European Penny Stocks To Watch: Gabetti Property Solutions And Two More

Reviewed by Simply Wall St

The European market has recently experienced a pullback, with the pan-European STOXX Europe 600 Index ending 1.24% lower amid concerns about overvaluation in AI-related stocks. Despite these broader market challenges, penny stocks continue to capture investor interest due to their potential for growth at accessible price points. While the term "penny stocks" may seem outdated, these smaller or newer companies can offer significant opportunities when backed by strong financials and solid fundamentals.

Top 10 Penny Stocks In Europe

| Name | Share Price | Market Cap | Rewards & Risks |

| Ariston Holding (BIT:ARIS) | €3.674 | €1.27B | ✅ 5 ⚠️ 2 View Analysis > |

| DigiTouch (BIT:DGT) | €2.06 | €28.46M | ✅ 3 ⚠️ 1 View Analysis > |

| Angler Gaming (NGM:ANGL) | SEK3.60 | SEK269.95M | ✅ 4 ⚠️ 2 View Analysis > |

| Angler Gaming (DB:0QM) | €0.37 | €224.95M | ✅ 2 ⚠️ 2 View Analysis > |

| Altri SGPS (ENXTLS:ALTR) | €4.86 | €1B | ✅ 3 ⚠️ 2 View Analysis > |

| Libertas 7 (BME:LIB) | €3.06 | €64.91M | ✅ 3 ⚠️ 3 View Analysis > |

| Hifab Group (OM:HIFA B) | SEK3.44 | SEK209.29M | ✅ 2 ⚠️ 2 View Analysis > |

| ForFarmers (ENXTAM:FFARM) | €4.545 | €404.8M | ✅ 4 ⚠️ 1 View Analysis > |

| High (ENXTPA:HCO) | €4.02 | €78.25M | ✅ 1 ⚠️ 5 View Analysis > |

| Deceuninck (ENXTBR:DECB) | €2.04 | €281.97M | ✅ 4 ⚠️ 1 View Analysis > |

Click here to see the full list of 281 stocks from our European Penny Stocks screener.

Let's dive into some prime choices out of the screener.

Gabetti Property Solutions (BIT:GAB)

Simply Wall St Financial Health Rating: ★★★★★☆

Overview: Gabetti Property Solutions S.p.A., with a market cap of €40.30 million, operates through its subsidiaries to offer real estate services both in Italy and internationally.

Operations: The company's revenue is derived from real estate services provided in Italy and international markets.

