- Finland

- /

- Oil and Gas

- /

- HLSE:NESTE

Neste Oyj (HLSE:NESTE) Is Up 6.5% After Strong Q3 Profit Beats on Lower Sales, Growth Guidance Reaffirmed

Reviewed by Sasha Jovanovic

- Neste Oyj reported third quarter 2025 results, posting net income of €106 million on sales of €4.53 billion and confirmed that renewable and oil products sales volumes are expected to rise in 2025 compared to 2024.

- While sales were lower year-on-year, the company's improved profitability alongside unchanged guidance for volume growth highlights management's confidence in operational performance and future demand.

- With net income rising despite lower sales, we'll explore what these results and positive guidance mean for Neste's investment narrative.

The latest GPUs need a type of rare earth metal called Dysprosium and there are only 37 companies in the world exploring or producing it. Find the list for free.

What Is Neste Oyj's Investment Narrative?

For anyone considering Neste Oyj, belief in the company really hinges on the potential for renewable fuels to power future growth, despite shaky recent profits and pressure on oil demand. The third quarter results underscore this dynamic: net income improved to €106 million even as sales dropped, offering a rare dose of margin resilience for a company grappling with market volatility and heavy investment needs. Management's steady guidance on higher renewable and oil products volumes for 2025 could be seen as a vote of confidence, potentially easing fears sparked by prior operational disruptions like the Rotterdam fire. Yet, while the latest update reassures on immediate growth catalysts, it does little to erase the fundamental risks, such as tight operating margins, debt coverage worries, and exposure to energy price swings, that have driven long-term underperformance. Recent gains in profitability are encouraging but don't fully resolve the path to sustainable earnings or value.

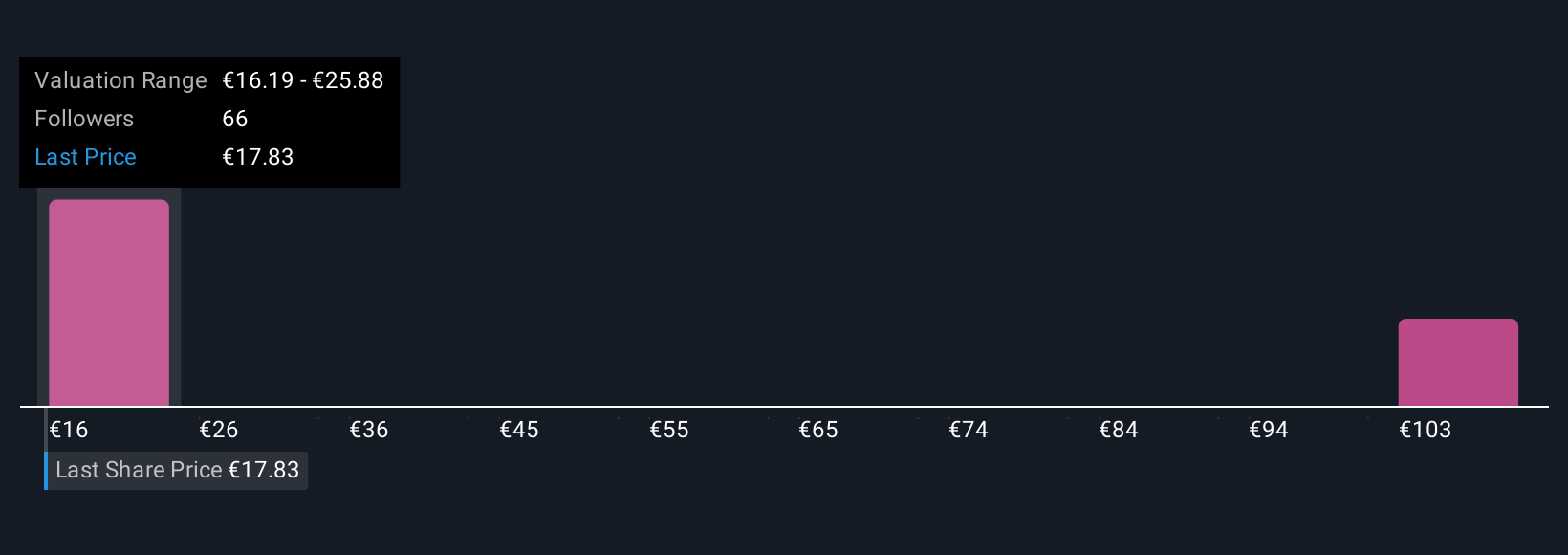

But, keep in mind, concerns about profit quality and debt coverage haven't disappeared. Neste Oyj's shares have been on the rise but are still potentially undervalued. Find out how large the opportunity might be.Exploring Other Perspectives

Explore 6 other fair value estimates on Neste Oyj - why the stock might be worth 11% less than the current price!

Build Your Own Neste Oyj Narrative

Disagree with existing narratives? Create your own in under 3 minutes - extraordinary investment returns rarely come from following the herd.

- A great starting point for your Neste Oyj research is our analysis highlighting 2 key rewards and 1 important warning sign that could impact your investment decision.

- Our free Neste Oyj research report provides a comprehensive fundamental analysis summarized in a single visual - the Snowflake - making it easy to evaluate Neste Oyj's overall financial health at a glance.

Contemplating Other Strategies?

These stocks are moving-our analysis flagged them today. Act fast before the price catches up:

- Explore 27 top quantum computing companies leading the revolution in next-gen technology and shaping the future with breakthroughs in quantum algorithms, superconducting qubits, and cutting-edge research.

- We've found 15 US stocks that are forecast to pay a dividend yield of over 6% next year. See the full list for free.

- Find companies with promising cash flow potential yet trading below their fair value.

This article by Simply Wall St is general in nature. We provide commentary based on historical data and analyst forecasts only using an unbiased methodology and our articles are not intended to be financial advice. It does not constitute a recommendation to buy or sell any stock, and does not take account of your objectives, or your financial situation. We aim to bring you long-term focused analysis driven by fundamental data. Note that our analysis may not factor in the latest price-sensitive company announcements or qualitative material. Simply Wall St has no position in any stocks mentioned.

Valuation is complex, but we're here to simplify it.

Discover if Neste Oyj might be undervalued or overvalued with our detailed analysis, featuring fair value estimates, potential risks, dividends, insider trades, and its financial condition.

Access Free AnalysisHave feedback on this article? Concerned about the content? Get in touch with us directly. Alternatively, email editorial-team@simplywallst.com

About HLSE:NESTE

Neste Oyj

Provides renewable diesel and sustainable aviation fuel in Finland, other Nordic countries, Baltic Rim, other European countries, the United States, and internationally.

Reasonable growth potential and fair value.

Similar Companies

Market Insights

Community Narratives