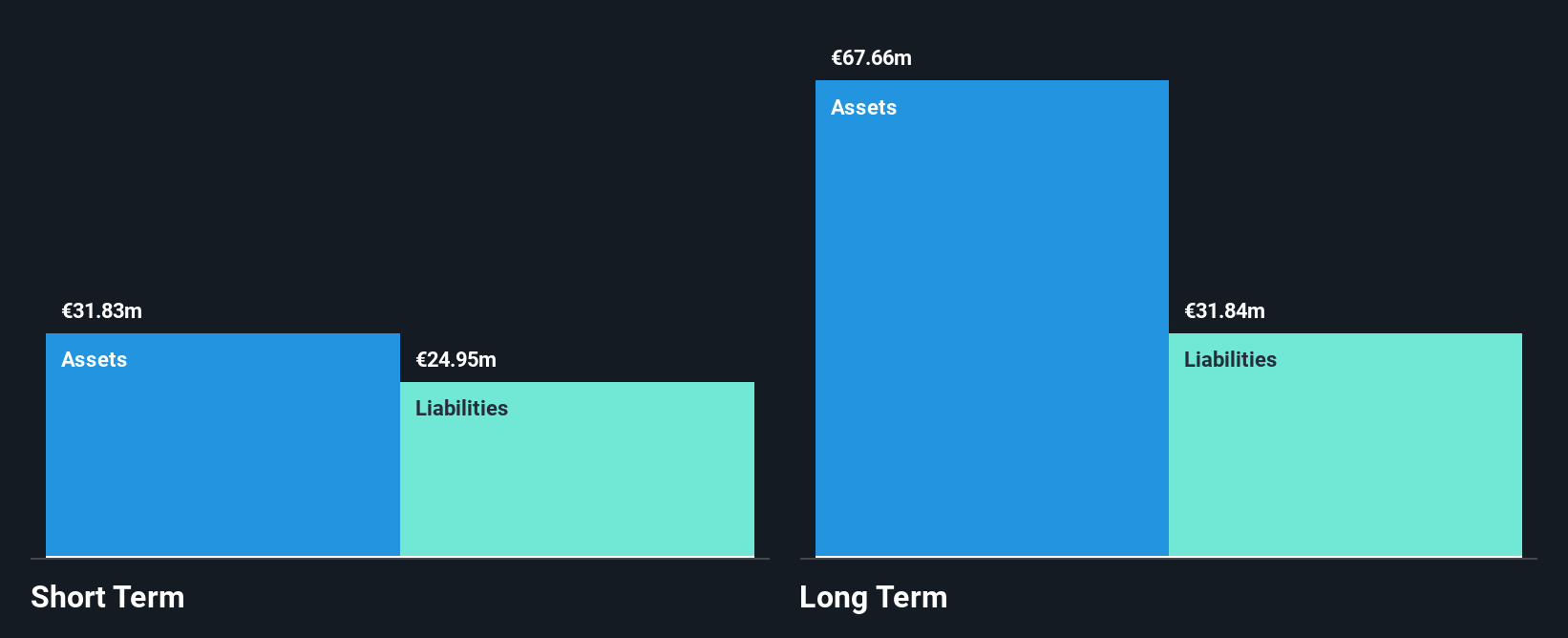

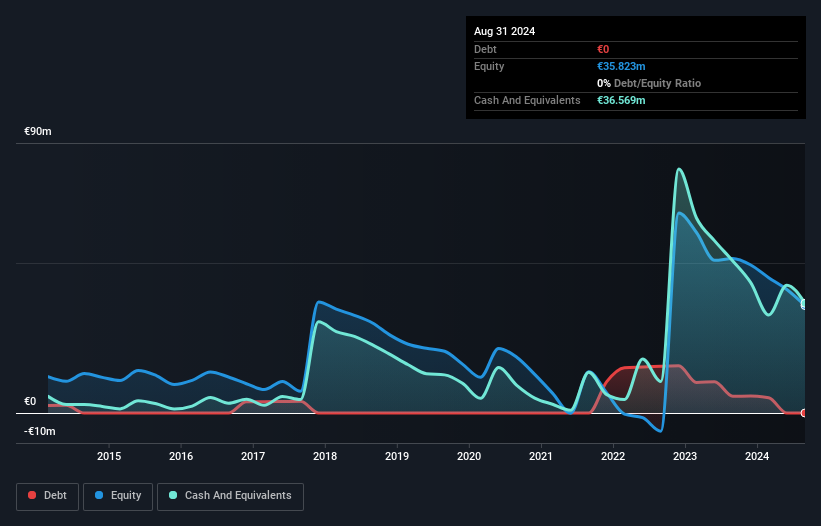

Heidelberg Pharma AG, with a market cap of €146.42 million, is advancing its oncology pipeline despite financial challenges. The company reported declining revenue of €6.42 million for the nine months ending August 31, 2025, and remains unprofitable with a net loss of €21.05 million. However, Heidelberg's innovative ATAC technology shows promise; HDP-101 received Fast Track Designation from the FDA for multiple myeloma treatment and demonstrated favorable safety in trials. Despite high share price volatility and less than a year of cash runway, short-term assets cover liabilities while strategic focus on clinical advancements continues amidst workforce reductions.

- Take a closer look at Heidelberg Pharma's potential here in our financial health report.

- Gain insights into Heidelberg Pharma's future direction by reviewing our growth report.

Taking Advantage

- Reveal the 281 hidden gems among our European Penny Stocks screener with a single click here.

- Ready To Venture Into Other Investment Styles? The end of cancer? These 29 emerging AI stocks are developing tech that will allow early idenification of life changing disesaes like cancer and Alzheimer's.

This article by Simply Wall St is general in nature. We provide commentary based on historical data and analyst forecasts only using an unbiased methodology and our articles are not intended to be financial advice. It does not constitute a recommendation to buy or sell any stock, and does not take account of your objectives, or your financial situation. We aim to bring you long-term focused analysis driven by fundamental data. Note that our analysis may not factor in the latest price-sensitive company announcements or qualitative material. Simply Wall St has no position in any stocks mentioned.

New: AI Stock Screener & Alerts

Our new AI Stock Screener scans the market every day to uncover opportunities.

• Dividend Powerhouses (3%+ Yield)

• Undervalued Small Caps with Insider Buying

• High growth Tech and AI Companies

Or build your own from over 50 metrics.

Have feedback on this article? Concerned about the content? Get in touch with us directly. Alternatively, email editorial-team@simplywallst.com

About OB:OTOVO

Adequate balance sheet with slight risk.

Market Insights

Community Narratives