Market Cap: €40.3M

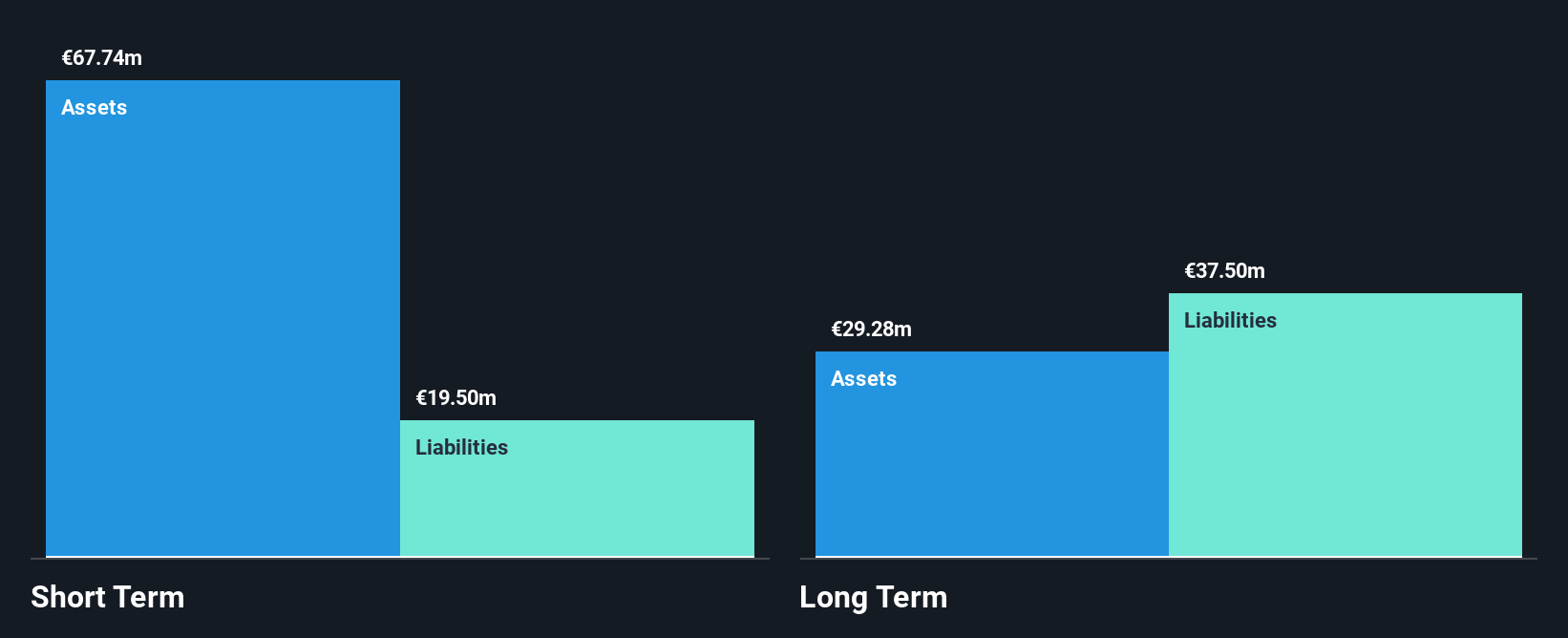

Gabetti Property Solutions S.p.A., with a market cap of €40.30 million, has shown financial resilience despite challenges. The company faced a significant one-off loss of €12.6 million impacting its recent results but maintains strong liquidity with short-term assets exceeding both short and long-term liabilities. Its debt levels, though high, are well covered by operating cash flow and interest payments are comfortably managed by EBIT. While earnings growth over the past year was modest at 4%, it is forecasted to grow significantly in the future. However, management's lack of experience could pose challenges in navigating market complexities effectively.

- Dive into the specifics of Gabetti Property Solutions here with our thorough balance sheet health report.

- Gain insights into Gabetti Property Solutions' outlook and expected performance with our report on the company's earnings estimates.

Biohit Oyj (HLSE:BIOBV)

Simply Wall St Financial Health Rating: ★★★★★★

Overview: Biohit Oyj is a biotechnology company that produces and sells acetaldehyde-binding products, diagnostic tools, and systems for research institutions, healthcare, and industrial use globally, with a market cap of €46.66 million.

Operations: The company's revenue is derived from its diagnostic kits and equipment segment, generating €14.28 million.

Market Cap: €46.66M

Biohit Oyj, with a market cap of €46.66 million, benefits from stable financial health and strong earnings growth. The company has no debt, which eliminates concerns over interest payments and enhances financial stability. Its short-term assets of €9.8 million comfortably cover both short-term (€3.5 million) and long-term liabilities (€1.1 million). Despite a low return on equity at 17.3%, Biohit's earnings have grown by 37.4% over the past year, outpacing the industry average of 6.6%. The Price-To-Earnings ratio of 20.8x suggests it is valued attractively compared to industry peers at 28.1x.

- Unlock comprehensive insights into our analysis of Biohit Oyj stock in this financial health report.

- Review our historical performance report to gain insights into Biohit Oyj's track record.

Netum Group Oyj (HLSE:NETUM)

Simply Wall St Financial Health Rating: ★★★★☆☆

Overview: Netum Group Oyj is an IT services company based in Finland with a market capitalization of €15.97 million.

