- Finland

- /

- Real Estate

- /

- HLSE:KOJAMO

What Kojamo Oyj (HLSE:KOJAMO)'s Mixed Q3 Results and Modest Revenue Outlook Mean for Shareholders

Reviewed by Sasha Jovanovic

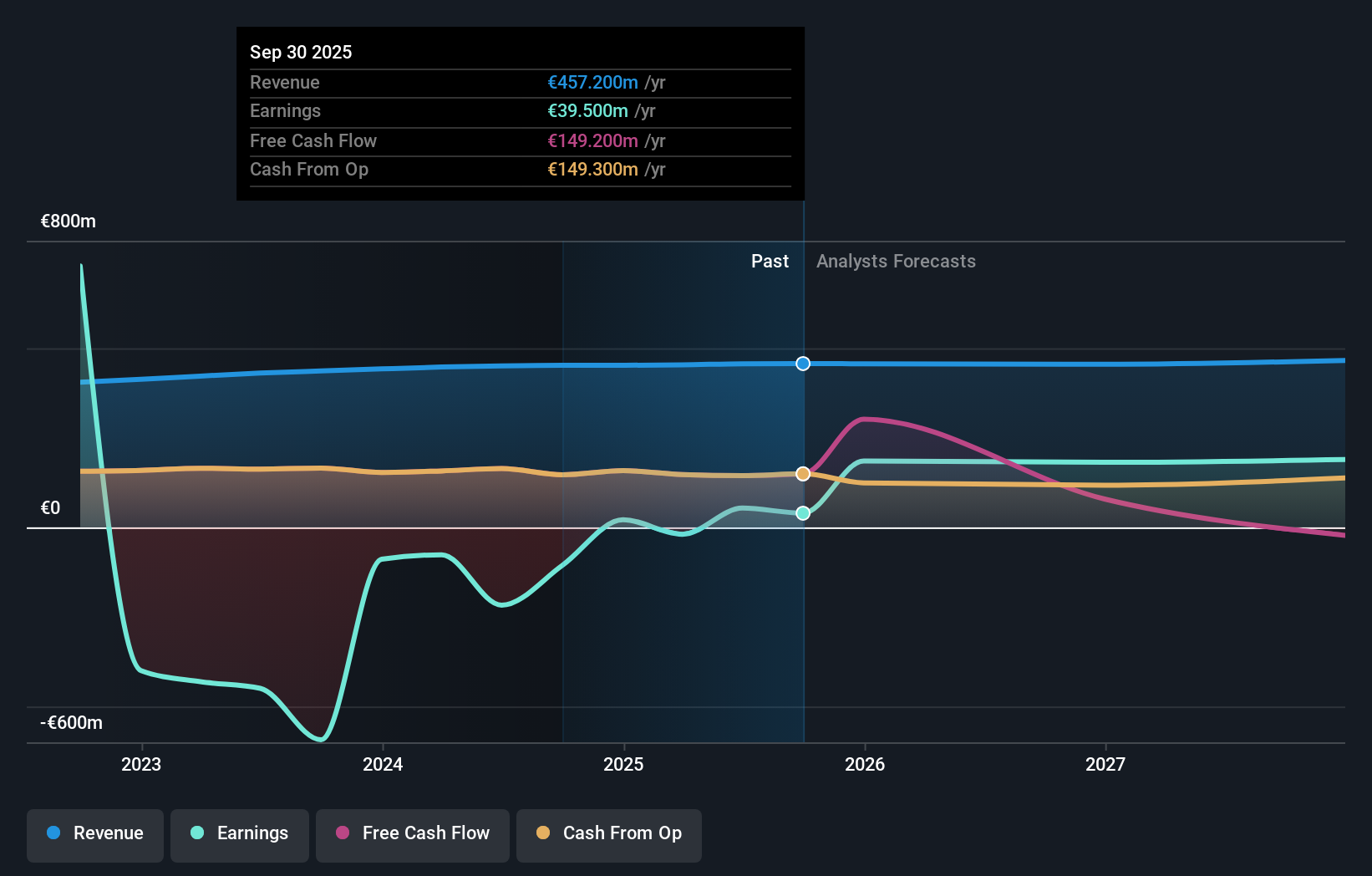

- Kojamo Oyj recently reported its third quarter 2025 earnings, showing sales of €113.6 million and net income of €26.1 million, alongside an update that full-year revenue is expected to grow by 0%–2% year-on-year.

