- Finland

- /

- Communications

- /

- HLSE:NOKIA

Nokia (HLSE:NOKIA): Exploring Valuation After Recent Share Price Momentum

Reviewed by Simply Wall St

Nokia Oyj (HLSE:NOKIA) shares have experienced a combination of short-term dips and longer-term gains. The stock has climbed about 42% over the past 3 months. Investors are watching to see if this momentum continues.

See our latest analysis for Nokia Oyj.

Nokia Oyj’s momentum has picked up sharply, with a 41.6% share price return over the past three months, even as investors digest recent swings. While the one-month share price return dipped slightly, the strong 12-month total shareholder return of 36.2% shows that longer-term holders have been well rewarded and the company’s growth signals are building rather than fading.

If you’re keen to see how other tech leaders are moving, it’s worth checking out our curated list of innovators with potential: See the full list for free.

Recent gains have investors wondering whether Nokia Oyj’s current valuation leaves room for upside. Is the share price still undervalued compared to fundamentals, or has the market already priced in future growth potential?

Most Popular Narrative: 1.5% Undervalued

Nokia Oyj’s most widely followed valuation narrative places its fair value at €5.39, which is just above the last close price of €5.31. Small variations could have a meaningful impact, and what is driving this outlook is detailed in the commentary below.

Strong demand from hyperscalers (cloud/AI data centers) and U.S./European infrastructure stimulus is expanding Nokia's addressable market for high-capacity network equipment, supporting future top-line growth. Ongoing global build-out of fiber and advanced 5G/6G networks, accelerated by regulatory programs and large CSP capex, provides a multi-year runway for increased product and service revenues, particularly in Fixed and Optical Networks.

Curious why the fair value is nudging higher? Some bold projections about future growth, margins, and a changing revenue mix could tip Nokia’s narrative in an unexpected direction. Which of these numbers carries the most weight in this finely balanced call? Get all the specifics and see how they add up for yourself.

Result: Fair Value of €5.39 (UNDERVALUED)

Have a read of the narrative in full and understand what's behind the forecasts.

However, persistent challenges in mobile networks and unpredictable currency swings could undermine profitability and limit Nokia’s long-term growth momentum.

Find out about the key risks to this Nokia Oyj narrative.