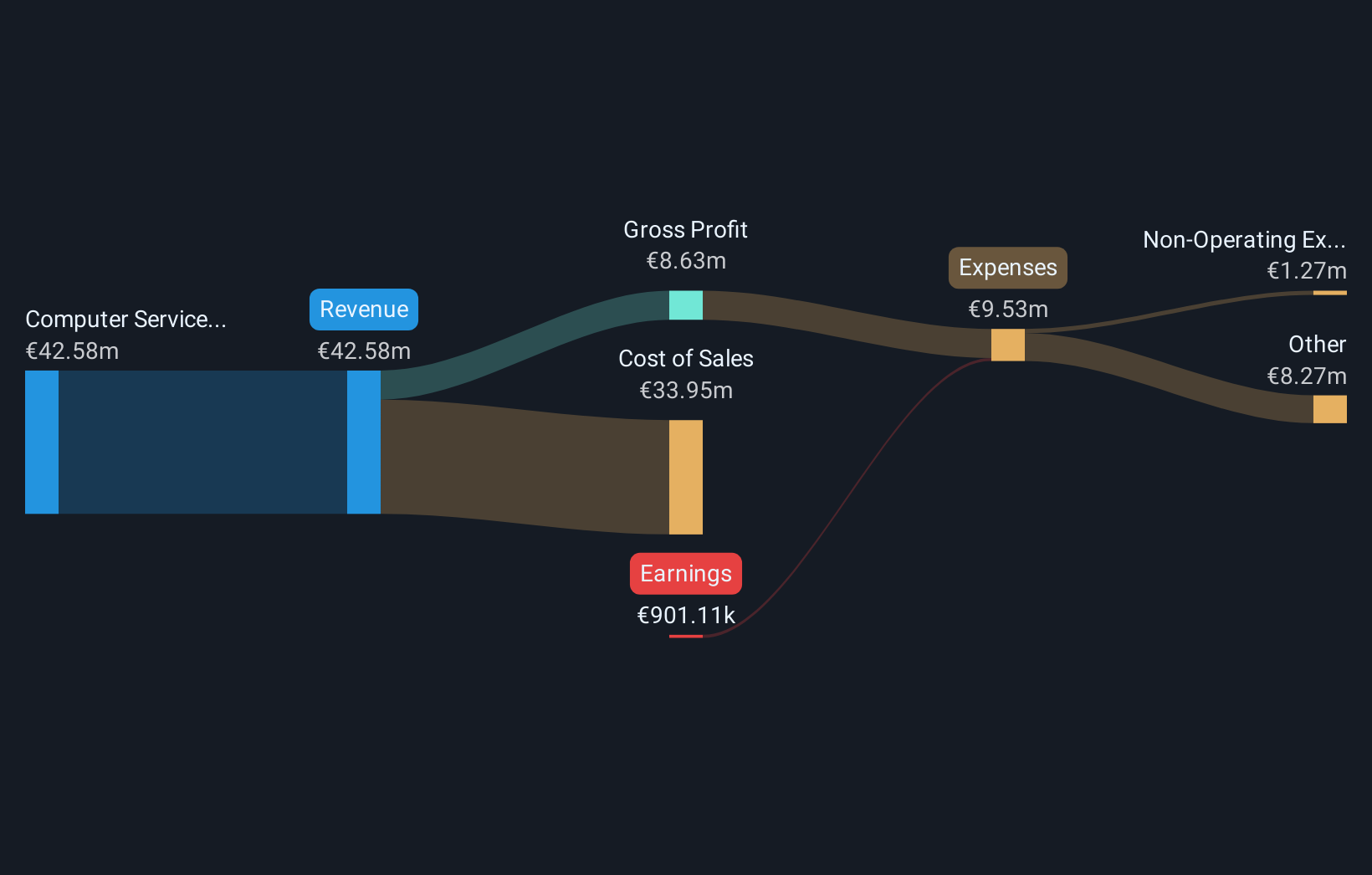

Operations: The company generates €42.58 million in revenue from its Computer Services segment.

Market Cap: €15.97M

Netum Group Oyj, with a market cap of €15.97 million, is navigating challenges typical of penny stocks. Despite being unprofitable and not expected to reach profitability in the next three years, it maintains a positive free cash flow, providing a cash runway exceeding three years. Recent management changes and strategic client agreements signal potential operational improvements. However, its high net debt to equity ratio of 61.8% remains concerning despite reductions over five years. The stock trades at 60.4% below estimated fair value but faces volatility higher than most Finnish stocks, reflecting inherent investment risks in this segment.

- Click here and access our complete financial health analysis report to understand the dynamics of Netum Group Oyj.

- Examine Netum Group Oyj's earnings growth report to understand how analysts expect it to perform.

Key Takeaways

- Click through to start exploring the rest of the 278 European Penny Stocks now.

- Ready To Venture Into Other Investment Styles? AI is about to change healthcare. These 32 stocks are working on everything from early diagnostics to drug discovery. The best part - they are all under $10b in market cap - there's still time to get in early.

This article by Simply Wall St is general in nature. We provide commentary based on historical data and analyst forecasts only using an unbiased methodology and our articles are not intended to be financial advice. It does not constitute a recommendation to buy or sell any stock, and does not take account of your objectives, or your financial situation. We aim to bring you long-term focused analysis driven by fundamental data. Note that our analysis may not factor in the latest price-sensitive company announcements or qualitative material. Simply Wall St has no position in any stocks mentioned.

Valuation is complex, but we're here to simplify it.

Discover if Netum Group Oyj might be undervalued or overvalued with our detailed analysis, featuring fair value estimates, potential risks, dividends, insider trades, and its financial condition.

Access Free AnalysisHave feedback on this article? Concerned about the content? Get in touch with us directly. Alternatively, email editorial-team@simplywallst.com

About HLSE:NETUM

Undervalued with adequate balance sheet.

Market Insights

Community Narratives