- Finland

- /

- Communications

- /

- HLSE:NOKIA

Nokia (HLSE:NOKIA): Assessing Valuation as New AI Networking Solutions Target Data Center Growth

Reviewed by Simply Wall St

Nokia Oyj (HLSE:NOKIA) is making waves with its newly announced 7220 Interconnect Router family and AI-powered automation tools. These developments target the rising needs of data center operators as AI workloads scale. The move directly addresses demands for flexible, efficient networking solutions driven by rapid AI adoption.

See our latest analysis for Nokia Oyj.

After a flurry of new product launches and strategic partnerships in recent weeks, Nokia Oyj’s 1-month share price return has surged 28.15%, with momentum building even further as shareholders have enjoyed a strong 45.65% total return over the past year. The recent streak of AI-powered product rollouts and fresh contract wins is helping to reset market expectations about Nokia’s growth potential and competitive edge as demand for advanced networking escalates.

If Nokia’s latest moves in AI networking got your attention, the next step could be to explore other game-changers in the tech and AI sector See the full list for free.

The rapid rise in Nokia’s share price raises an important question for investors: Is this the start of a new value cycle for the stock, or has the market already factored in all its future growth?

Most Popular Narrative: 13% Overvalued

With Nokia Oyj’s narrative fair value set at €5.29 and the current share price at €5.98, there is a significant gap between what leading analysts project and the prevailing market enthusiasm. The debate centers on whether recent wins and future earnings growth can justify the stock’s current premium.

Strategic innovation, disciplined operations, and IP monetization are boosting recurring revenues, expanding net margins, and supporting long-term profitability. Ongoing currency, competitive, and operational challenges threaten Nokia's revenue growth, market share, and long-term profitability across key network and cloud segments.

Can Nokia keep delivering on these big growth promises? The narrative’s bold assumptions about profit increases and margin expansion drive its fair value math. Which future milestones must the company hit to close that value gap? You’ll want to see what analysts are really banking on.

Result: Fair Value of $5.29 (OVERVALUED)

Have a read of the narrative in full and understand what's behind the forecasts.

However, persistent currency headwinds and intense competition could undermine Nokia’s growth outlook. This challenges the bullish narrative around margin expansion and market share.

Find out about the key risks to this Nokia Oyj narrative.