Another View: Looking Beyond the Surface

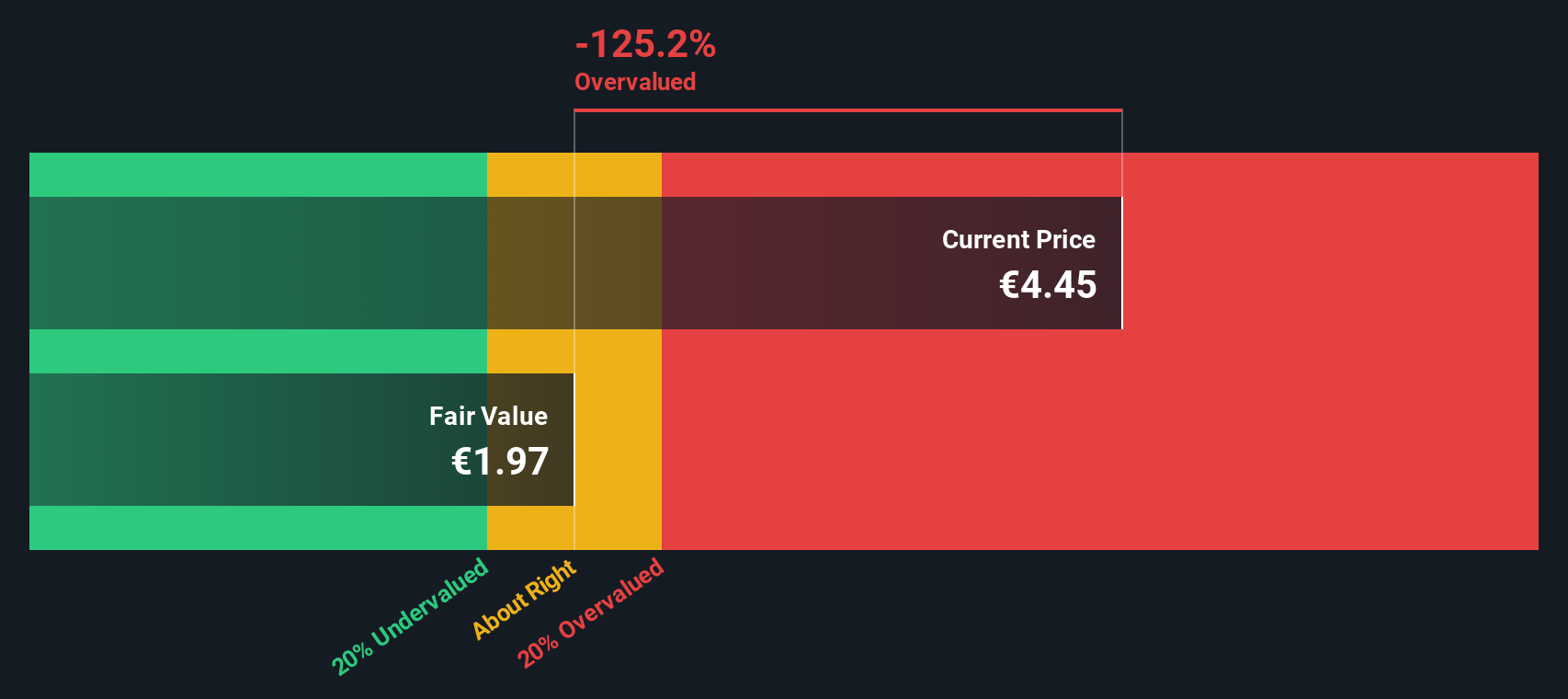

While the prevailing story sees Nokia as slightly undervalued, our DCF model takes a more cautious stance. It estimates fair value at just €1.99, which is well below the current share price of €5.28. This suggests investors may be banking on more optimistic growth than the DCF assumptions allow. Does this disconnect point to overlooked upside, or are risks being underestimated?

Look into how the SWS DCF model arrives at its fair value.

Build Your Own Nokia Oyj Narrative

If you see things differently or would rather dive into the numbers yourself, it’s easy to craft your own view on Nokia Oyj in just minutes. Do it your way

A great starting point for your Nokia Oyj research is our analysis highlighting 2 key rewards and 2 important warning signs that could impact your investment decision.

Looking for More Investment Ideas?

Gain an edge by uncovering high-potential stocks tailored to your strategy, all powered by Simply Wall Street’s advanced tools. Don’t miss your next winning opportunity; your smartest move could be just a click away.

- Unlock tomorrow’s market leaders by reviewing these 25 AI penny stocks that are harnessing artificial intelligence for significant growth in revenue and innovation.

- Boost your portfolio’s passive income by targeting top picks among these 14 dividend stocks with yields > 3% offering strong yields and the financial stability to support them.

- Seize potential bargains and undervalued gems early by evaluating these 932 undervalued stocks based on cash flows primed for a value-driven market turnaround.

This article by Simply Wall St is general in nature. We provide commentary based on historical data and analyst forecasts only using an unbiased methodology and our articles are not intended to be financial advice. It does not constitute a recommendation to buy or sell any stock, and does not take account of your objectives, or your financial situation. We aim to bring you long-term focused analysis driven by fundamental data. Note that our analysis may not factor in the latest price-sensitive company announcements or qualitative material. Simply Wall St has no position in any stocks mentioned.

Valuation is complex, but we're here to simplify it.

Discover if Nokia Oyj might be undervalued or overvalued with our detailed analysis, featuring fair value estimates, potential risks, dividends, insider trades, and its financial condition.

Access Free AnalysisHave feedback on this article? Concerned about the content? Get in touch with us directly. Alternatively, email editorial-team@simplywallst.com

About HLSE:NOKIA

Nokia Oyj

Provides mobile, fixed, and cloud network solutions in North and Latin America, Greater China, India, rest of the Asia Pacific, Europe, the Middle East, and Africa.

Flawless balance sheet with moderate growth potential.

Similar Companies

Market Insights

Weekly Picks

Solutions by stc: 34% Upside in Saudi's Digital Transformation Leader

The AI Infrastructure Giant Grows Into Its Valuation

Recently Updated Narratives

Not a Bubble, But the "Industrial Revolution 4.0" Engine

The "David vs. Goliath" AI Trade – Why Second Place is Worth Billions

The "Sleeping Giant" Wakes Up – Efficiency & Monetization

Popular Narratives

MicroVision will explode future revenue by 380.37% with a vision towards success

NVDA: Expanding AI Demand Will Drive Major Data Center Investments Through 2026