- Finland

- /

- Paper and Forestry Products

- /

- HLSE:UPM

Ultracapacitor Launch Could Be A Game Changer For UPM-Kymmene Oyj (HLSE:UPM)

Reviewed by Sasha Jovanovic

- Last week, UPM-Kymmene received an upgrade from Morgan Stanley to Overweight, with the investment bank highlighting the company's strong cash flow, decade-low capital expenditure requirements, and long-term growth prospects in pulp, biofuels, and biochemicals.

- The upgrade also followed UPM Energy's announcement that its six-megawatt ultracapacitor at the Kuusankoski hydropower plant is now operational, further expanding the company's capabilities in fast, emission-free energy balancing.

- We will now explore how the operational launch of UPM's ultracapacitor could shape the company's investment narrative around grid stability and sustainable energy.

Uncover the next big thing with financially sound penny stocks that balance risk and reward.

UPM-Kymmene Oyj Investment Narrative Recap

To be a shareholder in UPM-Kymmene, you need to believe in the company’s ability to reinvent itself through bio-based materials and new energy solutions, despite market and input cost pressures. The operational launch of the Kuusankoski ultracapacitor strengthens UPM’s sustainability profile, but does not materially shift the biggest near-term catalyst, progress at the Leuna biorefinery, or the risk from persistent input cost inflation, particularly for wood in Finland.

Of the latest product-related announcements, the ultracapacitor project stands out for its immediate relevance to energy balancing and emission-free power, directly supporting growth catalysts tied to UPM’s renewable energy positioning. While other launches, like premium label materials, highlight the pursuit of high-margin growth, the energy storage investment may have more direct implications for reducing earnings volatility in an increasingly renewables-driven market.

By contrast, investors should also be aware of how input cost volatility, especially with persistently high Finnish wood prices, could...

Read the full narrative on UPM-Kymmene Oyj (it's free!)

UPM-Kymmene Oyj's narrative projects €11.2 billion revenue and €1.3 billion earnings by 2028. This requires 3.0% yearly revenue growth and a €955 million earnings increase from €345.0 million today.

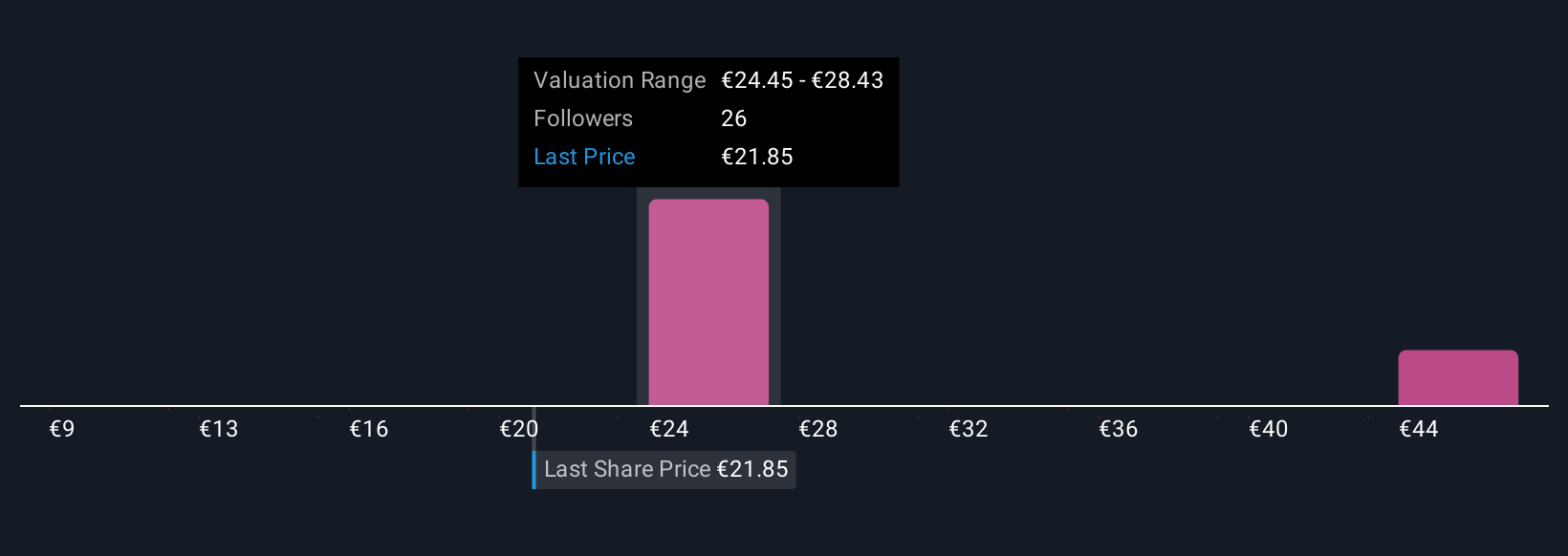

Uncover how UPM-Kymmene Oyj's forecasts yield a €26.25 fair value, a 8% upside to its current price.

Exploring Other Perspectives

Simply Wall St Community members have fair value estimates for UPM-Kymmene ranging from €18.20 to €45.16, across four different analyses. With new investments in grid-balancing technology, the ongoing issue of elevated wood input costs could have wider consequences for profitability and cash flow resilience.

Explore 4 other fair value estimates on UPM-Kymmene Oyj - why the stock might be worth as much as 86% more than the current price!

Build Your Own UPM-Kymmene Oyj Narrative

Disagree with existing narratives? Create your own in under 3 minutes - extraordinary investment returns rarely come from following the herd.

- A great starting point for your UPM-Kymmene Oyj research is our analysis highlighting 2 key rewards and 3 important warning signs that could impact your investment decision.

- Our free UPM-Kymmene Oyj research report provides a comprehensive fundamental analysis summarized in a single visual - the Snowflake - making it easy to evaluate UPM-Kymmene Oyj's overall financial health at a glance.

Interested In Other Possibilities?

Our top stock finds are flying under the radar-for now. Get in early:

- These 13 companies survived and thrived after COVID and have the right ingredients to survive Trump's tariffs. Discover why before your portfolio feels the trade war pinch.

- The best AI stocks today may lie beyond giants like Nvidia and Microsoft. Find the next big opportunity with these 27 smaller AI-focused companies with strong growth potential through early-stage innovation in machine learning, automation, and data intelligence that could fund your retirement.

- This technology could replace computers: discover 27 stocks that are working to make quantum computing a reality.

This article by Simply Wall St is general in nature. We provide commentary based on historical data and analyst forecasts only using an unbiased methodology and our articles are not intended to be financial advice. It does not constitute a recommendation to buy or sell any stock, and does not take account of your objectives, or your financial situation. We aim to bring you long-term focused analysis driven by fundamental data. Note that our analysis may not factor in the latest price-sensitive company announcements or qualitative material. Simply Wall St has no position in any stocks mentioned.

New: AI Stock Screener & Alerts

Our new AI Stock Screener scans the market every day to uncover opportunities.

• Dividend Powerhouses (3%+ Yield)

• Undervalued Small Caps with Insider Buying

• High growth Tech and AI Companies

Or build your own from over 50 metrics.

Have feedback on this article? Concerned about the content? Get in touch with us directly. Alternatively, email editorial-team@simplywallst.com

About HLSE:UPM

UPM-Kymmene Oyj

Engages in the forest-based bioindustry in Europe, North America, Asia, and internationally.

Adequate balance sheet average dividend payer.

Similar Companies

Market Insights

Community Narratives