- While nine-month net income improved from the previous year's loss, the company’s cautious revenue outlook and lower quarterly net profit highlight mixed operating trends in a still challenging market.

- To understand how this modest earnings trajectory and subdued guidance shape investor perspectives, we'll assess its impact on Kojamo's investment narrative.

AI is about to change healthcare. These 32 stocks are working on everything from early diagnostics to drug discovery. The best part - they are all under $10b in market cap - there's still time to get in early.

Kojamo Oyj Investment Narrative Recap

Investors in Kojamo Oyj often buy into the belief that limited new housing construction and persistent urban demand will eventually enhance the company’s rental income and asset values. The recent third quarter update, showing slow revenue growth and a dip in quarterly net profit, suggests that the most important short-term catalyst, tightening supply supporting rent levels, remains muted for now, while persistent oversupply and stagnant rents are still the biggest risks; the impact of this news is material, as subdued guidance slightly erodes near-term conviction.

Of Kojamo’s recent announcements, the 2025 revenue guidance revision to 0–2% growth is most relevant here. This tempered outlook directly reflects the ongoing supply and rent challenges, reinforcing why investors are closely monitoring any signs of improvement in rental market dynamics as a meaningful trigger for future upside or downside.

On the other hand, investors should pay close attention to the risk of ongoing oversupply and muted rent levels, especially since...

Read the full narrative on Kojamo Oyj (it's free!)

Kojamo Oyj's narrative projects €462.9 million revenue and €260.8 million earnings by 2028. This requires a 0.5% annual revenue decline and a €207 million earnings increase from €53.8 million today.

Uncover how Kojamo Oyj's forecasts yield a €10.77 fair value, in line with its current price.

Exploring Other Perspectives

The only community fair value estimate from Simply Wall St Community pegs Kojamo at €10.77 per share. While bullish forecasts hinge on housing shortages, muted revenue guidance highlights why outlooks and performance expectations can vary significantly, review alternative views for a fuller picture.

Explore another fair value estimate on Kojamo Oyj - why the stock might be worth just €10.77!

Build Your Own Kojamo Oyj Narrative

Disagree with existing narratives? Create your own in under 3 minutes - extraordinary investment returns rarely come from following the herd.

- A great starting point for your Kojamo Oyj research is our analysis highlighting 2 key rewards and 2 important warning signs that could impact your investment decision.

- Our free Kojamo Oyj research report provides a comprehensive fundamental analysis summarized in a single visual - the Snowflake - making it easy to evaluate Kojamo Oyj's overall financial health at a glance.

Want Some Alternatives?

These stocks are moving-our analysis flagged them today. Act fast before the price catches up:

- The end of cancer? These 29 emerging AI stocks are developing tech that will allow early identification of life changing diseases like cancer and Alzheimer's.

- Trump has pledged to "unleash" American oil and gas and these 22 US stocks have developments that are poised to benefit.

- We've found 15 US stocks that are forecast to pay a dividend yield of over 6% next year. See the full list for free.

This article by Simply Wall St is general in nature. We provide commentary based on historical data and analyst forecasts only using an unbiased methodology and our articles are not intended to be financial advice. It does not constitute a recommendation to buy or sell any stock, and does not take account of your objectives, or your financial situation. We aim to bring you long-term focused analysis driven by fundamental data. Note that our analysis may not factor in the latest price-sensitive company announcements or qualitative material. Simply Wall St has no position in any stocks mentioned.

Valuation is complex, but we're here to simplify it.

Discover if Kojamo Oyj might be undervalued or overvalued with our detailed analysis, featuring fair value estimates, potential risks, dividends, insider trades, and its financial condition.

Access Free AnalysisHave feedback on this article? Concerned about the content? Get in touch with us directly. Alternatively, email editorial-team@simplywallst.com

About HLSE:KOJAMO

Moderate growth potential with very low risk.

Market Insights

Community Narratives