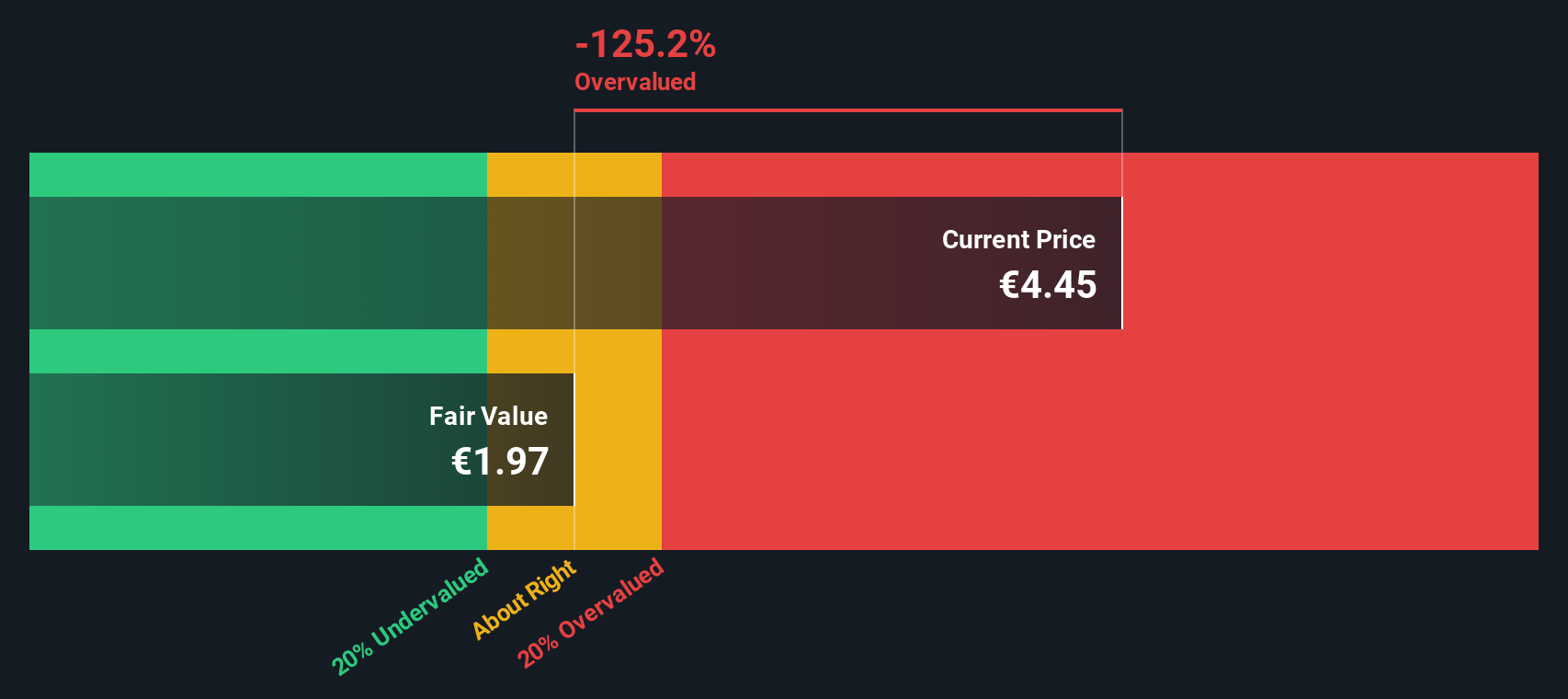

Another View: SWS DCF Model Challenges the Market Premium

Looking at Nokia from the perspective of our DCF model brings a striking contrast. The SWS DCF model suggests a fair value of €2.06, which is well below the current share price. This view frames Nokia as significantly overvalued at the moment. Are investors betting on a future that the fundamentals just do not support?

Look into how the SWS DCF model arrives at its fair value.

Build Your Own Nokia Oyj Narrative

If the narrative above does not match your view or you prefer to draw your own conclusions from the numbers, you can quickly craft a personalized outlook using our tools: Do it your way

A great starting point for your Nokia Oyj research is our analysis highlighting 2 key rewards and 2 important warning signs that could impact your investment decision.

Looking for more investment ideas?

Smart investors know opportunities are always out there. Go beyond Nokia by examining unique themes and strong performers across the market. There is no need to settle for just one story. Use these targeted tools to uncover your next great idea, so you never miss a winning trend:

- Tap into the potential of emerging technologies with companies focused on revolutionary quantum computing advancements by checking out these 27 quantum computing stocks.

- Capture escalating gains with top picks positioned for the next wave of AI transformation by starting with these 27 AI penny stocks.

- Boost your portfolio with quality stocks currently trading at a discount. See what is undervalued based on robust cash flow insights at these 885 undervalued stocks based on cash flows.

This article by Simply Wall St is general in nature. We provide commentary based on historical data and analyst forecasts only using an unbiased methodology and our articles are not intended to be financial advice. It does not constitute a recommendation to buy or sell any stock, and does not take account of your objectives, or your financial situation. We aim to bring you long-term focused analysis driven by fundamental data. Note that our analysis may not factor in the latest price-sensitive company announcements or qualitative material. Simply Wall St has no position in any stocks mentioned.

Valuation is complex, but we're here to simplify it.

Discover if Nokia Oyj might be undervalued or overvalued with our detailed analysis, featuring fair value estimates, potential risks, dividends, insider trades, and its financial condition.

Access Free AnalysisHave feedback on this article? Concerned about the content? Get in touch with us directly. Alternatively, email editorial-team@simplywallst.com

About HLSE:NOKIA

Nokia Oyj

Provides mobile, fixed, and cloud network solutions in North and Latin America, Greater China, India, rest of the Asia Pacific, Europe, the Middle East, and Africa.

Flawless balance sheet with moderate growth potential.

Similar Companies

Market Insights

Community Narratives